Get the free Business Tax Return 2024

Get, Create, Make and Sign business tax return 2024

How to edit business tax return 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tax return 2024

How to fill out business tax return 2024

Who needs business tax return 2024?

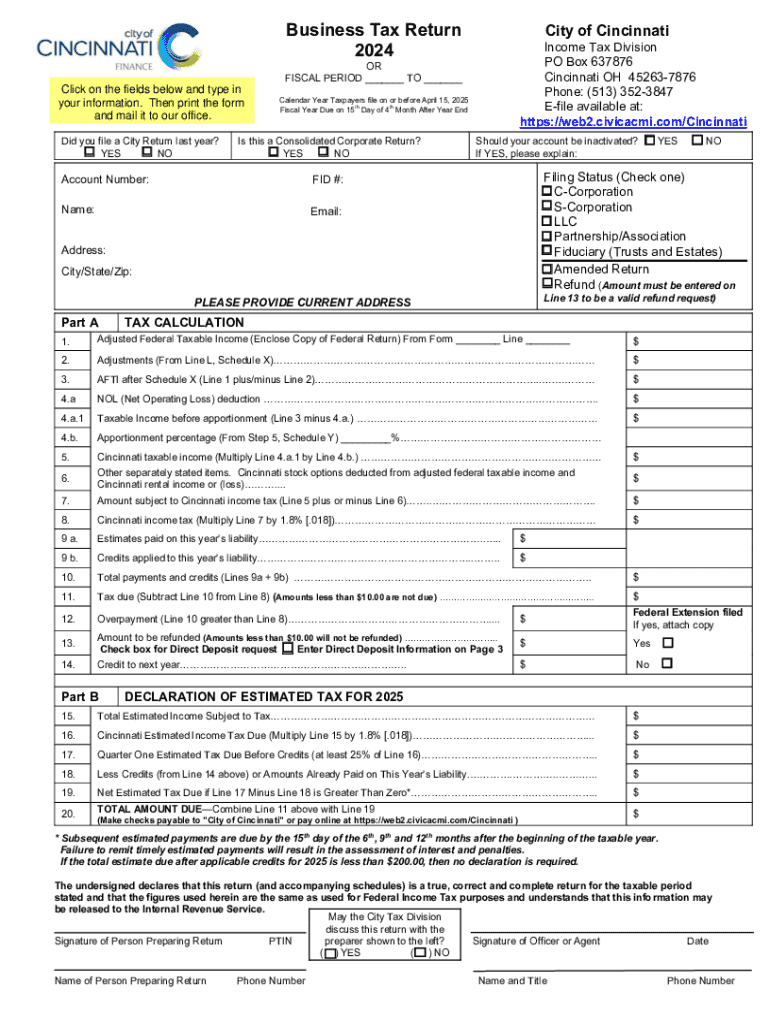

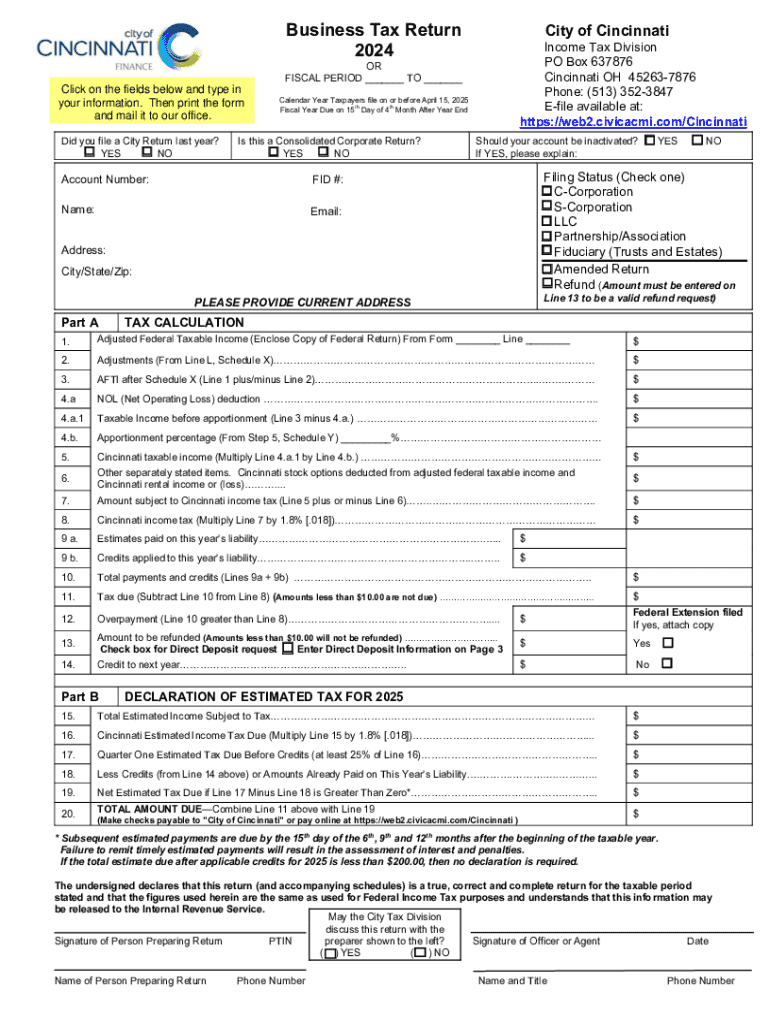

Business tax return 2024 form: A comprehensive guide

Understanding business tax returns in 2024

Filing a business tax return in 2024 is crucial for maintaining compliance with federal and state tax regulations. Accurate reporting ensures that your business avoids potential penalties and takes full advantage of available deductions and credits. With the evolving tax landscape, staying informed about changes is essential.

