Get the free Tax File Number Form

Get, Create, Make and Sign tax file number form

Editing tax file number form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax file number form

How to fill out tax file number form

Who needs tax file number form?

Your Comprehensive Guide to the Tax File Number Form

Understanding the tax file number (TFN)

A Tax File Number (TFN) is a unique identifier issued by the Australian Taxation Office (ATO) to individuals and businesses for tax purposes. This number is crucial for managing tax obligations, including filing returns and ensuring accurate taxation. The ATO uses the TFN to track taxpayer information, manage tax records, and avoid confusion between individuals with similar names.

The importance of a TFN goes beyond mere identification; it plays a vital role in the income tax system. It is necessary for various activities, including opening bank accounts, applying for government benefits, and enrolling in superannuation funds.

Who needs a TFN?

Individuals such as employees, business owners, and students require a TFN to comply with tax laws. Each taxpayer has a responsibility to obtain one, as it helps streamline tax payments and avoid penalties. For businesses, a TFN is essential for reporting income, paying tax, and ensuring compliance with GST regulations.

Additionally, non-residents and temporary residents need a TFN to pay tax on their Australian income. Without a TFN, they may face higher withholding taxes, which can impact their financial situation significantly.

TFN application process

Applying for a TFN is a straightforward process, but understanding the steps is essential to avoid delays. The first step involves gathering the required documents, including proof of identity, such as a passport or driver's license, and evidence of residency.

You can obtain the tax file number form through the ATO website or directly at service centers. Alternatively, you can apply online via the ATO's online services, which are now available to most individuals.

