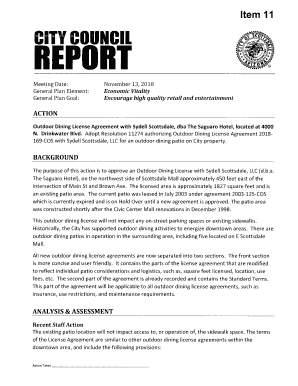

Get the free Investment Options Selection Form

Get, Create, Make and Sign investment options selection form

Editing investment options selection form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out investment options selection form

How to fill out investment options selection form

Who needs investment options selection form?

Investment options selection form: A comprehensive guide

Overview of investment options

Investment options encompass a variety of financial instruments that allow individuals to grow their wealth over time. The importance of selecting the right investment option lies in the alignment of choices with your financial goals, risk tolerance, and investment horizon. Common investment vehicle types include stocks, bonds, mutual funds, and ETFs (exchange-traded funds), each serving distinct investor needs.

Understanding your investment needs

Assessing your financial goals is fundamental when considering investment options. It's crucial to differentiate between short-term and long-term objectives, as they guide your selection of assets. For short-term needs, liquidity might take precedence, whereas long-term investments can leverage growth opportunities.

Another vital aspect is evaluating your risk tolerance. Classifying your risk profile into low, medium, and high categories will dictate the kinds of investments suitable for you. Additionally, your investment time horizon plays a pivotal role, distinguishing between immediate needs and future planning. Recognizing whether you are looking towards retirement, purchasing a home, or funding education can significantly influence your investment choices.

Investment options available

Investors have a diverse menu of investment choices to suit their unique financial preferences and risk appetites. Equity investments, which represent ownership in companies, include individual stocks and equity-focused mutual funds. While direct stock investment offers greater potential rewards, mutual funds provide diversification and professional management.

On the other hand, fixed-income investments like bonds represent loans made to borrowers. They can be ideal for conservative investors seeking steady income. Alternative investments, such as Real Estate Investment Trusts (REITs) or commodities, offer additional avenues for portfolio diversification and can serve to hedge against inflation.

Interactive tools for investment selection

Interactive tools can greatly enhance your investment decisions. pdfFiller's innovative features include risk assessment calculators and portfolio simulation tools, allowing you to visualize potential outcomes based on different investment strategies. Such tools can help clarify your choices and provide insights into how different investments might perform under various market conditions.

By utilizing these tools, investors can gain a deeper understanding of their risk profile, evaluate their expected returns, and make informed selections that align with their financial goals. Tailoring these assessments to your personal investment situation can lay the groundwork for a robust portfolio.

