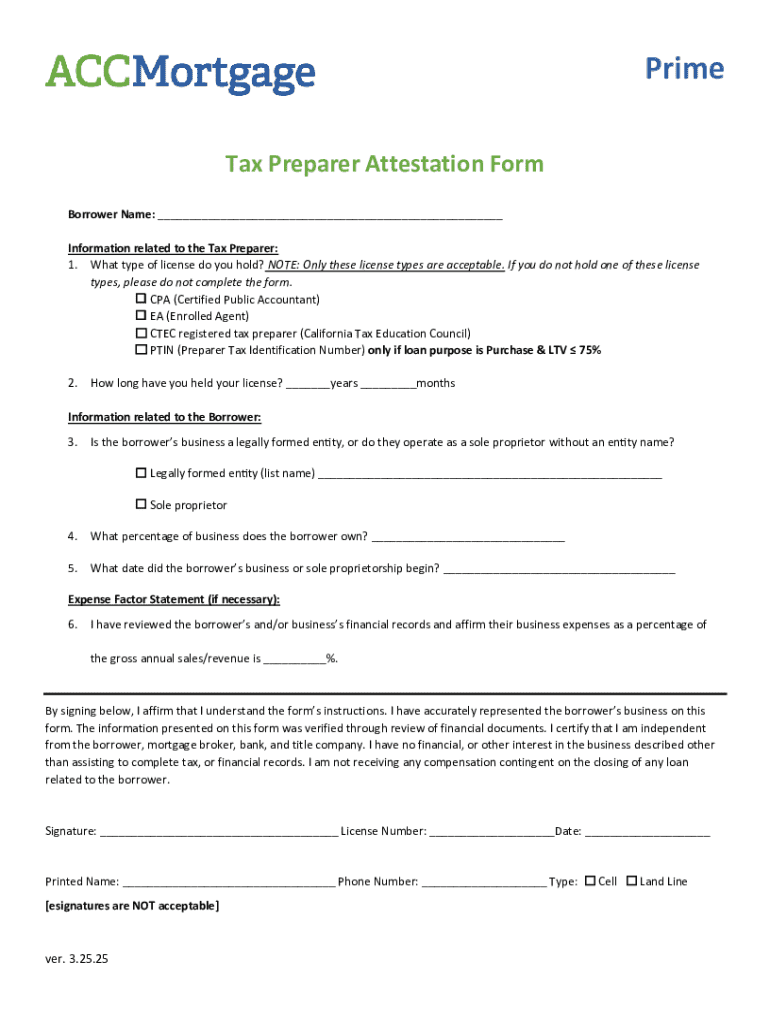

Get the free Prime Tax Preparer Attestation Form

Get, Create, Make and Sign prime tax preparer attestation

How to edit prime tax preparer attestation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out prime tax preparer attestation

How to fill out prime tax preparer attestation

Who needs prime tax preparer attestation?

Understanding the Prime Tax Preparer Attestation Form: A Comprehensive Guide

Understanding the prime tax preparer attestation form

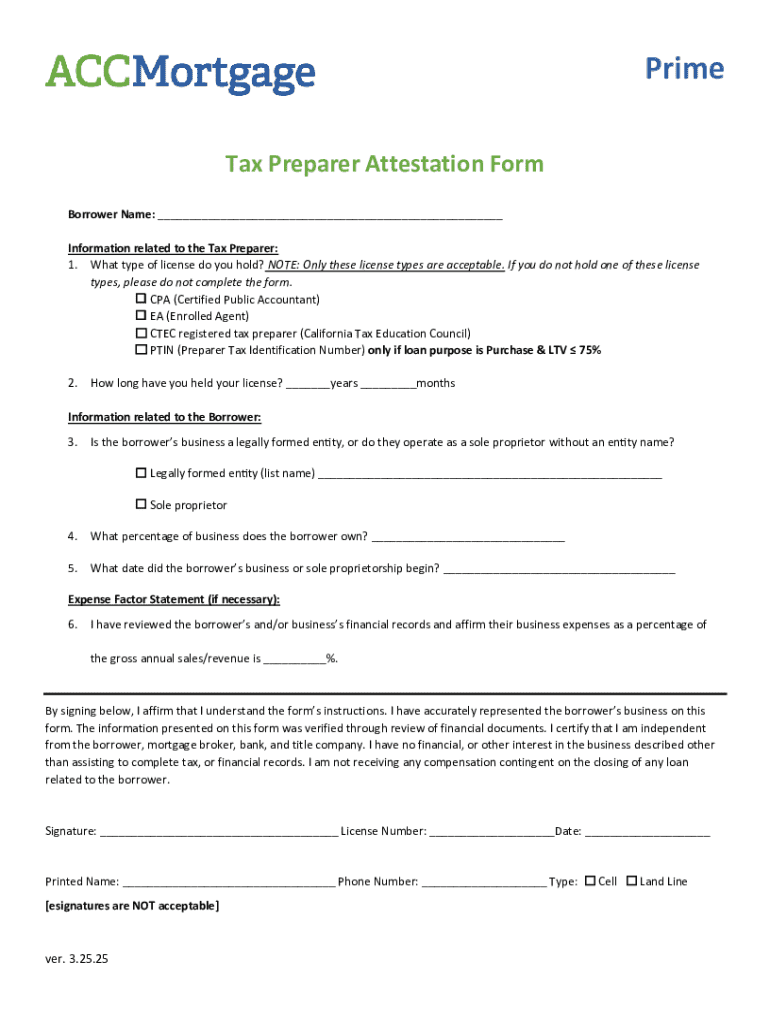

The prime tax preparer attestation form is a crucial document in the landscape of tax preparation. This form serves as a declaration that tax preparers meet certain qualifications and adhere to professional standards. Understanding its significance is essential for both clients and tax professionals. This compliance measure ensures that all individuals involved in tax preparation are adequately credentialed and capable of providing expert advice and services.

