Get the free Tax Preparer Attestation Form

Get, Create, Make and Sign tax preparer attestation form

Editing tax preparer attestation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax preparer attestation form

How to fill out tax preparer attestation form

Who needs tax preparer attestation form?

Tax Preparer Attestation Form: A Comprehensive How-to Guide

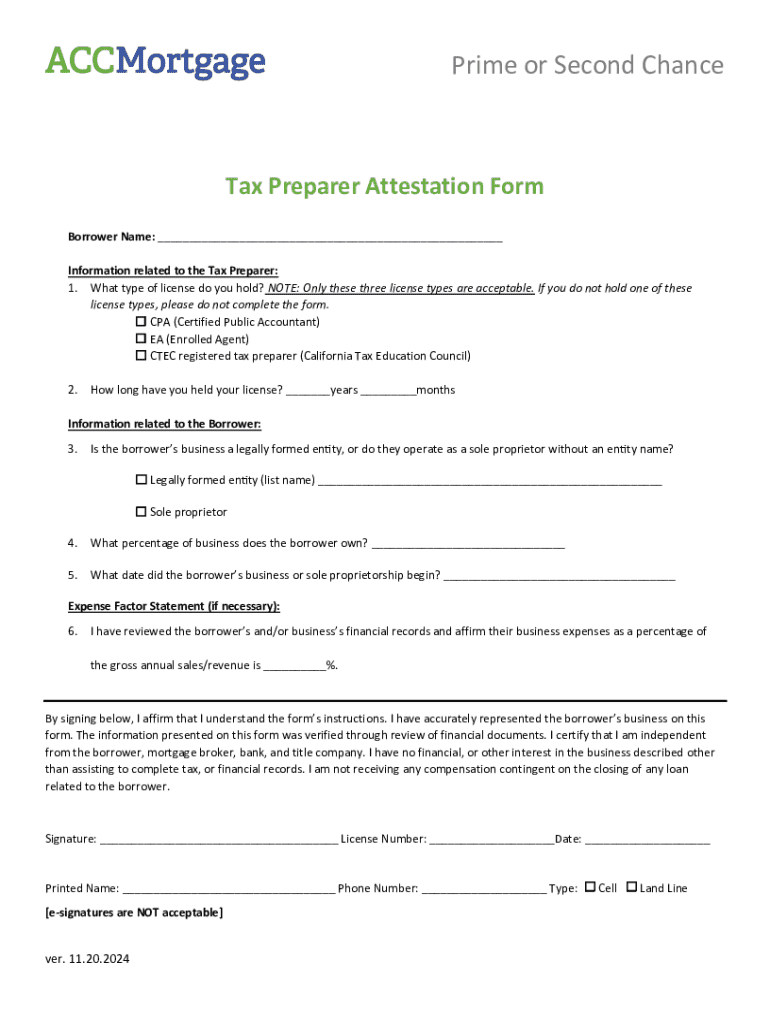

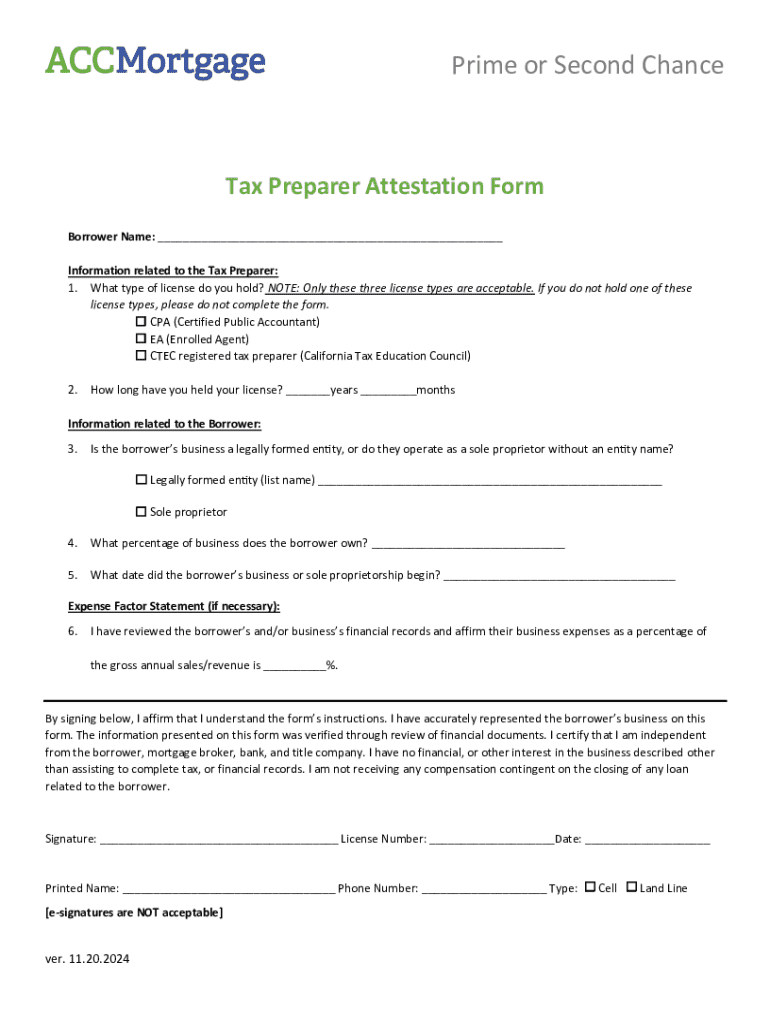

Understanding the tax preparer attestation form

The tax preparer attestation form is a crucial document in the landscape of tax preparation, serving not just as a procedural requirement but also as a guarantee of compliance. This form helps establish that tax preparers are adhering to the regulations set by the IRS, reflecting the accuracy of the information presented in tax returns. Its importance cannot be understated; it acts as a quality assurance mechanism for both the client and the government, ensuring that all parties are operating within the confines of the law.

