Get the free New Hire Sign-on Bonus Agreement

Get, Create, Make and Sign new hire sign-on bonus

Editing new hire sign-on bonus online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new hire sign-on bonus

How to fill out new hire sign-on bonus

Who needs new hire sign-on bonus?

Understanding and Managing Your New Hire Sign-On Bonus Form

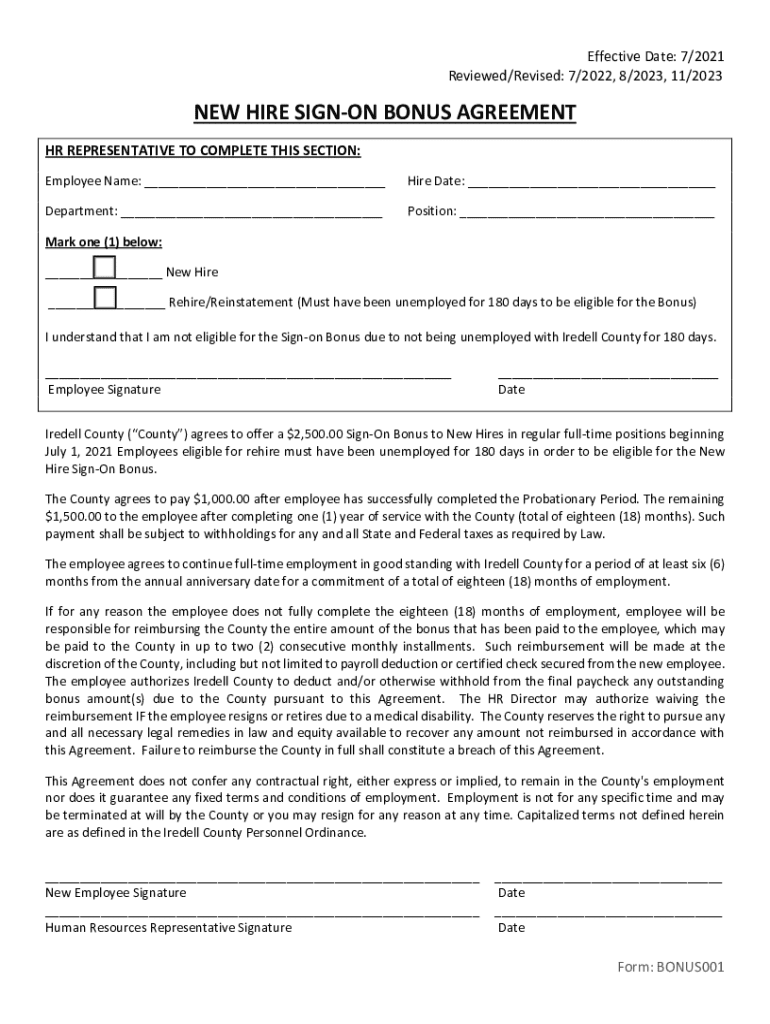

Understanding the new hire sign-on bonus

A sign-on bonus is a financial incentive offered by employers to attract new employees. These bonuses are typically presented as a lump sum payment upon starting employment or after a specific period of service. Their primary purpose is to motivate potential hires to join a company, especially in competitive job markets.

Employers who offer sign-on bonuses benefit in several ways. Firstly, a well-structured sign-on bonus can help attract top talent who may have multiple job offers. It also aids in reducing the time it takes to fill vacancies, ensuring that critical roles within the organization are occupied without prolonged disruption.

For new hires, sign-on bonuses can be a great opportunity. They provide additional immediate income that can alleviate financial stress during a transition period. Understanding these bonuses is crucial, as they can represent a significant part of the overall compensation package.

