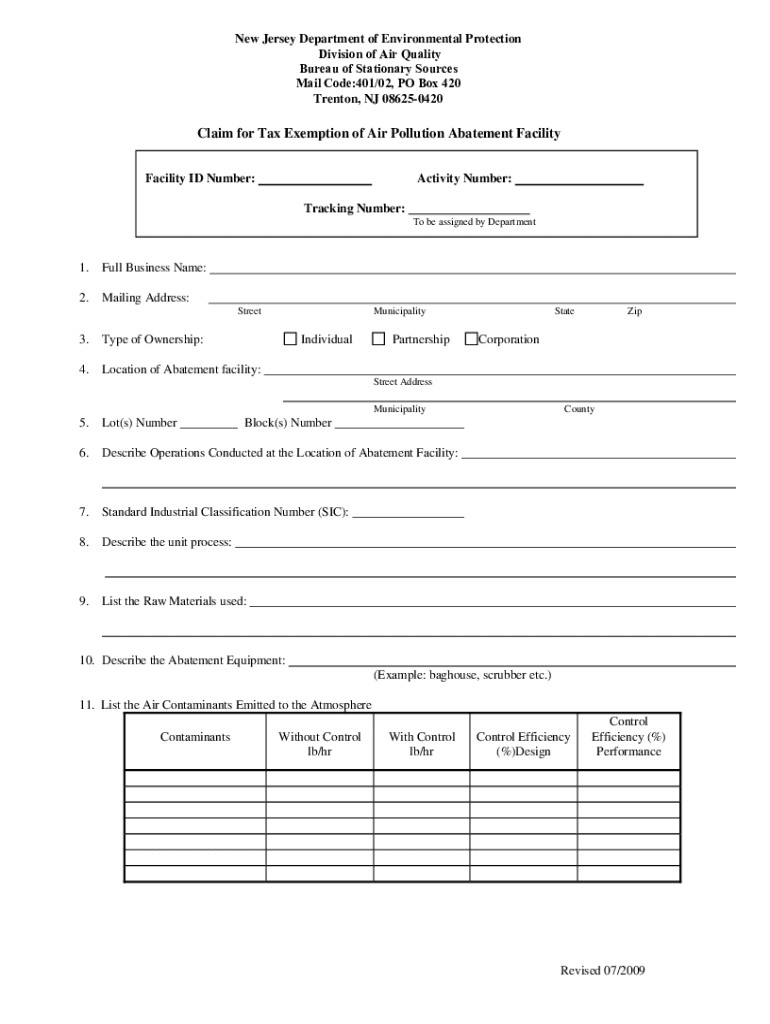

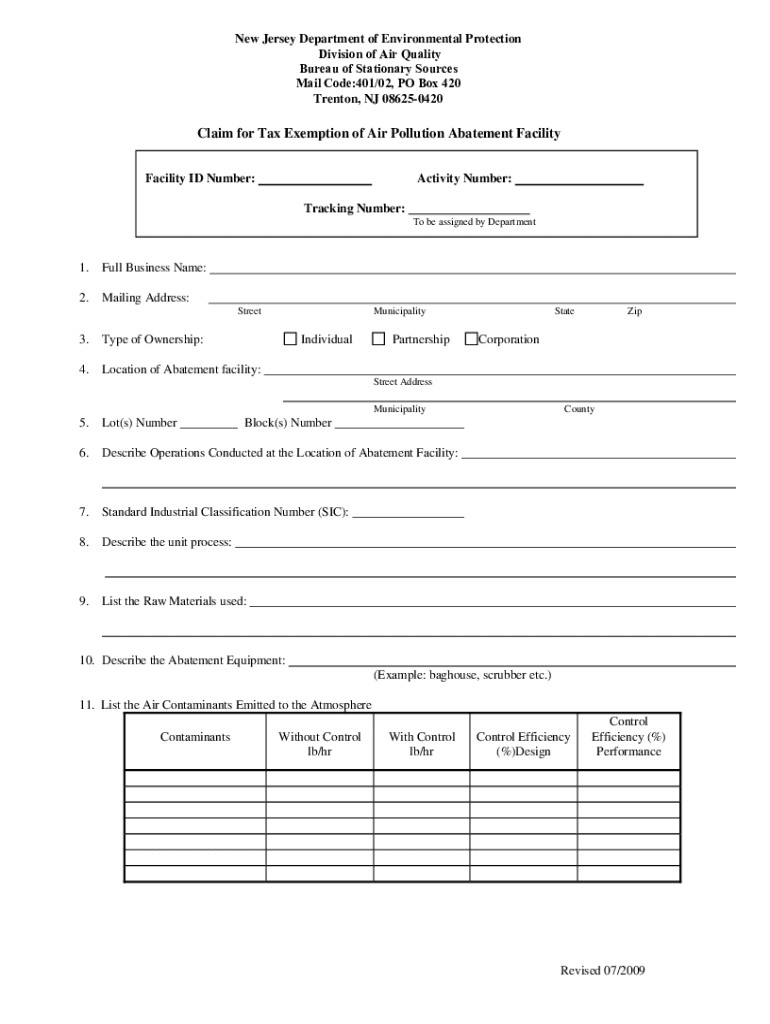

Get the free Claim for Tax Exemption of Air Pollution Abatement Facility

Get, Create, Make and Sign claim for tax exemption

How to edit claim for tax exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out claim for tax exemption

How to fill out claim for tax exemption

Who needs claim for tax exemption?

