Get the free New Mexico Schedule of Additions, Deductions, and Exemptions

Get, Create, Make and Sign new mexico schedule of

Editing new mexico schedule of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new mexico schedule of

How to fill out new mexico schedule of

Who needs new mexico schedule of?

Your Ultimate Guide to the New Mexico Schedule of Form

Understanding the New Mexico Schedule of Form

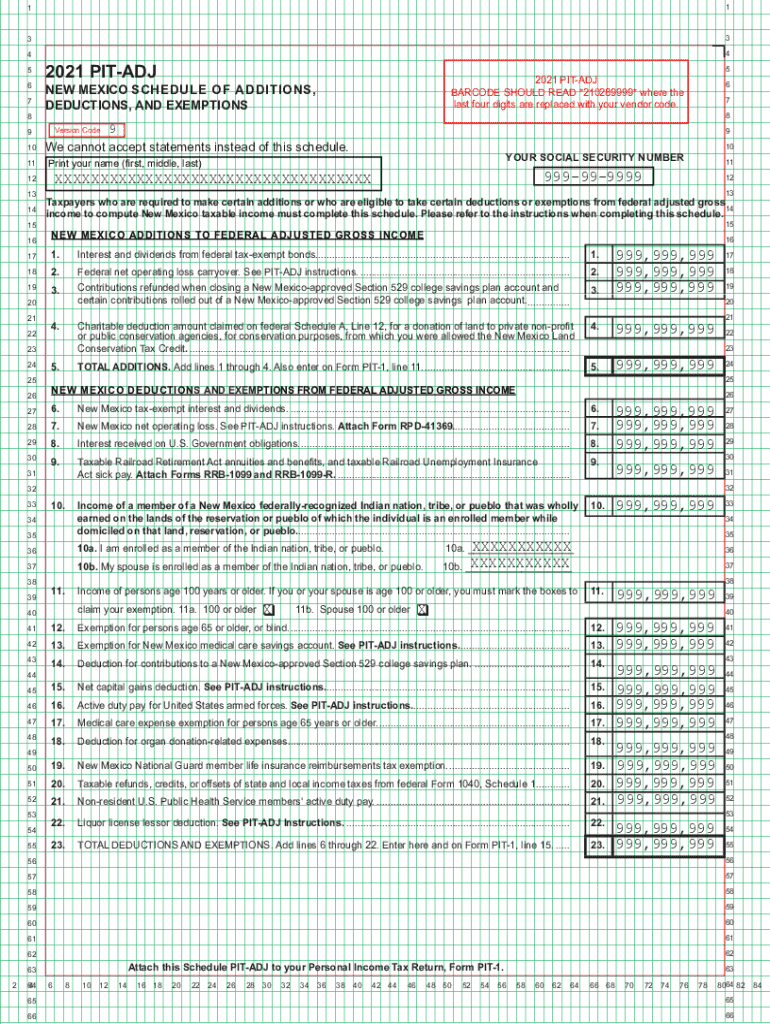

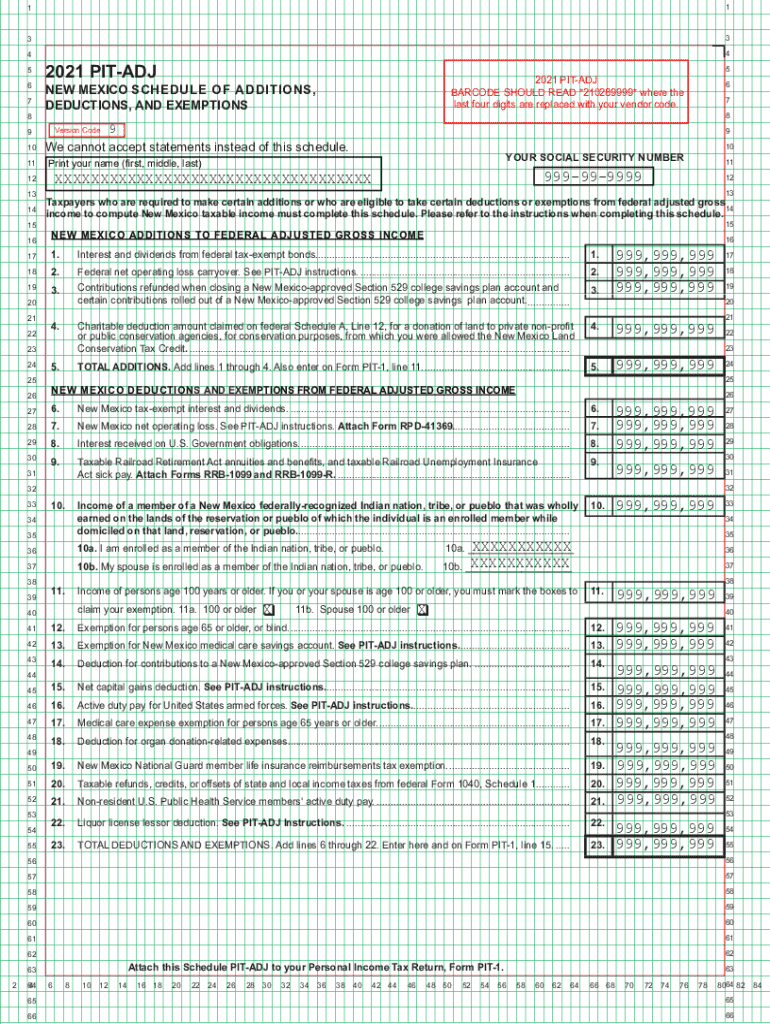

The New Mexico Schedule of Form is designed to streamline the tax filing process for residents and businesses within the state. It serves as a detailed template that taxpayers can utilize to report their income, deductions, and credits. Its main purpose is to ensure that both individuals and businesses comply with state tax regulations while maximizing potential tax benefits.

For individuals and teams navigating their tax obligations, this form is more than just an administrative hurdle; it is a vital tool that aids in organizing financial information effectively. The schedule encapsulates essential data that directly influences tax liabilities and potential refunds, making it crucial for financial planning.

Types of New Mexico schedules

In New Mexico, different schedules are available to cater to the diverse needs of taxpayers. They include individual and business tax schedules, each serving specific purposes tailored to the taxpayer's situation.

Individual tax schedules are crafted for personal income tax filings, helping individuals streamline their income reporting from all sources. Conversely, business tax schedules accommodate various business types, ensuring compliance with corporate tax specifications and fostering accurate reporting.

Specific situations dictate the formulation of these schedules. For instance, an individual filing might need to reference education credits, whereas a business might focus on operational write-offs, ensuring that both entities revel in the full scope of allowable deductions.

Step-by-step guide to filling out the New Mexico Schedule of Form

Filling out the New Mexico Schedule of Form can be straightforward if approached methodically. Preparation is half the battle; gather all necessary documents upfront. This typically includes W-2s, 1099s, and any documentation regarding deductions you plan to claim.

Understanding key terminology used in the form is essential. Terms like 'adjusted gross income' and 'tax credits' should be familiar to accurately complete the form.

Common mistakes to avoid include neglecting to report all income sources, failing to sign the form, and miscalculating deductions. A thorough review assists in mitigating these issues.

Editing and managing your New Mexico schedule online

In today’s digital landscape, managing tax forms online simplifies the entire process. pdfFiller provides tools for editing digital forms seamlessly and enables users to save and access forms from virtually anywhere, fostering an efficient filing experience.

The pdfFiller platform accommodates collaboration among teams, allowing multiple users to review and make edits easily. This feature is particularly beneficial for businesses that require several stakeholders to contribute to tax documentation.

