Get the free Notice to Stop Payment

Get, Create, Make and Sign notice to stop payment

How to edit notice to stop payment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice to stop payment

How to fill out notice to stop payment

Who needs notice to stop payment?

Notice to Stop Payment Form: A Comprehensive How-to Guide

Understanding the stop payment notice

A notice to stop payment is a formal request made to a financial institution, instructing them to halt the processing of a specific payment. This notice can be critical in various scenarios, particularly when there's a concern about fraud or an error in the transaction. For instance, if a check has been lost or stolen, immediately reporting it to the bank can prevent unauthorized access to your funds.

Common situations warranting a stop payment include instances where a check has not yet been cashed, where an electronic payment has been initiated in error or where funds are at risk of being withdrawn improperly. Understanding the urgency of acting quickly is paramount, as delays can result in unwanted financial losses.

When to use a stop payment notice

Stop payment notices are most commonly associated with two types of transactions: checks and electronic payments. When dealing with checks, a stop payment request can be issued prior to the check being cashed, preventing any further transaction activity. In the case of electronic payments, which include wire transfers and ACH payments, it's equally essential to act fast if there's reason to believe the transaction is fraudulent or erroneous.

Scenarios necessitating such measures may vary, ranging from mistakes made during payment inputs to intentional acts of fraud. Before issuing a stop payment, it is important to assess the legal implications as well; banks often require a valid reason for stopping payment, and incorrect claims may incur additional fees.

