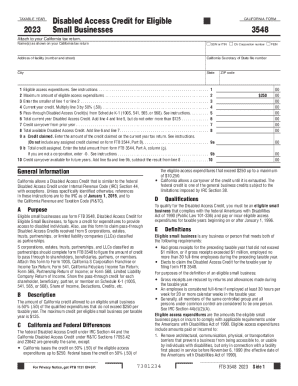

CA Form 3548 2024-2025 free printable template

Get, Create, Make and Sign CA Form 3548

How to edit CA Form 3548 online

Uncompromising security for your PDF editing and eSignature needs

CA Form 3548 Form Versions

How to fill out CA Form 3548

How to fill out 2024 form 3548 disabled

Who needs 2024 form 3548 disabled?

2024 Form 3548 Disabled Form: A Comprehensive How-To Guide

Understanding Form 3548: A Quick Overview

Form 3548 serves an essential purpose in the realm of disability applications and benefits. Specifically, it is designed to collect crucial information needed by individuals seeking disability-related assistance or modifications under various government programs. This form enables the authorities to assess the qualifications and entitlements of applicants, ensuring that the right support reaches those in need.

Individuals who need to file for disability benefits, or those already receiving aids and seeking to update their status, must use this form. As we advance into 2024, notable changes have been implemented that may affect how the form is filled out. Adjustments in information requirements and clarifications in definitions increase the overall accuracy of data submitted.

Essential information required for Form 3548

When preparing to complete the 2024 form 3548 disabled form, applicants should compile specific personal details to submit an accurate application. Primarily, one must include standard identifiers such as name, address, and Social Security Number. Additionally, the form requires detailed information regarding an individual's disability status, which is crucial for the approval process.

Financial information is equally significant. This section includes household income and specific types of disability benefits received. Understanding these requirements helps in providing a holistic picture of the financial situation of the applicant. This clarity directly influences eligibility evaluations and the level of support provided.

Step-by-step instructions for filling out Form 3548

Understanding how to properly fill out the 2024 form 3548 disabled form is vital for an efficient processing experience. Below are systematic steps that every applicant should follow:

Step 1: Gather necessary documentation

Before filling out the form, collect necessary documentation such as medical records, proof of income, and any previous correspondence with disability agencies. Gathering this paperwork beforehand avoids unnecessary delays.

Step 2: Detailed breakdown of each section

Delving into the details, the form consists of several critical sections.

Interactive tools to simplify your experience

Using resources like pdfFiller enhances your ability to complete the form accurately and efficiently. The platform offers an online PDF editor which is user-friendly, allowing you to utilize various editing tools effortlessly.

Features such as eSigning streamline the submission process, ensuring faster processing of your application. By reducing physical paperwork, pdfFiller’s cloud storage also helps in organizing and managing your forms and files, offering peace of mind in document retention.

Common mistakes to avoid when submitting Form 3548

Submitting the 2024 form 3548 disabled form can be straightforward if you remain vigilant about common pitfalls. One frequent mistake is leaving sections incomplete. Each area of the form is vital for comprehensive evaluation—overlooking any part can lead to delays or denial.

Another essential consideration is ensuring the accuracy of the information provided. Simple errors, like typos or incorrect financial figures, can significantly disrupt the processing of your application. Additionally, always pay attention to submission deadlines to avoid being disqualified due to late filings.

Special considerations for specific audiences

Different audiences may approach the 2024 form 3548 disabled form from unique perspectives, necessitating tailored advice.

For individuals with disabilities

For those directly applying for benefits, it's crucial to understand how personal circumstances can influence your application. Each application is unique, and including personal anecdotes about how your disability affects your daily life can strengthen your case.

For caregivers and family members

Caregivers completing the form on another's behalf should ensure all required information is accurate and comprehensive. They should also be aware of the individual’s history with disability benefits.

For organizations assisting disabled individuals

Organizations involved in assisting applicants can benefit from establishing best practices for group submissions. This approach not only helps streamline the filing process but also ensures that each submission meets the regulatory requirements.

Frequently asked questions (FAQs)

Navigating the intricacies of the 2024 form 3548 disabled form can raise several queries. Here are some common questions applicants frequently encounter:

Related forms and publications

Understanding the 2024 form 3548 disabled form may also lead you to explore other related forms. For instance, individuals may also find it useful to investigate the Supplemental Security Income (SSI) application or the Social Security Disability Insurance (SSDI) claims form.

Resources for further reading can often be found on government websites and organizations advocating for disability rights, providing insights that augment the understanding of these processes.

Essential support for your form completion journey

Completing the 2024 form 3548 disabled form can seem daunting without the right support. Assistance is readily available through various channels, including legal aid services and disability advocacy organizations, which provide valuable guidance.

Collaborating with professionals can dramatically enhance the quality of your application. Engage with internal members of your organization or trusted members of the community to garner support and insights tailored to your specific situation.

Tips for managing your documents post-submission

Once the 2024 form 3548 disabled form has been submitted, there are essential steps to ensure ongoing management of your documents. Tracking the status of your submission is crucial; keep copies of everything for your records, including any confirmation notices received from the agency.

Additionally, safeguarding your personal information is paramount. Use secure storage solutions, such as pdfFiller’s document management tools, to keep everything organized together. This not only ensures efficiency but also enhances privacy.

User stories and success tips

Hearing success stories from individuals who have effectively completed the 2024 form 3548 disabled form can provide inspiration and insights into best practices. Many have successfully navigated the process by remaining organized and thoroughly preparing documentation ahead of time.

Key takeaways include starting early, double-checking all entries for accuracy, and utilizing available resources such as guidance from disability advocates. By sharing experiences, users can contribute to a community of support, enhancing everyone’s opportunities for success.

People Also Ask about

What is California tax form 100?

Can I file CA 540NR online?

What is Form 3548?

Who must file California franchise tax?

Who must file California Form 100?

Who must file California partnership return?

Can I file California state taxes online?

What form do corporations file for taxes in California?

Who needs to file California nonresident return?

What is the difference between 540 and 540NR?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in CA Form 3548?

Can I create an eSignature for the CA Form 3548 in Gmail?

How do I edit CA Form 3548 straight from my smartphone?

What is form 3548 disabled?

Who is required to file form 3548 disabled?

How to fill out form 3548 disabled?

What is the purpose of form 3548 disabled?

What information must be reported on form 3548 disabled?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.