Get the free Enhanced Aca Tax Credits May 2024

Get, Create, Make and Sign enhanced aca tax credits

Editing enhanced aca tax credits online

Uncompromising security for your PDF editing and eSignature needs

How to fill out enhanced aca tax credits

How to fill out enhanced aca tax credits

Who needs enhanced aca tax credits?

Enhanced ACA Tax Credits Form: Your Comprehensive Guide

Understanding enhanced ACA tax credits

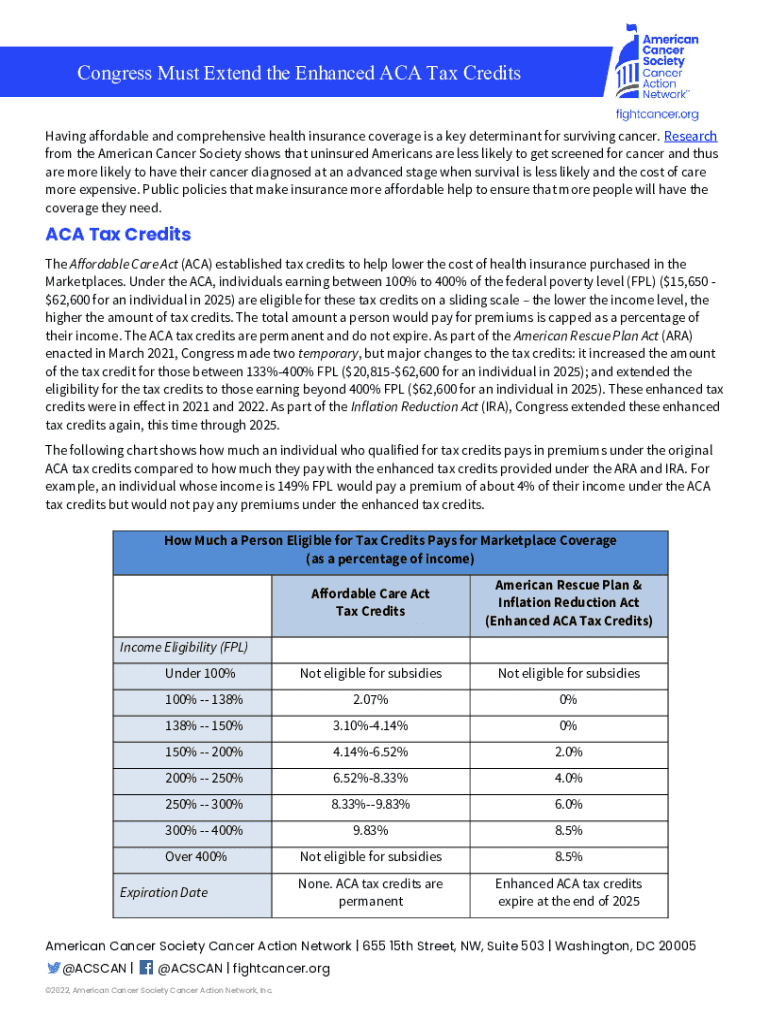

Enhanced ACA tax credits are a pivotal component of the Affordable Care Act (ACA), designed to make health insurance more affordable for individuals and families. These tax credits lower your monthly premium costs based on your income and family size, making healthcare accessible to millions who might otherwise be unable to afford it. With continually rising healthcare costs, such credits play a crucial role in ensuring that healthcare remains attainable for the average American.

To qualify for enhanced credits, you need to meet specific income thresholds, typically between 100% and 400% of the federal poverty level, depending on your household size. For example, a single individual in 2023 must have an annual income between approximately $13,590 and $54,360 to qualify. Understanding these credits is essential, as they can significantly impact your financial situation and healthcare access.

Key components of the enhanced ACA tax credits form

Filling out the enhanced ACA tax credits form accurately is crucial for ensuring you receive the maximum benefits available to you. The form includes several key sections, including Personal Information, Income Information, and Coverage Information. Each section must be meticulously completed, as discrepancies can lead to delays in processing your tax credits or, worse, ineligibility.

Accurate reporting in each of these segments is essential to avoid complications in credit approval and maintain eligibility for future benefits.

Step-by-step guide to completing the enhanced ACA tax credits form

Completing the enhanced ACA tax credits form can seem daunting, but breaking it down into manageable steps simplifies the process significantly. Here's a detailed guide to assist you.

