Get the free Early Retirement Incentive Program

Get, Create, Make and Sign early retirement incentive program

Editing early retirement incentive program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out early retirement incentive program

How to fill out early retirement incentive program

Who needs early retirement incentive program?

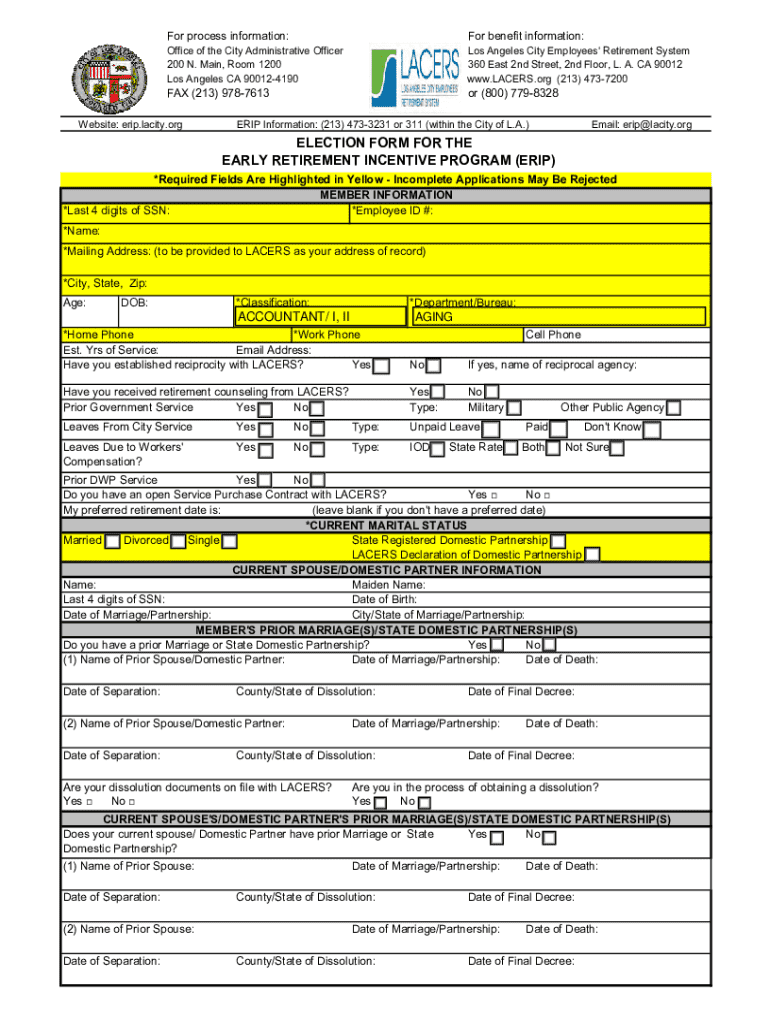

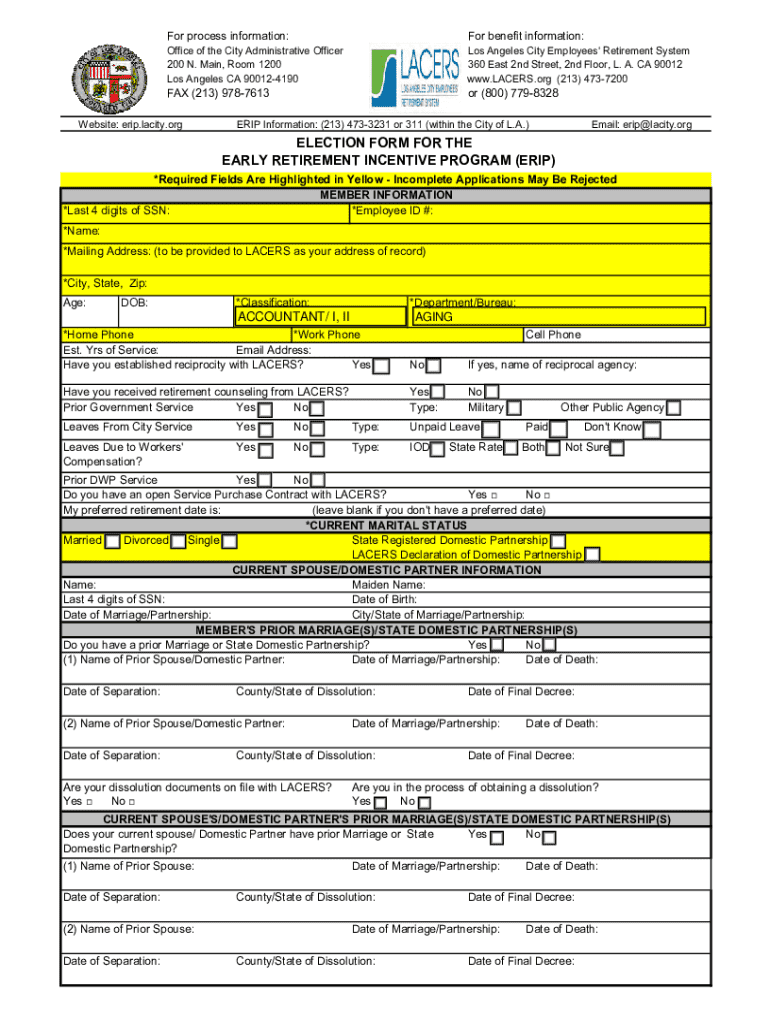

Understanding the Early Retirement Incentive Program Form

Understanding early retirement incentive programs

Early Retirement Incentive Programs (ERIs) are designed to offer employees, typically those approaching retirement age, an attractive option to leave the workforce ahead of schedule while receiving additional benefits. These programs are increasingly utilized by employers looking to manage workforce size and costs, especially in sectors facing financial constraints.

