Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 form: A Comprehensive How-to Guide

Understanding the form 990: Essential insights

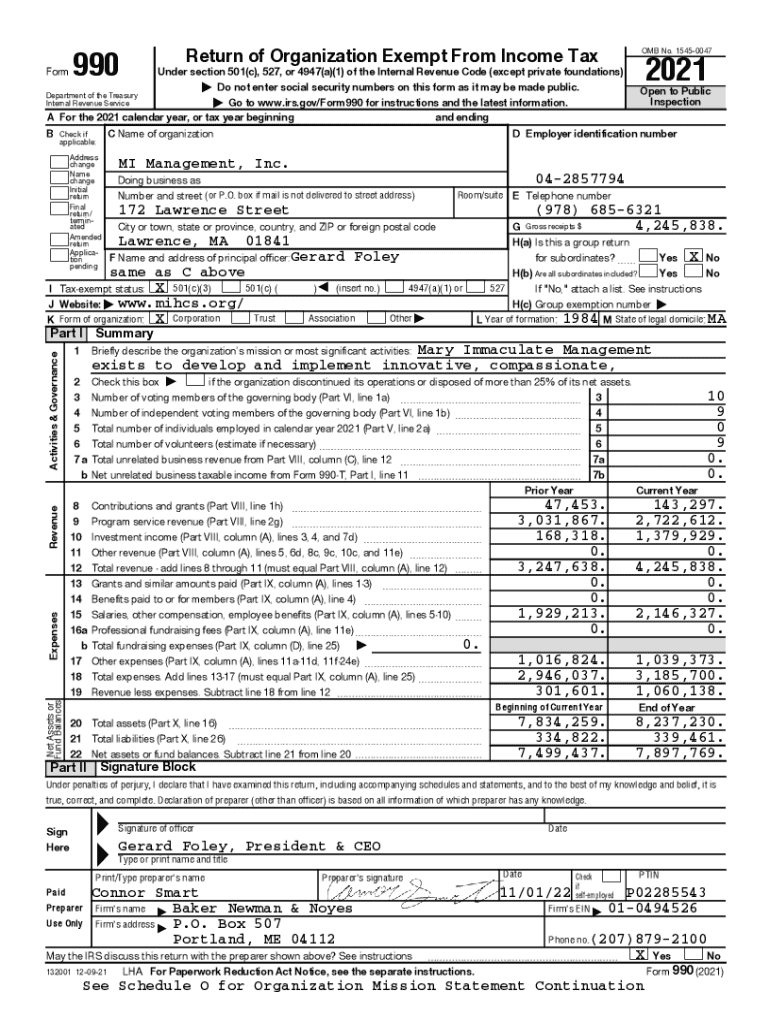

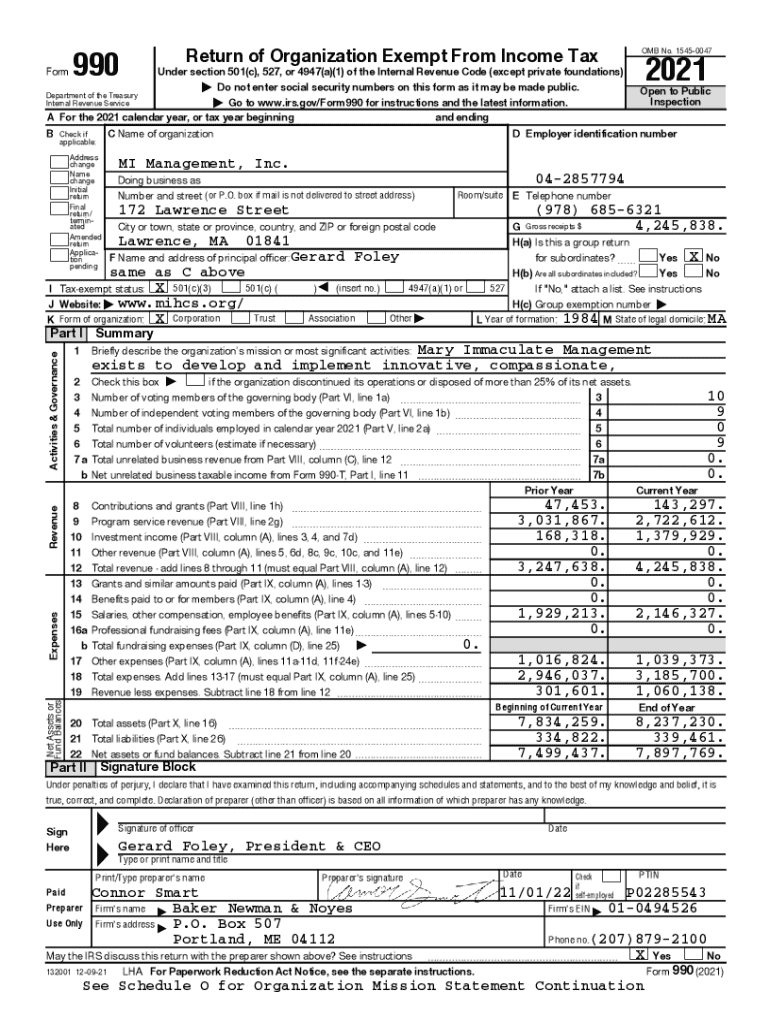

Form 990, a pivotal document in the nonprofit sector, acts as a public report on the organization's activities, financial health, and accountability. This form plays an essential role in the transparency of tax-exempt entities, allowing the IRS and the public to scrutinize these organizations’ operations. Nonprofits file Form 990 annually, providing a detailed overview of their revenue sources, expenses, and programs, ensuring that stakeholders understand how funds are being utilized.

The audience for Form 990 includes nonprofit organizations of all sizes, ranging from small charities to large foundations. Entities with gross receipts above specific thresholds are mandated to file, ensuring compliance with federal tax laws. Concentrating on its purpose, Form 990 not only highlights the financial status of the organization but also demonstrates the impact of its services within the community, making it crucial for both the organizations and their donors.

Navigating the filing requirements

Determining who must file Form 990 is essential for compliance. Generally, nonprofit organizations with gross receipts exceeding $200,000 or total assets exceeding $500,000 must file the full Form 990. Organizations below these thresholds may use Form 990-EZ or 990-N (e-postcard), simplifying the submission while still meeting IRS needs. However, even small organizations receiving over $50,000 a year in receipts are required to file Form 990-EZ.

Filing deadlines are critical; Form 990 is typically due on the 15th day of the 5th month after the end of the organization's accounting period. For most nonprofits with a December 31 year-end, the deadline is May 15. Nonprofits can apply for a 6-month extension using Form 8868, but it’s imperative to complete filings punctually to avoid penalties. Missing this deadline could lead to substantial fines, thus reinforcing the need for careful tracking of filing dates.

The filling process: step-by-step guide

The first step in filing the form 990 form is gathering the necessary documentation. This includes financial statements such as balance sheets and income statements, detailed records of program expenses, and updated information on key staff and board members. The accuracy of this data is crucial as it forms the backbone of your filing and represents your organization’s integrity.

