Get the free Notice of Tax Taking

Get, Create, Make and Sign notice of tax taking

How to edit notice of tax taking online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of tax taking

How to fill out notice of tax taking

Who needs notice of tax taking?

Notice of tax taking form: A comprehensive how-to guide for property owners

Understanding the notice of tax taking form

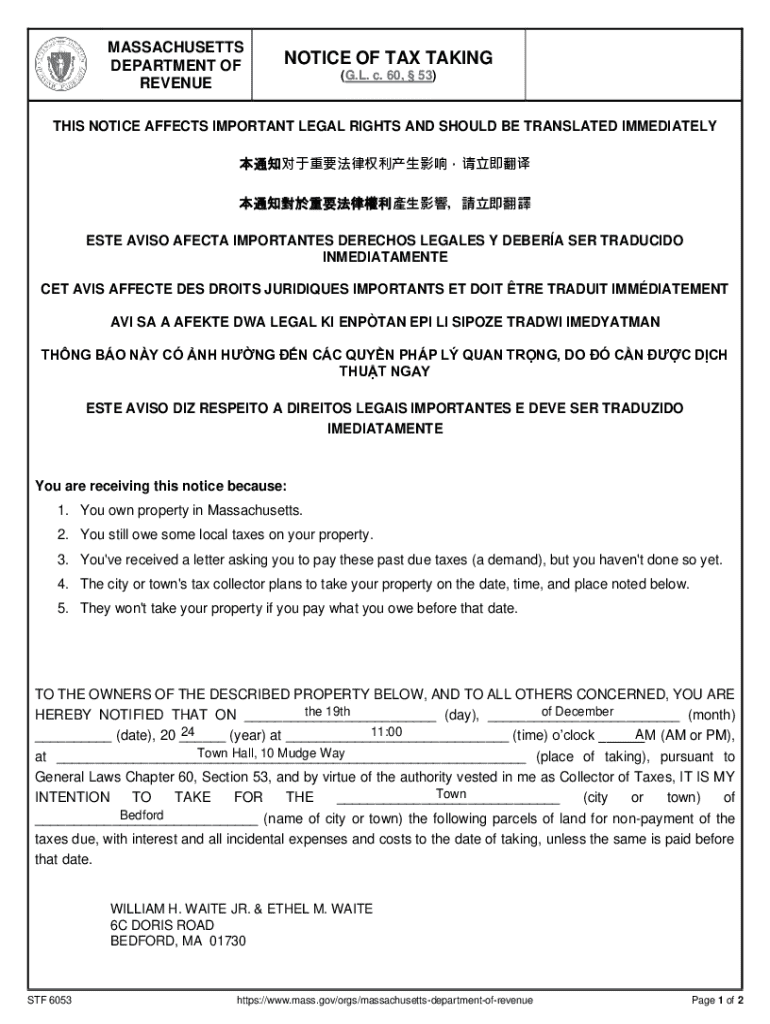

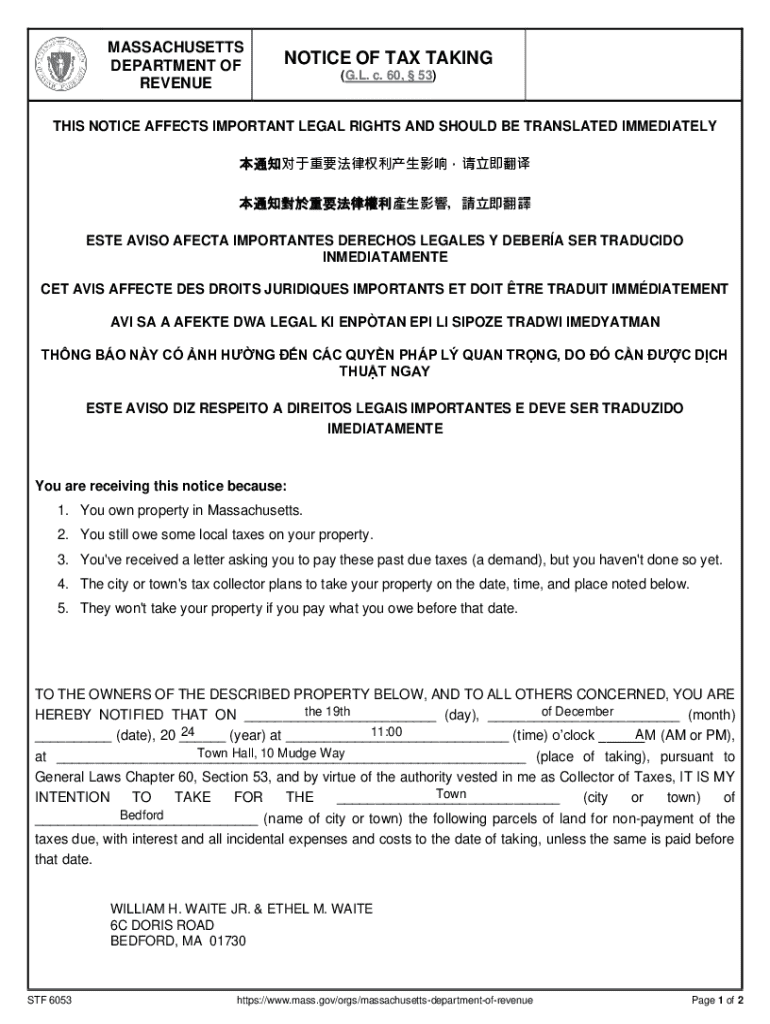

The notice of tax taking form is a legal document that informs property owners of unpaid property taxes, leading to potential tax liens and foreclosure. This document serves as a critical warning, indicating the steps that may be taken by the tax authority if the owed taxes are not resolved.

