Get the free 2025 Perm Rates Form

Get, Create, Make and Sign 2025 perm rates form

Editing 2025 perm rates form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 perm rates form

How to fill out 2025 perm rates form

Who needs 2025 perm rates form?

2025 Perm Rates Form: A Comprehensive How-to Guide

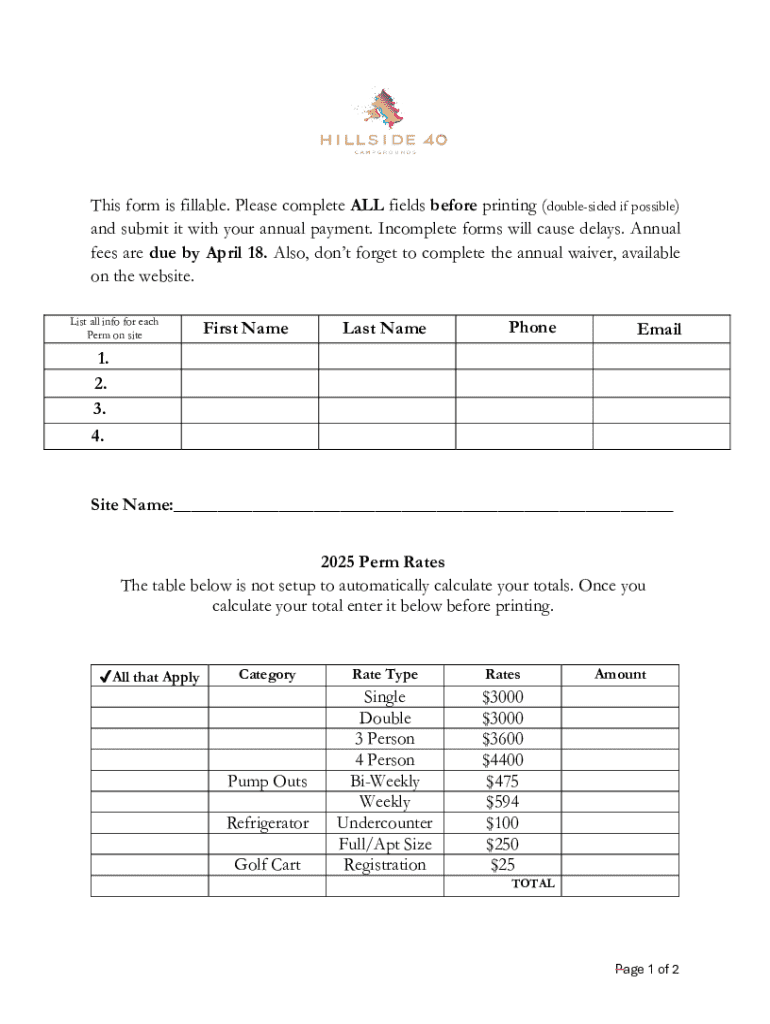

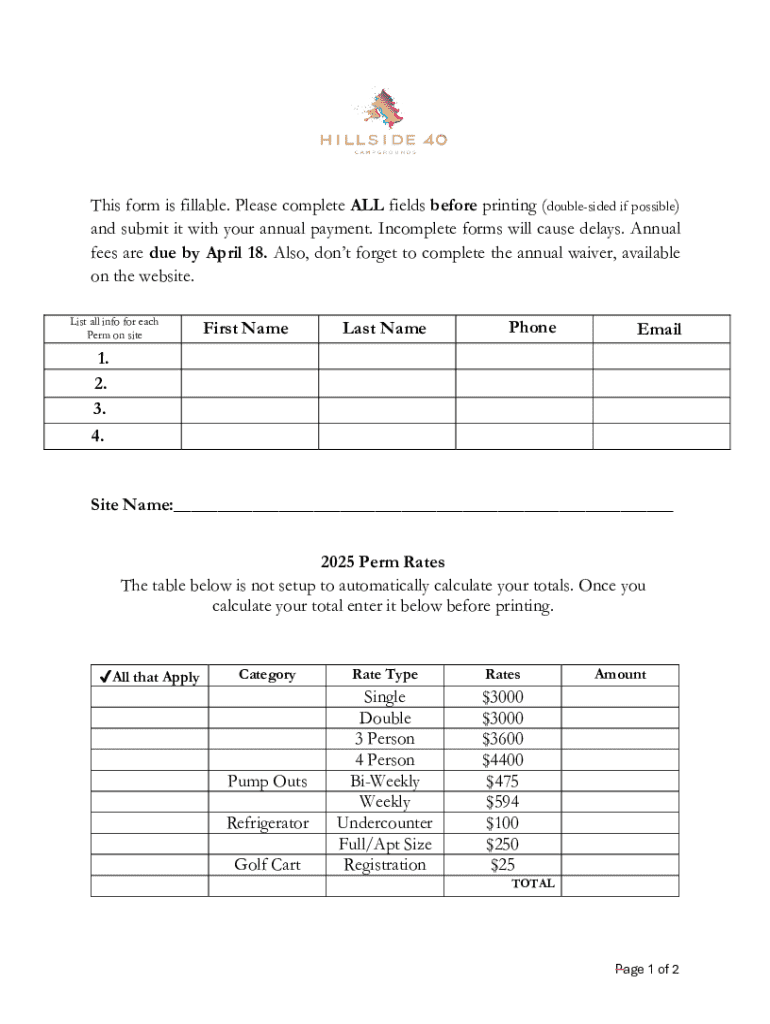

Understanding the 2025 PERM rates form

The 2025 PERM Rates Form serves a critical function in the U.S. labor certification process. It outlines the prevailing wage rates necessary for employers to pay foreign workers, helping ensure that hiring practices do not adversely affect the local labor market. This form is part of the Program Electronic Review Management (PERM) system, which is designed to facilitate streamlined employment-based immigration in the United States.

