Get the free Beneficiary Designation Form

Get, Create, Make and Sign beneficiary designation form

Editing beneficiary designation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation form

How to fill out beneficiary designation form

Who needs beneficiary designation form?

Beneficiary designation form: A comprehensive how-to guide

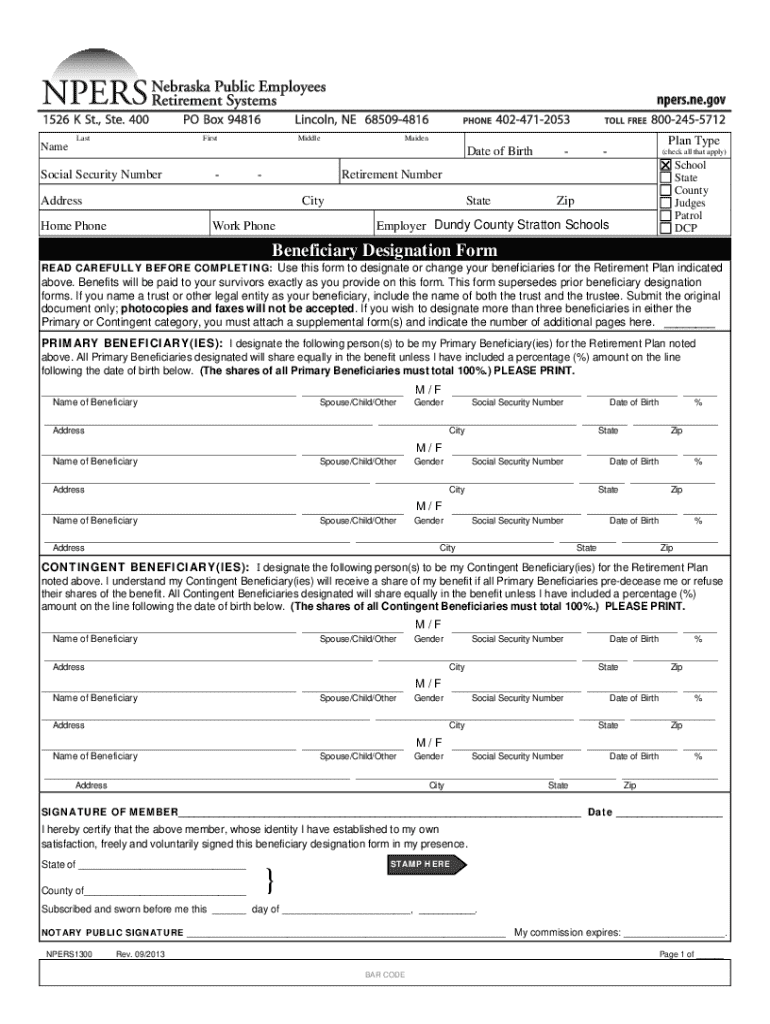

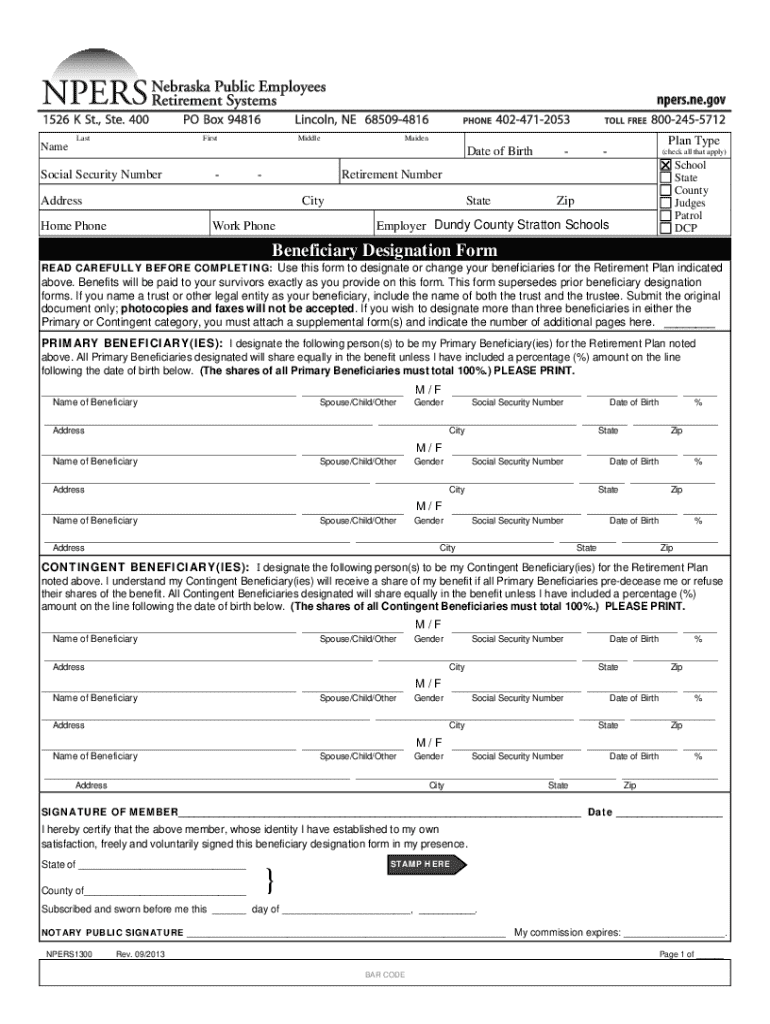

Understanding the beneficiary designation form

A beneficiary designation form is a crucial document that allows individuals to specify who will receive assets, benefits, or financial proceeds upon their death. These forms are commonly associated with insurance policies, retirement accounts, and certain types of financial accounts. Filling out this form accurately ensures that your assets are distributed according to your wishes.

The importance of designating a beneficiary cannot be overstated. Without clear directives, your assets may be subjected to lengthy probate processes, or worse, may not be distributed according to your preferences. A well-considered beneficiary designation ensures that your loved ones receive their entitled benefits swiftly and without unnecessary legal complications.

Common situations requiring a beneficiary designation include life insurance policies, retirement plans such as 401(k) accounts, and investment accounts. Understanding when and where this form applies helps in streamlining estate planning and safeguarding your family’s financial future.

Key elements of the beneficiary designation form

Understanding the key elements of a beneficiary designation form is essential for ensuring accuracy and compliance. Each form typically requires valuable information regarding both the policyholder and the designated beneficiaries. The form captures personal details that help establish identities and relationships.

Beneficiary categories play a vital role in asset distribution. Primary beneficiaries are those who will receive the assets first, while contingent beneficiaries are those designated to receive benefits if the primary beneficiaries are unavailable or deceased. It's also important to differentiate between individual beneficiaries and entities such as trusts or charities, particularly for larger estates.

Special considerations arise for minors and trusts—if a minor is designated, a guardian will need to be appointed. Furthermore, it’s wise to consult legal resources when naming a trust as a beneficiary, ensuring compliance with relevant laws.

