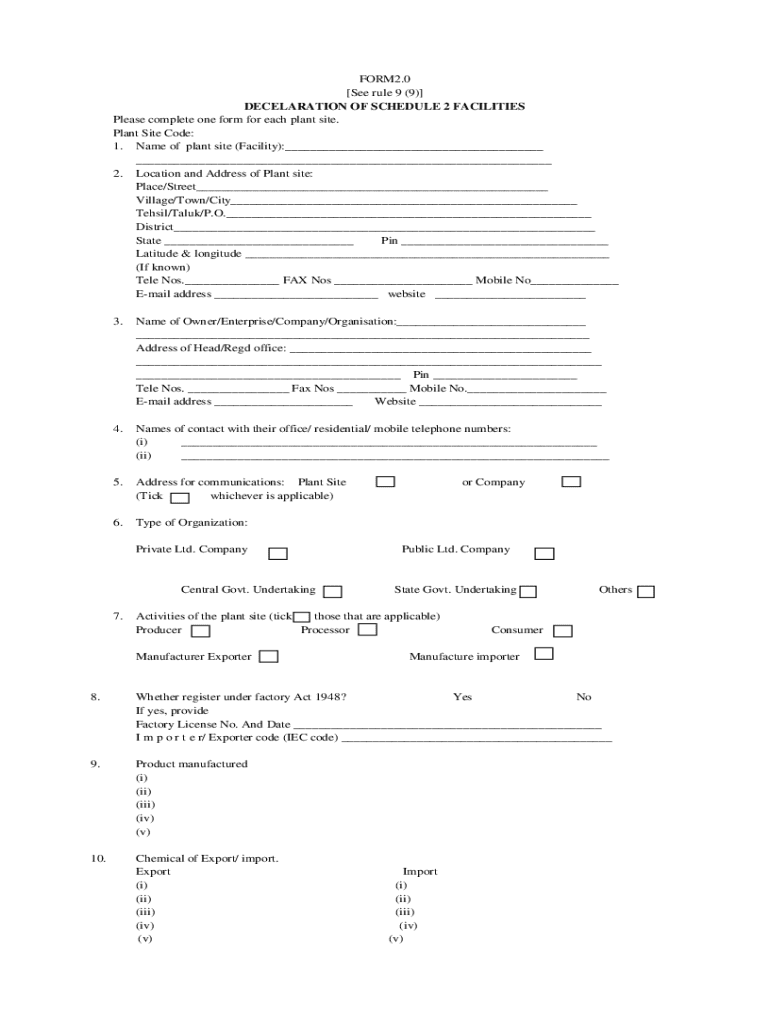

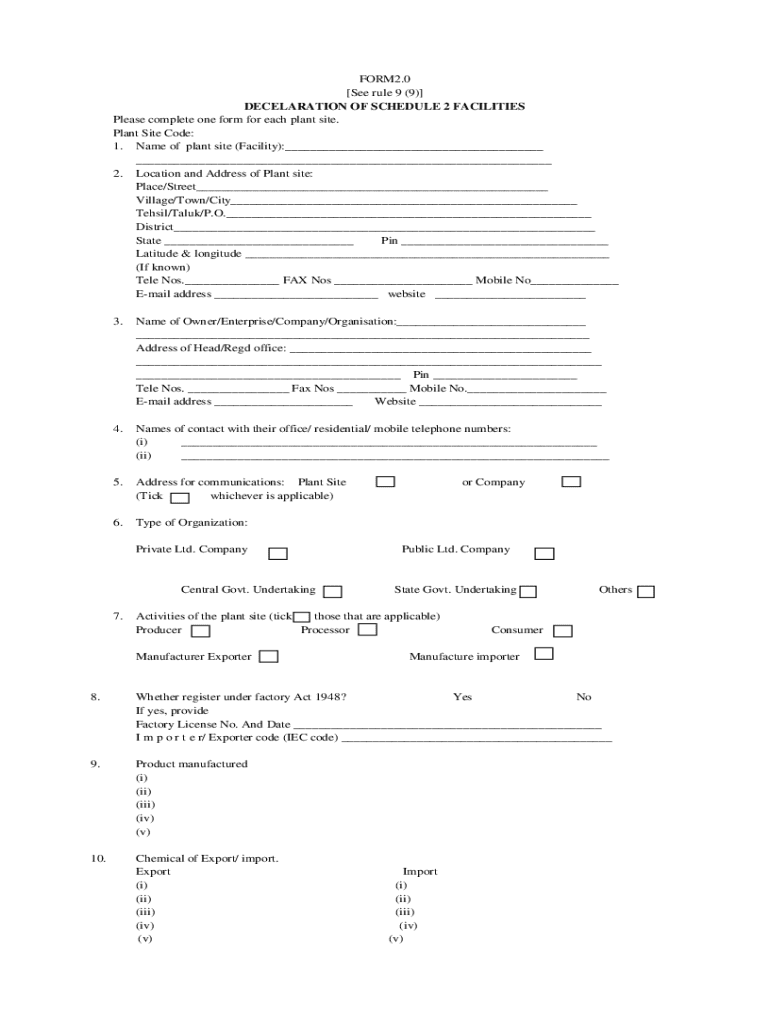

Get the free Declaration of Schedule 2 Facilities

Get, Create, Make and Sign declaration of schedule 2

Editing declaration of schedule 2 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out declaration of schedule 2

How to fill out declaration of schedule 2

Who needs declaration of schedule 2?

