Get the free Registered Plan Beneficiary Designation or Modification Notice

Get, Create, Make and Sign registered plan beneficiary designation

How to edit registered plan beneficiary designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out registered plan beneficiary designation

How to fill out registered plan beneficiary designation

Who needs registered plan beneficiary designation?

A comprehensive guide to the registered plan beneficiary designation form

Understanding the registered plan beneficiary designation form

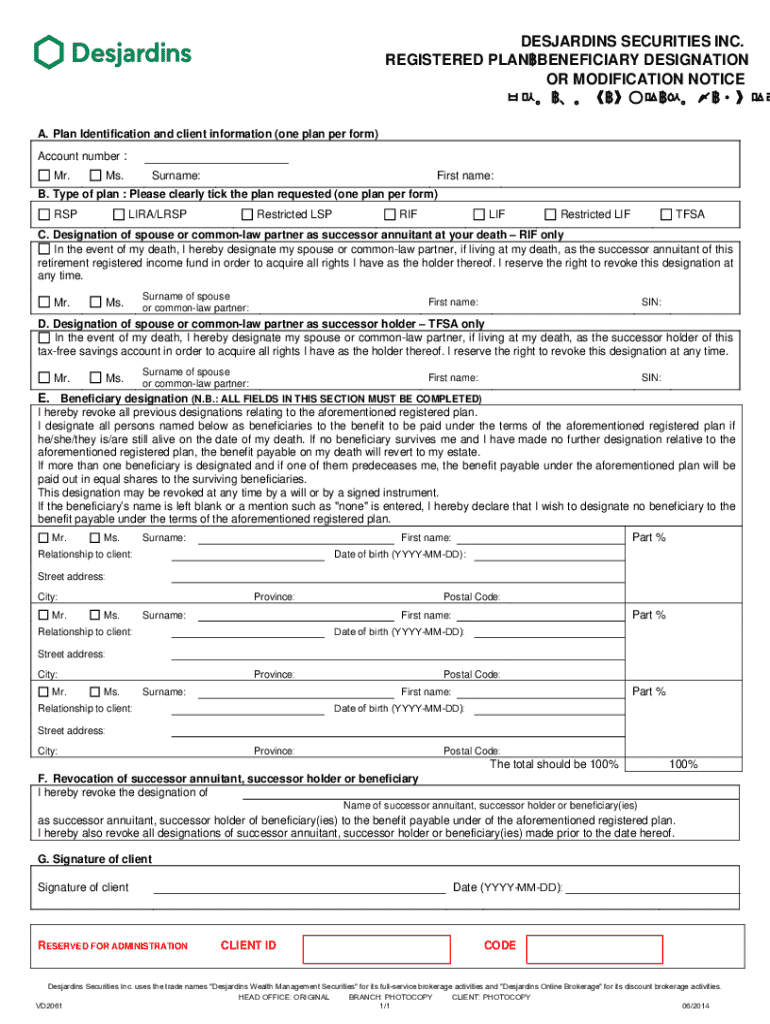

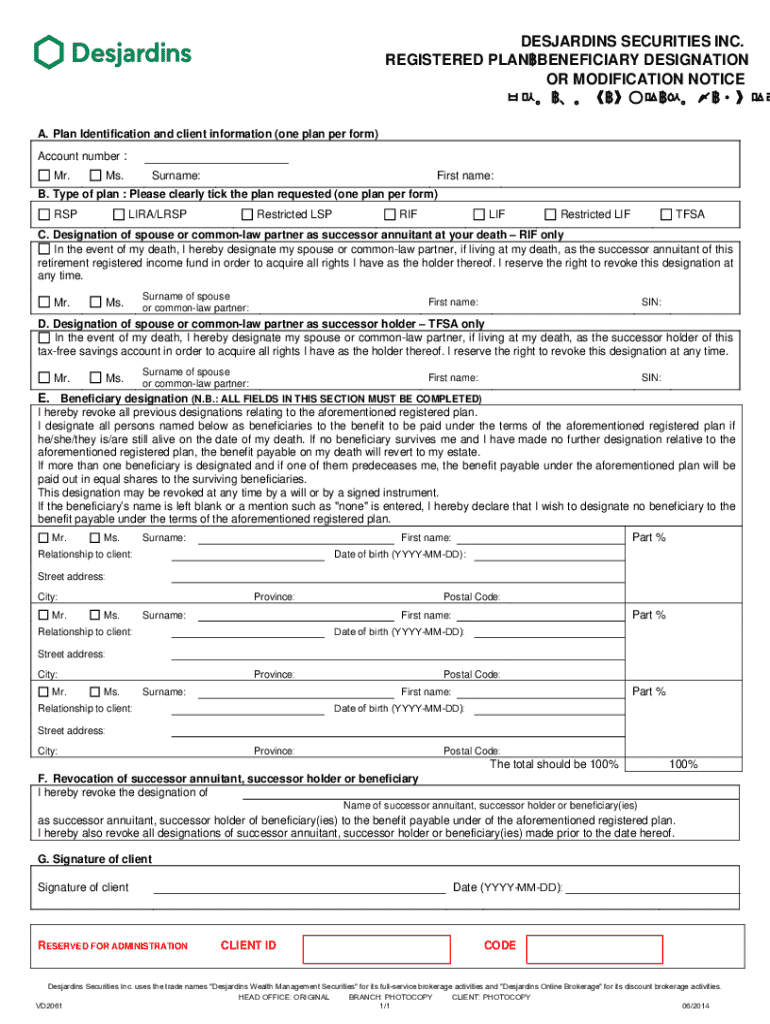

The registered plan beneficiary designation form is a crucial document that allows individuals to appoint one or more beneficiaries for their registered plans, such as retirement savings plans (RSPs), registered retirement income funds (RRIFs), and tax-free savings accounts (TFSAs). This form plays a vital role in estate planning, as it ensures that the assets in these accounts are distributed according to the holder's wishes upon their passing.

Understanding the terminology used in this form is essential. The term 'beneficiary' refers to the person or entity designated to receive the assets of a registered plan after the account holder's death. The 'designation process' encompasses the steps needed to fill out the form, submit it, and ensure it is legally recognized. It's also important to have an overview of various 'registered plans,' which are savings accounts recognized by the government that offer specific tax advantages.

Who needs a registered plan beneficiary designation form?

Individuals across various life stages should consider completing the registered plan beneficiary designation form. Properly designating beneficiaries is crucial for personal finances, as it dictates how your assets will be handled posthumously. By appropriately selecting beneficiaries, individuals can help minimize complications during estate settlements and ensure their financial legacy is honored.

Moreover, teams and organizations, including employers offering benefits to personnel, will also benefit from using this form. For employees enrolled in benefit plans, having a designated beneficiary is vital for accessing available benefits. Therefore, it can also assist HR departments by streamlining processes related to beneficiary designations, ensuring that all employees understand their options and making necessary updates when life changes occur.

Key components of the form

Filling out the registered plan beneficiary designation form requires several key pieces of personal information. Essential details include the identifying information of the plan holder, such as their full name and contact information, as well as the chosen beneficiaries' details, which may include their names, relationships to the plan holder, and other identifying attributes like Social Security numbers or birth dates.

When selecting beneficiaries, individuals should be aware of the distinctions between primary and contingent beneficiaries. Primary beneficiaries are those who are first in line to receive the benefits after the account holder's death, while contingent beneficiaries are secondary options if the primary beneficiaries are not available. Special considerations for designating beneficiaries should be noted; for instance, when designating minors, guardianship arrangements may be necessary to manage these assets.

Step-by-step guide to filling out the form

To effectively complete the registered plan beneficiary designation form, follow this step-by-step guide. Before filling out the form, conduct a pre-fill checklist to identify and gather necessary documents such as identification, current account statements, and details of your intended beneficiaries. This ensures that all required information is at hand.