Understanding the importance of the 2025 PERM Rates in labor certification cannot be overstated. Employers must adhere to these wage rates to ensure compliance and avoid legal repercussions. The PERM program aims to efficiently identify qualified foreign workers while prioritizing U.S. workers in the job market.

Key changes for 2025

2025 has ushered in several notable changes to PERM rates compared to the previous years. These updates reflect adjustments to labor market conditions such as inflation, demand for skilled labor, and economic recovery post-pandemic. The wage rates have generally increased across various occupations, aimed at attracting well-qualified candidates and ensuring that local workers are not underpaid.

For instance, the wage rate for Level 1 positions has risen from 2024, and similar upward trends can be observed across all levels. Employers need to recognize that these adjustments directly impact both their hiring strategies and their budgeting for labor costs. Failure to comply can lead to penalties or rejection of certification applications.

Detailed breakdown of the PERM rates

A detailed breakdown of the 2025 PERM Rates shows that wages are categorized by occupation, with distinct wage levels defined as Level 1, Level 2, Level 3, and Level 4. Employers need to align the job descriptions with the appropriate wage level to ensure compliance with Department of Labor regulations.

Geographic differences also play a significant role in determining wage rates. For instance, the cost of living and demand for labor in urban areas like New York City compared to rural areas will reflect substantial disparities. Additionally, the adverse effect wage rates, which protect U.S. workers from lower wage thresholds being set by foreign labor, must always be adhered to in the hiring process.

Filling out the 2025 PERM Rates Form

Filling out the 2025 PERM Rates Form requires careful attention to detail. Here’s a step-by-step guide to assist employers in the process.

Interactive tools for PERM rates calculation

To streamline the process of calculating wages in line with the 2025 PERM Rates Form, various online calculators can be of immense help. These tools can provide accurate wage estimates based on occupation, geographic location, and other parameters.

Users can benefit from utilizing tools available on pdfFiller for optimized document management. These resources can save time and ensure compliance, making the entire filing process more efficient and less prone to errors.

Document management and eSignature integration

Managing the 2025 PERM Rates Form becomes convenient with pdfFiller's tools for editing and electronically signing documents. Users can easily make adjustments to the form without needing to print and resubmit documents, leveraging a cloud-based platform to facilitate collaboration.

To securely sign the document electronically, users can follow straightforward steps to integrate eSignature features, ensuring compliance with federal guidelines while speeding up the submission process. Collaboration tools available on pdfFiller make it simple for teams to work on the form together, maintaining accuracy and accountability.

FAQs on the 2025 PERM rates form

As with any complex process, there are frequently asked questions surrounding the 2025 PERM Rates Form that potential users need clarity on. One common question revolves around compliance. Employers must ensure they are following all guidelines relative to wage levels, job descriptions, and recruitment efforts.

Another important aspect is the submission deadline; employers should be aware of any upcoming deadlines for labor certification applications to avoid delays. Questions about the auditing process often arise, highlighting the necessity of maintaining accurate records of all employment practices.

Resources for employers and employees

Adequately navigating the 2025 PERM Rates Form requires access to reliable resources. Links to official government guidelines can provide crucial insights into the labor certification process, while labor market tools assist in understanding wage dynamics.

Webinars and workshops that cover the PERM filing process are excellent for individuals who want to stay updated. Keeping informed of announcements regarding PERM rates and requirements helps ensure that employers and employees are always compliant with the latest regulations.

Compliance and legal considerations

When submitting the 2025 PERM Rates Form, employers must adhere to a comprehensive set of legal requirements. It is essential to ensure that documentation is accurate, as errors can lead to compliance issues, fines, or the disqualification of labor certification applications.

To mitigate risks associated with incorrect submissions, it’s vital to conduct thorough reviews of all information being submitted. Following established guidelines and maintaining records according to district court orders can enhance compliance efforts and reduce potential liabilities.

Preparing for future changes

Anticipating updates for the 2026 PERM Rates Form is critical for employers looking to stay ahead in their labor certification strategies. Employers should maintain awareness of evolving regulations that could influence wage rates and filing procedures.

Staying informed through updates from the U.S. Department of Labor and relevant organizations will provide valuable insights. Keeping records up to date will ensure that any upcoming shifts in compliance requirements can be navigated effectively and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 2025 perm rates form?

Can I create an electronic signature for signing my 2025 perm rates form in Gmail?

How can I edit 2025 perm rates form on a smartphone?

What is 2025 perm rates form?

Who is required to file 2025 perm rates form?

How to fill out 2025 perm rates form?

What is the purpose of 2025 perm rates form?

What information must be reported on 2025 perm rates form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.