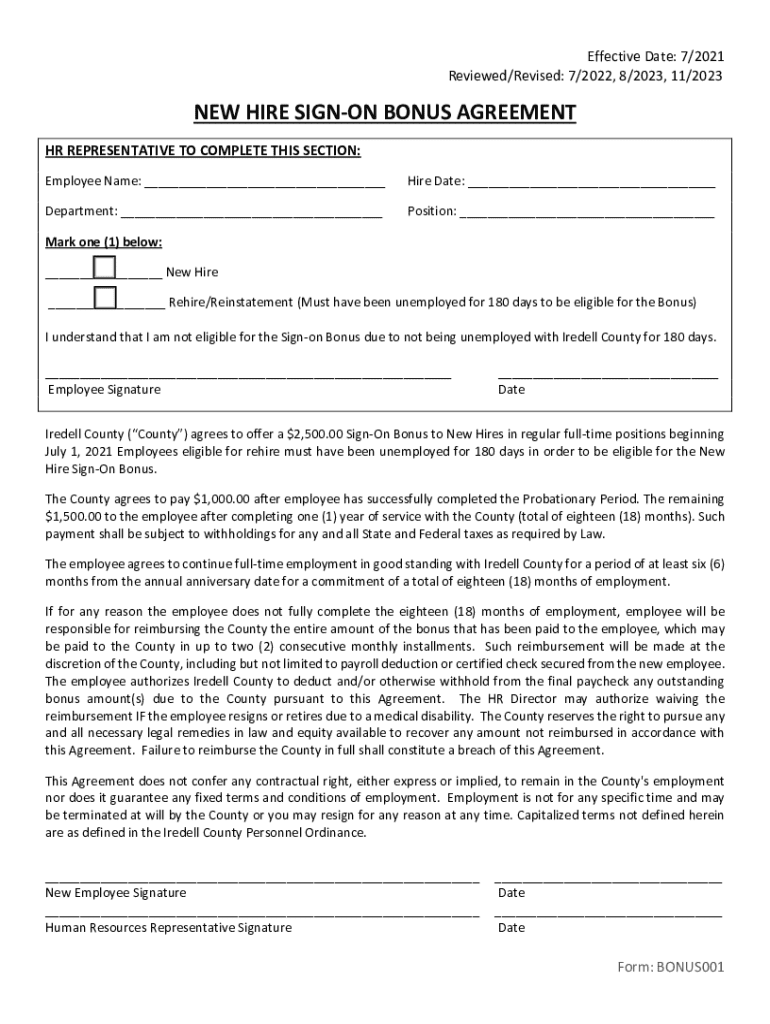

Key components of the new hire sign-on bonus form

The new hire sign-on bonus form includes essential information that both the employee and employer must fill out correctly. The primary sections include personal information, employment details, and the conditions associated with the bonus. Each component plays a key role in ensuring the bonus is processed accurately and in a timely manner.

1. **Candidate Personal Information:** This includes the employee's full name, address, and contact details. Accurate information ensures that tax documents and other correspondences reach the employee.

2. **Employment Details:** This section provides specific information about the job position, employment start date, department, and supervisor's contact information.

3. **Bonus Conditions and Terms:** This crucial section outlines how much the bonus is, when it will be paid, and any conditions that may prevent the bonus from being awarded, such as leaving the company before a specified timeframe.

Common mistakes to avoid may include typos in personal information, failing to read the terms clearly, or neglecting to ask questions about conditions related to the bonus.

Step-by-step guide to completing the new hire sign-on bonus form

Completing the new hire sign-on bonus form can be straightforward if you follow these steps. It's crucial to be organized and thorough throughout the process.

Editing and customizing the form

pdfFiller provides users with various tools to customize their new hire sign-on bonus form. This allows employees to tailor the document according to their needs and preferences.

Collaboration with HR or management is vital for the review process. Sharing the form for feedback allows for any discrepancies to be resolved before final submission.

Managing your new hire sign-on bonus form

Effective management of your new hire sign-on bonus form is crucial for future reference and tracking purposes. pdfFiller provides numerous functionalities for document management.

Troubleshooting common issues

Even with a robust platform, users can encounter technical issues while filling out the new hire sign-on bonus form. Addressing these problems promptly is vital to avoid submission delays.

Additional considerations for new hires

A sign-on bonus can significantly impact your financial situation, but understanding the implications of such a bonus is equally essential. One critical aspect is the potential tax implications that may arise.

New hires are encouraged to research further on employment benefits and speak with HR to gather comprehensive insights into their compensation package.

Leveraging pdfFiller for other forms and templates

pdfFiller isn’t just limited to the new hire sign-on bonus form but offers an array of document solutions. This capability allows users to manage all types of forms efficiently from one platform.

By applying these features, users can streamline their documentation processes and enhance productivity across teams.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete new hire sign-on bonus online?

How do I fill out new hire sign-on bonus using my mobile device?

How do I complete new hire sign-on bonus on an iOS device?

What is new hire sign-on bonus?

Who is required to file new hire sign-on bonus?

How to fill out new hire sign-on bonus?

What is the purpose of new hire sign-on bonus?

What information must be reported on new hire sign-on bonus?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.