Get the free Return of Organization Exempt From Income Tax 990

Get, Create, Make and Sign return of organization exempt

Editing return of organization exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of organization exempt

How to fill out return of organization exempt

Who needs return of organization exempt?

Return of Organization Exempt Form: A Comprehensive How-to Guide

Understanding the Return of Organization Exempt Form

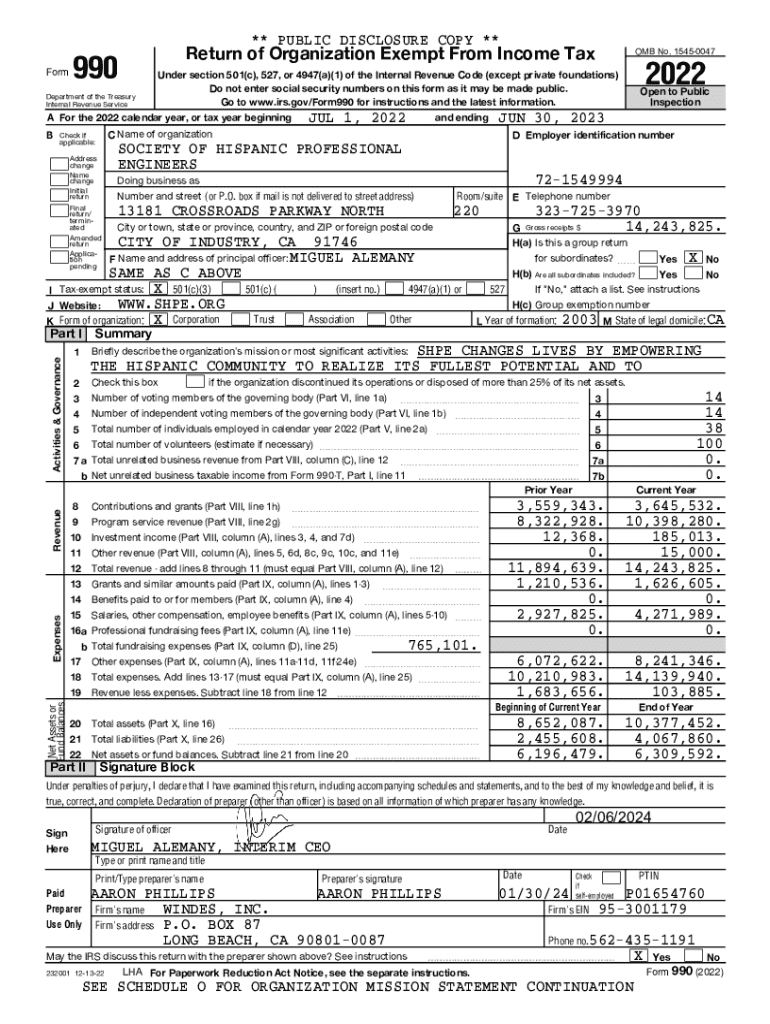

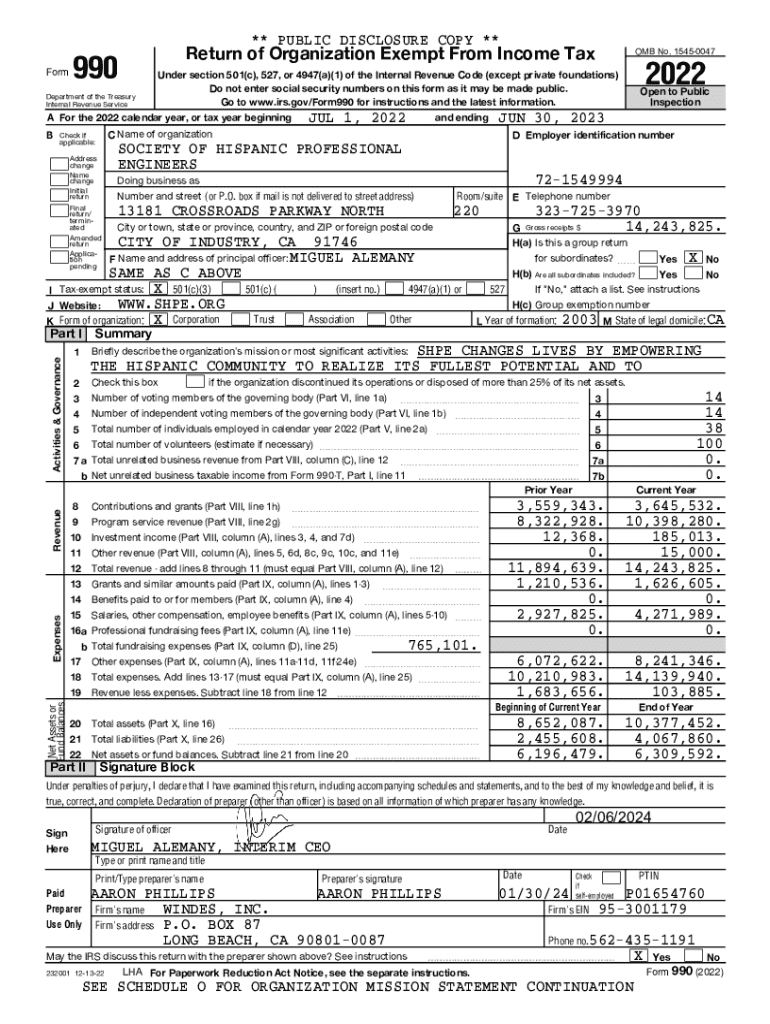

The Return of Organization Exempt Form, commonly known as Form 990, serves as a key reporting mechanism for tax-exempt organizations in the United States. It provides the IRS and the public with a comprehensive overview of an organization's financial health, activities, governance, and compliance with tax regulations. This form is essential, as it allows organizations to maintain their tax-exempt status by demonstrating transparency and accountability.

Filing this form is not just a bureaucratic requirement; it ensures that tax-exempt organizations operate within the legal framework and remain eligible for the benefits of their status. The importance of this form extends beyond compliance; it plays a significant role in building trust with donors, stakeholders, and the community. Understanding the crucial terminology such as 'exempt organizations,' 'public charities,' and 'private foundations' is vital for effectively navigating the complexities of Form 990.

Eligibility criteria for filing the form

Understanding who is required to file the Return of Organization Exempt Form is paramount for any organization seeking or maintaining tax-exempt status. Generally, any organization that is classified as tax-exempt under Section 501(c) of the Internal Revenue Code must file this form annually. This includes public charities, private foundations, and other tax-exempt entities. A critical criterion for maintaining tax-exempt status is ensuring that the organization is not primarily engaged in activities that benefit specific individuals or shareholders.

However, certain organizations may be exempt from this requirement. For instance, churches, interdenominational organizations, and specific governmental units do not need to file Form 990. Additionally, organizations with gross receipts under $50,000 can utilize Form 990-N, also known as the e-Postcard, which simplifies the reporting process for smaller nonprofits. Understanding these distinctions can make the filing process more straightforward and help organizations avoid unnecessary obligations.