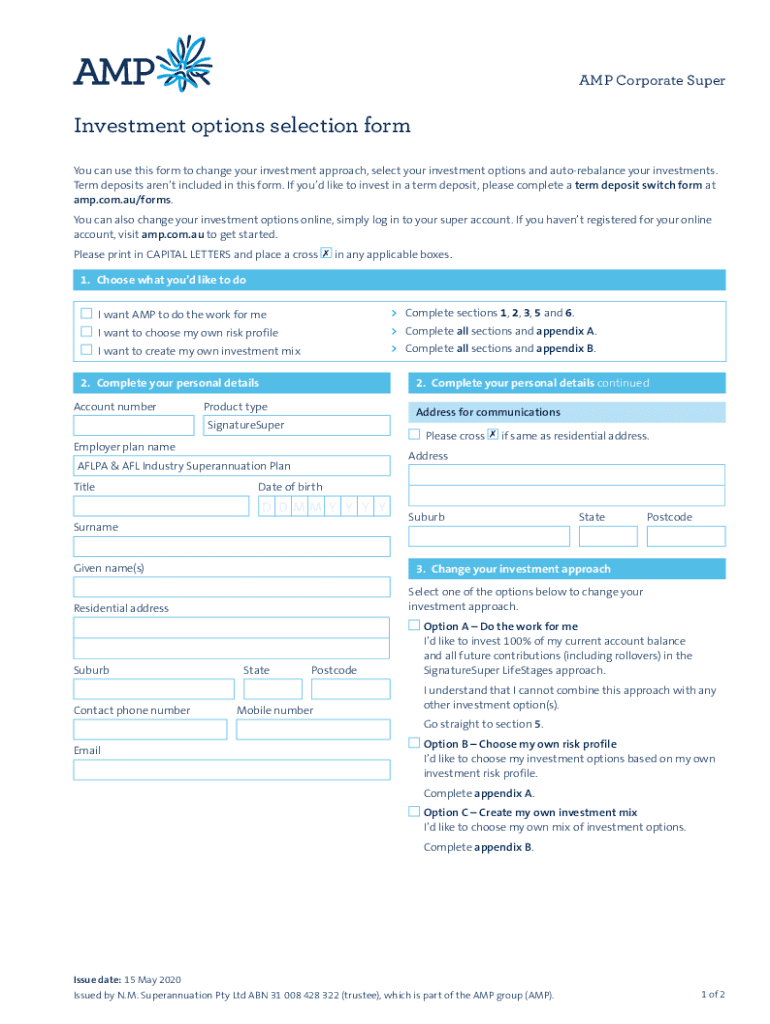

Steps for completing the investment options selection form

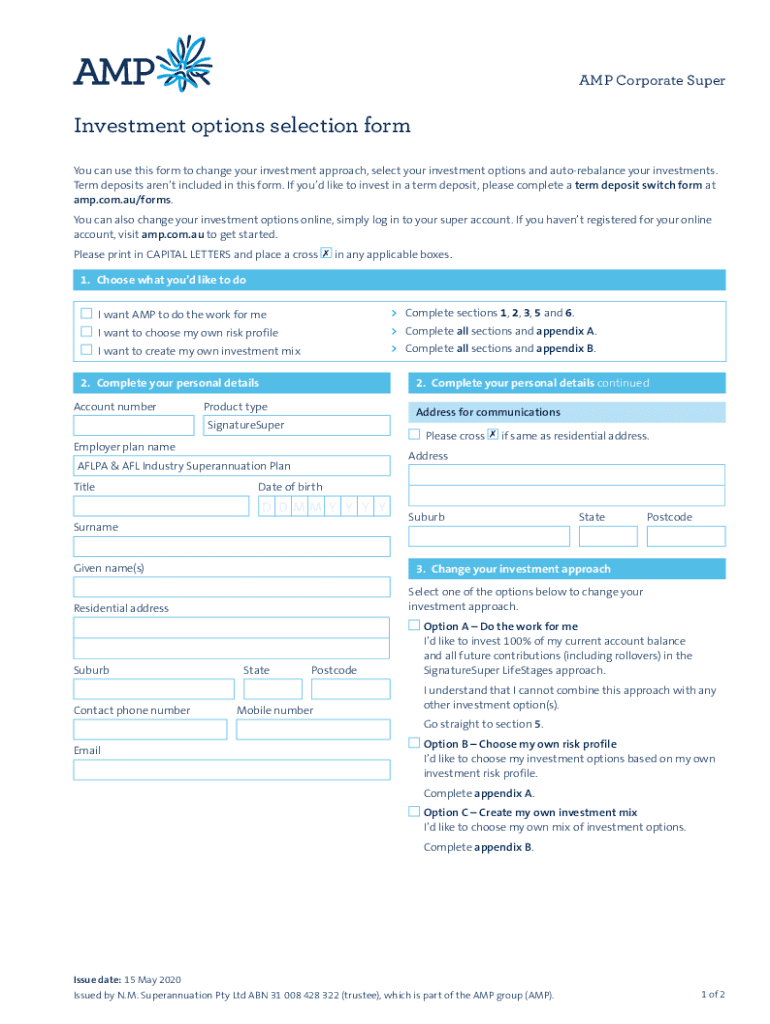

The investment options selection form serves as a roadmap for your investment journey. First, understanding its purpose is crucial; it helps articulate your investment objectives to steer your decisions effectively. Accessing and editing this form via pdfFiller is seamless, offering a user-friendly interface.