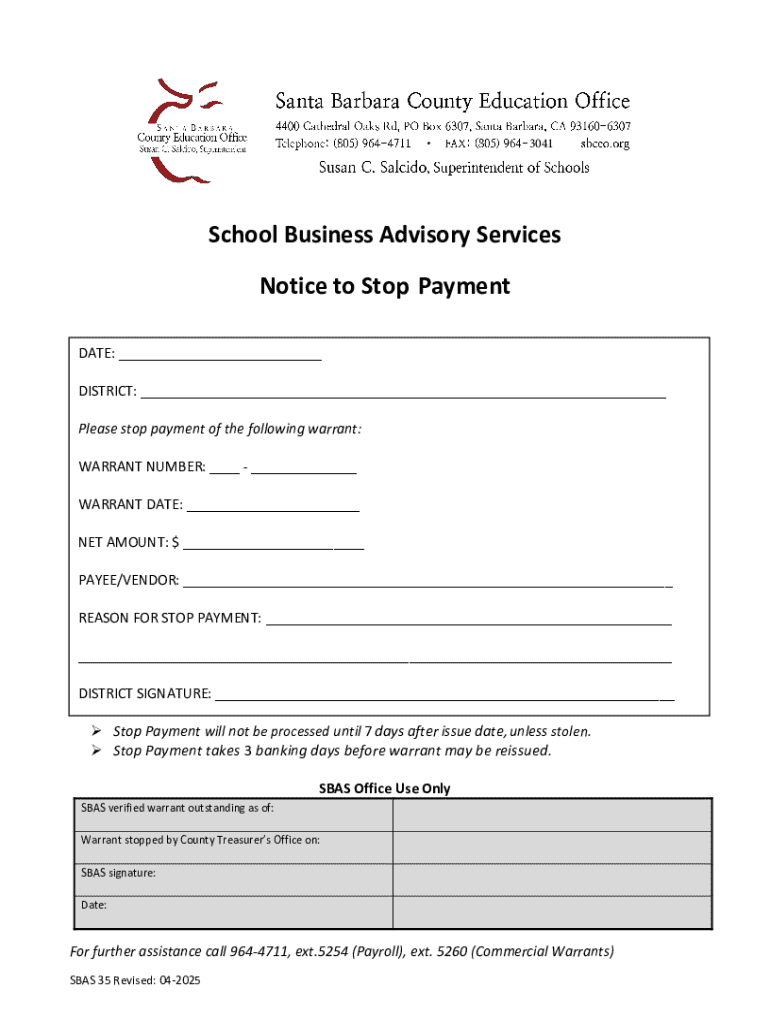

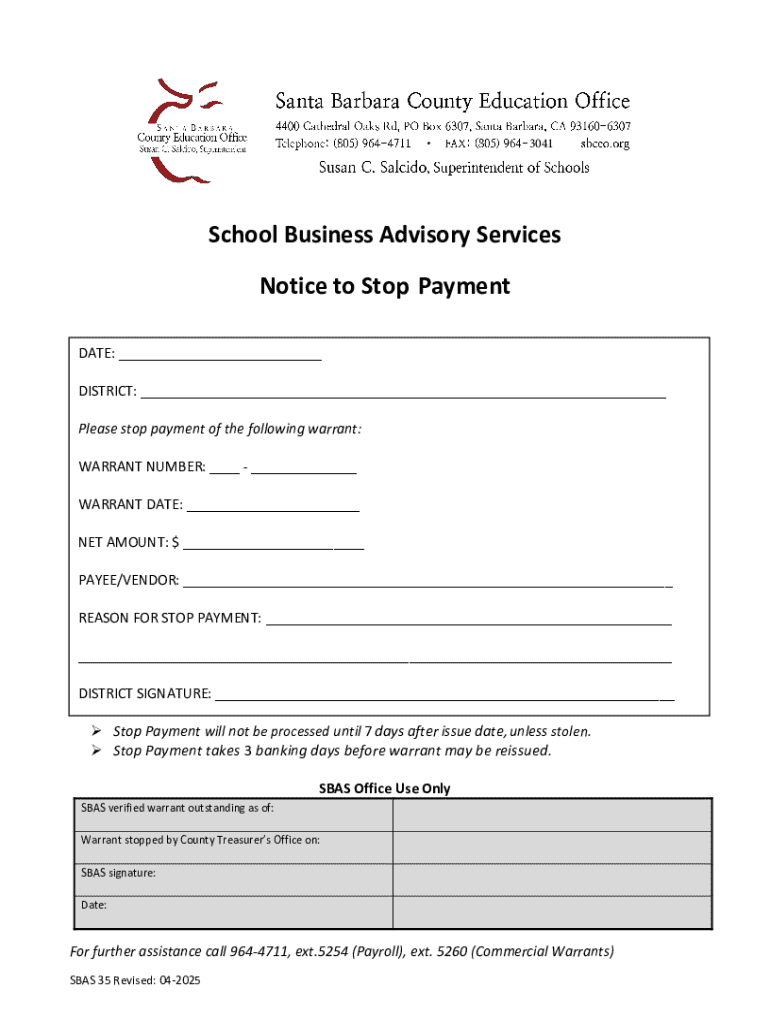

Essential components of the notice to stop payment form

When filling out a notice to stop payment form, several key components must be included to ensure that your request is processed efficiently. First and foremost, the account holder's details must be accurate, including their full name, address, and account number. These details help the bank to identify the account in question.

Next, specific details of the payment to stop are essential, which should include the check number (if applicable), the amount, the date of the transaction, and the payee’s information. Without these details, the bank may struggle to locate the payment, and the request could be delayed. Understanding the terminology such as 'payee' and 'transaction date' is also important for completing the form correctly.

Step-by-step guide to completing the notice to stop payment form

Completing a notice to stop payment form is a straightforward process when approached systematically. Here’s a five-step guide to help individuals understand how to fill out this important document:

Interactive tools for filling out the form

Using tools like pdfFiller can significantly ease the process of filling out the notice to stop payment form. pdfFiller offers features for document completion that allow users to fill out forms seamlessly and accurately. With the platform’s editable templates, you can fill out your documents without the hassle of pen and paper.

Moreover, the eSigning capabilities of pdfFiller enable faster processing. Users can sign their documents digitally, which not only expedites the verification process but also enhances security. This can save you valuable time when handling urgent payment matters.

Collaborative management of stop payment notices

Managing stop payment notices doesn't have to be a solo endeavor. Teams can collaborate effectively using platform features that allow for sharing and auditing of documents. By centralizing the management process, teams can track submissions and monitor responses directly within pdfFiller.

Additionally, notifications and updates can be set up for involved parties, ensuring that every stakeholder is aware of the stop payment request's status. This level of collaboration minimizes confusion and fosters transparency among team members.

Troubleshooting common issues related to stop payments

Should you encounter issues with your stop payment notice, understanding common pitfalls can save you from frustration. A frequent mistake is providing incorrect details in the form, leading to rejected requests or delays. If the notice is not honored, it’s crucial to contact your bank immediately. Gather your documentation to support your claim.

In many cases, banks have specific timelines for processing stop payments; knowing these can help you determine the best course of action. Ensure that you are familiar with your bank’s policies regarding stop payments, as this knowledge can provide clarity when addressing issues.

Additional benefits of using pdfFiller for stop payment management

Using pdfFiller offers distinct advantages for managing stop payment forms and notices. One of the primary benefits is the ability to store documents securely in the cloud, minimizing the risk of losing important information. Cloud storage allows you to retrieve your documents from anywhere, anytime, facilitating easier access in urgent situations.

The platform’s comprehensive digital document management capabilities further simplify operations. Carrying out edits, sharing documents, and following up on communications are streamlined within a single interface, reducing the need for multiple tools. This enhances organizational efficiency while providing peace of mind that your documents are effortlessly reachable.

Frequently asked questions (FAQs)

When considering the notice to stop payment form, several common queries arise. Users often ask about timelines for processing a stop payment request and whether there are fees associated with the service. Most banks process these requests quickly, typically within one business day, but it varies by institution.

Another frequent question pertains to the conditions under which a stop payment notice can be issued. It’s essential to understand that while banks facilitate this service, they require it to be valid and based on reasonable grounds—otherwise, users might face charges for incorrect requests.

Case studies: Successful use of stop payment notices

Examining real-life scenarios can reveal effective strategies for using stop payment notices. For instance, a local business found that a client had forged checks, leading the owner to immediately contact the bank and issue a stop payment. By acting swiftly, they managed to minimize losses and protect their assets.

Lessons learned from such situations emphasize the importance of vigilance when monitoring transactions. Establishing clear protocols for handling suspicious payments and ensuring all employees are trained can lead to better management of financial risks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my notice to stop payment in Gmail?

Can I create an electronic signature for signing my notice to stop payment in Gmail?

How do I edit notice to stop payment on an iOS device?

What is notice to stop payment?

Who is required to file notice to stop payment?

How to fill out notice to stop payment?

What is the purpose of notice to stop payment?

What information must be reported on notice to stop payment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.