Preparatory steps before filing

Preparation is critical before diving into the complexities of the Return of Organization Exempt Form. The first essential step is to gather all necessary information and documentation. This includes detailed records of the organization’s mission, activities, governance structure, and financial data over the past year. Make sure to compile relevant financial statements, which may include balance sheets and profit and loss statements, as these will be vital for accurate reporting.

The next preparation step involves identifying the correct version of the form to use. Organizations must understand the differences between Form 990, Form 990-EZ, and Form 990-N. For example, Form 990 is typically required for larger organizations with gross receipts over $200,000, while Form 990-EZ can be used by smaller organizations with gross receipts between $50,000 and $200,000. Knowing which form to file can save time and ensure compliance with IRS regulations.

Detailed instructions for completing the form

Completing the Return of Organization Exempt Form requires careful attention to detail. The form is structured in several sections, and each one must be completed accurately to avoid compliance issues. Starting with the header information, organizations must provide their legal name, address, and EIN (Employer Identification Number). Following this, an overview of the organization, including its mission and primary activities, should be entered.

In the financial activities section, organizations will report on their revenue, expenses, assets, and liabilities, providing a snapshot of their financial standing. It's imperative for organizations to disclose governance structures in the management section, detailing board members' roles and responsibilities. Additionally, certain schedules may be required for submission, including Schedule A for public charity status, Schedule B to disclose contributors, and Schedule C for reporting political campaign activities, as these elements are crucial for maintaining transparency.

Filing options: how and where to submit

Once the Return of Organization Exempt Form is completed, understanding the filing options becomes crucial. Organizations can choose to file offline through traditional mail, but it is essential to verify the mailing address and ensure timely delivery, which can be a drawback due to potential postal delays. Alternatively, online filing through the IRS website or third-party platforms like pdfFiller offers the advantage of instant submission and tracking.