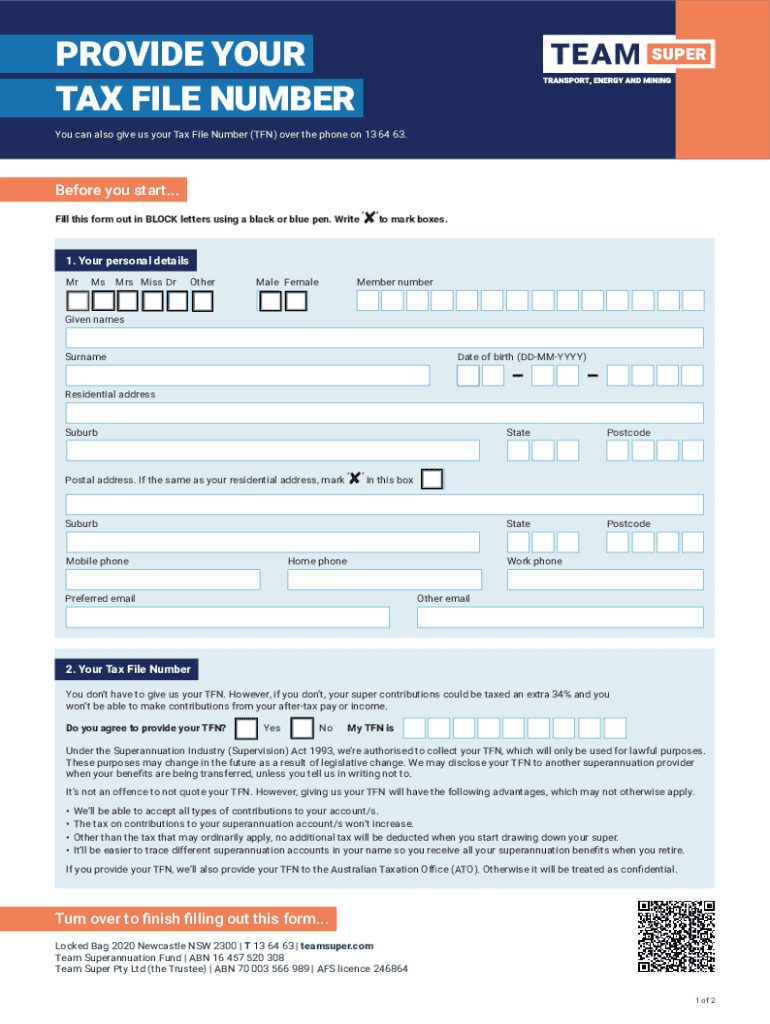

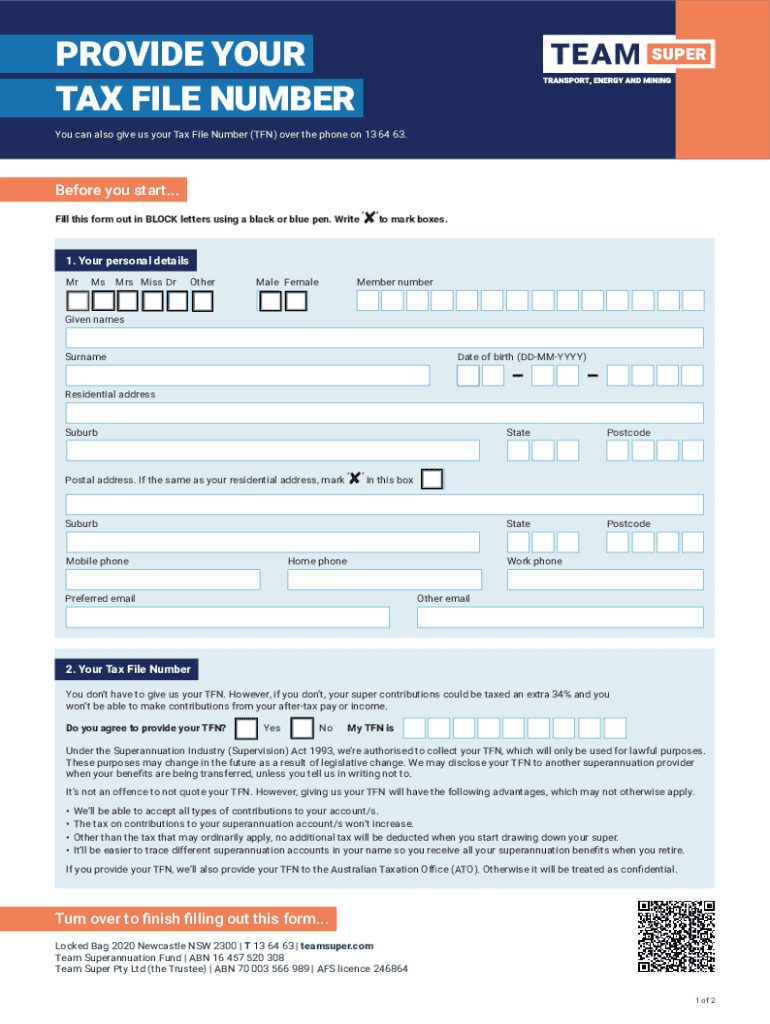

Filling out the tax file number form

When filling out the TFN application form, accuracy is crucial. Start with personal details such as your full name, current address, and date of birth. Pay special attention to residency status; this section differentiates between Australian residents and non-residents, affecting tax obligations significantly.

Submitting your application

Once the form is completed, you can submit it either online or via mail. Online submissions are generally processed faster, while mailing the form may take longer due to postal delays. Be prepared for additional verification checks, especially if you are a non-resident or have recently changed your name.

Managing your TFN information

Keeping your TFN information updated is essential for smooth dealings with the ATO. Updates may be necessary due to changes such as marital status, address changes, or alterations in residency status. It’s important to notify the ATO of any such changes to ensure compliance with tax laws.

To update your TFN details, you simply need to fill out the relevant sections of the application form, indicating the changes you wish to make. You may have to provide supporting documents for certain updates.

Losing or misplacing your TFN

If you lose or forget your TFN, it can cause unnecessary delays in your tax processes. Fortunately, there are several ways to retrieve your TFN, including checking your tax return documents, superannuation statements, or contacting the ATO directly for assistance.

The importance of keeping your TFN secure

Identity theft involving TFNs can lead to severe repercussions, including fraudulent tax returns filed in your name. Therefore, safeguarding your TFN is paramount. Avoid sharing your TFN unnecessarily and store related documents securely.

If you suspect your TFN has been compromised, report it to the ATO immediately. The ATO can provide guidance on how to proceed and protect your identity from potential fraud.

Reporting a compromised TFN

If you suspect unauthorized use of your TFN, take immediate action by contacting the ATO through their official channels. They may require you to verify your identity before assisting with the recovery process.

Common TFN questions and answers

Many individuals have questions regarding the application and management of their TFN. For instance, applying online is possible and often recommended due to its convenience and faster processing times.

Generally, it takes about 28 days to receive your TFN after applying, depending on your circumstances. Temporary residents should also apply for a TFN to manage any income tax responsibilities they may have during their stay in Australia.

User experiences

Real-life experiences vary; some individuals report a seamless application process, while others encounter issues with document verification. Being prepared with all necessary documentation can significantly improve your experience.

Interactive tools and resources

To assist you with the application process, pdfFiller provides interactive tools that can enhance your experience. You can download the tax file number form directly from the ATO website, ensuring you always have the latest version.

Downloadable tax file number form

Download instructions are straightforward. Access the ATO website and navigate to the forms section where you’ll find the tax file number form available in PDF format. Be sure to save it to your device for easy access during your application.

Interactive fillable form guide

Utilize pdfFiller’s interactive fillable form guide to ensure you complete the tax file number form correctly. This tool offers step-by-step instructions, making the process user-friendly, especially for those unfamiliar with such paperwork.

Links to additional government resources

For more information, visit the ATO website and explore various government services that can assist with tax matters. The ATO site has a wealth of resources, including FAQs and contact details if you need further assistance.

Collaborating on document creation

Sometimes, completing the tax form may involve family or financial advisors. Using pdfFiller’s collaborative features can make this process more efficient. Share the document with the necessary individuals, allowing them to review and suggest modifications.

Signing and sending the TFN application

After completing the form, it’s crucial to sign it. You can use pdfFiller’s eSigning capabilities to securely sign your document. Ensure that you send the completed form through secure channels to protect your personal information.

Tracking your application status

Once submitted, it's normal to wonder about the status of your TFN application. Generally, you can expect updates within 28 days. It's wise to make a note of when you applied and any reference numbers provided during the process.

Contacting the ATO for application inquiries

If you haven't received your TFN within the expected timeframe, you can reach out to the ATO for inquiries. Have your details ready, including your application reference number, to streamline the inquiry process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax file number form from Google Drive?

How can I get tax file number form?

How can I fill out tax file number form on an iOS device?

What is tax file number form?

Who is required to file tax file number form?

How to fill out tax file number form?

What is the purpose of tax file number form?

What information must be reported on tax file number form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.