Get the free Buyer(s) Closing Statement

Get, Create, Make and Sign buyers closing statement

How to edit buyers closing statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out buyers closing statement

How to fill out buyers closing statement

Who needs buyers closing statement?

Comprehensive Guide to the Buyers Closing Statement Form

Understanding the buyers closing statement form

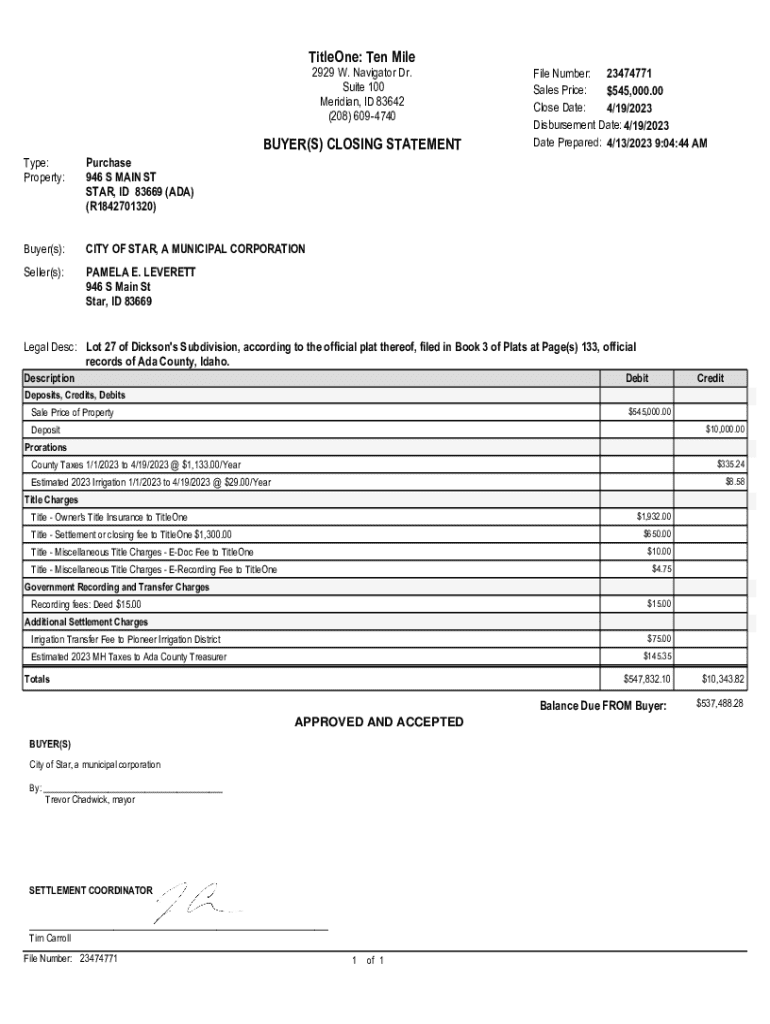

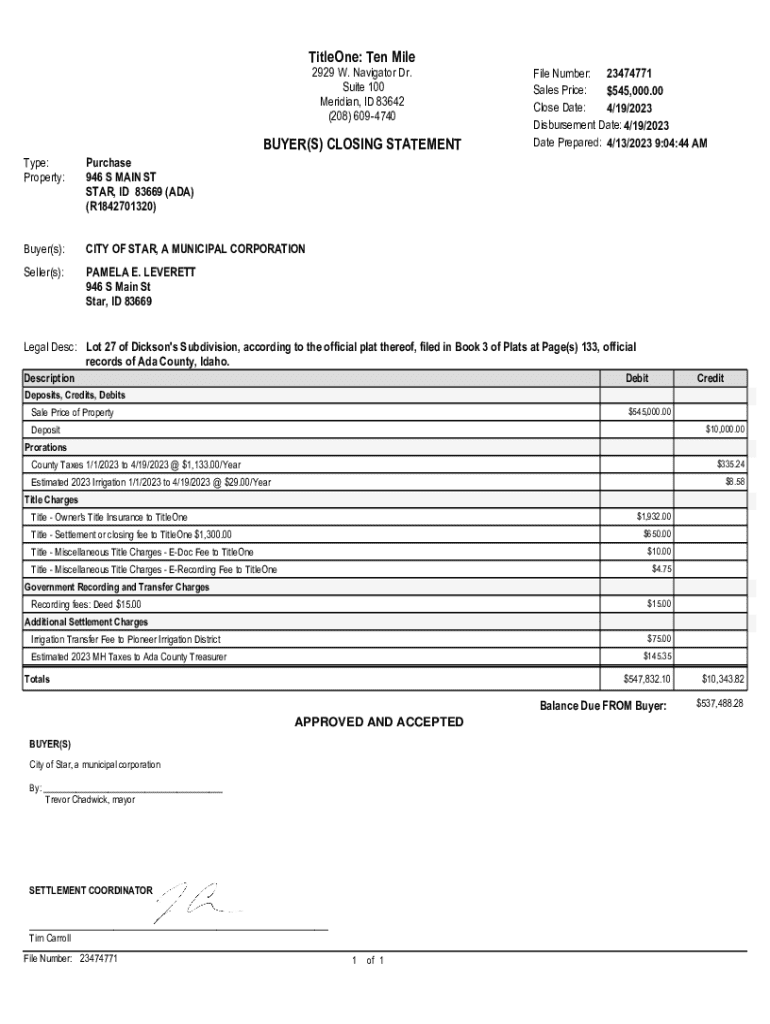

A buyers closing statement, often known as the settlement statement, is a crucial document in real estate transactions that outlines all financial aspects associated with the purchase of a property. Typically prepared by the closing agent or title company, this form provides a detailed breakdown of the costs and fees involved in finalizing the sale. For buyers, understanding this document is essential for transparency, as it summarizes all expenses they will incur, ensuring they are well-informed before the transaction is finalized.

This form holds significant importance in the context of real estate transactions. It not only serves as a financial ledger for buyers but also plays a critical role in safeguarding their interests by documenting every fee and adjustment. The buyers closing statement facilitates clarity and prevents any potential discrepancies, thereby making it a vital component of the closing process.

Key components of the form

Steps to fill out the buyers closing statement

Filling out a buyers closing statement requires meticulous attention to detail. Prior to starting, it is crucial to gather all necessary information. Begin with the purchase agreement, which outlines the terms of the transaction. Next, collect loan information, including the lender’s specifics and any pertinent rate details. Lastly, prepare your personal identification information, as you will need to include this in the statement.

