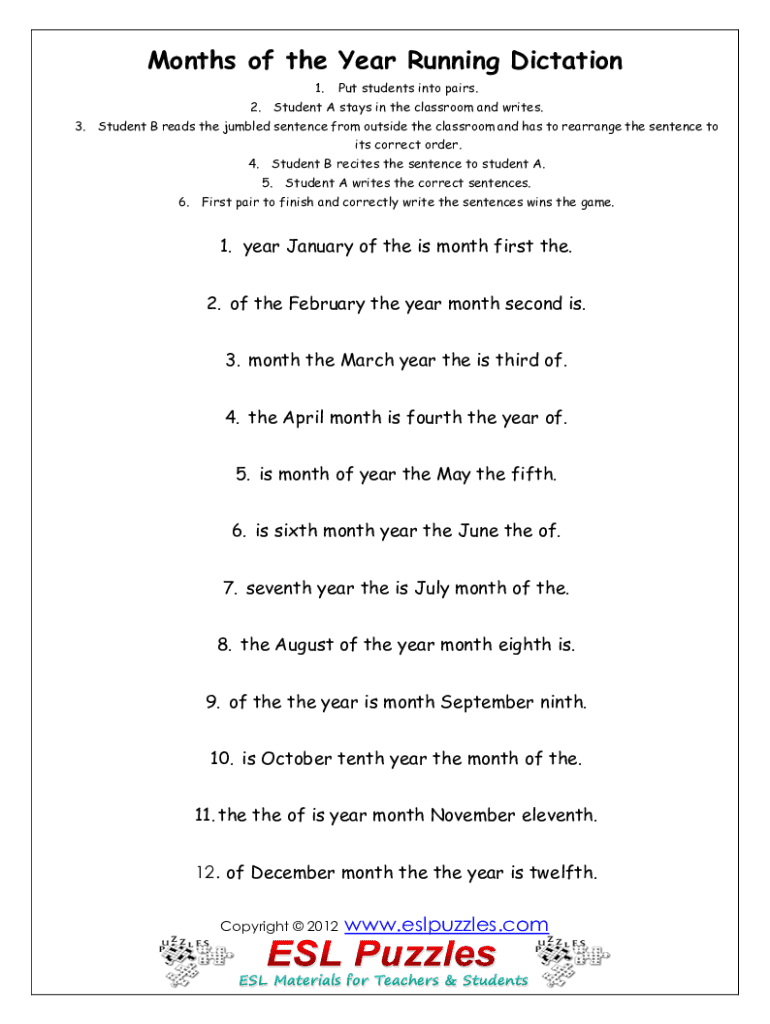

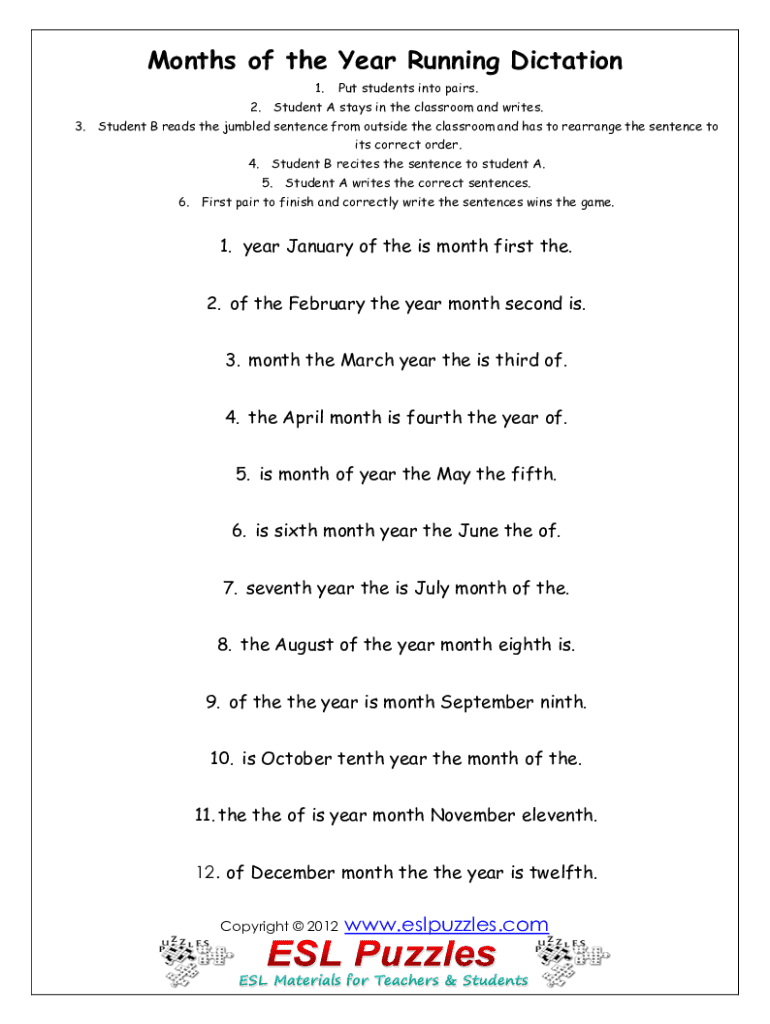

Get the free Months of the Year Running Dictation

Get, Create, Make and Sign months of form year

Editing months of form year online

Uncompromising security for your PDF editing and eSignature needs

How to fill out months of form year

How to fill out months of form year

Who needs months of form year?

Months of form year form: Your comprehensive how-to guide

Understanding months in relation to form year

A 'form year' encapsulates all the critical forms and documents needed over a span of twelve months, serving as the backbone for both legal compliance and organizational efficiency. Each month brings unique mandatory submissions, deadlines, and opportunities for adjustments. Recognizing the integral role that months play in legal and fiscal documentation is essential for effective document management.

Typically, forms must be submitted within specific windows that correspond to business reporting cycles, tax expectations, and regulatory requirements. Monthly submissions affect everything from financial reporting to personal tax responsibilities, underscoring the need for diligent tracking and management.

The role of months in document management

Monitoring the submission of documents by month is crucial for maintaining regulatory compliance, especially for businesses and individuals with various fiscal or legal obligations. To effectively track these submissions, implementing a structured calendaring system is advisable to align deadlines with organizational needs. A well-managed system enables stakeholders to prioritize tasks based on urgency and importance.

Key deadlines tend to cluster around specific months — for example, the end of the fiscal year in March or tax submissions in April. In addition to deadlines, timestamping documents can play a pivotal role in compliance. By documenting when forms are submitted, you mitigate risks associated with late penalties and can easily provide evidence of timely submissions if required.

Month-by-month breakdown: Key submissions and deadlines