For property owners, understanding this notice is paramount. Beyond merely being a notification, it outlines the seriousness of the situation and the potential consequences of neglecting tax obligations. Ignoring such a notice can result in severe financial repercussions, including losing one’s property.

When is a notice of tax taking issued?

Typically, a notice of tax taking is issued in the context of unpaid property taxes. If a property owner fails to pay property taxes by the deadline, they risk receiving this notice. Delinquent accounts may also trigger this documentation as local municipalities follow specific regulations to recover owed taxes.

The timeline leading to a notice of tax taking generally follows a specific pattern. Initially, property tax bills are issued, allowing a grace period for payment. Once this period elapses without payment, the tax authority typically sends reminders or delinquency notices before finally issuing the notice of tax taking, which signifies that the matter is being escalated.

Detailed breakdown of the notice components

Understanding the components of the notice of tax taking is crucial for property owners. The header information includes the name of the issuing agency, the relevant dates such as the issuance date and payment deadlines, and usually a reference number for tracking purposes.

Next, the notice describes the tax liability, detailing the amount owed, including interest or penalties. The property description outlines the specific property in question, often including the address and parcel number. Actions required by the property owner are clearly specified, along with the consequences of failure to respond. This could involve further legal actions such as foreclosure.

Steps to respond to a notice of tax taking

Receiving a notice of tax taking can be alarming, but how you respond is essential. The first step involves reviewing the notice carefully. It's crucial to understand each element of the document, as any inaccuracies could affect your response. Identifying errors in tax amounts or property details early can help avert further complications.

Next, gather necessary documentation, such as tax records and payment receipts. Having a comprehensive communication history can be beneficial for reference purposes. Finally, contact the appropriate authorities to discuss your situation. Identifying the right department—often the local tax collector’s office—will streamline your inquiries.

Filing a response or appeal

Filing a formal response to the notice of tax taking may involve preparing specific forms that detail your reasons for contesting the notice or resolving the debt. Critical to this process is adhering to deadlines, as failure to do so may result in a loss of appeal rights. Being proactive is essential.

If you decide to appeal, prepare by outlining grounds such as incorrect tax assessments or exceptional circumstances preventing payment. Gather all necessary documentation, which may include tax bills, receipts, and any prior correspondence. In some cases, engaging legal help may provide additional insights or support during the appeal process.

Managing future tax obligations

Understanding your tax liabilities is crucial for managing property taxes effectively. This includes being aware of property valuation methods and local tax rates that determine owed amounts. Familiarizing yourself with these details can significantly mitigate the risk of falling behind.

Property owners may also consider setting up payment plans if facing financial difficulties. Many local tax authorities offer various options that can help distribute the tax burden over manageable installments. Additionally, utilizing eServices provided by your local tax authority can greatly simplify accessing tax records and remitting payments online.

Resources for property tax management

pdfFiller provides an array of online tools that can greatly ease document management related to property taxes. With its user-friendly platform, uploading and editing forms becomes a breeze. The ability to eSign documents directly means you can quickly respond to notices or submit forms without delays.

Moreover, pdfFiller offers links to relevant forms and templates, including tax collector and property appraiser forms, ensuring that you have all necessary documentation at your fingertips. Comprehensive tutorials will guide you through the platform’s features, making the process seamless.

Real-life scenarios and tips

Case studies highlight that successful responses often stem from understanding the notice thoroughly. Common mistakes include ignoring the notice or responding late. Successful communication with tax authorities requires clarity and conciseness, aiding in fast resolution.

Engaging tax professionals can provide expert insights, ensuring you explore all available options and reduce stress. Their advice is invaluable for navigating complex tax regulations and maintaining compliance in the future.

Frequently asked questions (FAQs)

If you disagree with the tax amount presented in your notice, it is crucial to document your reasons and engage your local tax authority promptly. They may offer a process for reviewing assessments.

To prevent receiving a notice of tax taking in the future, ensure timely payments and stay informed about tax deadlines. Participating in relevant local tax workshops may also enhance your understanding of obligations.

After responding to the notice, expect a follow-up from the tax authority, possibly outlining the next steps or confirming the resolution of your case. Being ready for further communication is essential.

Additional considerations

Exploring potential tax relief options can be beneficial for property owners facing financial hardship. Programs may exist to alleviate some of the burdens imposed by unpaid taxes. Additionally, understanding available tax exemption programs can create opportunities for savings.

Keeping abreast of local tax regulations is crucial. Regularly check for any changes that could affect your tax obligations or introduce new opportunities for relief. Proactively managing your property taxes is key to maintaining ownership and financial stability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in notice of tax taking without leaving Chrome?

Can I create an electronic signature for the notice of tax taking in Chrome?

How do I edit notice of tax taking on an Android device?

What is notice of tax taking?

Who is required to file notice of tax taking?

How to fill out notice of tax taking?

What is the purpose of notice of tax taking?

What information must be reported on notice of tax taking?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.