Breaking down the form into its respective sections can streamline the filling process. Start by entering your personal details, ensuring accuracy in your name and other identifiers. Then, proceed to list the closing costs. It is essential to itemize fees effectively; specific fees might include title insurance costs, inspections, and escrow fees. After detailing these costs, calculate any adjustments and credits accurately, cross-referencing them with the terms noted in the purchase agreement.

Editing and customizing the buyers closing statement

Accessing the buyers closing statement form on pdfFiller is intuitive and user-friendly. Once you log in, navigating through the platform to locate the buyers closing statement template is straightforward. The search tool allows you to quickly find relevant documents, streamlining the process of managing your real estate needs.

Editing the form is equally simple. pdfFiller provides tools to add or remove sections based on your unique transaction requirements. Updating your personal information can be done with just a few clicks, allowing you to ensure that all details are current. To maintain accuracy in edits, it’s smart to double-check the figures you input and make use of pdfFiller’s built-in validation features that highlight potential errors.

eSigning the buyers closing statement

In today’s digital landscape, the importance of digital signatures cannot be understated. Electronic signatures are not only legally valid but also expedite the closing process. When utilizing pdfFiller for eSigning your buyers closing statement, you benefit from a seamless workflow that eliminates the need for physical document transfer.

The step-by-step guide to eSigning within pdfFiller is designed for ease of use. Begin by selecting the eSignature option once you’ve filled out your document. Next, follow the prompts to create or insert your digital signature. Finally, confirm your signature to secure the document. This method not only saves time but also ensures your document is safe and ready for submission.

