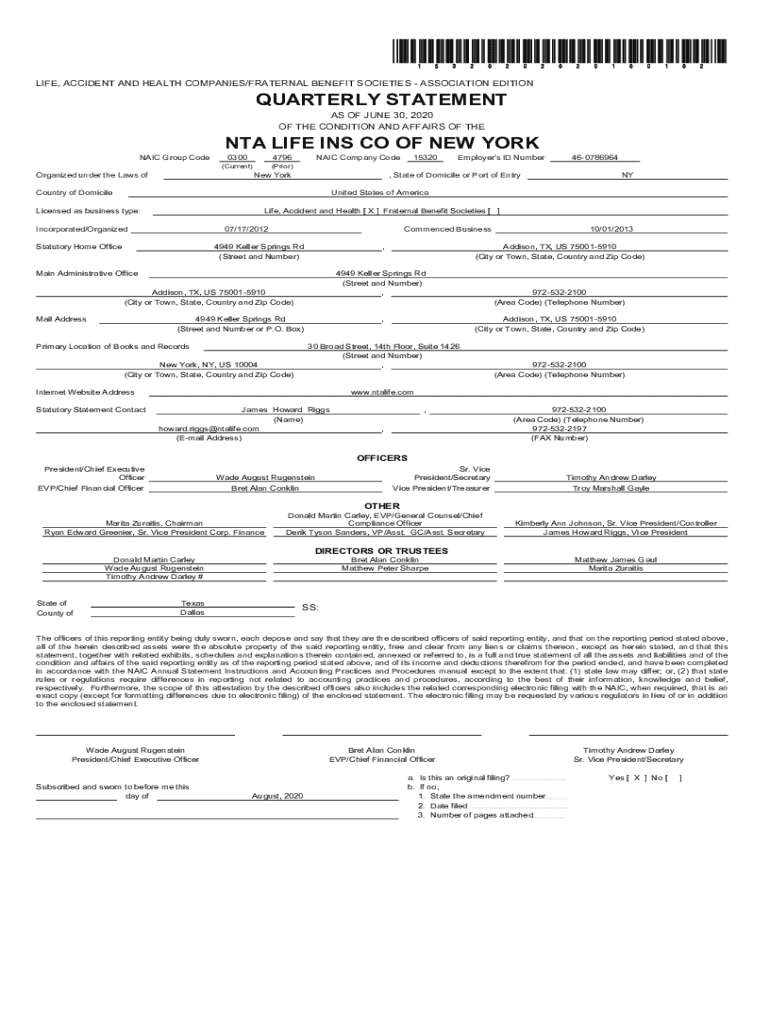

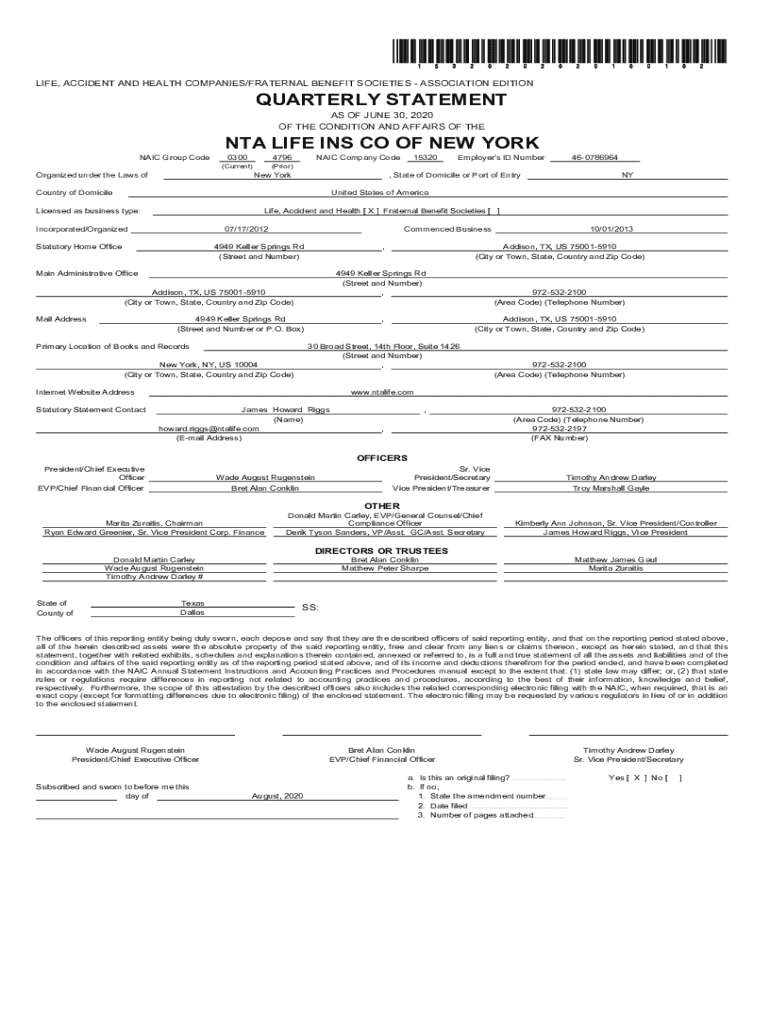

Get the free Nta Life Insurance Company Quarterly Statement as of June 30, 2020

Get, Create, Make and Sign nta life insurance company

How to edit nta life insurance company online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nta life insurance company

How to fill out nta life insurance company

Who needs nta life insurance company?

Navigating the NTA Life Insurance Company Form: A Comprehensive Guide

Understanding the NTA Life Insurance Company Form

The NTA Life Insurance Company Form serves as a crucial gateway for obtaining life insurance. This form is designed to collect essential information from applicants, allowing insurance providers to assess risk and determine coverage. It functions by capturing a wide range of personal and health-related information, which ultimately helps insurers tailor their offerings based on individual needs. Recognizing the importance of this form in the life insurance process is vital for anyone interested in securing financial protection for themselves and their loved ones.

The NTA Life Insurance Company Form not only enables individuals to apply for coverage but also significantly impacts the overall efficiency of the insurance underwriting process. With a well-completed form, applicants can expect quicker processing and enhanced accuracy during the evaluation stage. This highlights the importance of understanding what information is required and how to present it correctly.

Who needs the NTA Life Insurance Company Form?

Various individuals and entities require the NTA Life Insurance Company Form to establish life insurance coverage. One of the primary groups includes individuals seeking life insurance coverage for personal security and peace of mind. This demographic often includes young professionals starting families or older adults wanting to ensure financial stability for their dependents.

Moreover, families planning for long-term financial security will find the form's necessity paramount. By securing adequate life insurance, families can safeguard their financial future, ensuring that loved ones are not burdened by unexpected expenses in the event of a tragedy. Additionally, teams managing high-risk employee benefits in corporate environments also require this form to evaluate coverage options effectively. By understanding their specific needs, all these groups can leverage the NTA Life Insurance Company Form to their advantage.

Key components of the NTA Life Insurance Company Form