Step-by-step guide to completing the beneficiary designation form

Completing a beneficiary designation form can be straightforward if approached methodically. Here’s a step-by-step guide.

Submitting your beneficiary designation form

Once the beneficiary designation form is completed, submitting it properly is critical. Different submission methods exist, including electronic and traditional options.

Monitor your submission to ensure processing is complete, as this verifies that your beneficiary designations are officially recognized.

Managing your beneficiary designation

Regularly managing and updating your beneficiary designation is essential. Life events such as marriages, divorces, births, or deaths can significantly impact your choices.

Staying proactive in managing your beneficiary designation can save loved ones from potential complications after your passing, making the process smoother for everyone involved.

FAQs on beneficiary designation forms

Navigating the nuances of a beneficiary designation form can raise many questions. Here are some commonly asked inquiries.

Real-life applications and testimonials

Hearing success stories can be enlightening when managing your beneficiary designation. Individuals have shared how designations have directly impacted their families.

For example, one family recounts the peace of mind that came with specifying a trust for their children, which eliminated disputes during a challenging time. Case studies illustrate that when done correctly, beneficiary designations streamline the disbursement of assets, saving families from financial burdens.

Legal considerations

Each state can have specific regulations surrounding beneficiary designations. Understanding these laws is essential to avoid ramifications that can arise from improper designations.

Failing to designate a beneficiary can lead to your assets being directed to your estate, which may cause delays and unwanted taxes. Knowledge of legal requirements aids in making informed decisions, ensuring your intentions are clear.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute beneficiary designation form online?

How do I edit beneficiary designation form on an iOS device?

How do I complete beneficiary designation form on an iOS device?

What is beneficiary designation form?

Who is required to file beneficiary designation form?

How to fill out beneficiary designation form?

What is the purpose of beneficiary designation form?

What information must be reported on beneficiary designation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.