The importance of this attestation cannot be overstated. It safeguards the integrity of the tax preparation process, ensuring that clients receive high-quality service. This is particularly vital in an increasingly complex tax environment where errors can lead to severe consequences. By requiring an attestation, tax authorities uphold standards that protect taxpayers and enhance the overall accountability of tax practitioners.

Key features of the prime tax preparer attestation form

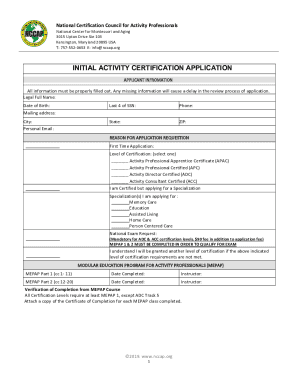

The prime tax preparer attestation form contains several key elements that every preparer needs to understand. These elements primarily focus on the qualifications of the preparer, including relevant licenses and certifications. In addition, the form may also outline the ethical standards and responsibilities that tax preparers must follow.

Signature requirements are a critical aspect of the attestation process. The form must be signed by the preparer to affirm the information is accurate and truthful. This signature may include options for digital signatures, allowing for more flexibility and efficiency in submission.

Additionally, submission guidelines are necessary to ensure that the form is lodged correctly. Adhering to the specified timelines and knowing where to submit the form will streamline the entire process and ensure compliance.

Step-by-step guide: filling out the prime tax preparer attestation form

Filling out the prime tax preparer attestation form correctly is essential to avoid any delays or issues during the tax preparation process. The following is a step-by-step guide on how to effectively complete this form.

Step 1: Gather necessary documentation

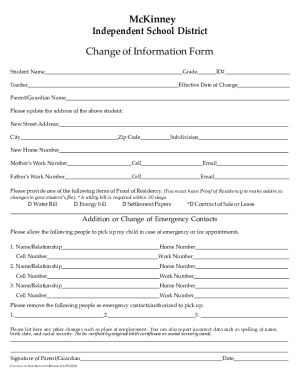

Step 2: Complete personal information section

This section requires your full name, contact information, and any relevant identification numbers. Ensure that all information matches official records to avoid discrepancies.

Step 3: Disclose previous tax preparation history

Providing an accurate account of your experience in tax preparation can bolster your credibility as a preparer. Clearly outline the types of returns you've worked on and the average volume of clients served.

Step 4: Sign and date the form

Ensure that you sign and date the form in the appropriate sections. This final step confirms your agreement to the information provided and adherence to any legal requirements of compliance with state and federal regulations.

Managing your prime tax preparer attestation form

Once you have filled out the prime tax preparer attestation form, it’s essential to manage it effectively. Using tools designed for document editing and management can enhance your efficiency and ensure that you maintain compliance.

Editing the form with pdfFiller

pdfFiller offers interactive tools that make editing the prime tax preparer attestation form straightforward. You can easily update your credentials and other necessary details without hassle.

eSigning and secure document management

Using a cloud-based platform like pdfFiller not only allows for secure eSigning but also better document management. Your information is stored safely and can be accessed from anywhere.

Storing your attestation form

To ensure your attestation form remains secure and easily retrievable, consider best practices for document storage, such as cloud storage solutions that offer encryption and organization features.

Collaboration made easy with pdfFiller

Collaborating on the prime tax preparer attestation form can streamline the process when working in teams. pdfFiller provides functionalities that promote efficient teamwork.

Sharing the form for review

You can invite team members to review and collaborate on the document quickly. This feature ensures that all relevant parties can provide input and confirm the final details.

Tracking changes and updates

The ability to monitor edits in real-time ensures that everyone is on the same page, reducing the potential for misunderstandings or errors in the submitted form.

Frequently asked questions about the prime tax preparer attestation form

It's common for individuals to have questions regarding the prime tax preparer attestation form. Here are some frequently asked questions that can clarify concerns.

Resources to further assist you

Accessing additional resources can significantly enhance your understanding of tax preparation and the attestation process. Various avenues provide information and support.

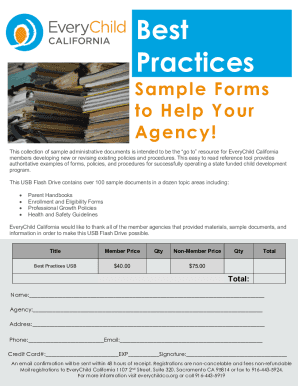

Compliance and best practices

Maintaining compliance with local and federal tax regulations is fundamental for any tax preparer. Understanding these regulations safeguards your practice and your clients.

Real-life case studies

Real-life examples provide valuable lessons in the application of the prime tax preparer attestation form. Successful case studies highlight the importance of the form in ensuring quality tax preparation.

Moving forward: what to expect after submission

After you've submitted the prime tax preparer attestation form, there are several steps to follow. This ensures you are prepared for confirmation and any subsequent actions required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send prime tax preparer attestation for eSignature?

How do I make changes in prime tax preparer attestation?

How do I fill out prime tax preparer attestation using my mobile device?

What is prime tax preparer attestation?

Who is required to file prime tax preparer attestation?

How to fill out prime tax preparer attestation?

What is the purpose of prime tax preparer attestation?

What information must be reported on prime tax preparer attestation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.