Get the free Monthly Tip Ledger

Get, Create, Make and Sign monthly tip ledger

How to edit monthly tip ledger online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly tip ledger

How to fill out monthly tip ledger

Who needs monthly tip ledger?

Understanding the Monthly Tip Ledger Form: A Comprehensive Guide

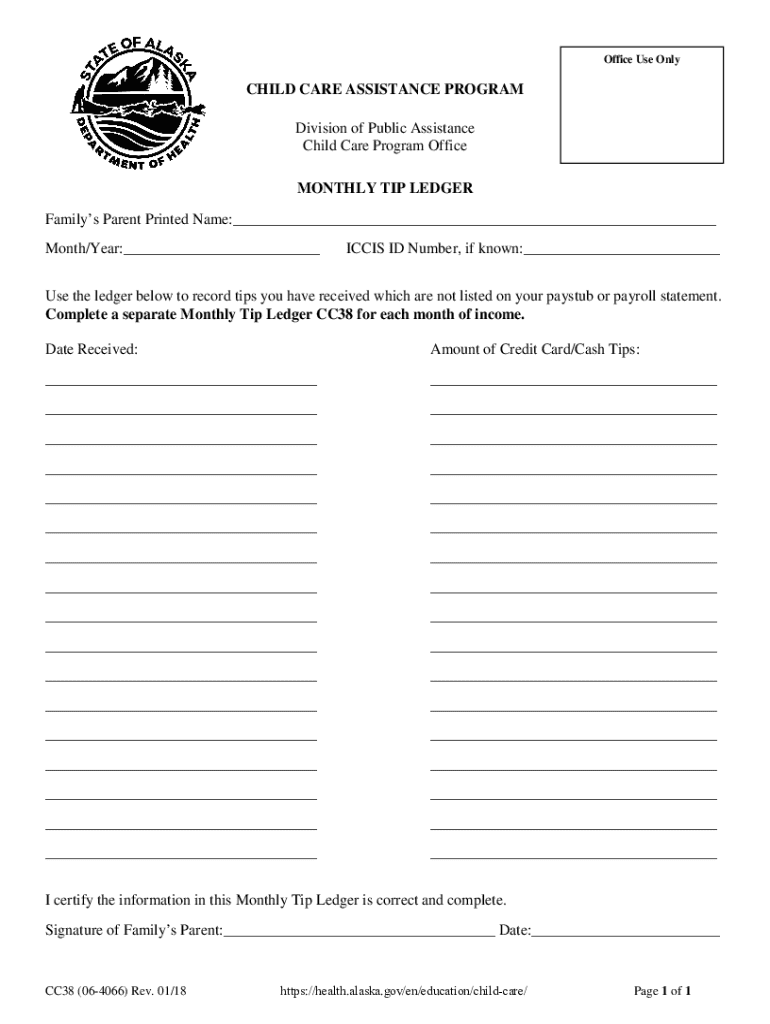

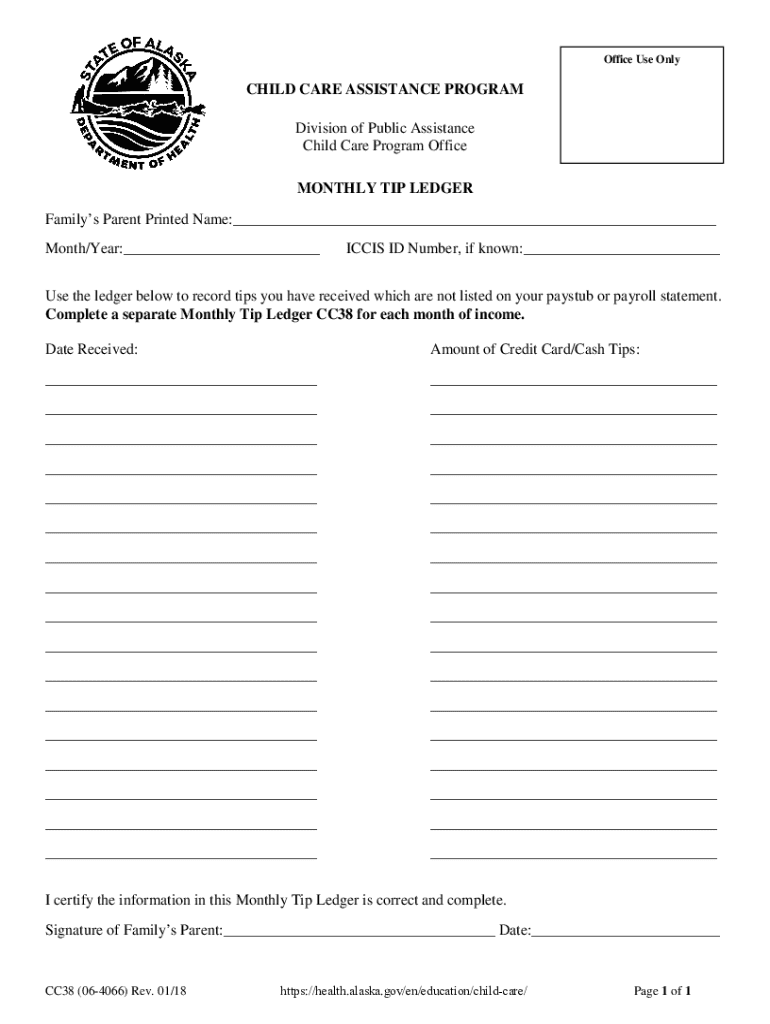

What is a monthly tip ledger form?

