Get the free Claim Form

Get, Create, Make and Sign claim form

How to edit claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out claim form

How to fill out claim form

Who needs claim form?

Claim Form: How to Effectively Manage Your Claims

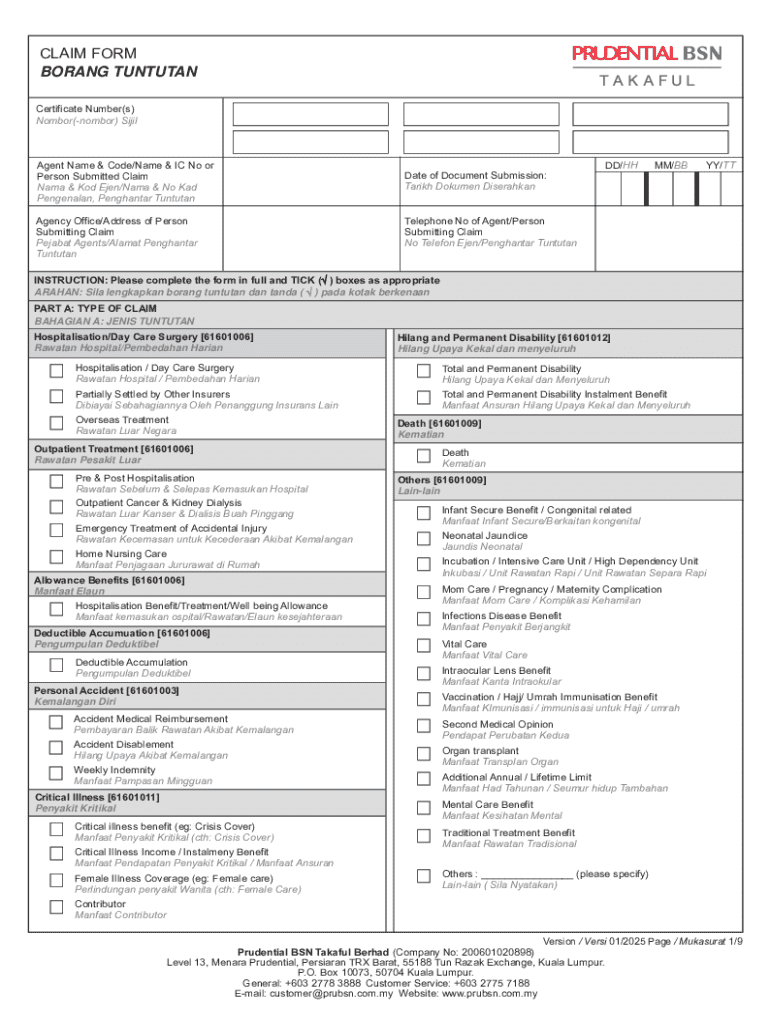

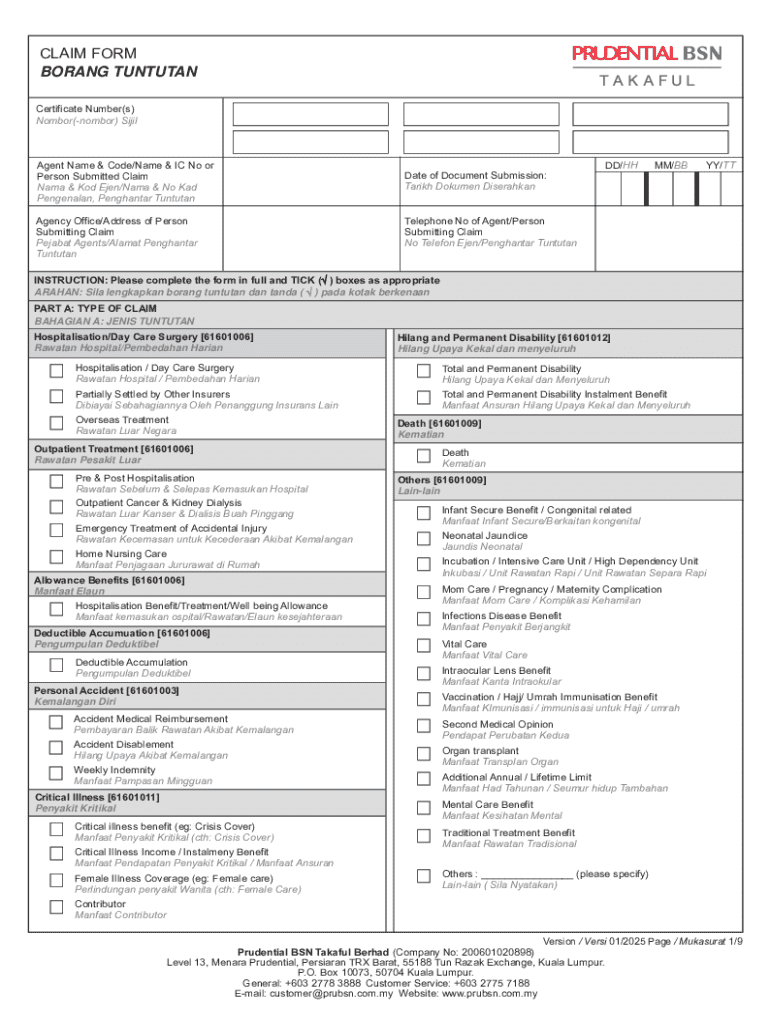

Understanding claim forms

A claim form is a formal request submitted to an organization requesting compensation or benefits based on a contract or policy. These forms are commonplace in insurance, healthcare, and financial sectors, serving as a crucial link between policyholders and the providers of services. The accuracy of the information provided within the form significantly impacts the processing speed and likelihood of approval, making it essential for users to meticulously complete each section.