Claim for Tax Exemption Form - How-to Guide

Understanding tax exemption

A tax exemption is a provision that reduces or eliminates the tax liability for an individual or organization. It is essential for lowering the financial burden on taxpayers. Tax exemptions can apply to various contexts, including income tax, property tax, and sales tax, making them significant for both individuals and businesses.

The importance of tax exemptions cannot be understated, especially for low-income families, non-profit organizations, and specific business sectors. They serve as a tool to promote economic growth and social welfare by providing financial relief to eligible entities.

Types of tax exemption forms

Tax exemption forms are critical documents used to officially claim tax relief. These forms might vary by jurisdiction and the nature of the exemption being sought. One of the most common forms is the Claim for Tax Exemption Form, designed for individuals and businesses who meet specific requirements to seek exemptions.

Eligibility for claiming exemptions can include factors such as educational status, income level, or business type. For example, educational institutions often qualify for tax exemptions, while certain small businesses may also apply for financial relief under favorable tax codes.

Preparing to claim a tax exemption

Before filing a Claim for Tax Exemption Form, it's vital to gather necessary documentation. This documentation not only supports your claim but is also crucial for ensuring compliance with legal standards.

Identification proof, financial statements, and other relevant supporting documentation, such as proof of income or proof of non-profit status, are pivotal in backing your claim. Understanding the legal implications involves knowing what types of exemptions are available and how they apply to your situation.

Step-by-step instructions for completing the claim for tax exemption form

Filling out the Claim for Tax Exemption Form is an essential process. The first step involves gathering all necessary information, which may include personal details, tax identification numbers, and specifics related to the exemption type you're applying for.

The second step is filling out the form carefully. Each section usually deals with different aspects of your situation, and attention to detail is key. Common mistakes include providing incomplete information, using incorrect social security numbers, or misunderstanding the eligibility requirements.

Submitting your claim for tax exemption

Submitting your Claim for Tax Exemption Form can be done through various methods. Many jurisdictions now offer online submission, which is typically the fastest route. For those preferring traditional methods, mail-in submissions and in-person filing are also available.

It is crucial to pay attention to the submission timeline, as claims can take time to process. To track the status of your submission, note down any submission confirmation numbers provided during your filing process.

Handling denials or issues with your claim

If your claim for tax exemption is denied, it is essential to understand the common reasons for such denials. These can range from incomplete applications to discrepancies in submitted information. Correcting these issues promptly can lead to successful appeals.

In case of a denial, the first step is to read the denial letter thoroughly and understand the reason. From there, you can begin crafting an appeal. Keeping records of all communication and documentation is crucial during this phase to reinforce your position.

Best practices for managing tax exemption claims

Effective document management can greatly aid individuals and organizations in their tax exemption journey. This encompasses keeping detailed records of all submissions and communications related to your claim. Documenting every interaction and maintaining backups creates a safety net during potential audits or disputes.

Utilizing tools such as pdfFiller can streamline this process, making it easier to manage all your documents in one cloud-based solution. Regularly updating your exemption status is also vital to stay compliant with any changes in law or personal circumstances.

Frequently asked questions about tax exemption claims

Tax exemption claims often lead to numerous queries. Addressing concerns about form completion, eligibility criteria, or specific scenarios can significantly assist individuals in navigating the process.

Questions often arise regarding the types of documentation needed, timelines for processing claims, and how to handle unforeseen complications. Gathering specific insights on these points can help demystify the process.

Utilizing pdfFiller for your tax exemption needs

pdfFiller serves as a robust platform not just for filling out the Claim for Tax Exemption Form but also for managing your entire documentation needs. With powerful features such as editing PDFs, secure collaboration, and easy eSigning capabilities, it simplifies the often complex paperwork associated with tax exemptions.

Accessing templates for tax exemption claims through pdfFiller ensures that you have a solid starting point. Its cloud-based solutions further offer flexibility, allowing users to edit, save, and retrieve documents from anywhere.

Expert insights and advice

Insights from tax professionals can empower individuals and teams to effectively navigate the complex landscape of tax exemptions. Staying informed about recent updates or changes in tax exemption laws is crucial, as these can significantly impact eligibility and filing requirements.

Expert advice often includes strategically planning your claims and understanding the long-term implications of your exemptions. Engaging with tax professionals can also help uncover opportunities for additional savings via eligible claims.

Related tax resources and tools

Finding reliable resources is crucial for navigating tax exemptions effectively. Individuals can benefit from state-specific tax resources that provide localized guidelines, tools, and forms required for various tax-related claims.

Various online calculators can help estimate potential exemptions and assist in financial planning. Ensuring access to relevant guides and forms can facilitate an efficient filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute claim for tax exemption online?

How do I edit claim for tax exemption on an Android device?

How do I complete claim for tax exemption on an Android device?

What is claim for tax exemption?

Who is required to file claim for tax exemption?

How to fill out claim for tax exemption?

What is the purpose of claim for tax exemption?

What information must be reported on claim for tax exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.