The monthly tip ledger form is a critical document used primarily in industries where employees receive tips as a significant portion of their earnings, such as restaurants, bars, and salons. This form helps employers and employees keep accurate records of tips received over each month. It's essential for ensuring that both parties comply with applicable tax regulations and that employees receive their fair share of tips earned. By standardizing the recording process, this form provides transparency and accountability in the distribution of gratuities.

Typically, a monthly tip ledger form includes fields for the employee's name, dates, total tips reported, allocated tips, and any deductions that may apply. It plays a vital role in maintaining records that can be referenced during audits or reviews and is invaluable in promoting a fair workplace.

Benefits of using a monthly tip ledger form

Utilizing a monthly tip ledger form offers numerous advantages to both employers and employees. First and foremost, it streamlines tip tracking by providing a structured format that is easy to fill out and reference. With this organized approach, employers can manage their financial records more effectively and ensure payouts to employees are precise.

Additionally, utilizing this form contributes to compliance with IRS regulations regarding reported tips. Accurate record-keeping mitigates the risks of penalties that can arise from improper reporting. Finally, having detailed logs assists in facilitating fair distribution of tips, as employees can clearly see how their earnings accumulate monthly.

How to fill out a monthly tip ledger form

Filling out a monthly tip ledger form is straightforward but requires attention to detail. Begin by gathering necessary information, including the employee's name, the reporting period, and the total tips received. This is typically obtained from daily sales reports or tip collection jars.

Common mistakes to avoid include failing to report tips received on days off or miscalculating totals. Double-checking figures and ensuring that all reported amounts align with your business's records can prevent discrepancies.

Interactive tools for managing your monthly tip ledger

Digital tools can significantly enhance the management of your monthly tip ledger. Platforms like pdfFiller provide users with access to customizable templates tailored specifically for tip tracking. Utilizing these tools allows for ease of use, as they offer features like pre-filled data, easy editing capabilities, and secure cloud storage.

Accessing a pdfFiller template is simple: visit their website, navigate to the forms section, and search for 'monthly tip ledger form.' From there, you can easily customize the document as per your business requirements. The benefits of using a cloud-based solution include the ability to edit documents from anywhere and share them securely with team members or accountants.

Editing and customizing your monthly tip ledger form

One of the significant advantages of the monthly tip ledger form is its adaptability to cater to your specific business needs. You can personalize the form by adding or removing fields based on factors like the number of employees or the nature of your business. For instance, if your team consists of multiple service types, adjusting the ledger to separate tips by service can enhance clarity.

This level of customization frees you to create a robust tracking system that not only meets regulatory requirements but also enhances transparency and trust among employees.

eSigning the monthly tip ledger form

Securing signatures on your monthly tip ledger form is an important step for validation and accountability. Utilizing electronic signatures helps streamline the process, allowing for timely approvals and fewer chances for losing paperwork. With the help of pdfFiller, signing and sending the form electronically is straightforward.

With these steps, teams can maintain an efficient and organized documentation process that adheres to both internal and external compliance standards.

Collaborating on the monthly tip ledger form

Collaboration can enhance the accuracy and effectiveness of filling out the monthly tip ledger form. By sharing the form with team members, you encourage collective input and promote transparency regarding tip distributions. Leveraging tools like pdfFiller allows for real-time collaboration where team members can add their input simultaneously.

Establishing best practices around collaboration fosters a cooperative atmosphere, enhancing accuracy and trust while managing tips.

Managing and storing your monthly tip ledger forms

Once completed, it is essential to have a solid plan for managing and storing your monthly tip ledger forms. Proper archiving ensures that historical records are available for audits and compliance checks. Organizing forms by date or employee name in a structured manner can make it easier to retrieve necessary documentation.

By prioritizing organization and security, businesses can ensure they remain compliant while reassuring employees about the integrity of the tip tracking process.

Reporting tips to the IRS

Understanding the reporting requirements for tips is vital for compliance with IRS regulations. Employees are obligated to report all tips received, which have tax implications for both individuals and businesses. Accurate recordkeeping using the monthly tip ledger form plays a crucial role in these compliance efforts.

Filing forms on time and ensuring all information aligns with your monthly tip ledger form can simplify tax submission and avoid complications down the line.

FAQs about monthly tip ledger forms

To ensure users feel equipped to handle the monthly tip ledger form effectively, addressing common questions can be highly beneficial. For example, individuals often ask about the best way to correct errors on the form. It's advisable to draw a line through incorrect text and write the correct information clearly next to it.

Addressing these FAQs can enhance user confidence and encourage diligence in managing tip reporting effectively.

Best practices for employers handling tips

Employers play a crucial role in the equitable management of tips. It is essential to establish guidelines that dictate how tips are reported and distributed. Training employees on correct documentation practices is vital, ensuring that everyone understands the reporting process and compliance requirements.

These practices help foster a positive workplace environment while maintaining compliance with IRS requirements.

Final thoughts on effective tip management

Maintaining an accurate monthly tip ledger form is integral to minimizing disputes and ensuring compliance within businesses with tipped employees. By leveraging tools like those offered by pdfFiller, organizations can manage their tip documentation more effectively, ensuring that the process is both transparent and accessible.

Emphasizing the benefits of cloud-based solutions helps modernize document management, benefiting both employers and staff. Consider implementing a digital approach to enhance efficiency and stay ahead of compliance while providing fair management of earned gratuities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify monthly tip ledger without leaving Google Drive?

How do I edit monthly tip ledger online?

How can I fill out monthly tip ledger on an iOS device?

What is monthly tip ledger?

Who is required to file monthly tip ledger?

How to fill out monthly tip ledger?

What is the purpose of monthly tip ledger?

What information must be reported on monthly tip ledger?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.