In 2024, several new tax regulations may impact how businesses file their returns. These changes often include adjustments to deduction limits, new credits, and modifications in filing procedures. Being aware of these can save businesses both time and money.

Who needs to file a business tax return?

The obligation to file a business tax return hinges on the structure of your business. Each business structure comes with distinct filing thresholds and requirements, encompassing sole proprietorships, partnerships, corporations, LLCs, and even nonprofits.

Sole proprietorships generally file their business income on Schedule C of their personal tax return, whereas corporations file IRS Form 1120 or 1120-S, depending on their categorization. Partnerships require IRS Form 1065, and LLCs may have distinct filing requirements based on how they choose to be taxed.

Types of business tax forms for 2024

In 2024, various tax forms cater to the specific needs of different business entities, indicating that understanding which form to use is critical. For instance, corporations typically use IRS Form 1120, while partnerships rely on IRS Form 1065. Sole proprietorships utilize IRS Schedule C to report income.

In addition to these primary forms, businesses might need to complete other forms like IRS Form 941 for quarterly payroll taxes, Form 943 for agricultural employees, and Form 990 for nonprofit organizations. Notably, the IRS may introduce new forms to accommodate updated regulations in 2024.

Key IRS deadlines for businesses in 2024

Filing deadlines are critical for businesses to avoid penalties. For sole proprietorships and single-member LLCs, the deadline is typically April 15, while C Corporations must file by the 15th day of the fourth month after the end of their fiscal year. S Corporations have a similar deadline, with returns due on March 15.

Estimated tax payments also have set deadlines throughout the year, generally coinciding with quarters. Businesses need to be proactive about these due dates to maintain good standing with the IRS and avoid penalties for late payments.

Step-by-step guide to completing the 2024 business tax return

A systematic approach is vital when completing your business tax return. First, gather the necessary documentation, including income statements, expense receipts, and previous tax returns, to ensure a hassle-free filing process. Organizing this paperwork ahead of time can significantly reduce stress.

Next, filling out the tax form requires attention to detail. Accurate information must be entered in each section, including business income, deductions, and credits. Be cautious about common mistakes, such as misreporting income or failing to include necessary deductions, as they can lead to audits or penalties.

Managing deductions and credits for businesses

Deductions play a crucial role in reducing taxable income for businesses. Common business deductions include operating expenses, equipment depreciation, and costs related to home offices. By effectively managing these deductions, businesses can significantly lower their tax burden.

Additionally, tax credits available to small businesses, such as the Research and Development Credit and the Employee Retention Credit, offer further opportunities to decrease tax liabilities. Staying informed about these credits is essential to maximize financial benefits.

Filing your business tax return with pdfFiller

Utilizing a cloud-based platform like pdfFiller can streamline the tax filing process. The platform offers user-friendly editing tools, secure e-signature options, and collaboration features that are invaluable for teams tackling business tax returns together. This flexibility allows users to complete documentation from anywhere.

Interactive tools within pdfFiller enhance the user experience, making form preparation seamless. Whether you’re filing the IRS Form 1120, Form 1065, or any other tax return, pdfFiller's capabilities simplify the process, ensuring accuracy and efficiency.

Post-filing process and audit preparedness

Once the tax return has been filed, understanding the post-filing process is essential. Expect to receive any correspondence from the IRS regarding your return, which may include notices of acceptance or requests for additional information. Keeping accurate records for several years is wise in case of audits.

Preparing for an audit involves maintaining thorough documentation of income, deductions, and credits claimed. Ensuring that all records are organized and readily accessible can simplify the audit process should the need arise.

Avoiding penalties and ensuring compliance

To avoid penalties, businesses must stay aware of common pitfalls such as misfiling, underreporting income, or missing deadlines. Implementing best practices for tracking income and expenses throughout the year can prevent errors during tax season.

Utilizing platforms like pdfFiller can also help businesses stay organized. By keeping all documentation in one secure place, teams can easily develop an audit trail and ensure compliance with IRS regulations.

Frequently asked questions about business tax returns

Navigating the complexities of business tax returns often raises questions for owners. If a business misses the tax deadline, it may incur immediate penalties, and filing an extension is one way to mitigate this issue. Amending a tax return involves submitting Form 1040-X for personal taxes or the corresponding business form to rectify any inaccuracies.

For businesses that owe money to the IRS, options like installment agreements exist to ease financial burdens. Additionally, resources from pdfFiller can guide businesses in their filing process and answer any lingering questions.

How pdfFiller supports your 2024 business tax return needs

pdfFiller is a powerful tool tailored for businesses aiming to effectively manage their 2024 tax filing process. With key features designed specifically for tax-related documentation, users can simplify their workflow. The ability to collaborate with team members, manage multiple forms, and access them from anywhere ensures that users remain efficient.

Countless customer success stories highlight businesses that have saved time, reduced errors, and improved their compliance with IRS regulations by using pdfFiller. Flexible plans and pricing options cater to both individual needs and team workflows, making it a versatile choice for any business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business tax return 2024 directly from Gmail?

How do I edit business tax return 2024 in Chrome?

Can I sign the business tax return 2024 electronically in Chrome?

What is business tax return?

Who is required to file business tax return?

How to fill out business tax return?

What is the purpose of business tax return?

What information must be reported on business tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.