Get the free Personal Financial Statement

Get, Create, Make and Sign personal financial statement

How to edit personal financial statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal financial statement

How to fill out personal financial statement

Who needs personal financial statement?

Understanding Personal Financial Statement Forms

Understanding the personal financial statement form

A personal financial statement form is a critical tool for individuals looking to organize and summarize their financial situation. This document provides a snapshot of a person’s financial health by detailing their assets, liabilities, and net worth. It succinctly helps individuals maintain a clear understanding of their finances, making it essential for various financial activities.

Maintaining a personal financial statement is particularly important for anyone seeking loans, mortgages, or financial advice. Its main purpose is to give lenders or financial advisors a comprehensive view of an individual's financial liabilities and assets, thereby fostering informed decision-making. This can also be a helpful tool for individuals looking to get a grip on their financial futures, ensuring they plan appropriately for retirement or major expenditures.

Who needs a personal financial statement?

Various individuals and groups find personal financial statements beneficial for an array of reasons. First and foremost, individuals seeking loans or mortgages often need to provide these forms to potential lenders. This document helps assess creditworthiness and the ability to repay the borrowed amount.

Business owners and entrepreneurs can also benefit significantly from maintaining a personal financial statement. It offers a foundational understanding of financial health, which is vital when seeking investments or additional funding. Moreover, financial advisors and consultants routinely request these statements to offer tailored advice to clients based on their disclosed financial status. Finally, professionals wanting clarity on their financial health can use personal financial statements to guide their financial planning and strategy, ensuring they're adequately prepared for life’s financial challenges.

How to fill out a personal financial statement form

Completing a personal financial statement does not have to be daunting. Following these straightforward steps can guide you through the process, ensuring accuracy and completeness.

Using pdfFiller to manage your personal financial statement

pdfFiller elevates the process of managing your personal financial statement by providing a suite of user-friendly features. With easy PDF editing tools, users can customize their forms effortlessly, ensuring their financial details are accurately reflected.

Additionally, pdfFiller’s eSignature capabilities allow you to sign documents promptly, while collaboration options enable teamwork when necessary. Accessing your personal financial statement from anywhere, thanks to its cloud-based technology, means you can update or share it on the go. This flexibility is particularly advantageous when working with financial advisors or institutions that require up-to-date documents.

Common mistakes to avoid when filling out your personal financial statement

When compiling a personal financial statement, certain pitfalls can undermine its accuracy and effectiveness. One common mistake is overestimating your assets, which gives a false sense of security regarding your financial health. This may mislead both you and any lenders or advisors you might approach.

Conversely, underreporting liabilities is another critical error that can lead to financial mismanagement. Maintaining a clear record is fundamental, as failing to update your personal financial statement regularly can result in missed opportunities or financial strains due to inaccurate information. Additionally, it's important to account for hidden liabilities, like potential future obligations or guarantees, which are often overlooked.

Tips for maintaining your personal financial statement

Regular updates are essential for a personal financial statement, whether on a quarterly or annual basis. Frequent reviews help reflect any changes in your financial situation, including new assets gained, debts incurred, or changes in income. Diligently keeping your supporting documents organized and accessible can reduce stress when it comes time to revise your statement.

Another strategy is to understand your evolving personal financial circumstances, as life events such as marriage, job changes, or retirement can significantly affect your financial picture. Awareness of these dynamics allows you to be proactive in your financial planning, adjusting your personal financial statement accordingly to maintain a clear view of your financial health.

Why use online tools like pdfFiller for your personal financial statement?

Employing online tools like pdfFiller offers distinct advantages when handling your personal financial statement. Chief among these is the accessibility and convenience of managing documents from different locations at any time. pdfFiller ensures enhanced security measures are in place to protect sensitive financial information, allowing users to demonstrate confidence when sharing personal financial information.

The platform also streamlines sharing with financial institutions or advisors, making collaboration seamless. Integration with other financial management tools allows users to maintain holistic oversight over their financial activities and decisions, reducing the hassle often associated with manual updates or document reconciliations.