Who needs to use the tax preparer attestation form? Primarily, it's utilized by tax preparers, including accountants and tax consultants who prepare tax returns for clients. In various scenarios—ranging from individual taxpayer assistance to corporate tax filings—this form becomes indispensable. It acts as both a declaration of professional ethics and a legal safeguard, allowing clients to be assured of the integrity and accuracy of their tax documents.

Key components of the tax preparer attestation form

When reviewing the tax preparer attestation form, there are key sections that every preparer must understand. Essential elements include personal information such as the tax preparer's name, address, and identification number, alongside clearly defined attestation statements where preparers attest to the accuracy and completeness of the information provided. Finally, a signature line is necessary, confirming that the individual has read and understands the responsibilities that come with signing the document.

It’s also vital to familiarize yourself with common terminology found in the form. Terms like 'attestation,' 'IRS compliance,' and 'professional standards' all carry specific meanings that affect tax accuracy and compliance. Understanding these terms not only clarifies the responsibilities of the preparer but also enhances the efficacy of tax preparation by limiting errors and omissions.

How to fill out the tax preparer attestation form

Filling out the tax preparer attestation form correctly is imperative for ensuring compliance and maintaining the integrity of tax submissions. Here’s how to do it effectively:

To avoid errors, double-check your entries and consider reviewing the details with a colleague. Common mistakes may include incorrect client information or failing to capture all required signatures, which can lead to compliance issues down the line.

Editing the tax preparer attestation form

Editing the tax preparer attestation form can be streamlined through the use of tools available on platforms like pdfFiller. The program features an editable PDF that allows users to modify existing documents without fear of disturbing the integrity of the original content. By utilizing interactive tools, tax preparers can easily update any information that requires correction or adjustment.

Best practices include ensuring compliance with IRS guidelines during edits to prevent any alterations that could misrepresent the preparer's obligations. Always preserve the original document format, as this enhances the reliability and trustworthiness of any submitted forms. Maintaining document integrity is paramount, especially when these documents undergo review by regulatory entities.

Signing the tax preparer attestation form

Understanding the legal importance of electronic signatures is fundamental for tax professionals. eSignatures are commonly accepted in tax documents, provided they meet certain certification requirements. This modern approach offers advantages over traditional signatures, such as efficiency in processing and ease of tracking, which can be crucial during tax season.

To electronically sign using pdfFiller, users can follow these simple steps:

Managing and storing your tax preparer attestation form

Properly organizing documents such as the tax preparer attestation form is essential for both efficiency and compliance. Best practices for document organization within cloud storage include categorizing files by tax year and client name. This structured approach simplifies retrieval when needed, especially during audits or inquiries, thereby saving valuable time.

Security is also a paramount concern for sensitive information. It is recommended to use encrypted cloud storage solutions to ensure data protection. pdfFiller provides safeguards that enhance document security, ensuring that your attestation forms remain available only to authorized individuals. Implementing strong access controls and regular audits of your document storage practices can help maintain compliance and protect sensitive data.

Troubleshooting common issues

Filling out the tax preparer attestation form can sometimes present challenges. Common issues include repetitive errors, such as misplacing or neglecting required information. Identifying these errors early is crucial. A tip is to establish a checklist for the form's requirements to ensure every area is completed before submission.

If you encounter persistent issues, contacting customer support for assistance can provide clarity. Many users misunderstand aspects of the form, leading to further confusion. Frequently asked questions about the form often revolve around signing, submission deadlines, and the implications of incorrect information.

Additional tools and resources related to the tax preparer attestation form

In conjunction with the tax preparer attestation form, several related forms and templates may be beneficial. For instance, forms related to client authorization, consent for electronic communication, and state-specific tax forms can enhance compliance and streamline the preparation process. These complementary resources serve as valuable assets for tax professionals.

Furthermore, many tax professionals are adopting online filing options to simplify the submission process. By submitting the tax preparer attestation form through reliable platforms like pdfFiller, preparers can benefit from a more straightforward filing process that reduces the chances of errors often associated with paper submissions. Electronic filing also allows for quicker confirmations and tracking, thus optimizing workflow.

Final thoughts

Accurate documentation is critical in the realm of tax preparation. The tax preparer attestation form plays an integral role in ensuring compliance, accountability, and transparency between taxpayers and preparers. Understanding how to navigate this process effectively is essential for professionals responsible for managing these documents.

Using powerful tools like pdfFiller enhances the document management process, helping to streamline workflows and reduce the stress that can accompany tax season. By integrating robust editing, eSigning, and compliance features, pdfFiller provides users with the capabilities needed to handle their document needs with confidence, ensuring that tax preparer attestation forms are not only filled out correctly but also efficiently managed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the tax preparer attestation form electronically in Chrome?

Can I create an electronic signature for signing my tax preparer attestation form in Gmail?

How do I fill out the tax preparer attestation form form on my smartphone?

What is tax preparer attestation form?

Who is required to file tax preparer attestation form?

How to fill out tax preparer attestation form?

What is the purpose of tax preparer attestation form?

What information must be reported on tax preparer attestation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.