January

January marks the beginning of the form year, a time for individuals and organizations to strategize and organize documentation for the year ahead. Key forms to be submitted this month often include W-2s and 1099s, among others. To start the year on an organized note, consider investing time into creating an annual document submission calendar.

February

February often entails reviewing the first month’s submissions and ensuring that all forms have been correctly filled out. Set reminders for important forms such as state tax returns that are due by the end of the month. Tools like pdfFiller allow users to set alerts and track deadlines effectively.

March

As the fiscal year draws to a close in March, it’s critical to focus on final preparations for tax filing. Specific forms such as 1099s, K-1s, and corporate tax returns should be on the radar this month. Establish a checklist to insure completion to simplify your submission process.

April

April is synonymous with tax season, and the April 15th deadline looms large for many individuals and businesses. Essential forms include the IRS Form 1040 for individuals and the corporate tax returns for businesses. Preparing in advance by gathering all necessary financial documents will make the filing process less stressful.

May

In May, conducting mid-year document checks is vital. Review completed forms for accuracy, making any necessary adjustments or reconciliations to enhance your documentation integrity. This proactive approach will also set you up for success in future submissions.

June

June is an ideal time to prepare for the second half of the year. Ensure that any forms requiring attention, such as quarterly reports or updates to business licenses, are prioritized. This month is instrumental for forward-planning and setting benchmarks for success.

July

As summer sets in, July encourages mid-year financial reviews. Critical forms to keep in mind include quarterly earnings reports and mid-year assessments. Utilize tools for efficient summertime document preparation to ensure compliance.

