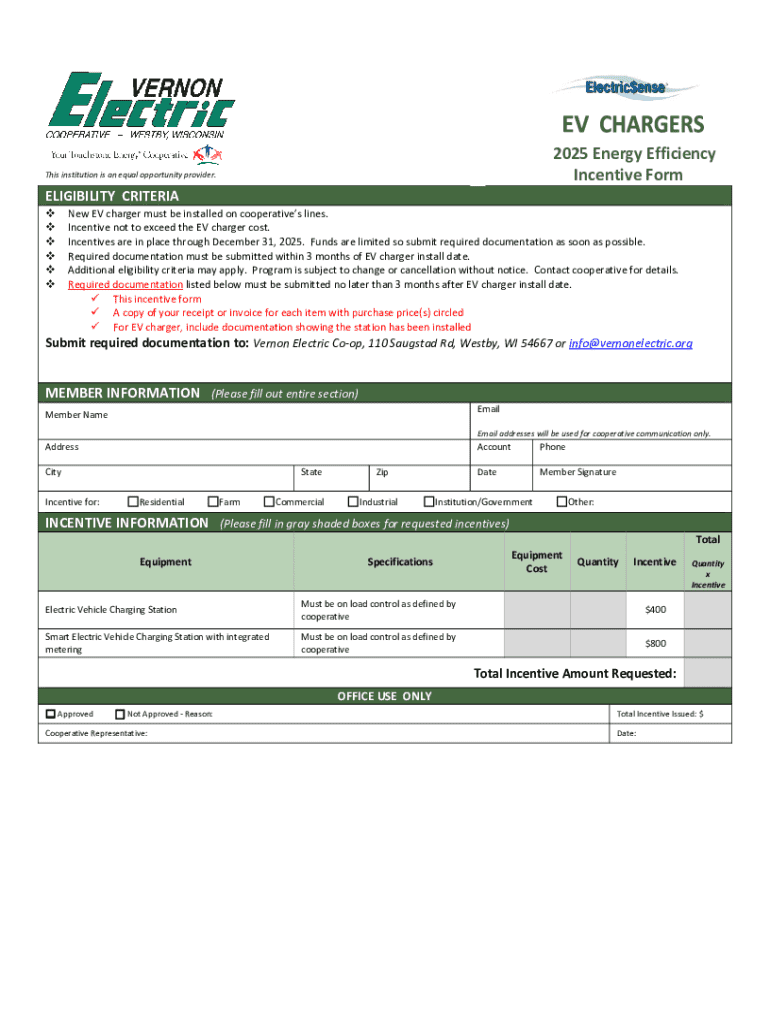

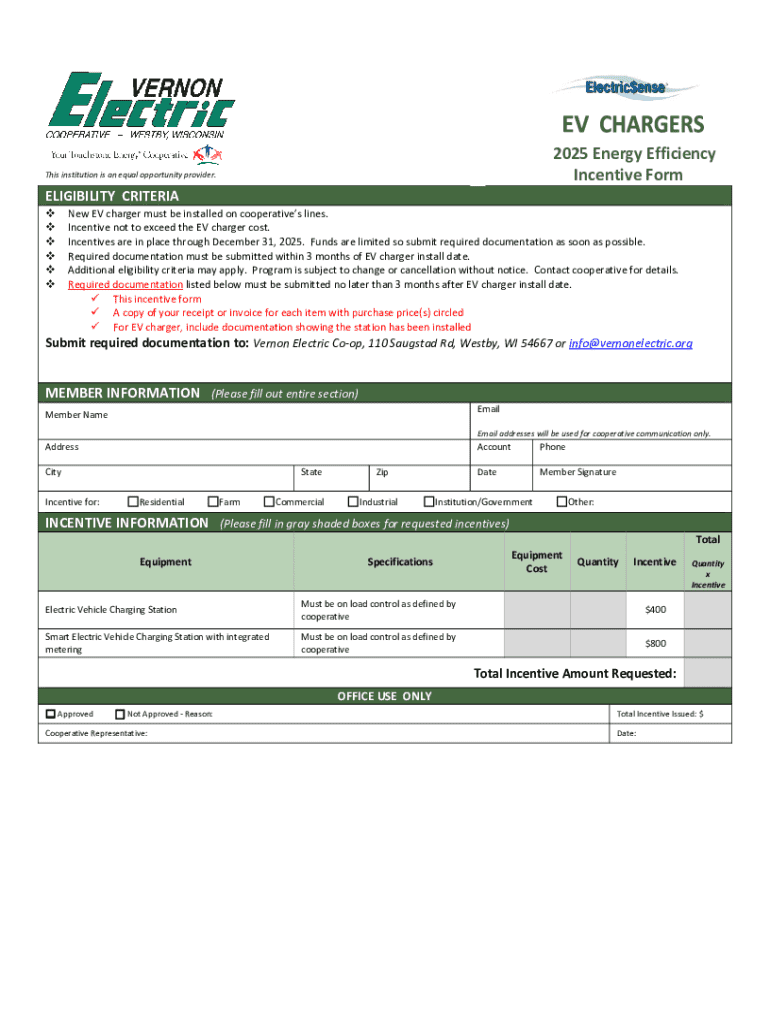

Get the free 2025 Energy Efficiency Incentive Form

Get, Create, Make and Sign 2025 energy efficiency incentive

Editing 2025 energy efficiency incentive online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 energy efficiency incentive

How to fill out 2025 energy efficiency incentive

Who needs 2025 energy efficiency incentive?

2025 Energy Efficiency Incentive Form: A Comprehensive Guide

Overview of 2025 energy efficiency incentives

Energy efficiency is a key component of sustainable living and plays a crucial role in reducing household utility expenses. As such, the 2025 energy efficiency incentives are designed to encourage homeowners to implement energy-saving upgrades. These incentives are available at both federal and local levels, making them accessible to a broader audience. The importance of government support cannot be understated, as these programs not only help individual households save money but also contribute to the larger goal of reducing overall energy consumption and greenhouse gas emissions.

Key benefits of the 2025 energy efficiency incentive program

Homeowners can reap multiple benefits from participating in the 2025 energy efficiency incentive program. Not only can they expect to save significantly on their utility bills through the installation of high-efficiency appliances and systems, but they may also enjoy potential tax savings and credits that can alleviate the financial burden of home improvement projects.

Moreover, the environmental impact associated with investing in energy-efficient technologies is substantial. By reducing energy consumption, homeowners contribute to sustainability, decrease reliance on fossil fuels, and help combat climate change. This dual benefit of saving money while positively influencing the environment makes these incentives particularly attractive.

