Get the free Nondelegated Correspondent Annual Recertification

Get, Create, Make and Sign nondelegated correspondent annual recertification

How to edit nondelegated correspondent annual recertification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nondelegated correspondent annual recertification

How to fill out nondelegated correspondent annual recertification

Who needs nondelegated correspondent annual recertification?

Navigating the Nondelegated Correspondent Annual Recertification Form: A Comprehensive Guide

Understanding the nondelegated correspondent annual recertification form

The nondelegated correspondent annual recertification form is a critical document utilized within the nondelegated correspondent program. This program allows lenders to establish partnerships while maintaining direct oversight of their loan products. Each year, participants in this program must complete a recertification process to reaffirm their eligibility to operate as nondelegated correspondents. The primary purpose of the form is to ensure compliance with industry regulations and maintain high standards of operation.

The annual recertification process is vital for both existing and prospective correspondents. It not only serves as a mechanism for compliance but also helps organizations assess their current operational capabilities and market conditions. By systematically reviewing their programs, lenders can identify potential risks while ensuring that all necessary policies and practices are in place.

Categories of participants for recertification

Not everyone in the nondelegated correspondent program is required to submit the annual recertification form. Understanding who qualifies is essential for both established correspondents and new market entrants. Established correspondents seeking to renew their status must complete the form, while new entrants may need to pass through additional due diligence processes based on their history and operational capabilities.

Eligibility criteria also play a significant role in the recertification process. Organizations must demonstrate financial stability, providing specified documentation to support their claims. Key documents generally include recent financial statements, tax returns, and information outlining the company's risk management policies. These criteria ensure that participating correspondents are not only compliant but also capable of sustaining operational functions effectively.

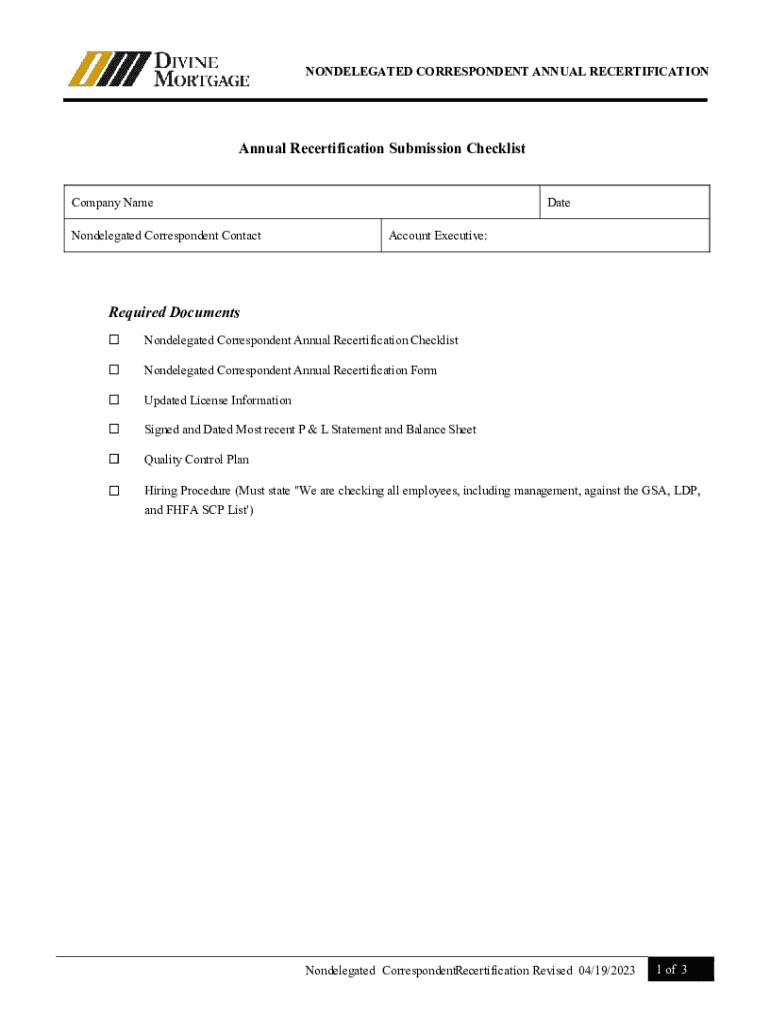

Required documentation for the recertification process

Completing the nondelegated correspondent annual recertification form requires specific documentation to provide a comprehensive view of the organization’s financial and operational health. Essential forms include the Nondelegated Correspondent Application form, which captures vital company information relevant to compliance and operations.

