Get the free Business Tangible Personal Property Return

Get, Create, Make and Sign business tangible personal property

Editing business tangible personal property online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tangible personal property

How to fill out business tangible personal property

Who needs business tangible personal property?

Business Tangible Personal Property Form: Your Comprehensive Guide

Understanding business tangible personal property

Tangible personal property comprises physical items that a business owns and uses in its operations. This includes machinery, equipment, furniture, and inventory. Understanding this concept is crucial for businesses as it is inherently linked to tax assessments and property valuation.

For businesses, tangible personal property represents significant assets that can impact financial statements, tax liabilities, and overall operational efficiency. Recognizing this distinction aids businesses in managing their resources effectively, which can lead to better financial planning and improved tax strategies.

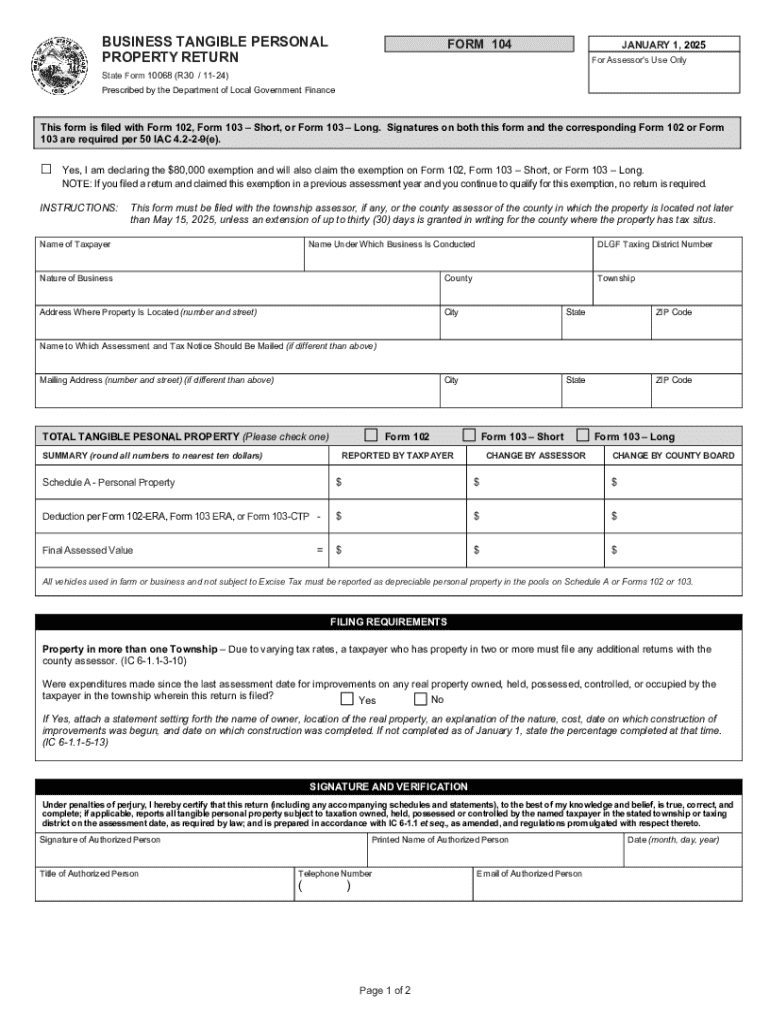

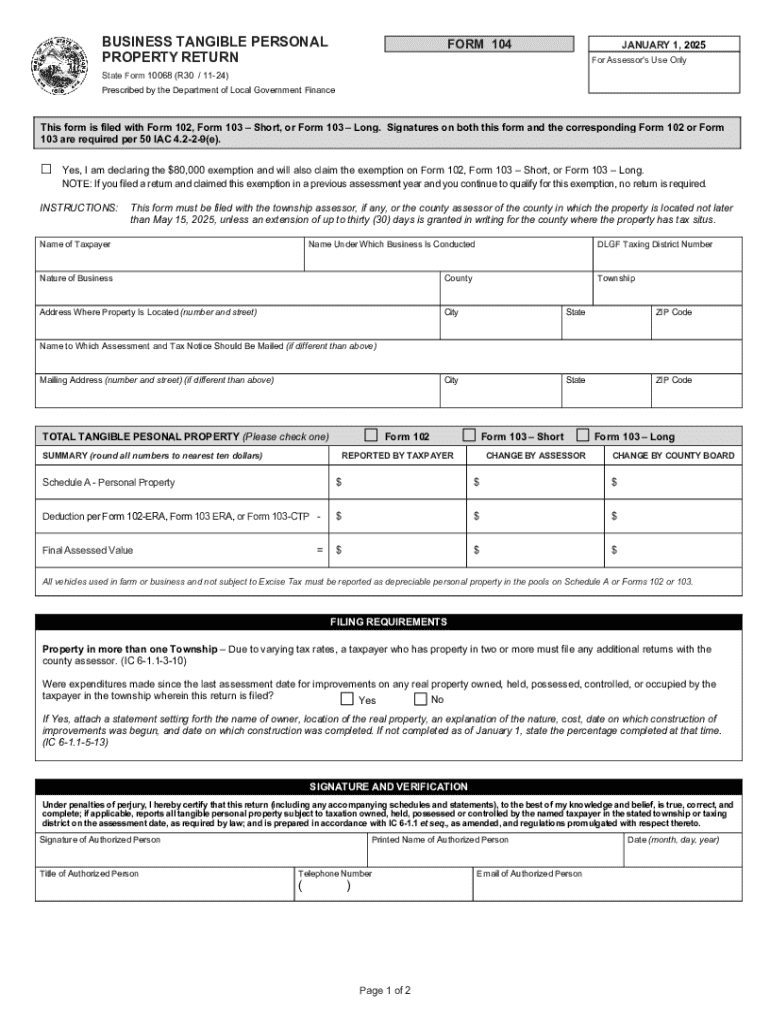

The business tangible personal property form

The Business Tangible Personal Property Form is a crucial document that businesses must file to report their physical assets for taxation purposes. Accurately completing this form ensures that your business complies with local and state tax requirements, thereby avoiding penalties and facilitating proper asset management.

This form typically includes sections that capture key details about the assets owned by the business, their classification, and the preferred methods of valuation. Competent completion ensures that your property assets are accurately reflected on tax records, substantiating your business’s financial standing.

Why you need to complete the business tangible personal property form

Filing the Business Tangible Personal Property Form is not merely a regulatory obligation; it serves several critical functions for your business. Firstly, it aids in fulfilling legal requirements, often mandated by state laws to report business-related tangible assets accurately.