Once documentation is in hand, pdfFiller can be utilized to fill out Form 990. By accessing the form through pdfFiller’s platform, users can take advantage of interactive tools that streamline the process. This includes the capability to fill out necessary sections directly online, reducing the burden of managing paper documents and ensuring that the latest version of the form is being used.

Common mistakes to avoid when filing form 990

Filing Form 990 requires attention to detail; common pitfalls can lead to penalties and misrepresentation. Incomplete or inaccurate entries are among the most frequent issues encountered. Double-checking the numbers and ensuring that all sections are filled out completely can help avert such errors. Additionally, often organizations forget to attach supporting documents required for specific claims, which could result in important pieces of information being overlooked by the IRS.

A thorough understanding of IRS definitions is also critical to prevent misrepresentation. Nonprofits must ensure that they clearly delineate between unrestricted and temporarily restricted funds, as failure to do so can mislead stakeholders and audit trails. Hence, meticulous attention to definitions and guidelines provided by the IRS can greatly aid in painting an accurate picture of your organization’s activities.

Public inspection and transparency regulations

Transparency is a cornerstone of nonprofit accountability. Form 990 information is public and must be made available for public inspection, forming a vital resource for donors, grantors, and the general public. By law, nonprofits must make their three most recent Forms 990 available to the public upon request, reinforcing the notion that nonprofit organizations operate not just for profit but for public benefit. This regulatory landscape promotes transparency.

Maintaining good governance and public trust is about accessibility; thus, nonprofits should ensure that Form 990 is easily accessible on their websites. Moreover, organizations need to retain these forms for at least three years from the date of filing, allowing stakeholders to review historical data on financial health and programmatic effectiveness.