Declaration of Schedule 2 Form: A Comprehensive How-To Guide

1. Understanding the Declaration of Schedule 2 Form

The Declaration of Schedule 2 Form serves as an essential document in various regulatory and financial contexts, allowing individuals and businesses to report specific financial details accurately.

This form is pivotal for compliance with tax reporting and financial assessments. It typically details income sources, expenses, and other pertinent financial information. Understanding its implications is crucial for effective management of one’s financial obligations.

2. Key components of the Declaration of Schedule 2 Form

Filling out the Declaration of Schedule 2 Form involves several critical components to ensure completeness and accuracy. Each section of the form extracts vital information that contributes to the overall understanding of your financial standing.

Understanding these components is essential for effective completion of the form, as errors or omissions can lead to compliance issues.

3. Preparing to Complete the Declaration of Schedule 2 Form

Before filling out the Declaration of Schedule 2 Form, thorough preparation is crucial to ensure accuracy. Gathering all relevant documents helps facilitate a smoother completion process.

Reviewing financial documents, bills, and previous tax returns are essential steps in this preparation phase. This readiness allows you to provide accurate financial data and avoid unnecessary delays.

4. Step-by-Step Guide to Filling Out the Declaration of Schedule 2 Form

Completing the Declaration of Schedule 2 Form can seem daunting, but breaking it down into manageable steps can simplify the process significantly.

From providing identification to reporting financial information, each step requires attention to detail to ensure compliance with regulations.

5. Filing options for the Declaration of Schedule 2 Form

Once you have completed the Declaration of Schedule 2 Form, the next step is to file it correctly. There are several options available for submission, each with its advantages.

Choosing the method that works best for you can streamline your filing process, whether you prefer traditional paper submissions or modern digital routes.

6. Common mistakes to avoid when submitting the Declaration

Submitting the Declaration of Schedule 2 Form can entail common pitfalls that could lead to complications. Familiarizing yourself with these pitfalls can help you avoid unnecessary issues.

From incomplete information to failing to sign and date the form, being aware of these errors can save you from potential compliance headaches.

7. Understanding compliance and regulatory requirements

Compliance with regulations surrounding the Declaration of Schedule 2 Form is paramount. Familiarizing yourself with the governing rules will prepare you better for filing.

Understanding the potential consequences of non-compliance, such as fines or audits, emphasizes the importance of accuracy and timeliness in your submissions.

8. Resources for assistance and guidance

Utilizing available resources can drastically enhance the accuracy and efficiency of completing the Declaration of Schedule 2 Form.

Official instructions, professional help, and online tools can serve as critical assets in navigating the complexities of the process.

9. Case studies: Real-world application of the Declaration of Schedule 2 Form

Analyzing real-world applications of the Declaration of Schedule 2 Form sheds light on its significance. Case studies often illustrate the pivotal role of accurate reporting and compliance.

These examples can offer valuable insights into common missteps and highlight best practices for successfully navigating the filing process.

10. FAQ section on the Declaration of Schedule 2 Form

Addressing frequently asked questions regarding the Declaration of Schedule 2 Form can provide clarity. These questions often arise for both novice and seasoned filers.

Understanding the answers to these queries can ease the filing experience and ensure compliance.

11. Special considerations for filers

Certain unique situations require additional attention when filling out the Declaration of Schedule 2 Form. These can include international filings or filings made by third-party representatives.

Being aware of these specifics can streamline the filing process and ensure adherence to regulatory requirements.

12. Conclusion: Navigating the Declaration of Schedule 2 Form with confidence

Successfully completing the Declaration of Schedule 2 Form is essential for compliance and accurate financial reporting. Utilizing tools like pdfFiller can enhance your experience, offering an accessible platform for document management.

Emphasizing accuracy and attention to detail will ensure that your submissions meet regulatory standards, mitigating future complications.

13. Recommended next steps after filing the Declaration

After submitting the Declaration of Schedule 2 Form, it's vital to keep thorough records of your submission. Doing so not only helps in future filings but also in staying informed about any regulatory changes.

Proactive management of your documents ensures timely compliance in forthcoming reporting periods and maintains a well-organized system.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get declaration of schedule 2?

How do I make edits in declaration of schedule 2 without leaving Chrome?

How can I edit declaration of schedule 2 on a smartphone?

What is declaration of schedule 2?

Who is required to file declaration of schedule 2?

How to fill out declaration of schedule 2?

What is the purpose of declaration of schedule 2?

What information must be reported on declaration of schedule 2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.