Get the free Form 10-d

Get, Create, Make and Sign form 10-d

How to edit form 10-d online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-d

How to fill out form 10-d

Who needs form 10-d?

Form 10- How-to Guide

Understanding Form 10-

Form 10-D serves a crucial role in various financial processes, primarily related to pension funds and other withdrawal scenarios under the Employee Retirement Income Security Act (ERISA). This form allows individuals to request a distribution from their retirement plans, ensuring compliance with federal regulations.

The importance of Form 10-D cannot be overstated, as it establishes the legitimacy of the request for funds, protecting both the beneficiary and the institution involved. It ensures that withdrawals are tracked and handled appropriately, minimizing administrative errors and potential legal issues.

Components of Form 10-

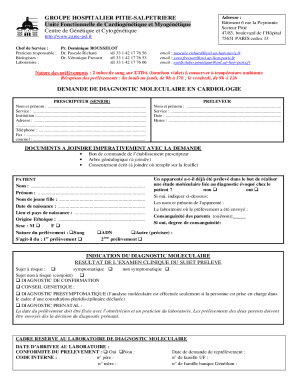

Form 10-D consists of several vital sections designed to capture comprehensive information needed for processing a withdrawal request. Each section plays a significant role in ensuring that your application is complete and accurate.

The key components include the Personal Information Section, Financial Information Section, and Signature and Consent Section. Understanding each of these elements is fundamental for accurate form completion.

Detailed breakdown of each section

In the Personal Information Section, you will need to provide details such as your full name, address, date of birth, and Social Security number. Accuracy is paramount here; any discrepancies could delay processing times.

The Financial Information Section requests data about your retirement account, including account numbers and the amount you wish to withdraw. Make sure to format this information clearly to avoid confusion.

Finally, the Signature and Consent Section is where you'll confirm everything is accurate and that you consent to the regulatory obligations tied to the withdrawal. Always double-check for completeness and accuracy; this section holds legal weight.

Common mistakes to avoid

Eligibility for Form 10-

Determining eligibility for Form 10-D is essential before proceeding with your application. Generally, eligibility is defined by your status as a participant in a qualified retirement plan, such as a 401(k) or pension fund.

To qualify, applicants must be a certain age, commonly at least 59½, and meet specific employment status criteria. Documentation to support these claims, such as identification and proof of employment, may be required.

Understanding eligibility limitations

There are notable exceptions to eligibility. For example, individuals facing financial hardship may be permitted to withdraw funds before the stipulated age. Understanding the specific requirements and any limitations is crucial to avoid application issues.

Steps for completing Form 10-

Before diving into the application, preparation is vital. Gathering necessary documents, such as proof of identity and relevant financial statements, will help streamline the process.

Here's a step-by-step guide to completing Form 10-D to ensure every necessary aspect is addressed.

Submission guidance

Submitting Form 10-D can vary by institution, but typically there are two main methods: online and mail-in. It’s essential to understand both options to choose the one that suits your situation best.

For online submissions, you can often find platforms associated with your retirement plan's administrator where the form can be completed and submitted electronically. Make sure to follow their specific instructions for upload.

If opting for mail-in submission, print the completed form, sign it, and send it to the provided address. Always confirm packaging and postage details to avoid delays.

Checking the status of your Form 10- submission

Tracking your application progress can typically be done through the same online portal where you submitted your form, or by contacting customer service at the institution managing your retirement plan. Important timelines to note are usually indicated on their platforms, helping you stay informed throughout the process.

Managing your Form 10-

What happens after submission is a critical aspect to keep in mind. Processing times can vary, but most institutions aim to complete evaluations within a few weeks. During this time, staying patient yet proactive is key.

If needed, you may have options for amending or withdrawing your submission. Each institution has its protocols, so check their guidelines immediately if changes are necessary.

Can withdraw my entire pension amount?

Withdrawal conditions can be complex. Primarily, you may withdraw a total pension amount under certain criteria, such as reaching retirement age or facing specific hardships. Be vigilant in reviewing your plan’s rules to understand limitations and conditions that may impact your withdrawal options.

FAQs about Form 10-

Addressing common questions and concerns surrounding Form 10-D clears up confusion and empowers applicants to navigate the process effectively.

Conclusion and next steps

Having clear guidance on Form 10-D brings peace of mind during a potentially overwhelming process. Utilizing tools such as pdfFiller can significantly enhance your experience when creating, editing, and managing this document.

pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform. With interactive tools tailored to Form 10-D, applicants can fill out and sign forms effortlessly, ensuring a smooth transaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 10-d directly from Gmail?

How do I execute form 10-d online?

How do I fill out the form 10-d form on my smartphone?

What is form 10-d?

Who is required to file form 10-d?

How to fill out form 10-d?

What is the purpose of form 10-d?

What information must be reported on form 10-d?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.