Get the free Mail-in Donation Form

Get, Create, Make and Sign mail-in donation form

Editing mail-in donation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mail-in donation form

How to fill out mail-in donation form

Who needs mail-in donation form?

Comprehensive Guide to Mail-in Donation Forms

Understanding mail-in donations

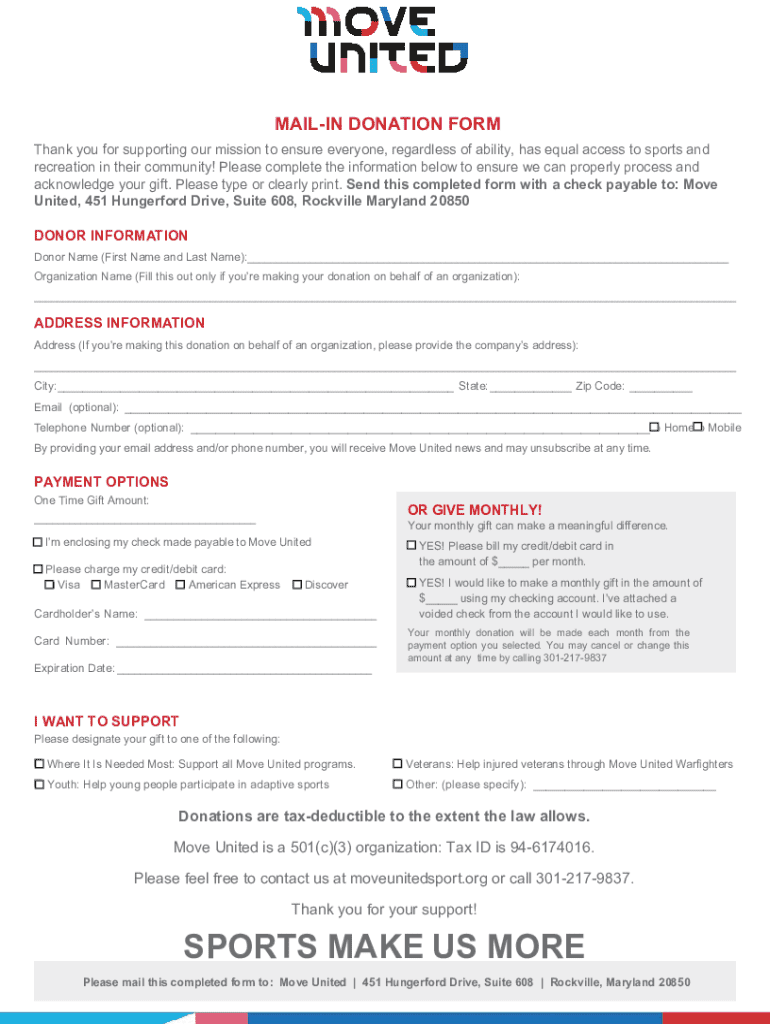

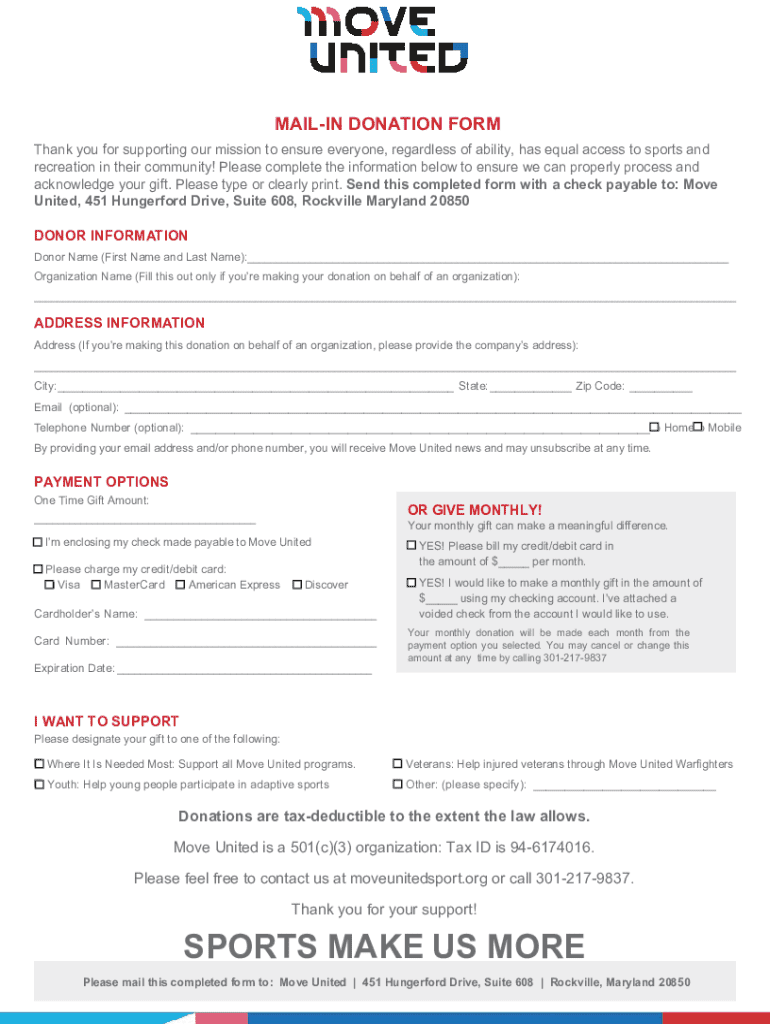

A mail-in donation form is a printed document that allows donors to contribute to an organization by sending their donation via postal mail. This method serves several purposes: it provides a tangible way for individuals to support causes they care about, while also enabling nonprofits to manage their fundraising efforts efficiently. Mail-in donations can be a preferred option for many due to the personal touch they offer and the ability for donors to physically write checks or include cash.