Frequently asked questions (FAQs) about personal financial statements

When dealing with personal financial statements, questions often arise. For example, what should you do if you don’t have all the necessary documents? In cases like this, try to gather as much relevant information as possible and note any sections that require approximations or estimates until you can provide complete documentation.

Another common inquiry is whether personal financial statements can be used for businesses. While primarily designed for individuals, self-employed individuals or business owners can utilize personal financial statements to reflect their financial status, especially when their business expenditures impact their personal finances. Lastly, many wonder about the security of their information in pdfFiller; this platform is built with robust security protocols to ensure your data remains confidential and protected.

Testimonials and case studies

Users of pdfFiller have experienced significant benefits in managing their personal financial statements. One user reported enhanced clarity in their financial planning, allowing them to make informed decisions when it came to investments and savings. Many testimonials highlight the importance of ease-of-use and efficiency that pdfFiller has introduced into their financial documentation process.

A notable case study involves a small business owner who effectively utilized pdfFiller’s services to prepare a personal financial statement as part of their loan application process. They successfully articulated their financial position with lenders, leading to secured funding that allowed them to grow their business.

Interactive tools and resources within pdfFiller

pdfFiller goes beyond basic document management by offering interactive tools and resources designed to enhance your personal financial statement journey. Various templates are available, catering to different financial situations. These templates save time while ensuring you have a structured document that captures all necessary information.

Additionally, pdfFiller also provides financial calculators and other helpful tools to assist users in determining net worth and projecting future financial health. Accessing industry insights and best practices can help you stay informed about changing regulations or strategies related to financial management, fostering a proactive approach to maintaining your personal financial statement.

Support and guidance

Receiving guidance and support is crucial as you navigate filling out and maintaining your personal financial statement. pdfFiller provides comprehensive support channels, including access to customer service representatives who can assist with technical issues or questions about document features. Additionally, community resources and forums give users a platform to learn from others’ experiences, sharing tips and best practices.

Moreover, insights from financial experts featured on the platform can offer valuable advice on best practices for preparing personal financial statements, investing, and financial planning, assisting users in making informed decisions.

Navigating your personal financial statement journey with pdfFiller

Setting clear goals for your financial health is the first step in your personal financial statement journey. With pdfFiller, users can track progress through regular reviews of their financial documentation, ensuring they stay on the path to meeting their objectives. Utilizing the feedback and insights derived from pdfFiller’s tools encourages ongoing learning and adaptation as personal and economic circumstances change.

Furthermore, combining insights from your personal financial statement with data from pdfFiller provides a data-driven approach to financial management. This enables users to identify areas for improvement and focus on strategies to enhance their overall financial well-being.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get personal financial statement?

Can I sign the personal financial statement electronically in Chrome?

How do I fill out personal financial statement on an Android device?

What is personal financial statement?

