Get the free Business Online Banking Enrollment Form

Get, Create, Make and Sign business online banking enrollment

How to edit business online banking enrollment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business online banking enrollment

How to fill out business online banking enrollment

Who needs business online banking enrollment?

Business online banking enrollment form: A how-to guide

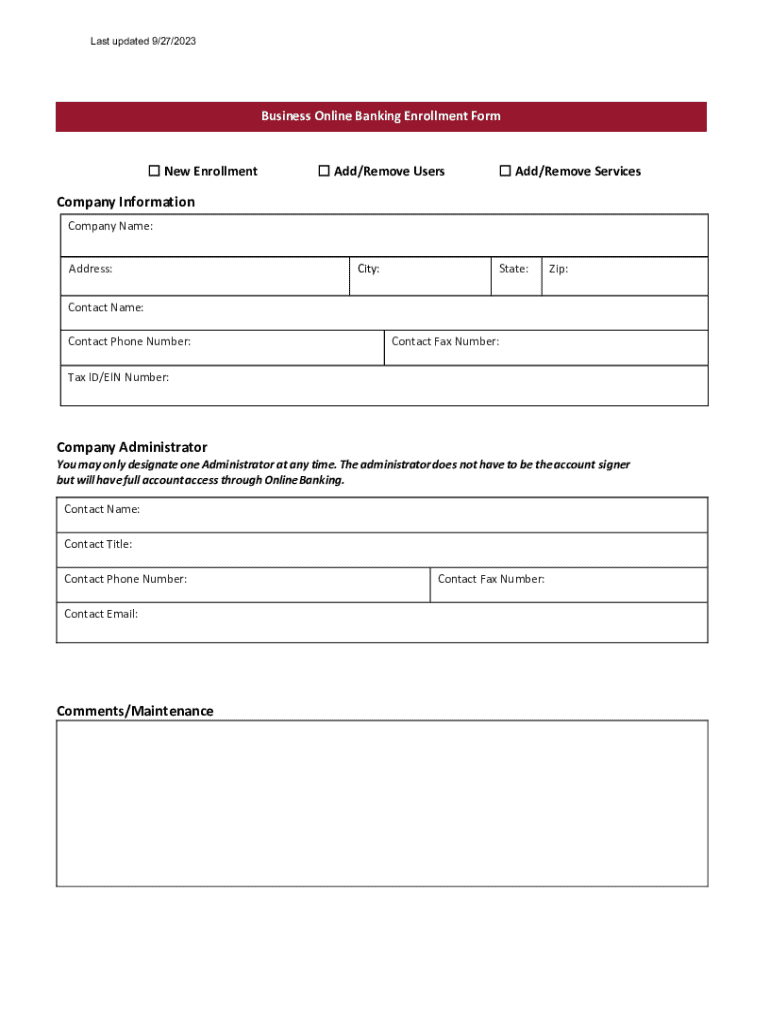

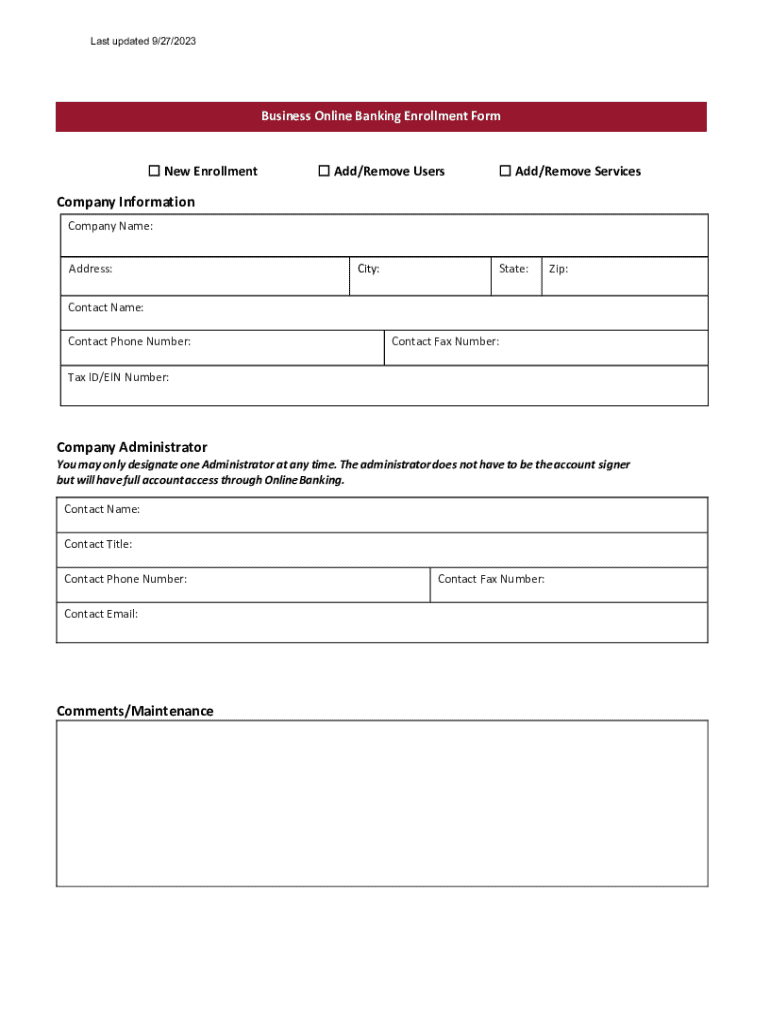

Understanding online banking enrollment forms

A business online banking enrollment form is a crucial document that businesses must complete to access their bank's online banking services. This form allows organizations to manage their financial activities remotely, offering tools and facilities tailored to their specific needs. Without this enrollment, accessibility to vital financial operations, such as monitoring transactions, making payments, and managing employees' payroll, is severely limited.

The significance of online banking enrollment cannot be overstated. It streamlines the banking interaction process, allowing businesses to perform essential functions anytime, anywhere. This flexibility is particularly beneficial for teams with varying locations or those who are often away from the office.

Preparing for your enrollment

Before diving into the enrollment process, it’s vital to gather all necessary information and documents. This preparation ensures a smoother experience and helps avoid any potential delays. The required documentation typically includes personal identification and financial information.

Additionally, ensure you have the required technology to complete your enrollment. Accessing the form typically requires internet connectivity and a compatible device such as a laptop, tablet, or smartphone.

Step-by-step guide to completing your online banking enrollment form

To successfully enroll in online banking, follow these structured steps:

Troubleshooting common issues

Despite diligent preparation, you may encounter issues during the enrollment process. Here are common problems and solutions:

Managing your account post-enrollment

Upon successfully completing your enrollment and receiving access, it's time to set up your online banking access. Start by creating secure login credentials, ensuring you follow best practices for password security.

Leveraging pdfFiller for your online banking enrollment experience

Utilizing pdfFiller can significantly enhance your experience when completing your business online banking enrollment form. The platform offers powerful tools that simplify document management.

Frequently asked questions (FAQs)

As you navigate through the business online banking enrollment process, various questions may arise. Here are some frequently asked queries and their responses.

Next steps after enrollment

Once your enrollment is approved, it's beneficial to set up alerts and notifications for your transactions. This proactive approach helps keep tabs on your account’s activities and ensures any unauthorized transactions are promptly flagged.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify business online banking enrollment without leaving Google Drive?

How can I send business online banking enrollment to be eSigned by others?

How can I get business online banking enrollment?

What is business online banking enrollment?

Who is required to file business online banking enrollment?

How to fill out business online banking enrollment?

What is the purpose of business online banking enrollment?

What information must be reported on business online banking enrollment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.