Get the free Mortgage Broker Application

Get, Create, Make and Sign mortgage broker application

Editing mortgage broker application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage broker application

How to fill out mortgage broker application

Who needs mortgage broker application?

A comprehensive guide to the mortgage broker application form

Understanding the mortgage broker application process

Applying to become a mortgage broker entails a specific process designed to ensure that candidates meet industry standards. The mortgage broker application form is a critical step within this process, serving as the first impression for your future as a broker. Completing this application accurately and thoroughly is essential for not only your approval but also for establishing trust with clients.

Understanding the importance of a complete application cannot be understated. Missing information can delay the approval process and may raise red flags. Familiarity with key terms enhances your comprehension while filling out the application. Terms such as 'mortgage broker', which refers to the licensed professional facilitating loans between lenders and borrowers, and 'loan origination,' the process of creating a new loan, are integral to the industry.

Preparing to apply: what you need to know

Before you dive into filling out the mortgage broker application form, it’s imperative to be aware of eligibility requirements. Most states require brokers to hold specific licenses and certifications, ensuring they are equipped to handle the responsibilities effectively. Checking your state’s regulations will provide clarity on the licensing process.

In addition to regulatory compliance, gathering necessary documentation is critical. Essential documents typically include personal identification, financial records, and any relevant business structure documents. Being organized will not only expedite the process but will also streamline the submission of your application.