The NTA Life Insurance Company Form comprises several critical sections. First, the Personal Information Section is essential, capturing basic details such as your name, address, and contact information. This section ensures that the insurer can reach you for further evaluation or to provide updates on your application. Accurate data entry is crucial as any discrepancies can cause delays in the application process.

The Health Information Section follows, which delves into an applicant's medical history and current health status. This segment is pivotal in assessing risk because it allows insurers to understand any preexisting conditions that might affect policy terms. Lastly, the Beneficiary Designation Section allows you to choose your beneficiaries. This designation is not just a formal requirement; it’s a vital decision that influences how your policy benefits will be distributed after your passing, making it crucial that applicants give careful thought to this aspect.

Preparing to fill out the NTA Life Insurance Company Form

Before beginning the application process, it’s essential to gather all necessary documents to ensure a smooth filling experience. Key documents include identification such as a driver’s license and social security number, as well as medical records related to your health history. Having this information readily available will simplify the process and prevent unnecessary delays when completing the NTA Life Insurance Company Form.

In addition to gathering documents, it’s also crucial to understand your insurance needs. Consider determining the coverage amounts necessary to effectively protect your loved ones. Assessing any additional riders or benefits needed can also provide a tailored insurance plan that best fits your situation. The more informed you are about your needs, the better prepared you'll be to complete the form accurately.

Step-by-step instructions for completing the NTA Life Insurance Company Form

Filling out the NTA Life Insurance Company Form can be straightforward if approached methodically. Begin with the personal information section by filling in your full name, date of birth, and contact information. Ensure accuracy in this initial step, as it forms the foundation of your application.

Next, provide detailed health information. Answer all health-related questions truthfully, as omissions or inaccuracies may delay processing or even nullify coverage eligibility. Then, move on to the beneficiary designation. Make sure to list both primary and contingent beneficiaries along with their relationship to you; this ensures seamless distribution of policy benefits. Finally, review the entire form for accuracy before signing and dating it at the bottom. Any errors at this stage may lead to complications down the line.