August

August is marked by review and adjustment. Take this opportunity to analyze any ongoing trades, funding opportunities, or document requirements. Stay aware of end-of-summer deadlines that can creep up quickly, making adjustments as necessary.

September

September calls for planning ahead for October, focusing on quarter-end forms and documents that need completion. Ensure that all documentation aligns with internal strategies, and coordinate responsibilities among team members to maintain order.

October

As October approaches, the urgency to finalize year-end deadlines intensifies. Ensure that all outstanding forms are completed and submitted, avoiding any last-minute pitfalls. Engage team members in wrapping up any remaining responsibilities.

November

November serves as a reminder to check off year-end to-do lists. Evaluate which documentation is necessary for new fiscal strategies while preparing for the upcoming calendar year. Insightful preparation now can foster efficiency in the months to come.

December

December is all about wrapping up the year. It’s crucial to finalize critical forms required before year-end, including year-end financial statements and closing reports. Planning for the upcoming year should also begin, considering any forms that may need to be submitted in January.

Essential considerations when filling out forms

When filling out forms, several key elements should be adhered to in every submission. Accuracy is paramount; double-check names, dates, and financial figures to minimize the risk of errors. The utilization of digital tools like pdfFiller can significantly reduce common mistakes, ensuring forms are submitted correctly and on time.

One common mistake lies in improper handling of electronic signatures. Make sure that eSigning tools are in sync with compliance regulations. This ensures that your submissions not only get through but also hold up under scrutiny.

The impact of form years on different stakeholders

Understanding the impact of form years is pivotal for various stakeholders. Individuals often face substantial implications for taxes, health forms, and employment documentation. Accuracy in these submissions can influence tax refunds, benefit eligibility, or job opportunities.

For teams or organizations, the stakes can be even higher. Business-related filings, annual reports, and collaborations all hinge upon proper documentation and timely submissions. Missed deadlines can jeopardize projects, create distrust, or invite penalties, making knowledge of each month’s requirements critical for professional success.

Frequently asked questions (FAQs)

One pressing question is the consequences of late submissions. Each month carries specific penalties, ranging from fines to legal repercussions, further emphasizing the importance of compliance. Understanding these potential inconveniences can motivate timely submissions.

Another common query relates to grace periods available for submissions within a form year. While some agencies may offer a brief grace period, relying on them may not be wise, as it varies greatly. Always check the guidelines specific to your required submissions.

Tools and resources for streamlined document management

Utilizing tools like pdfFiller elevates your document management strategy immensely. The platform's capabilities enable users to manage and execute monthly tracking effectively, ensuring no important deadlines are overlooked. The ability to edit PDFs, eSign documents, and collaborate with team members from any location enhances overall efficiency.

Moreover, security features and cloud-based solutions provide peace of mind. Using interactive tools available on pdfFiller allows users to stay organized and compliant, streamlining the entire process while giving invaluable oversight to important documentation.

Unique insights on maintaining compliance throughout the year

Regular reviews are non-negotiable when it comes to compliance. Scheduling audits of your documents assists in identifying discrepancies early on, which is critical for maintaining positive relationships with stakeholders. Annual assessments can also help spot trends and issues before they escalate.

Incorporating electronic signatures can streamline the signing process while keeping everything legitimate and traceable. Consider platforms like pdfFiller that facilitate team collaboration, ensuring transparency and reducing bottlenecks in getting forms signed and submitted.

Final thoughts on managing months and form year forms successfully

Staying ahead of deadlines is essential for successful document management. Embracing proactive strategies, such as utilizing digital solutions and comprehensive tracking systems, can enhance your overall efficiency. Establish an organized regimen to mitigate risks associated with late submissions, ensuring that your month-to-month operations run smoothly.

The incorporation of tools that streamline document management can pave the way for better practices, time management, and compliance throughout the entire form year. As the digital landscape evolves, adapting to these innovative solutions will remain crucial for success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit months of form year from Google Drive?

How do I fill out months of form year using my mobile device?

How do I fill out months of form year on an Android device?

What is months of form year?

Who is required to file months of form year?

How to fill out months of form year?

What is the purpose of months of form year?

What information must be reported on months of form year?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.