Get the free Card Application Form & Stop Notice

Get, Create, Make and Sign card application form stop

How to edit card application form stop online

Uncompromising security for your PDF editing and eSignature needs

How to fill out card application form stop

How to fill out card application form stop

Who needs card application form stop?

Understanding and Managing the Card Application Form Stop Form

Understanding the card application form stop form

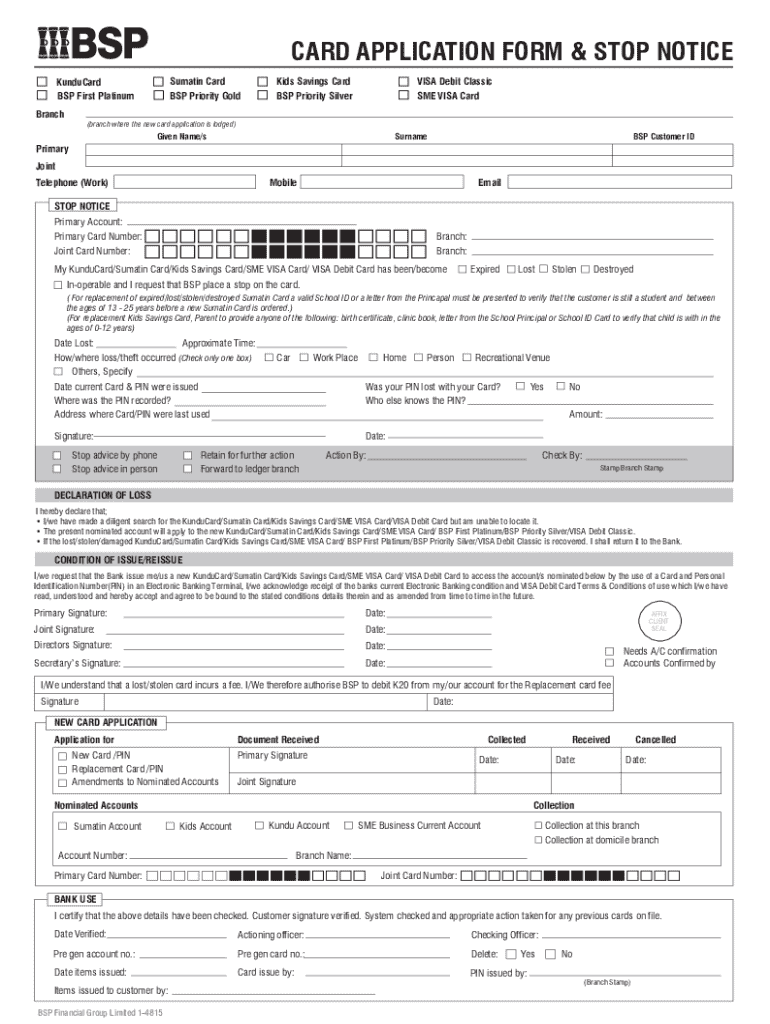

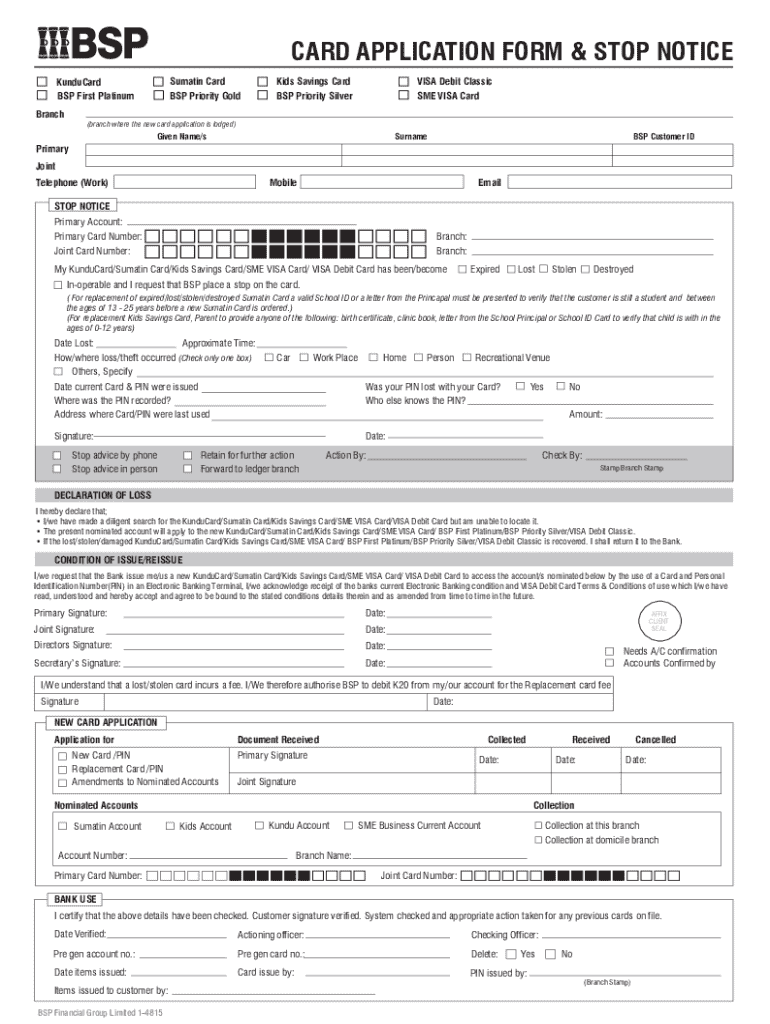

A card application form stop form is an essential document designed to halt or prevent the processing of a card application or any related transactions. This form serves several purposes, with one of the primary reasons being to protect consumers from potential fraud or unauthorized dealings. In situations of lost or stolen cards, or even when a user suspects that their application has been compromised, submitting a stop form is vital to securing their financial information.