Sign and submit your New Mexico schedule

eSigning has transformed the submission process of tax forms, providing a secure and efficient way to complete your filing. Using pdfFiller, users can sign documents electronically, ensuring they meet standard compliance requirements without wasting time on physical paperwork.

When it comes to submission methods, taxpayers have options. Online submission is the quickest route, providing instant confirmation of successful filing. Alternatively, if you prefer traditional methods, mailing instructions are available, ensuring that your documents reach the taxation department securely.

Important deadlines and dates for New Mexico tax filings

Understanding key deadlines is fundamental in ensuring compliance with state tax laws. For individuals, tax filings generally align with federal deadlines, typically April 15th. However, it’s important to check for any specific New Mexico state extensions or changes each year.

For businesses, deadlines can vary based on the structure and type of entity. Certain corporations may have different submission timelines, necessitating careful attention to avoid penalties.

Resources for common questions and issues

Tax filing can sometimes feel overwhelming, but resources are available to answer common queries. The New Mexico Taxation and Revenue Department offers assistance through various channels, ensuring taxpayers can find required support.

Frequently asked questions cover topics ranging from eligible deductions to filing schedules and deadlines. Additionally, links to official publications can enhance your understanding and provide clarity on complex tax matters.

Enhancing your tax filing experience

Effective organization of tax documents is integral to a smooth filing process. Utilizing cloud-based solutions like pdfFiller allows users to keep track of all necessary paperwork, reducing last-minute scrambles before deadlines.

Leveraging technology not only simplifies document management but also ensures compliance with state requirements. Being prepared with correct forms can save valuable time and stress during tax season.

Conclusion: Streamlining your tax season with pdfFiller

The New Mexico Schedule of Form, when handled correctly, can greatly simplify your tax season. By utilizing pdfFiller's capabilities, users benefit from a seamless process encompassing editing, signing, and management, all from one platform.

As tax regulations evolve, staying ahead with efficient tools ensures you can focus on financial growth rather than paperwork. Exploring the full array of pdfFiller's features will enhance your overall tax experience, paving the way for compliance and organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in new mexico schedule of?

Can I edit new mexico schedule of on an iOS device?

How do I complete new mexico schedule of on an Android device?

What is new mexico schedule of?

Who is required to file new mexico schedule of?

How to fill out new mexico schedule of?

What is the purpose of new mexico schedule of?

What information must be reported on new mexico schedule of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.