Get the free Roth Ira Conversion Request Form - (internal)

Get, Create, Make and Sign roth ira conversion request

Editing roth ira conversion request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out roth ira conversion request

How to fill out roth ira conversion request

Who needs roth ira conversion request?

Your Comprehensive Guide to the Roth IRA Conversion Request Form

Understanding Roth IRA conversions

A Roth IRA conversion refers to the process of transferring funds from a Traditional Individual Retirement Account (IRA) to a Roth IRA. This strategic financial move allows individuals to take advantage of the tax-free growth potential of a Roth IRA, where qualified withdrawals are not subject to income tax.

The fundamental difference between Traditional IRAs and Roth IRAs lies in their tax treatment. With a Traditional IRA, you may receive a tax deduction upon contribution, but taxes are owed upon withdrawal. Conversely, contributions to a Roth IRA are made with after-tax dollars, allowing for tax-free withdrawals in retirement. The benefits of converting to a Roth IRA include tax-free growth, no required minimum distributions during the account holder's lifetime, and potential tax savings for heirs.

Eligibility for Roth IRA conversion

To qualify for a Roth IRA conversion, there are no income limits imposed on conversions themselves; however, individuals must be aware of the tax implications that could come into play depending on their income levels. One should ideally be at least 59½ years old to avoid early withdrawal penalties from a Traditional IRA, although younger individuals can convert at any age.

It's essential to assess whether a conversion aligns with your financial situation and goals. For instance, if you anticipate a lower income in retirement, maintaining a Traditional IRA may be more beneficial. Additionally, if converting pushes you into a higher tax bracket for the year, it may not be advisable.

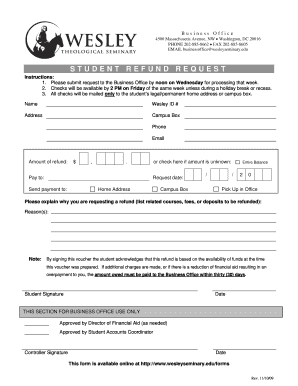

The Roth IRA conversion request form

The Roth IRA conversion request form is a critical document in initiating the conversion process. This form formalizes your intention to shift funds from a Traditional IRA to a Roth IRA, ensuring that your financial institution processes the request efficiently. The significance of the form cannot be overstated, as it serves as both a directive and a record of your conversion intent.

You can easily obtain the Roth IRA conversion request form through various financial institutions and platforms like pdfFiller. This platform streamlines the process, allowing users to fill, edit, and manage their forms conveniently.

How to access the Roth IRA conversion request form on pdfFiller

Accessing the Roth IRA conversion request form through pdfFiller is straightforward. Navigate to the pdfFiller website, where you can find the form by using their search feature or browsing through their extensive library of financial documents. This platform provides numerous interactive tools and features that enhance the user experience.

With pdfFiller, users can preview the form, edit text directly, and use various online tools such as digital signatures or document collaboration. These functionalities are particularly useful for individuals and teams looking for an efficient document management solution.

Preparing to complete the conversion request form

Before diving into the Roth IRA conversion request form, it’s crucial to gather all necessary information. Begin by collecting your personal details such as your full name, address, and Social Security number. Next, ensure you have your current IRA account details handy, as these will be required for the conversion.

Understanding the tax implications of your conversion is equally important. A Roth IRA conversion can affect your taxable income for the year, so anticipate discussing this with a tax professional to strategize effectively.

Understanding the information required on the form

Each section of the Roth IRA conversion request form requires specific information, and it is crucial to fill it out accurately. This includes personal details, the amount you wish to convert, and your current account type. Understanding these fields is paramount to avoid errors that might delay your conversion processing.

Key terms to consider include beneficiaries, which designates who will inherit your Roth IRA after your passing. Additionally, pay attention to the different account types you may hold, as accurately identifying your current account will aid in processing your conversion. Areas of confusion often include the designation of conversion amounts; it’s best to consult with a financial advisor if you are unsure.

Step-by-step guide to completing the Roth IRA conversion request form

Step 1: Fill in personal details

Accurately entering personal information is the first step in the conversion request form. Start with your full name, current address, and Social Security number. Ensuring compliance with all required fields will prevent processing delays.