Accurate completion of a claim form not only expedites the review process but also assists in preventing denial due to incomplete or erroneous information. There are several types of claim forms, the most common including insurance claims, financial claims, and healthcare claims. Each type has its unique requirements and processes, necessitating an understanding of the specific nuances of your claim’s context.

Preparing for your claim submission

Preparing for a claim submission involves two crucial steps: identifying the correct claim form and gathering necessary documentation. Each claim category has a distinct form with formulated questions tailored to a particular situation. For example, if you are filing for auto insurance, you will fill out a different form compared to a health insurance claim. Understanding these categories is key to a smooth application process.

Once you’ve identified the correct claim form, gather the necessary documentation to support your claim. Essential documents may include proof of loss or damages, relevant correspondence, and any receipts that substantiate your expenses. This preparation phase is critical because missing documentation can lead to delays or outright denials of your claim.

Step-by-step guide to filling out a claim form

Filling out a claim form might seem straightforward, but attention to detail is vital. Most standard claim forms have sections for personal information and a detailed description of the claim. When submitting your personal information, ensure that every detail is accurate—this includes your address, policy number, and contact information—to avoid any potential issues later.

For the description of the claim, articulate your situation clearly. Provide all pertinent details, covering what happened, where it occurred, and any individuals involved. This structured approach facilitates a smoother review process, enhancing your chances of approval.

Editing and signing your claim form

Once your claim form is filled out, it’s time to polish it using pdfFiller's editing features. You can customize text fields, add notes, and ensure that the form is tailored to your exact needs. Ensuring a professional and polished document can make a significant difference in the impression it makes on reviewers, emphasizing your seriousness in filing the claim.

In addition to editing, pdfFiller’s eSignature feature allows you to sign your claim electronically, which is both convenient and ensures that your submission is legitimate. Before finalizing your document, it’s recommended to preview it thoroughly to catch any last-minute errors or adjustments that need to be made.

Submitting your claim form

The next step is submitting your claim form. Understand that there are various options available; either file it online or submit it by mail. If you choose to file online, ensure that you follow the specific procedures outlined by the relevant organization. Many companies have specific online systems that common claimants should use, which can significantly speed up the processing time.

Tracking your claim status is another critical aspect. Most organizations provide tools to monitor claims, allowing you to stay informed and follow up as necessary. Being proactive could expedite the resolution process.

After submission: Understanding the process

After filing your claim, it is essential to know what to expect during the review period. Organizations often have set timeframes for claim reviews, and understanding these can alleviate anxiety. During this time, you might receive periodic communications from the claims office updating you on the status of your request, including any additional information they may need for processing.

If your claim is approved, familiarize yourself with the payout process. Understanding how compensation will be distributed is critical, whether it will be a direct deposit, check, or other means. If your claim is denied, review the explanation and consider your options to appeal if you believe the decision was incorrect.

Handling denials and appeals

Claim denials can be frustrating, but knowing common reasons for such outcomes helps prepare you for the possibility. Typical reasons for denials include incomplete documentation, inaccuracies in the submission, or claims falling outside policy limits. Understanding these pitfalls allows you to be more thorough when crafting your claim.

Should you receive a denial, initiating an appeal is your next course of action. Document your case meticulously for resubmission, providing any new evidence or clarification that supports your claim. Persistence, combined with clear communication, significantly increases your chances of success in the appeal process.

Specialized claim forms

Certain claim forms cater to specific situations and require unique approaches. For example, health claims often involve detailed medical and pharmacy forms that necessitate the involvement of healthcare providers for verification. Similarly, transportation claims, such as those related to lost luggage or vehicle damage, come with their own specific requirements. Understanding these specialized forms ensures that you are well-equipped to handle claims unique to your context.

Additionally, if your claim pertains to international contexts, be aware of the variations that might occur based on country-specific regulations or requirements. Collecting the correct documentation becomes even more vital when dealing with international claims, as local policies may differ significantly from those in your home country.

FAQs about claim forms

Having clarity when facing claim-related uncertainties is critical. Some frequently asked questions about claim forms include inquiries regarding submission procedures, required documents, and how to troubleshoot common issues. It is advisable to consult the guidelines provided by the organization for particular insights into their requirements.

Ultimately, knowing where to direct your questions, be it customer service or online support, can prove beneficial and help resolve issues faster, enhancing your experience overall.

Maximizing the benefits of pdfFiller for your claims

pdfFiller empowers users to manage their claim forms seamlessly in a cloud-based environment. This platform offers interactive features that streamline the document creation and submission process. Utilizing these cloud-based functionalities, users can fill out, edit, and share their claims without geographical limitations, making it an excellent solution for individuals and teams handling multiple claims.

Collaboration is another strong suit of pdfFiller; teams can work together in real-time to ensure all aspects of a claim form are addressed adequately. Several case studies demonstrate how users have successfully navigated the claims process more efficiently using pdfFiller, showcasing its adaptability and effectiveness.

Tips for future claims management

Managing claims effectively starts with keeping records organized. Utilize folders, both digital and physical, to categorize your documentation. This approach ensures you can quickly access necessary information when needed.

Additionally, staying informed about any changes in policy or requirements can save a lot of trouble during your next claims submission. Utilize tools like pdfFiller not just for individual claims, but for ongoing document needs to streamline future processes, making your administrative tasks much simpler.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the claim form electronically in Chrome?

Can I create an electronic signature for signing my claim form in Gmail?

How do I fill out the claim form form on my smartphone?

What is claim form?

Who is required to file claim form?

How to fill out claim form?

What is the purpose of claim form?

What information must be reported on claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.