The benefits of opting for a mail-in donation over digital methods include enhanced privacy and security for personal financial information as well as the potential for thoughtful, intentional giving, as donors can take time to reflect on the cause and their contribution.

Essential terms to know

Why choose a mail-in donation form?

Choosing a mail-in donation form offers numerous advantages for both donors and organizations. For donors, one of the primary benefits is convenience; they can fill out their forms and send their contributions at their own pace, without the urgency often felt when donating online. Additionally, these forms can be filled out privately at home, alleviating any concerns over sharing sensitive information online.

Moreover, mail-in donations allow donors to choose their donation amounts flexibly. They can decide how much to give, whether it's a one-time gift or multiple installments, all while maintaining control over their timing. Organizations also benefit significantly from mail-in donations; they can manage records more effectively as contributions arrive in an organized format, making tracking easier. Moreover, mail-in donation campaigns can reach demographics that might not be as engaged with digital platforms, expanding the donor base.

Creating your mail-in donation form with pdfFiller

Creating a mail-in donation form can be a simple and efficient process with pdfFiller. This cloud-based platform allows users to edit, sign, and manage documents easily. Users can select from a variety of templates tailored specifically for donation forms, which can significantly streamline the creation process.

The features of pdfFiller include cloud-based editing and storage, ensuring that your forms are accessible anywhere at any time, as well as eSignature functionalities that allow donors to sign forms electronically. By utilizing these features, organizations can improve their workflow while making it easier for donors to contribute.

Step-by-step process to create your form

Filling out the mail-in donation form

When filling out a mail-in donation form, it’s crucial to provide specific information. Required fields typically include the donor's name, address, and donation details, which may entail specifying the amount and preferred designation of funds within the organization. Additionally, optional fields can enhance the personal connection, such as comments or dedications that allow donors to express their support more personally.

To ensure accurate submissions, donors should double-check for common mistakes, such as misspelled names or incorrect numerical entries. Ensuring that all information is legible and complete can prevent delays and ensure the donation is processed quickly.

Editing and managing your mail-in donation form

Utilizing pdfFiller's editing tools allows users to make changes even after the initial form has been completed. Whether adding new options for donations or correcting errors, pdfFiller's platform provides the flexibility needed for ongoing management of donation forms. In addition to editing capabilities, users can save multiple versions of a document, ensuring that all updates are tracked and easily accessible.

Collaborating with team members is equally simplified on pdfFiller. You can easily share forms within your organization, defining permissions for who can edit or view the documents, allowing for smooth cooperation on fundraising efforts.

Signing the mail-in donation form

Understanding the eSignature process is essential for modern fundraising. With pdfFiller, eSignatures are legally valid and secure, offering donors a quick and efficient way to sign their donation forms without needing to print and scan. This method is widely accepted across most legal and organizational frameworks, making it a convenient choice.

For those who prefer traditional methods, alternative options include providing instructions for a manual signature. Donors can print the form, sign it by hand, and resend it without the need for advanced technology.

Submitting your donation form

After completing the mail-in donation form, donors should follow best practices for submission. It is advisable to choose appropriate envelopes and postage that align with the size and weight of the mailed donation to ensure it reaches the organization efficiently. Tracking options, such as registered postage or delivery confirmation, can provide peace of mind, confirming the safe arrival of the donation.

Once submitted, donors can expect an acknowledgment process in which the organization typically sends a thank-you letter or receipt detailing the donation. This document is essential for tax purposes as it confirms the contribution and helps with filing deductions.

Common questions about mail-in donations

A few common questions may arise when using mail-in donation forms. Many donors inquire about what to do if their donation does not reach the organization. In such cases, keeping a record of mailing details, including tracking numbers, can be invaluable. Donors can also directly contact the organization or use support channels such as pdfFiller's customer service for assistance.

Other frequently asked questions include queries about filling out the forms correctly. It’s essential for donors to follow the provided instructions closely to avoid common pitfalls like leaving required fields blank.

Media inquiries and public relations

Organizations can effectively utilize the funds collected through mail-in donations to support vital programs and community initiatives. By sharing success stories and impact reports, organizations can show donors the tangible benefits of their contributions. Testimonials from past beneficiaries can also serve as powerful tools to engage potential contributors and illustrate the difference those donations can make.

Public relations efforts should highlight effective use of donations, garnering attention and trust. Case studies that delve into how funds have been allocated improve transparency and demonstrate organizational commitment to mission fulfillment.

Safety and privacy considerations

When handling mail-in donation forms, protecting donor information is paramount. Organizations must adhere to secure data storage practices, ensuring sensitive information is protected from unauthorized access. This not only assures donors of their privacy but also builds trust in the organization’s operations.

Compliance with donation laws and regulations is equally crucial. Understanding relevant legislation, such as IRS guidelines regarding charitable donations, ensures that organizations are not only transparent in their activities but within legal boundaries as well.

Maximizing your mail-in donation campaign

To encourage participation in mail-in donation campaigns, organizations can implement effective outreach methods. Creative promotional tools, including flyers and brochures with compelling stories, can attract new donors while reminding past contributors of the impact of their support.

Engaging donors after their submission is equally important. Building relationships through regular communication, updates on programs funded by donations, and future fundraising opportunities keeps donors invested in the organization’s mission and encourages continued support.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mail-in donation form for eSignature?

How can I get mail-in donation form?

How do I edit mail-in donation form in Chrome?

What is mail-in donation form?

Who is required to file mail-in donation form?

How to fill out mail-in donation form?

What is the purpose of mail-in donation form?

What information must be reported on mail-in donation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.