Step 2: Designate the amount to convert

Identify how much you wish to convert from your Traditional IRA to your Roth IRA. Consider your current financial situation and the impact of taxes. Whether opting for a partial or full conversion, this decision should align with your long-term financial strategy.

Step 3: Indicate your current account type

It's essential to specify the type of account from which you are converting funds. Whether it’s a Traditional IRA, SEP IRA, or SIMPLE IRA, this information is critical for your financial institution to process your request correctly.

Step 4: Provide tax information (if applicable)

In certain cases, you may need to provide information regarding your estimated tax implications resulting from the conversion. Be prepared to discuss how this conversion will affect your tax filings, as you may owe taxes on the converted amount.

Step 5: Sign and date the form

The last step requires your signature and the date on which you are submitting the conversion request form. Ensure that you understand the legal implications of your signature, especially if you’re submitting electronically. Confirm that all provided information is accurate before you sign.

Managing the process after submission

After submitting your Roth IRA conversion request form, the processing time may vary depending on your financial institution's policies. Generally, you will receive confirmation of your request within a few business days. Be aware that additional documentation may be required during the processing phase.

It’s wise to stay proactive and follow up if you haven't received confirmation within the expected timeframe. Communication with your financial institution is key to ensuring your conversion proceeds smoothly.

Tracking your Roth IRA conversion

Utilize pdfFiller’s dashboard and tracking tools to monitor the progress of your Roth IRA conversion. This intuitive system allows you to check the status of your conversion request at any time, ensuring transparency and peace of mind as you navigate the process.

Keep detailed records of all submissions, confirmations, and correspondence with your financial institution. This organized approach not only helps you track your conversion but can also aid in future financial decisions.

Troubleshooting common issues

Common errors in Roth IRA conversion request forms and how to avoid them

Mistakes can occur while completing the Roth IRA conversion request form. Typical errors include incorrect personal information, not specifying the conversion amount, or misidentifying account types. These mistakes can lead to delays or denial of your conversion request.

To remedy these common mistakes, double-check each section before submitting the form. If you find yourself facing difficulties, pdfFiller provides customer support to assist you in navigating the form and rectifying any issues.

Understanding denial reasons for conversion requests

Several reasons might lead to the rejection of your Roth IRA conversion request. Common issues include failing to meet eligibility criteria, taxable income exceeding thresholds, and incomplete forms. Understanding these factors can help you avoid future denials.

If your request is denied, take the time to assess the reasons provided by your financial institution. Often, rectifying simple misunderstandings or errors can lead to a successful application. Reach out to customer service for guidance on the next steps.

FAQs about Roth IRA conversions

Many questions arise during the Roth IRA conversion process. Here are a few common queries and concise answers that can help you along the way.

Seeking authoritative answers from financial professionals or trusted sources can ensure a solid understanding of these complexities. This knowledge empowers you to make informed decisions regarding your retirement savings.

Empowering your document management with pdfFiller

pdfFiller not only streamlines the Roth IRA conversion request form process but also empowers users with access to a suite of documents for various life events. From tax forms to estate planning documents, pdfFiller offers all the tools you need to manage your financial paperwork effectively.

Using pdfFiller enhances your overall document management experience, enabling collaborative approaches with teammates or partners. Teams can easily share, edit, and sign documents in a secure, cloud-based environment.

Success stories: User experiences with Roth IRA conversions using pdfFiller

Many users have shared positive experiences utilizing pdfFiller for completing their Roth IRA conversions. Testimonials highlight the platform’s user-friendly design and efficient processing times, with notable case studies illustrating how pdfFiller simplified the conversion process for both individuals and businesses.

These success stories not only showcase the ease of use but also reflect the platform's capability to handle various document management tasks efficiently, proving pdfFiller to be an invaluable resource for those navigating their financial landscapes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my roth ira conversion request directly from Gmail?

How do I edit roth ira conversion request in Chrome?

How do I fill out roth ira conversion request on an Android device?

What is roth ira conversion request?

Who is required to file roth ira conversion request?

How to fill out roth ira conversion request?

What is the purpose of roth ira conversion request?

What information must be reported on roth ira conversion request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.