Filling out the form involves a systematic approach. Begin by entering your personal information, followed by outlining your specific investment objectives. Next, select your preferred investment vehicles and engage in a review process to confirm your choices, ensuring they reflect your financial strategy.

pdfFiller's editing features allow for easy customization of your selections, enabling you to re-evaluate your choices as market conditions evolve. This flexibility can be invaluable as you adapt your strategy over time.

eSign and document management

The importance of securely signing your investment selections cannot be overstated. eSigning via pdfFiller not only enhances security but also ensures that your choices are officially documented. The platform offers intuitive options for eSigning, streamlining the process and making it convenient for investors.

Managing your documents online is essential for keeping your investment decisions organized. pdfFiller provides various storage options for your investment forms and allows you to easily share them with financial advisors. This accessibility ensures that you can review or modify your selections whenever necessary.

Frequently asked questions (FAQs)

Many investors have questions about the investment options selection form and the rationale behind specific choices. Common inquiries among novice and experienced investors alike pertain to the best strategies for diversification, assessing risk, and understanding how market fluctuations can impact their portfolios.

Providing clarity on these points can help alleviate concerns and promote a sense of confidence when making investment decisions. Engaging with resources that offer insights into current market trends can empower investors to adapt their strategies as necessary.

Additional considerations

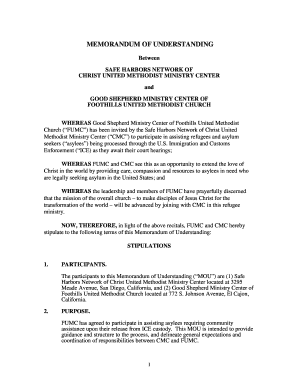

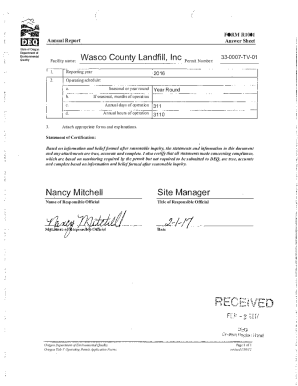

While navigating investment options, it is vital to pay attention to legal notices and documentation. Reading legal agreements carefully can help you understand any associated fees and regulations that might impact your investment choices. Awareness of these factors helps ensure you are fully informed before making decisions.

Additionally, keep in mind the impact of market fluctuations. Strategies for staying adaptive, such as regularly reviewing your portfolio and being prepared to make adjustments, can contribute to long-term investment success. Embracing flexibility in your investment strategy can lead to better outcomes, even in changing market conditions.

Tools and resources

Supporting your investment decisions requires access to quality resources. There are a wealth of external resources available, such as investment articles and financial news platforms that can offer valuable insights into current trends and market analysis. Additionally, engaging in community forums can provide ongoing support and advice from peers.

Utilizing pdfFiller's features for document management also plays a critical role in your investment journey. By accessing the platform, you can manage all your investment documents in one place, ensuring they are easily retrievable as you navigate complex financial decisions.

Support and assistance

pdfFiller is here to support you throughout the investment selection process. With a user-friendly interface that caters to individuals and teams, pdfFiller provides assistance not only in filling out forms but also in editing and signing documents to enhance your investment management experience.

Should you require assistance, pdfFiller's customer support options are readily available. In addition, resources for financial advice and planning assistance can empower you in making informed investment decisions that align with your long-term objectives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get investment options selection form?

How do I complete investment options selection form on an iOS device?

Can I edit investment options selection form on an Android device?

What is investment options selection form?

Who is required to file investment options selection form?

How to fill out investment options selection form?

What is the purpose of investment options selection form?

What information must be reported on investment options selection form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.