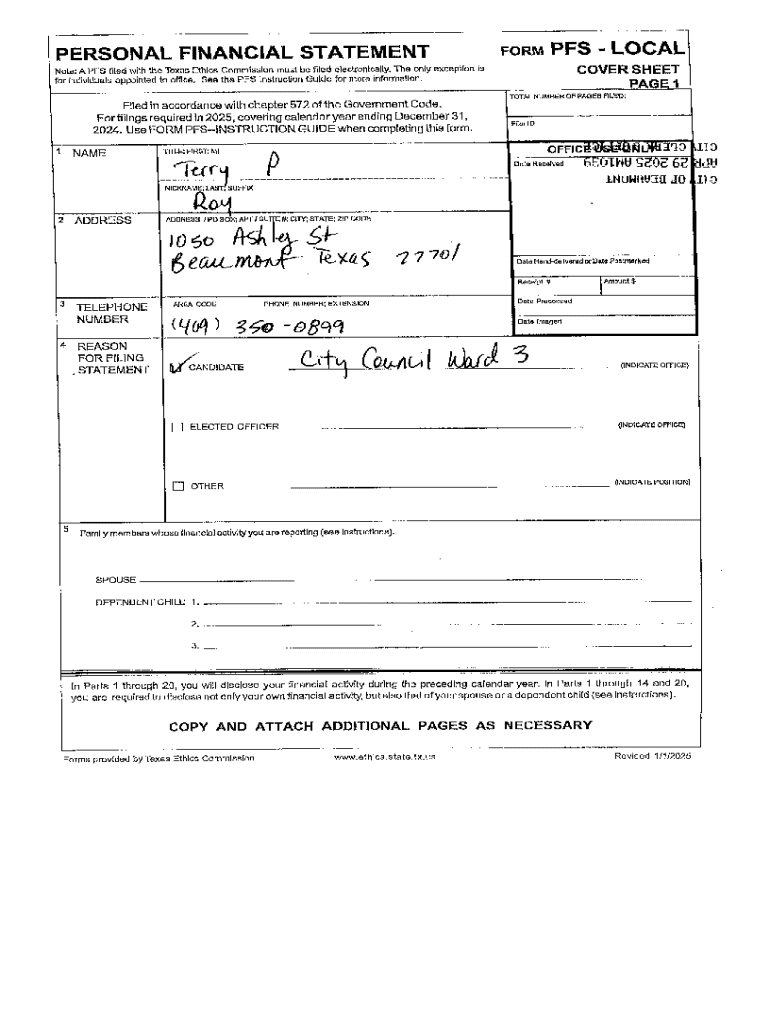

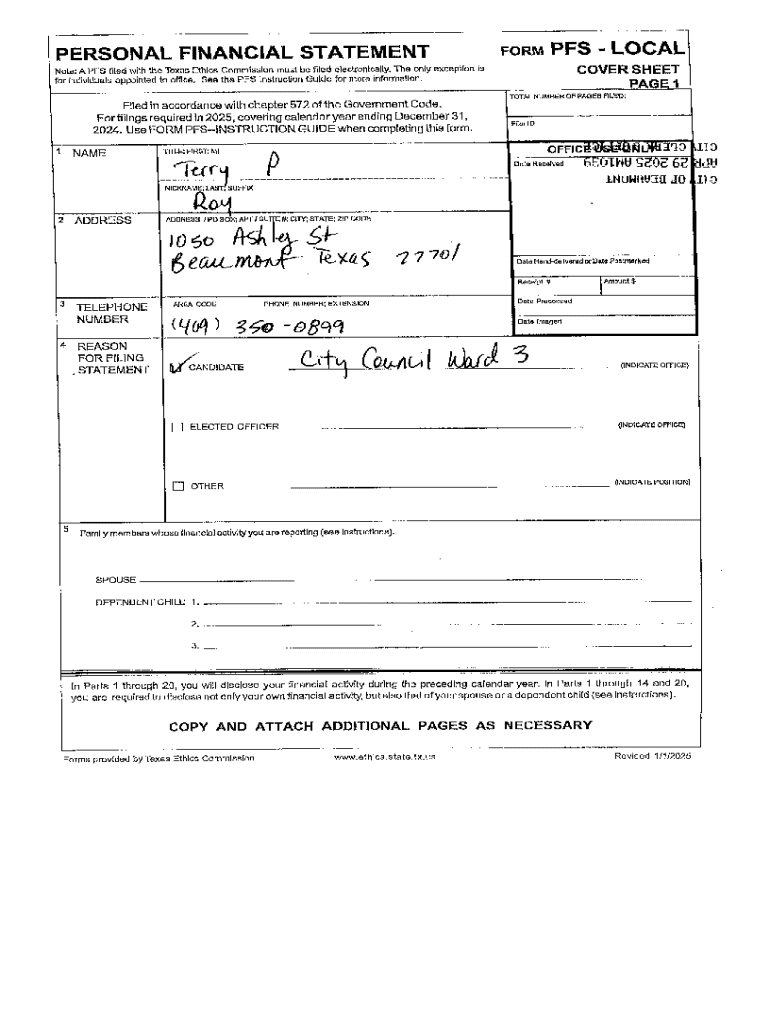

Who is required to file personal financial statement?

How to fill out personal financial statement?

What is the purpose of personal financial statement?

What information must be reported on personal financial statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.