Get the free Commercial Umbrella Liability Coverage

Get, Create, Make and Sign commercial umbrella liability coverage

Editing commercial umbrella liability coverage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out commercial umbrella liability coverage

How to fill out commercial umbrella liability coverage

Who needs commercial umbrella liability coverage?

Understanding commercial umbrella liability coverage form

Understanding commercial umbrella liability coverage

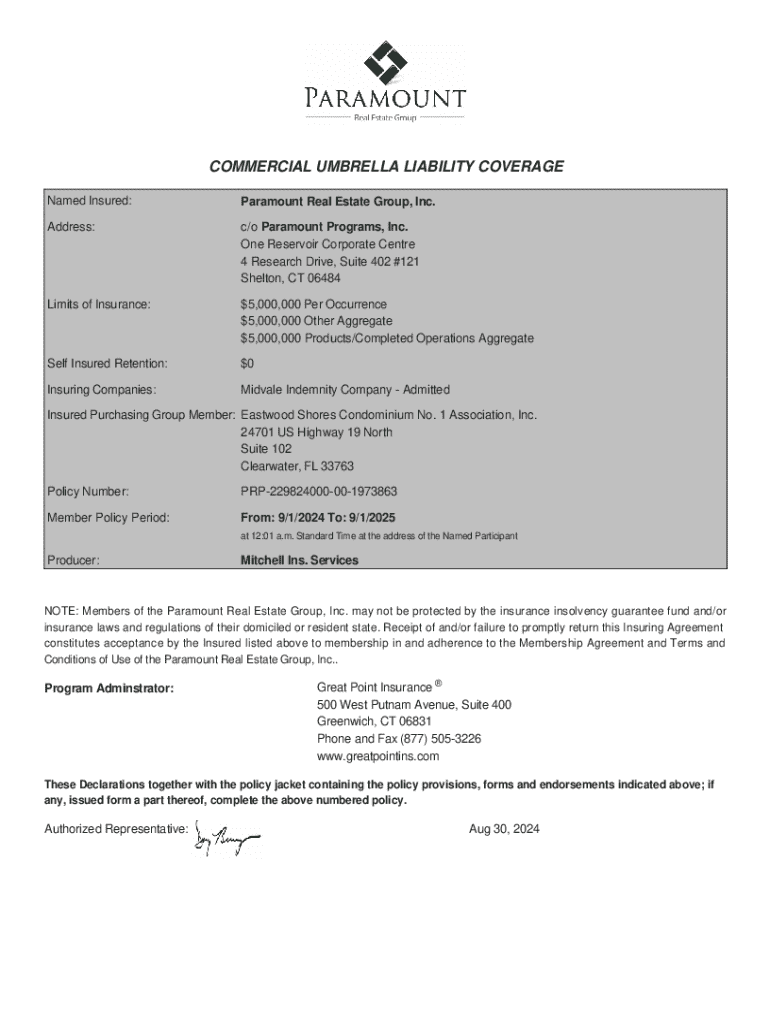

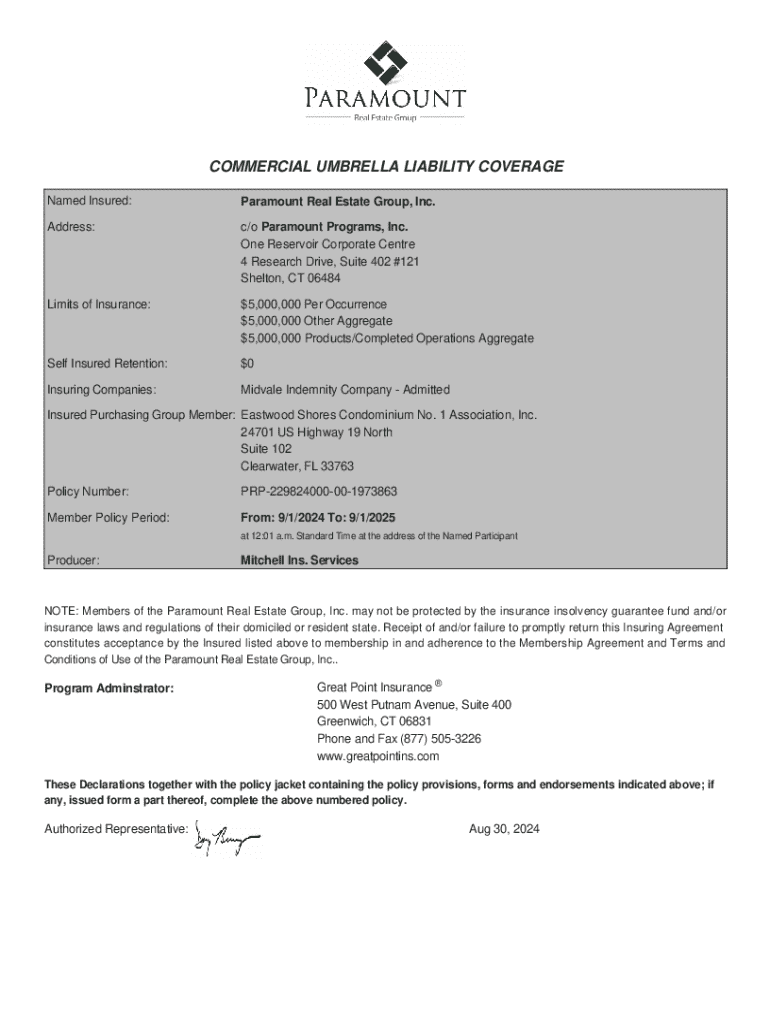

Commercial umbrella liability coverage is a form of insurance that provides an extra layer of protection for businesses. It kicks in when the standard liability limits of general liability or auto liability policies are exhausted, covering various claims such as bodily injury, property damage, and personal injury. The primary purpose of this coverage is to mitigate substantial risks that businesses face, especially those operating in industries with potential legal liabilities that could lead to significant financial strain.

The importance of commercial umbrella liability coverage cannot be understated. It serves as a safety net that protects a business's assets, ensuring that unforeseen events do not plunge the company into financial jeopardy. Without this additional layer of protection, a single lawsuit could consume the basic liability policy limits, leaving the business to fend for itself against excessive claims that threaten stability.

Differentiating between umbrella and excess liability

While both umbrella and excess liability insurance serve to provide additional coverage, they are distinct in their applications. Excess liability insurance extends beyond the limits of an underlying policy but does not add new coverage types. In contrast, commercial umbrella liability coverage fills gaps between policies, offering flexibility in coverage types as well as higher limits.