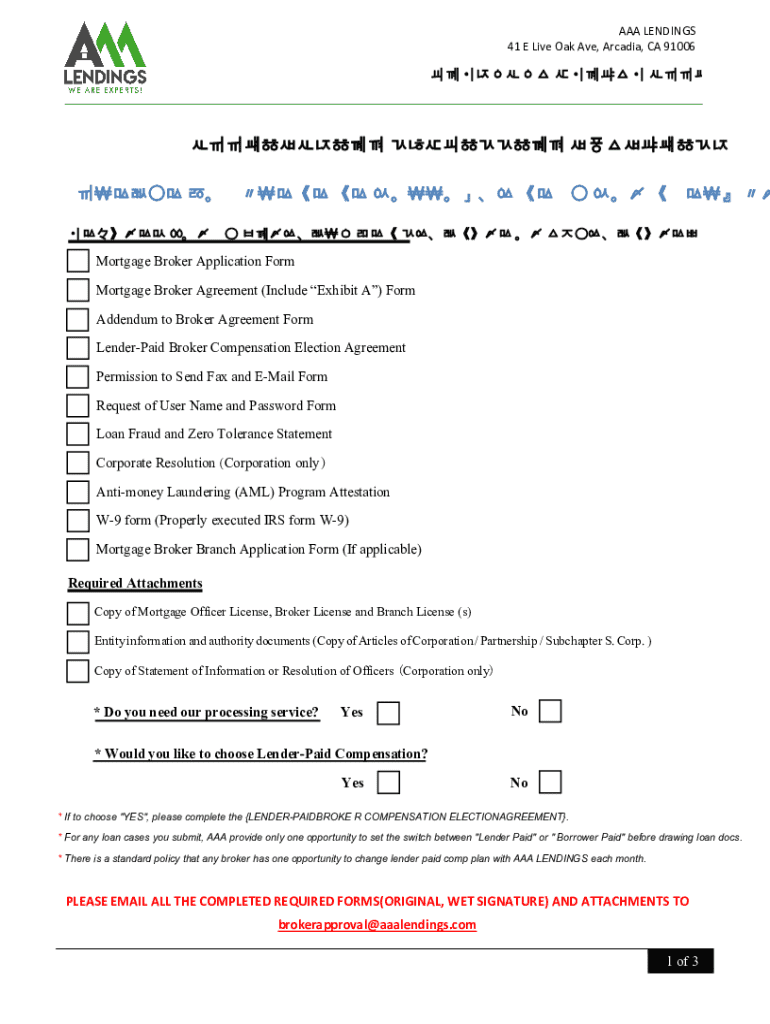

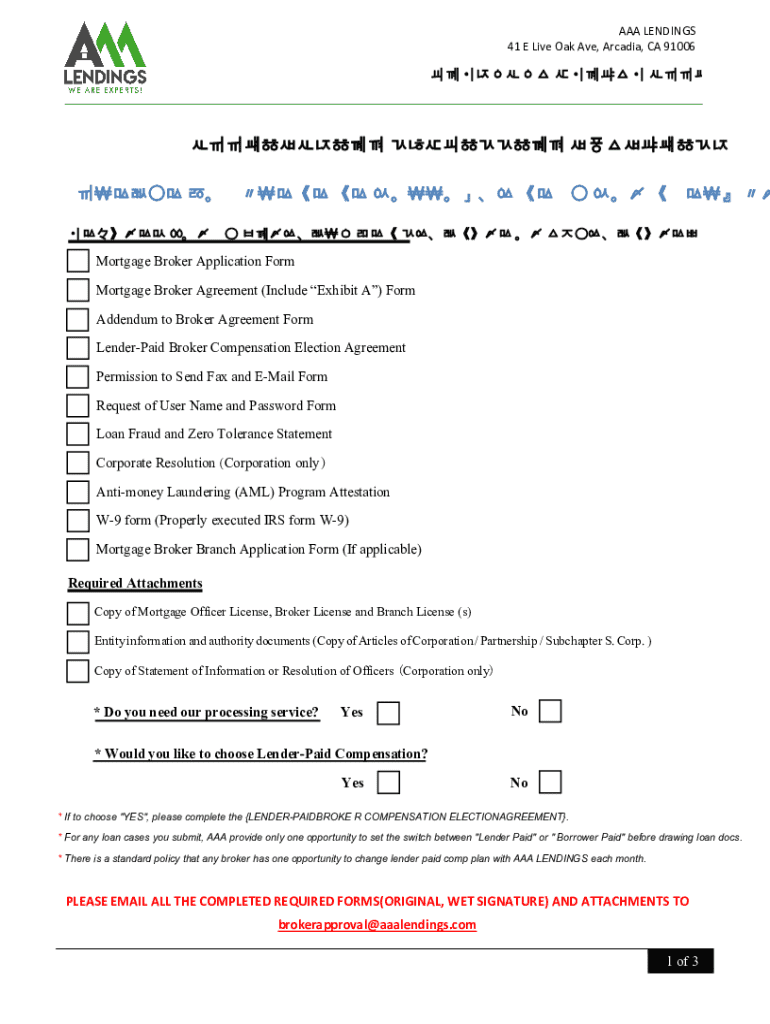

Step-by-step guide to filling out the mortgage broker application form

Filling out the mortgage broker application form can seem daunting, but breaking it down into sections simplifies the task. The first section usually requires your personal information such as name, address, and contact details.

Accuracy in this initial section is crucial. Double-checking spellings and numbers reinforces your attention to detail, which is an essential trait for any broker.

The second section should focus on your business information. This includes specifying your business structure, whether as a sole proprietorship, partnership, or corporation. Make sure you include necessary business licenses and registration details in this section.

The subsequent sections typically require financial information, outlining your income disclosure and asset information. Don't overlook the experience and background section; providing relevant work experience and professional references can bolster your application. Finally, ensure compliance with legal considerations by familiarizing yourself with disclosure requirements and background checks.

Editing and collaborating on your application

Once you complete the application form, the next step is to review and edit the content. Utilizing tools like pdfFiller allows for seamless editing of PDF forms. You can highlight sections for further examination or make necessary adjustments directly within the platform, promoting efficiency.

Collaboration plays an essential role in refining your application. Engaging team members or trusted advisors can provide valuable feedback, ensuring all aspects of your application are polished. Using pdfFiller’s features allows for streamlined collaboration, ensuring everyone involved has access to the latest version of the document and preventing unnecessary confusion.

eSigning the mortgage broker application

The importance of eSigning your mortgage broker application cannot be overlooked. eSignatures legally bind documents and expedite the review process. With pdfFiller’s eSignature feature, you can sign documents easily and securely, allowing for quick completion of your application.

The legal validity of electronic signatures has been affirmed by laws like the ESIGN Act and UETA, making them equivalent to traditional signatures in most legal instances. Therefore, utilizing pdfFiller not only enhances the speed of your application but also ensures it meets all legal requirements.

Submitting your application

Understanding the submission process for your mortgage broker application form is critical. Many states now offer electronic submission processes; familiarizing yourself with these requirements can save time and ensure efficiency. Ensure that you review the state guidelines for electronic submission to meet all specifications.

If mail-in submission is necessary, be aware of the guidelines: include all required documents, use proper postage, and ensure your application is sent through traceable mail. After submission, monitor the status of your application through the state’s online portal or contact the relevant authority to keep track.

Common mistakes to avoid when applying

While filling out the mortgage broker application, it’s vital to remain vigilant about potential mistakes. One of the most common pitfalls is submitting an incomplete application. Missing information can lead to unnecessary delays and potential rejection of your application. Additionally, avoid providing misleading information; honesty is essential in establishing your credibility as a broker.

Lastly, failing to meet deadlines can jeopardize your chances of approval. Being proactive by outlining a timeline for completion and adhering to application submission deadlines will enhance your chances of success. Proper organization can be the difference between securing your license and facing complications.

Resources for mortgage brokers

Understanding the continuously evolving landscape of mortgage brokering is essential. Keeping abreast of industry standards and regulations can bolster your application, offering clarity on what is expected. One of the key resources is the Department of Financial Services, which provides guidelines and resources tailored for brokers.

Furthermore, accessing information from the NMLS will clarify licensing and compliance requirements specific to your state. By leveraging these resources, you empower yourself with knowledge, leading to a more compelling and complete mortgage broker application.

Frequently asked questions (FAQs)

After submitting your mortgage broker application, it’s common to have questions about the next steps. For instance, you might wonder what happens after submission. Typically, your application enters a review phase where background checks and evaluations are performed. This process can vary based on state regulations and may take several weeks.

If your application is denied, it’s crucial to understand the reasons behind this decision. Candidates often have options to appeal or rectify issues before reapplying. Staying informed about timelines and procedures following your submission will assist in navigating any outcomes effectively.

Leveraging pdfFiller for document management as a mortgage broker

Utilizing pdfFiller offers numerous benefits for mortgage brokers beyond the application process. This platform streamlines document management, from templates for contracts to client interaction forms. Allowing users to create, edit, and store important documents from anywhere empowers brokers looking to enhance their operational efficiency.

Case studies demonstrate how employing pdfFiller results in successful brokering, as individuals easily manage forms, client records, and essential documentation. Access to cloud storage ensures that important files are retrievable from anywhere, supporting brokers on the go and improving service delivery.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mortgage broker application to be eSigned by others?

Where do I find mortgage broker application?

How do I edit mortgage broker application on an Android device?

What is mortgage broker application?

Who is required to file mortgage broker application?

How to fill out mortgage broker application?

What is the purpose of mortgage broker application?

What information must be reported on mortgage broker application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.