Beyond the application form, organizations are typically required to present detailed financial statements, tax returns, and operational practices that adhere to industry standards. Additional documentation might include comprehensive operational policies and up-to-date risk management strategies. These documents serve to substantiate the correspondents' claims while demonstrating adherence to established lending practices.

Step-by-step guide to completing the recertification form

Initiating the completion of the nondelegated correspondent annual recertification form involves carefully gathering all necessary information. Start by consolidating essential contact information and company details, focusing on accuracy as discrepancies can lead to delays in processing.

As you dive into filling out the form, it consists of several sections requiring detailed input. The first section usually involves company identification, followed by a comprehensive financial overview which outlines revenue, liabilities, and asset management. The compliance statements section is equally important, as it demonstrates your adherence to state and federal regulations governing mortgage lending.

Before submitting your application, conduct a thorough review. Common mistakes include incomplete fields and inconsistent data, which can delay the approval process. Creating a checklist can assist in ensuring that all required documents are present, and each section of the application is properly filled out.

Submission and approval process

The submission process for the nondelegated correspondent annual recertification form can be conducted online, or by mailing in paper forms, depending on the preferences set by the regulatory body. Online submissions allow for quicker processing times through digital tracking systems, while paper submissions may require additional time for delivery and handling.

Generally, the timeline for review and approval is structured around industry standards. On average, organizations can expect a processing time of several weeks, depending on the completeness of the application and the regulatory backlog. After submission, it's important to remain informed about the status of your application and any potential next steps required for approval.

Post-recertification responsibilities

Upon successful recertification, maintaining compliance continues to be critical. Organizations must engage in ongoing monitoring to ensure that all operational practices adhere to industry standards and regulatory requirements. This involves regular internal assessments as well as adjustments based on changes in the market or legislative environment.

It's also essential to report any changes in business structure or financial status. Keeping the regulatory bodies informed not only builds trust but ensures that your organization remains compliant. Setting up timeline reminders for future recertifications can help eliminate last-minute scrambles and position your organization for continual success.

Tips and best practices

Taking advantage of interactive tools can greatly simplify the certification process. Utilizing platforms like pdfFiller allows users to streamline document management and enhance collaboration across teams, making the form-filling process more efficient. Input fields can be easily edited, allowing for quick changes as necessary.

Collaboration is key during the recertification process. Assign specific roles within your team, ensuring that the responsibilities for gathering information, filling out different sections, and reviewing final submissions are distributed. Employing cloud-based document management solutions can also facilitate easy document sharing and real-time editing, ensuring that everyone stays on the same page.

Frequently asked questions (faqs)

Understanding the implications of potential pitfalls during the recertification process is essential. One common concern is what happens if your recertification is denied. If this occurs, it is vital to learn from any deficiencies highlighted in the feedback and swiftly address them to improve your chances for approval in the next cycle.

Another frequently asked question revolves around the reapplication frequency – typically, you need to reapply annually, but specific timelines may vary based on your lender’s requirements. Additionally, the recertification process should not be delegated entirely; however, consulting experts or using automated tools can streamline the workflow while ensuring accountability.

Resources for further assistance

For those navigating the nondelegated correspondent annual recertification form process, accessing official guidelines and form templates can provide clarity and direction. PDF editing platforms such as pdfFiller enhance your ability to create, edit, and electronically sign documentation, serving as invaluable tools for effective form management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nondelegated correspondent annual recertification for eSignature?

How can I get nondelegated correspondent annual recertification?

How can I edit nondelegated correspondent annual recertification on a smartphone?

What is nondelegated correspondent annual recertification?

Who is required to file nondelegated correspondent annual recertification?

How to fill out nondelegated correspondent annual recertification?

What is the purpose of nondelegated correspondent annual recertification?

What information must be reported on nondelegated correspondent annual recertification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.