For example, if a company has a general liability policy with $1 million limits and is sued for $1.5 million, the excess liability policy would cover another $500,000 but only in the scope of what the primary policy covers. Meanwhile, an umbrella policy could potentially cover claims beyond those limits, such as wider instances of negligence.

Key components of the coverage form

To make informed decisions, it's essential to understand the key components of the commercial umbrella liability coverage form. The coverage form typically begins with an overview of coverage limits. These limits are crucial as they dictate the maximum amount your insurer will pay for claims, and establishing these adequately is vital. Many factors influence these limits, including the size of the business, the nature of operations, and estimates of potential risks.

Covered risks and exclusions are also detailed in the coverage form. Common risks usually covered include personal injury, property damage, and even non-physical damages like defamation in certain cases. However, it’s important to be aware of exclusions, which can commonly be related to pollution, war, and intentional damage, as they can leave significant gaps in coverage when claims arise.

Understanding the policy structure and terms used in the coverage form is equally vital. It helps in deciphering what is covered and what isn’t. Confusing terminology can lead to misunderstandings that could negatively impact claims. Thus, businesses must engage with the policy language, ensuring clarity about terms such as ‘aggregate limit,’ ‘per occurrence limit,’ and ‘definitions of terms’ frequently used within the document.

Steps to fill out the coverage form

Filling out the commercial umbrella liability coverage form requires careful attention to detail. First, gather necessary information. Having complete documents like prior insurance policies, claims history, and projected revenue figures will smooth the process. A thorough risk assessment document will provide insight into potential liabilities that need coverage.