The primary purpose of an ERI is to entice eligible employees to retire early, thus reducing payroll expenses and allowing for a restructuring of the workforce. Benefits of participating in an ERI can range from financial incentives to extended health benefits, making the transition smoother for those who choose to take advantage of these programs.

Eligibility for these programs usually depends on factors such as age, years of service, and sometimes financial considerations specific to the organization. Understanding these eligibility criteria is crucial for individuals contemplating early retirement.

Key components of early retirement incentive programs

ERIs can offer various types of incentives, which may differ significantly depending on the organization and sector. Common forms of financial incentives include lump-sum payments, which provide immediate cash benefits, and annuity options that deliver regular payments over time. Each of these options has different implications for personal finance and long-term planning.

In addition to financial incentives, some programs might extend health benefits for a limited period post-retirement, addressing a critical concern for retiring employees. It's vital for potential candidates to thoroughly evaluate these incentives and how they align with personal financial goals.

Additionally, differences across various sectors—such as public versus private organizations—may significantly influence the structure and offerings within ERIs, making it essential for employees to be aware of the specific details provided by their employer.

Essential information to gather before completing the form

Before filling out the early retirement incentive program form, you need to gather crucial personal information, including your full name, address, and contact details. Moreover, having a comprehensive employment history is vital. This should encompass your job titles, tenures, and a summary of past benefits received within the organization.

Financial considerations play a pivotal role when deciding to retire early. Analyze your retirement benefits, including eligibility for pensions and Social Security. Understanding how these benefits align with the incentives offered can help determine the most financially sound decision for your future.

Step-by-step guide to completing the early retirement incentive program form

Completing the early retirement incentive program form can seem daunting, but following a structured approach can make it manageable. Here's a step-by-step guide to ensure your completion is thorough and accurate.

By following these steps methodically, you can navigate the retirement incentive program form with confidence, ensuring that all pertinent information is accurately captured.

Common mistakes to avoid when completing the form

Completing the early retirement incentive program form requires attention to detail. Avoiding common pitfalls can ensure a smoother application process and mitigate delays in processing your request.

By being mindful of these common mistakes, applicants can enhance their chances for a successful early retirement transition.

Calculating the financial impact of your early retirement decision

Understanding the financial implications of participating in an early retirement incentive program is critical for making sound decisions. pdfFiller offers tools and resources that can assist employees in performing detailed financial analyses.

Take into account various factors such as pension plans, healthcare costs, and other retirement options. Assessing these elements will empower you to understand your total financial picture post-retirement.

Utilizing the resources available through pdfFiller can help clarify how various decisions will affect your retirement income and overall financial health.

Important timelines and processing recommendations

Timelines play a crucial role in the early retirement process. Typically, processing times for ERI applications can vary, but understanding these timelines can help ensure a seamless transition from employment to retirement.

Many organizations specify a timeframe within which applications must be reviewed and responded to. Therefore, getting your forms submitted as early as possible is advisable to avoid any unwarranted delays.

By adhering to these timelines and recommendations, prospective retirees can ensure that their transitions are organized and in accordance with organizational protocols.

Exploring additional benefits and considerations

Aside from the incentives directly tied to ERIs, numerous additional benefits may be available to retirees. For instance, some organizations might offer retirement resources, seminars, or counseling services to aid in the transition process.

It’s also essential to consider potential implications of returning to work post-ERI. Depending on the terms stipulated, returning to the workforce may affect your retirement benefits, so it's crucial to clarify these details beforehand.

By exploring these additional benefits, individuals can make more informed choices about their retirement and future employment paths.

Frequently asked questions

Navigating the early retirement incentive program can come with many questions. Common queries often arise regarding eligibility, specifics of the incentives, and the overall application process.

Addressing these questions can alleviate potential anxiety and ensure you are well-prepared to take advantage of ERI opportunities.

Interactive tools on pdfFiller for managing your ERI documents

pdfFiller provides robust tools and features designed to simplify the management of your early retirement incentive program documents. You can track the status of your ERI application, collaborate with family or financial advisors, and ensure everything is organized for your smooth transition into retirement.

These interactive tools available on pdfFiller not only streamline the documentation process but also enhance your confidence as you prepare for your new chapter.

Related concepts and terms

Familiarity with key terminology related to early retirement incentive programs can enhance your understanding of the options available. Important terms to know include 'pension rollover,' 'annuity payment,' and 'lump sum.'

Having a grasp of these related concepts can empower you to make informed choices about your retirement strategy and ultimately your financial future.

Contact and support options

When faced with questions or uncertainties regarding the early retirement incentive program form, pdfFiller offers comprehensive support options. You can access a variety of customer service resources to guide you through the process.

Utilizing these support options can alleviate concerns and ensure you navigate the retirement process smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute early retirement incentive program online?

Can I edit early retirement incentive program on an Android device?

How do I complete early retirement incentive program on an Android device?

What is early retirement incentive program?

Who is required to file early retirement incentive program?

How to fill out early retirement incentive program?

What is the purpose of early retirement incentive program?

What information must be reported on early retirement incentive program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.