Comprehensive breakdown of available incentives

Tax credits for energy efficiency upgrades

In 2025, federal tax credits for energy-efficient upgrades provide homeowners with significant opportunities for savings. These credits typically cover a percentage of the cost associated with qualifying upgrades, from solar panels to efficient HVAC systems. To qualify, homeowners must meet specific eligibility requirements related to income levels and the types of products installed.

For instance, homeowners may receive a tax credit of up to 30% for solar energy systems. Understanding these credits is essential to capitalizing on the available benefits, and eligible homeowners can potentially save thousands in tax deductions.

Rebates and grants for energy-efficient home improvements

State and local programs offer various rebates and grants, further enhancing the 2025 energy efficiency incentive landscape. These rebates often target specific upgrades, such as home insulation or energy-efficient water heating. Applying for these grants typically involves submitting a detailed application that includes evidence of completed projects. A step-by-step guide for applying can simplify the process and help homeowners gather necessary documentation.

Understanding the 2025 energy efficiency incentive form

Purpose and importance of the incentive form

The 2025 energy efficiency incentive form is essential for homeowners looking to claim the benefits associated with the incentive program. This form ensures that applicants can systematically document their upgrades and verify their eligibility for various tax credits and rebates. By following the structured format of the form, homeowners can ensure a smoother filing process and increase their chances of approval.

