Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Understanding Form 8-K: A Comprehensive Guide

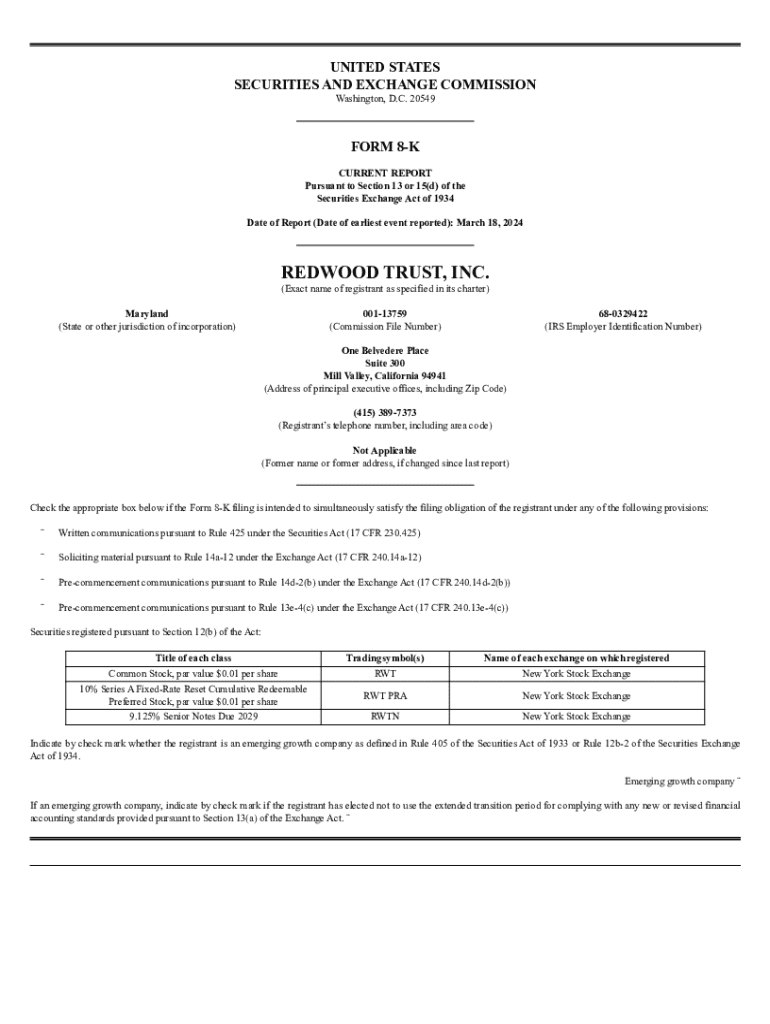

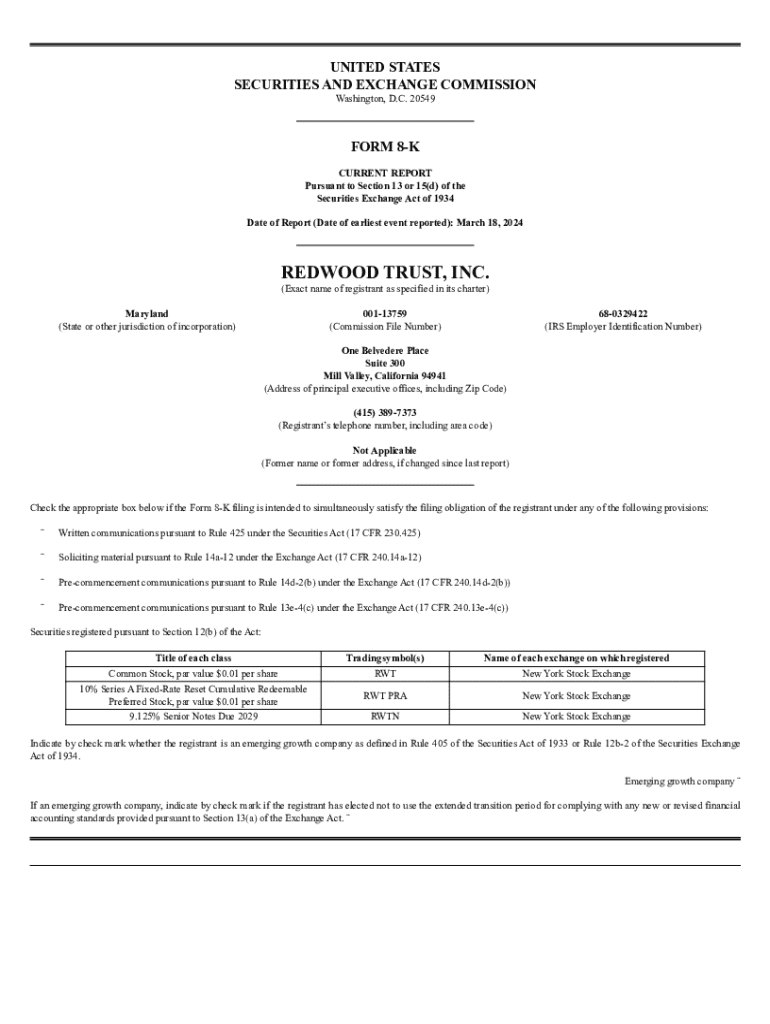

Overview of Form 8-K

Form 8-K is a crucial report that publicly traded companies in the United States are required to file with the Securities and Exchange Commission (SEC) to disclose major events that shareholders should know about. This form plays a pivotal role in maintaining transparency in the capital markets and facilitates timely communication between companies and their investors.