Consequences of non-filing: understanding penalties

Failure to file Form 990 can lead to significant penalties that can jeopardize an organization’s tax-exempt status. The IRS imposes fines for late or incomplete filings, which can range from $20 per day, up to a maximum of $10,000 for organizations that fail to file a complete Form 990 by the due date. For small nonprofits, these penalties can be particularly burdensome, detracting from funds that could have been used for charitable purposes.

Additionally, notable cases in the nonprofit sector have illustrated the serious implications of non-compliance. Organizations that consistently fail to meet these requirements may face revocation of their tax-exempt status altogether, indicating how critical it is for nonprofits to have robust systems in place to ensure timely and accurate filings.

Historical context and importance of form 990

First introduced in 1942, Form 990 has evolved significantly over the years, responding to the changing landscape of the nonprofit sector. Originally designed to fulfill basic reporting needs, it now includes comprehensive data fields aimed at enhancing transparency and accountability. The form reflects the IRS' commitment to ensuring that nonprofits not only serve their missions but do so in a manner that aligns with public expectations and regulatory standards.

The importance of Form 990 goes beyond regulatory compliance; it plays a vital role in promoting public trust in the nonprofit sector. By requiring detailed disclosures of financial information and programmatic accomplishments, Form 990 helps prevent abuses within the sector, ensuring that organizations utilize their resources effectively to benefit society.

Utilizing form 990 for charity evaluation research

Form 990 serves as a crucial tool for stakeholders interested in evaluating the effectiveness of charitable organizations. By analyzing data reported on Form 990, researchers, donors, and regulatory bodies can gauge an organization’s financial health, fundraising efficiency, and programmatic impact. This is particularly important for donors looking to ensure their contributions support viable and effective organizations.

Several tools exist for digging into Form 990 data, including platforms that aggregate and compare nonprofit performance metrics. These data became increasingly valuable in assessing an organization’s accountability and transparency, allowing stakeholders to make informed decisions. Case studies of successful nonprofits reveal how properly utilizing Form 990 data can lead to meaningful improvements in fundraising and program delivery, ultimately benefiting the communities they serve.

Finding resources and support for filing

Navigating Form 990 filing can be complex, but numerous third-party resources can help organizations fulfill their obligations. Professional services, consultants, and online platforms like pdfFiller provide assistance tailored to specific filing needs. Additionally, engaging with online forums and communities of nonprofit professionals can yield valuable insights and shared experiences, enriching the filing process.

Moreover, pdfFiller itself is an invaluable resource, bringing together filing guidelines, templates for Form 990, and interactive tools to facilitate the completion and submission of the form. By combining expert guidance with essential technology, nonprofits can streamline compliance and ensure adherence to the ever-evolving regulatory landscape.

Advanced considerations for large nonprofits

For larger nonprofits, filings are particularly nuanced, often requiring detailed financial reporting due to heightened scrutiny from regulators and the public. Larger organizations must include a detailed breakdown of their financial activities, including revenue streams, asset allocation, and detailed program expenditures. This depth of information mandates a sophisticated understanding of accounting principles and regulatory compliance.

Additionally, audits become a more prominent aspect of the reporting landscape for large nonprofits, necessitating robust internal controls to ensure accuracy in revenue reporting and financial disclosures. Compliance demands can vary substantially, and tailoring Form 990 to reflect unique organizational structures becomes essential, especially in organizations with multiple programs or departments.

Interactive tools available via pdfFiller

pdfFiller is designed to streamline the Form 990 filing process with interactive tools that enhance collaboration and accuracy. The platform allows users to fill out forms efficiently, with features enabling team members to collaborate remotely. Document tracking tools within pdfFiller also provide insights into submission statuses, enabling organizations to keep abreast of compliance requirements without confusion.

The cloud-based nature of pdfFiller ensures that documents can be accessed and managed from anywhere, making it a flexible solution for nonprofit teams working in varied environments. User-friendly features such as eSigning and automated reminders for filing deadlines reduce administrative burdens, highlighting pdfFiller’s commitment to empowering nonprofits in their filing responsibilities.

Searchable features and FAQs

Navigating the complexities of Form 990 can prompt numerous questions. Utilizing searchable features within pdfFiller allows users to quickly locate answers to common inquiries about filing requirements, common mistakes, and compliance updates. This functionality increases efficiency and minimizes frustration associated with the filing process.

The FAQ section available on pdfFiller provides comprehensive answers, guiding users through frequently faced challenges. This resource empowers organizations to enhance their understanding of the filing process and ensures that they are well-prepared when working on their Form 990.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the form 990 electronically in Chrome?

Can I create an eSignature for the form 990 in Gmail?

How can I edit form 990 on a smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.