How to edit and manage your NTA Life Insurance Company Form online

With advancements in technology, managing your NTA Life Insurance Company Form online has become easier, especially through platforms like pdfFiller. One of the primary advantages is the ability to edit your completed form. You can quickly upload your document to the cloud and utilize various editing tools to modify any information as needed. This facility ensures that your form remains up-to-date and accurately reflects your current circumstances.

Additionally, eSigning your form through pdfFiller adds another layer of convenience. The process involves a few straightforward steps that take moments to complete. Not only is eSigning faster than traditional signatures, but it also contributes to a more secure and organized submission process, making it easier to track and manage your documents, all while eliminating the risks associated with postal delays.

Submitting your NTA Life Insurance Company Form

After completing and signing your NTA Life Insurance Company Form, the next step is submission. There are primarily two methods to do so: online submission through the insurance provider’s portal and mailing a physical copy. If you opt for online submission, be sure to follow any prompts carefully to ensure your form reaches the intended destination securely. If postal submission is your choice, consider timing, as delays can sometimes occur with traditional mail.

Once submitted, applicants will enter the underwriting process, a critical phase where the insurer reviews your application before making a decision. Understanding this step helps set realistic expectations regarding timelines. Expect a processing window that can vary; typically, applicants might receive feedback or approval within a few weeks, depending on the workload of the insurer’s underwriting department.

Frequently asked questions about the NTA Life Insurance Company Form

Many applicants have questions as they navigate the completion of the NTA Life Insurance Company Form. For instance, if you make a mistake on your form, it’s best to rectify it as soon as possible by contacting the insurance provider for guidance. Keeping a record of what was submitted is beneficial for future reference. Tracking the status of your application is also critical. Most insurers provide online portals where you can log in and view the progress of your application.

Another common concern revolves around changing beneficiaries after submission. This process often requires submitting a specific form or providing written notice to the insurance company, emphasizing the importance of double-checking your beneficiary selections before turning in your original form.

Troubleshooting common issues with the NTA Life Insurance Company Form

Common errors to look out for when filling out the NTA Life Insurance Company Form include missing signatures or incomplete sections. These errors can lead to issues during the processing phase, potentially delaying approval or coverage activation. Hence, careful reviewing of the form before submission is a must.

If you encounter any challenges or have questions during the form-filling process, don't hesitate to reach out to customer support. They can provide invaluable assistance and help troubleshoot any issues that may arise, ensuring a smoother experience.

Case studies: Successful applicants

Understanding the experiences of others can provide valuable insights into successfully navigating the NTA Life Insurance Company Form. For example, one applicant, Sarah, a young mother, successfully obtained her life insurance policy by meticulously following the guidelines provided above. By gathering her health records and understanding her family’s financial needs, she was able to fill out the form confidently and without errors.

Another applicant, John, a small business owner, learned the importance of listing his primary and contingent beneficiaries correctly after a minor hiccup in his application process. Both individuals reflect how thorough preparation and attention to detail can significantly ease the completion of the NTA Life Insurance Company Form, ensuring that their insurance policies serve their needs.

Tips for a smooth application process

To ensure a successful application process, consider adopting a few best practices when filling out the NTA Life Insurance Company Form. Start by creating a checklist of required documents to avoid missing critical information. Utilize the editing tools available in pdfFiller for optimal results; checking and glancing back at your entries before submission prevents errors.

Additionally, familiarize yourself with key legal terms associated with life insurance applications. This understanding not only enhances your confidence while completing the application but also clarifies any confusing language that may arise during the process. Each of these strategies contributes to a more streamlined experience, ensuring you maximize the potential benefits of your life insurance policy.

Bonus section: Navigating related forms and documentation

Beyond the NTA Life Insurance Company Form, it’s essential to be aware of additional forms that might be associated with life insurance policies. For instance, health declaration forms may need to be filled out, especially if you report preexisting conditions. It’s crucial to approach these forms with honesty, as discrepancies can affect claim approvals later on.

Lastly, maintaining accurate and updated documents is vital. Regularly reviewing your life insurance information, especially beneficiary choices and health status declarations, ensures that your coverage remains relevant and effective. Adhering to these guidelines will further empower you in managing your life insurance policy effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute nta life insurance company online?

How do I make edits in nta life insurance company without leaving Chrome?

Can I create an electronic signature for signing my nta life insurance company in Gmail?

What is nta life insurance company?

Who is required to file nta life insurance company?

How to fill out nta life insurance company?

What is the purpose of nta life insurance company?

What information must be reported on nta life insurance company?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.