Circumstances where a stop form becomes necessary include instances where a user reports their card lost or stolen, requests a block on a specific transaction due to suspicion of fraud, or simply wishes to pause an application pending further review. Regardless of the specific situation, the stop form acts as a security measure, ensuring users retain control over their financial activities.

Key components of the card application form stop form

Completely filling out the card application form stop form is crucial for ensuring its effective processing. Key components include required personal details such as your full name, current address, and contact information. These details are essential for the financial institution to identify your account and communicate with you regarding any developments.

Moreover, the form typically requires account specifics, including the type of card you are stopping (e.g., credit or debit card) and the relevant account number. Omitting these details can lead to delays, or the form may be rejected. While not always mandatory, opting to include additional data, such as reasons for submission or a brief description of incidents leading to the stop request, can enhance clarity.

Importance of using a stop form

Utilizing a card application form stop form plays a critical role in safeguarding your finances. One of its primary benefits is the protection it offers against unauthorized transactions. When a user suspects their card or application information has been compromised, submitting a stop form can effectively prevent potential fraudsters from accessing their funds.

Furthermore, the stop form serves as a necessary step in card management and security. By promptly submitting it, users minimize financial loss and can regain control over their banking activities. Financial institutions take these requests seriously and act quickly to investigate and mitigate any perceived threats, ensuring peace of mind for the cardholder.

Step-by-step guide to completing a card application form stop form

Completing the card application form stop form correctly is vital for ensuring its acceptance and expedient processing. Here’s a step-by-step guide:

Common mistakes to avoid when filling out the stop form

While filling out a card application form stop form may seem straightforward, there are common pitfalls that can hinder processing. One such mistake is providing incomplete information. If critical sections are left blank, your form may not be processed in a timely fashion, or it could be outright rejected.

Another frequent error is mismatching account details. It's crucial to ensure that details like account numbers and card types are accurate to avoid confusion. Additionally, misunderstanding submission instructions can result in submitting the form incorrectly or through an unintended channel. Always check with your financial provider for the correct procedures to ensure your application is properly managed.

How pdfFiller can simplify the process

pdfFiller significantly enhances the experience of filling out and managing a card application form stop form. The platform offers interactive tools to simplify the form-filling process, allowing users to input their information easily and accurately. With its user-friendly interface, pdfFiller ensures that all required fields are appropriately labeled, helping to avoid common mistakes.

Additionally, pdfFiller’s features enable users to edit and sign documents digitally, eliminating the need for printing and scanning. This not only saves time but also enhances security by keeping sensitive information within a centralized platform. Furthermore, being cloud-based allows for easy access to your documents anywhere, empowering individuals and teams to manage their forms collectively and efficiently.

FAQs about the card application form stop form

Understanding the nuances of the card application form stop form comes with several questions. Here are some frequently asked questions that users tend to have:

Tips for effective document management with pdfFiller

For optimal management of your forms and documents, pdfFiller provides several useful tips. Start by organizing your forms and templates efficiently within the platform. Group similar documents together or create folders based on categories, ensuring easy access whenever needed.

Collaboration is integral in team settings, so utilize pdfFiller's features for effective document sharing. By allowing team members to review or edit documents in real time, you can improve workflow efficiency. Additionally, maximize pdfFiller's utilization by leveraging its search capabilities to quickly locate forms, making document management less time-consuming.

Additional considerations

It's crucial to understand your rights when stopping a card application. Consumers are entitled to pause or halt applications to protect their financial interests. Beyond merely submitting a stop form, practices such as regularly monitoring your accounts for any unauthorized activity are equally vital after requesting a halt.

Alternatives to consider when managing card applications may include directly contacting your financial institution for immediate reporting of issues. Proactive communication can often prevent the need for a formal stop form in cases where issues can be quickly addressed or clarified.

Related resources and tools

For those seeking to streamline their financial documentation, consider exploring pdfFiller’s array of templates related to card management. The platform provides various forms and documents designed to assist in identifying potential risks and managing finances effectively.

By comparing different card management solutions, customers can make informed decisions that suit their needs best. pdfFiller serves not just as a tool for creating the card application form stop form, but also functions as a comprehensive resource for enhancing users’ overall financial document management endeavors.

Get started with pdfFiller today

Now is the perfect time to access the card application form stop form template available on pdfFiller. Utilize the benefits of this cloud-based solution to enhance your document needs. By signing up and creating an account, you gain total access to tools that streamline your form completion, editing, and management processes.

With pdfFiller, not only can you ensure that your forms are completed accurately, but you also facilitate better collaboration and document control—key elements for anyone handling sensitive financial documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify card application form stop without leaving Google Drive?

How do I execute card application form stop online?

How do I edit card application form stop straight from my smartphone?

What is card application form stop?

Who is required to file card application form stop?

How to fill out card application form stop?

What is the purpose of card application form stop?

What information must be reported on card application form stop?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.