E-filing is increasingly recommended due to its efficiency and security, allowing organizations to file in a matter of minutes. Specific state requirements must also be considered, as many states have their filing requirements for tax-exempt organizations. Resources such as state tax offices can provide guidance on these requirements and ensure compliance on all fronts.

Key considerations and best practices

Timeliness in filing the Return of Organization Exempt Form cannot be overstated. Missing deadlines can lead to penalties and loss of tax-exempt status. Therefore, it is essential for organizations to mark their calendars with the filing deadline, which typically is the 15th day of the 5th month after the end of their accounting period. Organizations must also remain vigilant to avoid common pitfalls, such as incomplete forms or incorrect data entry, which can delay processing and lead to further complications.

Beyond the initial filing, maintaining compliance post-filing is vital. Nonprofits should establish an internal system for record-keeping, ensuring that all documentation supporting the information submitted is accessible for future reference or in the event of an IRS audit. This diligence will not only promote transparency but also reflect positively in funder and donor relationships, enhancing the organization’s reputation.

Final steps after filing the form

After submitting the Return of Organization Exempt Form, it's important for organizations to confirm receipt with the IRS. This can often be done through the IRS’s online portal, where organizations can check the status of their form. Keeping copies of the submitted form and all related correspondence is critical for record-keeping. Proper organization of these files will streamline future filings and audits.

Following confirmation, nonprofits must understand the implications of their filing status. Organizations should monitor their standing with the IRS to ensure that they continue to meet the requirements for tax-exempt status. Engaging in regular reviews of operations and ensuring adherence to IRS regulations will help avert issues and support the organization's mission in the long run.

Additional tools and resources

To aid in the preparation and submission of the Return of Organization Exempt Form, various interactive tools and resources can enhance the process. Checklists and templates specific to Form 990 can help keep organizations organized, ensuring no critical information or documents are overlooked. Financial calculators available online can assist in budgeting and projecting income and expenditures accurately, facilitating informed decision-making.

Additionally, FAQs related to the Return of Organization Exempt Form can serve as valuable references, covering common questions and concerns organizations may face during the filing process. Accessing support from platforms like pdfFiller can provide step-by-step guidance and assistance for those requiring extra help, ensuring that organizations are well-equipped for compliance.

Importance of filing correctly

The risks associated with non-filing or late filing of the Return of Organization Exempt Form can be significant. Organizations can face penalties, and in extreme cases, they may lose their tax-exempt status entirely. This loss not only affects the organization’s operational capacity but also harms its reputation and credibility in the community. Maintaining accuracy in filing strengthens an organization’s standing with its supporters and enhances public trust.

Moreover, the benefits of accurate and timely filing extend beyond compliance. A well-prepared Form 990 can attract potential donors and grant makers who often scrutinize financial records before supporting an organization. Demonstrating transparency and responsibility in financial reporting communicates to stakeholders that an organization can manage resources efficiently, thereby fostering loyalty and continued support.

Tax topics relevant to nonprofits

Understanding tax regulations affecting nonprofits is crucial for compliance and future planning. Nonprofits must stay updated on evolving tax laws that impact tax-exempt organizations. Recent updates, such as changes in reporting thresholds and potential tax reforms, necessitate ongoing education and adaptation. Regularly reviewing news regarding nonprofit tax filings can keep organizations responsive to changes that influence their operations and financial health.

Notably, trends in nonprofit tax filing and compliance illustrate the importance of adapting practices to fit emerging best practices. Many organizations now utilize software solutions to enhance the accuracy of their filings and streamline their documentation processes. Engaging in community discussions, either through forums or seminars, can also provide insights and shared experiences that benefit nonprofit leaders striving for compliance and excellence.

Connect with resources

For nonprofit leaders eager to enhance their knowledge and network, numerous opportunities for learning and connection exist. Workshops, webinars, and conferences focusing on nonprofit management and tax compliance can provide invaluable insights. Engaging with resources from organizations such as the National Council of Nonprofits offers tools and support tailored to nonprofit directors and managers.

Furthermore, platforms that facilitate the sharing of experiences and challenges can create a robust support network for tax-exempt organizations. Leveraging community resources, including local nonprofit associations and online forums, allows organizations to collaborate and learn from one another, creating a stronger foundation for navigating the complexities of tax compliance and governance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit return of organization exempt on an iOS device?

How can I fill out return of organization exempt on an iOS device?

Can I edit return of organization exempt on an Android device?

What is return of organization exempt?

Who is required to file return of organization exempt?

How to fill out return of organization exempt?

What is the purpose of return of organization exempt?

What information must be reported on return of organization exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.