The importance of Form 8-K in SEC reporting cannot be overstated as it ensures that all relevant stakeholders are informed about significant occurrences that could impact the company's financial status or operations. Common scenarios for using Form 8-K include changes in executive leadership, acquisitions, financial restatements, or regulatory challenges.

When is Form 8-K required?

Form 8-K is triggered by specific events that might significantly influence a company’s financial condition or its operational integrity. Some of the primary triggering events include:

Companies generally must file Form 8-K within four business days of the triggering event. Failing to file Form 8-K on time can lead to severe penalties, including financial fines and potential scrutiny from regulators.

Components of Form 8-K

The structure of Form 8-K is designed to provide clear and concise information regarding the reported events. Key sections include:

Each section mandates specific disclosure requirements, ensuring that all material facts are presented clearly to assist investors.

Filing process for Form 8-K

Filing Form 8-K involves a series of structured steps to ensure compliance and accuracy. Here's a simplified guide to the filing process:

The importance of electronic filing cannot be under-emphasized. Platforms like pdfFiller facilitate easy filing by providing templates and document management features, making compliance simple.

Reading and interpreting Form 8-K

Understanding Form 8-K involves recognizing the context behind disclosures and their potential material impacts on investments. Investors should focus on key elements such as financial outlook changes, potential risks, and significant operational changes.

Tools like financial modeling software can assist in analyzing the disclosures. Case studies of past 8-K filings reveal how timely information can lead to shifts in market sentiment, underscoring the document's relevance in investment decision-making.

Benefits of using Form 8-K

Employing Form 8-K offers several advantages to issuers and investors alike. It enhances transparency and builds trust with investors by providing timely updates concerning significant changes or risks.

The continued dissemination of crucial information helps streamline communication with stakeholders, fostering a more informed investment community. Consequently, companies that leverage Form 8-K effectively can position themselves favorably in the eyes of current and potential investors.

Historical context of Form 8-K

Form 8-K has undergone notable evolution since its inception, adapting to the changing needs of the market. Regulatory changes have continuously reshaped how companies report events, enhancing the disclosure requirements to protect investors better.

Historically, the trends in 8-K filings reflect growing investor demand for timely information on corporate governance, financial performance, and operational stability, emphasizing the necessity for companies to maintain dynamic reporting practices.

Common challenges and FAQs about Form 8-K

Navigating the requirements of Form 8-K can pose several challenges. Common confusion arises over filing timelines, particularly when determining what constitutes a material event that necessitates disclosure.

Additionally, companies may encounter issues related to amendments and corrections. Clarity on these points is vital to ensure compliance and avoid penalties.

Integration with other SEC filings

Form 8-K works in conjunction with other important SEC filings, including Forms 10-K and 10-Q, which address annual and quarterly reporting requirements respectively. This interconnectedness reinforces the importance of consistency across filings.

Cross-referencing disclosures between these forms is essential for a comprehensive understanding of a company’s financial health and operational developments. By maintaining alignment across documents, companies can enhance the reliability of their financial reporting.

Sector-specific insights on Form 8-K

Different industries have unique approaches to utilizing Form 8-K. For instance, technology firms are often focused on rapid disclosures surrounding product launches or cybersecurity incidents, while financial institutions may prioritize changes in regulatory compliance or executive leadership.

Unique filings from sectors like healthcare may include disclosures related to clinical trial outcomes or mergers with pharmaceutical companies, showcasing how Form 8-K adapts to sector-specific reporting requirements.

Interactive tools and resources

Utilizing pdfFiller’s interactive tools can significantly simplify the process of creating and managing Form 8-K. The platform offers templates and user-friendly functionalities designed to assist users in ensuring their filings are thorough and compliant.

Additionally, access to webinars or tutorials can empower users to navigate SEC filings more effectively, enhancing their understanding of any regulatory changes that could affect their reporting duties.

How pdfFiller can enhance your Form 8-K experience

pdfFiller is equipped with robust features that support end-to-end document management for Form 8-K, allowing users to seamlessly edit PDFs, eSign, and collaborate effectively throughout the compliance process. Its capabilities promote team engagement and streamline workflows.

Furthermore, pdfFiller integrates with existing software systems, enhancing efficiency and ensuring that users can manage their Form 8-K filings without unnecessary complications, thus reinforcing the overall compliance framework.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 8-k?

How do I edit form 8-k online?

How do I edit form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.