Be sure also to avoid common mistakes made during form completion, including incorrect figures, misleading information, or failing to disclose pertinent details about risks and operations. Taking the time to review the entire document thoroughly can greatly reduce the chances of such errors and improve the accuracy of submissions.

Best practices for managing your commercial umbrella liability coverage

Effective management of commercial umbrella liability coverage is a continuous process. Regular reviews and updates of the policy are essential to adapt to changes in business operations or growth, ensuring that your coverage accurately reflects your evolving liability landscape. It’s advisable to reassess your coverage, ideally on an annual basis, or whenever significant business changes occur.

Building a good relationship with your insurer is key for successful coverage management. Frequent communication helps ensure coverage aligns with your business needs. It's beneficial to discuss any changes in operations, new projects, or increased risks, as these factors will determine the adequacy of your existing coverage.

Moreover, educating your team about commercial umbrella liability coverage policies and procedures is crucial. Training employees on the importance of liability insurance ensures that they understand their role in risk management and can be proactive about reporting incidents that may lead to claims.

Tailoring coverage for specific business needs

Different industries have unique coverage needs due to the varying types of risks involved. It is important to consider the specific operational landscape your business navigates. A construction firm may face different liability risks from a tech startup, and thus, the commercial umbrella liability coverage should reflect those nuances.

Case studies involving businesses that have successfully implemented tailored coverage can provide valuable insights. For instance, a transportation company might share how modifications in their commercial umbrella liability policy saved them from financial ruin after an unexpected claim. These real-world applications enforce the concept of adjusting coverage as per specific operational demands.

Additionally, engaging with professional advisors can prove beneficial. Insurance brokers or consultants can analyze your current coverage and help in redesigning insurance packages that cater specifically to your business context. This professional support helps businesses feel secure and comprehensively covered against potential liabilities.

Utilizing interactive tools for document management

Managing the commercial umbrella liability coverage form can be simplified with the right digital tools. pdfFiller provides a suite of features that make the process of filling out, editing, and submitting forms more efficient. Users can easily access the platform to edit PDFs, fill out forms, and track submissions from any location, thus enhancing productivity.

The eSignature capabilities enable businesses to sign documents digitally, expediting processing time significantly. Gone are the days of printing, signing, and scanning documents. Additionally, pdfFiller's collaboration features allow team members to work together seamlessly, making it easy to fill out comprehensive forms by sharing access and collaborating in real time.

FAQ on commercial umbrella liability coverage

Businesses often have questions regarding commercial umbrella liability coverage. Clarifying common inquiries such as the necessity of this insurance, the differences between types of policies, and the best practices for ensuring adequate coverage ensures informed decision-making. Many businesses ponder the question of whether the added cost of an umbrella policy is justified by the protection it provides against large, unexpected claims.

Myths surrounding umbrella liability coverage often circulate. Some believe it only applies to larger businesses, while others misunderstand its role in covering certain claims. It's important to demystify these misconceptions, ensuring that both small and large businesses understand the protections available through commercial umbrella liability coverage.

Empowering your document management with pdfFiller

pdfFiller’s cloud-based solutions enhance the management of commercial umbrella liability coverage forms, providing businesses with a unified platform to create, edit, and manage documents. Users benefit from accessible templates that streamline the form-filling process, allowing for quick adaptability to changes and requirements.

Enhanced business efficiency results from these tools, as businesses enjoy seamless workflows in document handling. By automating cumbersome processes, teams can devote more energy to their core operations rather than paperwork. Many users have shared customer success stories about how pdfFiller has transformed their document management practices, reducing errors and improving accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the commercial umbrella liability coverage form on my smartphone?

How do I complete commercial umbrella liability coverage on an iOS device?

How do I edit commercial umbrella liability coverage on an Android device?

What is commercial umbrella liability coverage?

Who is required to file commercial umbrella liability coverage?

How to fill out commercial umbrella liability coverage?

What is the purpose of commercial umbrella liability coverage?

What information must be reported on commercial umbrella liability coverage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.