Once ready, you can start by downloading the form from pdfFiller. Carefully fill in your personal information including your full name, address, and account numbers. Next, document the names of your beneficiaries and their relationships to you. Specify any percentage allocations for distributing assets among multiple beneficiaries. Lastly, be mindful of common mistakes, such as forgetting to include signatures or leaving out critical information that may delay processing.

Editing and customizing the form

pdfFiller offers robust editing tools that facilitate easy customization of the registered plan beneficiary designation form. Users can add notes or additional details that may clarify intentions or provide context regarding the selections made on the form. The user-friendly interface allows for straightforward adjustments, ensuring accuracy in the information being submitted.

In addition, once all edits are completed, users have various options for saving and exporting the document. pdfFiller allows users to store their forms in a secure cloud environment, ensuring the flexibility to access and modify documents from any device. This feature enhances document management by keeping all necessary files organized and readily retrievable.

Signing the form

Once the registered plan beneficiary designation form is accurately filled out, signing it is the next step. The eSignature is an essential component of the process, adding a layer of validity and security to the document. An electronic signature ensures that the completed form is legally binding, paving the way for the proper execution of your wishes.

To eSign on pdfFiller, follow the simple step-by-step process that allows for quick and secure signing. Users can also ensure the integrity of signatures through pdfFiller’s secure eSignature platform, which employs encryption and authentication measures to protect user identities and documents from unauthorized access.

Submitting the form

Once signed, the registered plan beneficiary designation form needs to be submitted appropriately. Users can choose between online submission via pdfFiller or traditional routes like printing and mailing the form to the necessary financial institution. It's essential to follow the submission guidelines of the respective plan provider to ensure acceptance.

After sending the form, tracking submission status can further provide peace of mind. Many institutions offer tracking options to confirm whether the designation has been successfully processed, allowing users to feel secure that their wishes are honored.

Managing your beneficiary designations

Managing beneficiary designations is an ongoing responsibility. It is crucial to review and update the information whenever significant life events occur, such as marriage, divorce, or the birth of a child. Keeping these designations current minimizes potential disputes among beneficiaries and ensures that assets are distributed as intended. Regular check-ins with your documents can help maintain clear records of your financial plans.

Moreover, always keep your records secure and accessible. pdfFiller’s cloud platform aids in maintaining organized documentation, providing updates and managing multiple beneficiaries. This feature reduces risk while facilitating easy access to important documents when needed.

FAQ about the registered plan beneficiary designation form

Troubleshooting common issues

While filling out and submitting the registered plan beneficiary designation form, users may encounter some common issues. One of the prevalent problems is difficulty downloading or printing the form. Ensure that your browser settings allow for file downloads and that you have the necessary software to view PDFs. If problems persist, try switching browsers or clearing your cache.

Signature discrepancies may also arise. It's crucial to ensure that the eSignature matches the legal name as stated on the form. If the signatures vary significantly, the form may not be accepted. Additionally, if you receive return mail from submissions, it could indicate an issue with the address provided or missing information that needs to be rectified before resubmission.

Additional tips for effective beneficiary designation

Consulting a financial advisor can provide valuable insights into effective beneficiary designations. These professionals offer advice tailored to individual financial situations, ensuring that you are making informed decisions regarding your estate. Furthermore, fostering open communication with beneficiaries about your plans can prevent future misunderstandings and conflicts, promoting harmony.

Lastly, consider leveraging pdfFiller not just for the beneficiary form; utilize it for comprehensive document management. The platform allows for streamlined organization of all your vital forms, thus enhancing both accessibility and security.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify registered plan beneficiary designation without leaving Google Drive?

How can I send registered plan beneficiary designation to be eSigned by others?

Can I sign the registered plan beneficiary designation electronically in Chrome?

What is registered plan beneficiary designation?

Who is required to file registered plan beneficiary designation?

How to fill out registered plan beneficiary designation?

What is the purpose of registered plan beneficiary designation?

What information must be reported on registered plan beneficiary designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.