Collaborating with others during the closing process

Collaboration during the closing process is vital, and pdfFiller’s collaboration tools are designed to enhance this experience. One of the standout features is the ability to invite others to review your buyers closing statement. You can add participants, such as your real estate agent or lender, enabling them to provide feedback or make necessary adjustments in real-time.

Additionally, pdfFiller’s real-time editing capabilities allow multiple users to work on the document simultaneously. This feature ensures that everyone involved in the transaction is on the same page, eliminating confusion and facilitating a smoother closing experience. Clear communication with your real estate agents and lenders is reinforced through the platform’s shared comments option, further streamlining the entire process.

Managing your buyers closing statement

Once you’ve completed your buyers closing statement, effectively managing this document is key. pdfFiller offers cloud-based storage solutions, providing significant advantages like easy access from anywhere and secure safeguarding of your essential documents. You can categorize your forms for intuitive retrieval each time you need to refer back to them.

Retrieving and modifying past forms is also hassle-free with pdfFiller. The system maintains a history of your completed documents, enabling you to access previous versions quickly. If adjustments need to be made to past statements, you can simply duplicate the original and modify it as necessary. This feature ensures that no important details are lost as you navigate through different transactions.

Best practices for filling out a buyers closing statement

Filling out your buyers closing statement accurately is crucial to avoid common pitfalls and ensure clarity in your financial commitments. One significant mistake to avoid is failing to double-check the amounts listed for closing costs. Errors in these figures could lead to unexpected expenses during closing day.

Transparency in costs is essential. Make it a practice to communicate openly with your real estate agent or lender about the costs involved, and be prepared to negotiate if you find discrepancies. Furthermore, understanding your closing costs allows you to plan your budget better and avoid financial surprises. Setting a meeting with your agent before the closing can ensure alignment on all expenses, enhancing the overall transaction.

Understanding related documents

Alongside the buyers closing statement, it’s crucial to understand other related documents that accompany real estate transactions. Notably, the Closing Disclosure, similar yet distinct from the buyers closing statement, is required under federal law to detail the final terms of your mortgage, including all closing costs. Understanding the differences and similarities between these documents can help buyers navigate the closing process more effectively.

Furthermore, reviewing your Loan Estimate is also beneficial. This document outlines the estimated loan costs, including interest rates and closing costs, presented to buyers at an early stage. Familiarizing yourself with these documents will enhance your overall understanding of the transaction and ensure that you’re making informed decisions throughout the home buying experience.

Contacting support for help and guidance

Navigating the complexities of real estate documents can be daunting. Fortunately, pdfFiller provides a wealth of support resources to assist you. The Help Center is an excellent place to start, offering FAQs and detailed explanations about common issues users may encounter. This feature can give you quick solutions at your fingertips.

If you require more personalized assistance, pdfFiller also offers live chat support. This allows you to connect directly with a customer service representative who can provide tailored guidance as you work through your buyers closing statement. Having reliable support ensures that you can tackle any challenges that arise during the closing process with confidence and ease.

Additional features offered by pdfFiller

pdfFiller transcends the typical document creation experience by offering extensive document management solutions. Beyond serving as a platform solely for the buyers closing statement, pdfFiller empowers users with tools to create, edit, and store various transactional documents all in one place. This paperless solution supports users in eliminating the clutter of physical paperwork while ensuring that all essential documents are easily accessible and securely stored.

As an added advantage, pdfFiller continuously updates its library of templates, ensuring you have access to the most current forms and documents relevant to your needs. This feature is vital in a dynamic field like real estate, where regulations and form requirements can shift frequently. By leveraging the full capabilities of pdfFiller, users can elevate their document management practices, making for a more efficient closing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit buyers closing statement from Google Drive?

How do I edit buyers closing statement in Chrome?

How do I edit buyers closing statement straight from my smartphone?

What is buyers closing statement?

Who is required to file buyers closing statement?

How to fill out buyers closing statement?

What is the purpose of buyers closing statement?

What information must be reported on buyers closing statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.