Common mistakes to avoid

Even minor oversights on the enhanced ACA tax credits form can lead to significant issues. One prevalent mistake is inaccurate income reporting. Ensure you don't underestimate or exaggerate your earnings, as this can affect your eligibility. Similarly, failing to include necessary documentation can delay the review process or lead to denials.

Changes in your life, such as a new job or a change in family size, should also prompt you to revisit your submitted information. Regularly updating your details as life circumstances evolve is critical to maintaining your eligibility for these credits.

What happens after submission?

Once you submit your enhanced ACA tax credits form, the IRS and your local health marketplace will review your application to determine your eligibility. Processing times vary but expect confirmation or notifications within a few weeks. The outcome may include approval, denial, or requests for additional information. Being proactive in checking your application status helps mitigate surprises during the tax season.

If approved, the credits will directly reduce your premium costs, making healthcare more affordable. You will also receive a notice from the IRS outlining your credit amount, which you should keep for your records.

Managing your enhanced ACA tax credit throughout the year

Managing your enhanced ACA tax credit isn't just a one-time event. Throughout the year, it's crucial to track any changes in your income or household size, as these can affect your credit eligibility. For example, if you receive a raise or your spouse joins the workforce, your income could exceed the qualifying threshold.

Keeping these proactive steps in mind will help you to navigate the credit system more effectively and avoid surprises at tax time.

Resources for assistance

Utilizing tools such as pdfFiller can enhance your experience while completing the enhanced ACA tax credits form. pdfFiller provides user-friendly features for editing, eSigning, and managing documents directly from the cloud. You can easily upload your tax documentation, fill out the form electronically, and ensure everything is in order for submission.

For those needing further guidance, reaching out to tax professionals or ACA navigators can provide personalized assistance. Additionally, government resources offer detailed information regarding eligibility requirements and application processes.

Case studies and scenarios

Several real-life examples illustrate how individuals have successfully navigated the enhanced ACA tax credits form. For instance, Jane, a single parent, drastically reduced her monthly healthcare costs by utilizing enhanced tax credits. By accurately claiming her income and household size, she accessed a plan that cut her premium costs by over 50%.

Another case is that of Mark and Lisa, a couple whose combined income fluctuated throughout the year. By staying updated with the marketplace about income changes, they ensured they did not over- or underestimate their credits, thus maximizing their benefits and avoiding reconciliation surprises.

Frequently asked questions (FAQs)

Navigating the enhanced ACA tax credits form raises various questions, from eligibility criteria to the submission process. Common inquiries include, 'What constitutes a household size?', 'Can I amend my form after submission?', and 'How do I know if my credits will change this year?' Addressing these frequently asked questions can demystify the process and empower individuals to confidently complete their forms.

For specific queries, consulting resources on the IRS website can provide additional insights, or a conversation with a tax professional can clarify the nuances of your situation.

Tools and templates for ease of use

Interactive tools and templates available on pdfFiller simplify the process of filling out the enhanced ACA tax credits form. Their platform provides easy editing options, allowing for quick adjustments to ensure accuracy. This time-saving approach allows users the ability to focus on obtaining the information needed without getting bogged down in manual paperwork.

Using these interactive resources, like customizable templates specifically designed for the enhanced ACA tax credits form, can streamline the completion and enhance your efficiency, allowing you to spend less time on paperwork and more on your health.

Next steps after receiving your enhanced ACA tax credits

Once you receive your enhanced ACA tax credits, understanding how to utilize them effectively is vital. Use these credits to offset your healthcare premiums throughout the year in the marketplace. It's also essential to keep your documentation organized for the upcoming tax season, as you will need to report these credits when filing your taxes.

Planning effectively involves regular monitoring of any changes in income or household size that could affect your benefits. This proactive management ensures you can adapt quickly to any potential changes, maximizing the advantages of your enhanced ACA tax credits and maintaining access to affordable healthcare.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in enhanced aca tax credits without leaving Chrome?

How do I edit enhanced aca tax credits straight from my smartphone?

How do I edit enhanced aca tax credits on an Android device?

What is enhanced ACA tax credits?

Who is required to file enhanced ACA tax credits?

How to fill out enhanced ACA tax credits?

What is the purpose of enhanced ACA tax credits?

What information must be reported on enhanced ACA tax credits?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.