Step-by-step instructions for completing the incentive form

Interactive tools for completing the form

To ease the process of filling out the 2025 energy efficiency incentive form, pdfFiller provides interactive tools. Features such as PDF editing and e-signing allow users to manage their documents efficiently from anywhere. This digital experience not only enhances the ease of form completion but also assures users of a streamlined filing process.

Strategies to maximize your incentive claims

Tips for effective documentation

Maintaining organized records is critical for a successful claim. Keeping copies of receipts, installation invoices, and warranties can serve as vital support for your application. Best practices also recommend categorizing documents by type and project to simplify the documentation process during submission.

Combining multiple upgrades for increased savings

Homeowners should consider planning multiple upgrades in the same tax year to maximize their incentive benefits. For example, if one installs energy-efficient windows and HVAC systems simultaneously, they may qualify for multiple tax credits and rebates, significantly increasing potential savings. Consulting with a tax professional can provide guidance on the best strategies for maximizing claims.

Details for claiming the energy efficiency home improvement tax credit

Important changes to claim eligibility in 2025

The 2025 incentives come with updated eligibility criteria and new qualifying products. Homeowners should familiarize themselves with these changes, as they may affect the products or systems they planned to upgrade. For instance, recent legislation may have expanded the types of energy-efficient appliances that qualify for tax credits, making this an opportune time for homeowners to reassess their options.

Maximizing your claim amount

Utilizing tax credits fully requires a clear understanding of the limitations and caps associated with various incentives. Engaging with a tax advisor can help homeowners navigate these complexities while ensuring they leverage the maximum benefits available to them. It's crucial to stay informed about potential adjustments to credit amounts and eligibility throughout the tax year.

Common mistakes to avoid when filing the incentive form

Filing the 2025 energy efficiency incentive form can be daunting, and many homeowners fall into common pitfalls. Frequent mistakes might include incomplete information or failing to include essential supporting documentation. Homeowners are encouraged to double-check their entries and ensure that all required files are attached before submission to prevent delays or rejections.

Detailed examples of energy efficiency upgrades and their benefits

Example 1: Air source heat pumps tax credit

Homeowners upgrading to air source heat pumps may qualify for a substantial tax credit in 2025, depending on efficiency ratings and installation costs. This upgrade not only reduces reliance on traditional heating methods but can also lower energy bills long-term.

Example 2: Energy-efficient windows and doors

The installation of energy-efficient windows and doors is another eligible upgrade for tax credits. By minimizing heat loss, these improvements can significantly impact a home’s energy use, leading to both immediate savings and enhanced comfort.

Example 3: Insulation and sealing improvements

Improving insulation and sealing in a home can also qualify for rebates and credits. This not only boosts a home’s energy efficiency but also makes it more environmentally friendly by reducing overall emissions.

Staying informed: Updates on energy efficiency policies

Homeowners should actively seek information about updates on energy efficiency incentives, as policies can change frequently. Resources include official government websites, local utility companies, and community organizations. Staying current on any modifications in tax laws is particularly important for maximizing benefits.

Conclusion: Empower yourself with pdfFiller

Filing the 2025 energy efficiency incentive form does not have to be overwhelming. With the help of pdfFiller’s tools, users can easily edit documents, eSign, collaborate effectively, and manage their forms seamlessly. This cloud-based platform ensures access from anywhere, making the process of completing and submitting critical forms simple and straightforward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 2025 energy efficiency incentive?

How can I fill out 2025 energy efficiency incentive on an iOS device?

Can I edit 2025 energy efficiency incentive on an Android device?

What is 2025 energy efficiency incentive?

Who is required to file 2025 energy efficiency incentive?

How to fill out 2025 energy efficiency incentive?

What is the purpose of 2025 energy efficiency incentive?

What information must be reported on 2025 energy efficiency incentive?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.