Furthermore, inaccurate reporting can have significant implications, leading to potential fines, increased scrutiny from tax authorities, and an unfavorable audit trajectory. Conversely, adhering to compliance can yield numerous benefits, such as tax exemptions for certain asset classes and a clearer reflection of assets on financial statements, thus supporting business creditworthiness.

How to access the business tangible personal property form

Finding and filling out the Business Tangible Personal Property Form is user-friendly, especially when using pdfFiller. The platform offers easy navigation to templates that allow for quick access and efficient completion.

Once on the site, you can use interactive tools to customize the form to suit your unique business needs. Features like editing capabilities and electronic signature options enable seamless collaboration among team members, ensuring everyone involved can contribute to the completion of the form.

Filling out the business tangible personal property form: step-by-step guide

Navigating the business tangible personal property form may seem overwhelming, but following a structured approach can simplify the process significantly. Begin by gathering all necessary supporting information, including asset purchase receipts, prior tax filings, and any relevant business documents.

Next, log into your pdfFiller account to access the form. Each section of the document requires careful attention; accurate identification details can prevent misunderstandings with tax authorities.

Post-submission process

After submitting the Business Tangible Personal Property Form, you may be left wondering what comes next. Typically, tax authorities will review the submission to ensure accuracy, and they may reach out for clarifications or additional information. Be prepared to respond promptly to any inquiries to maintain compliance.

It is wise to keep copies of all submitted documents for your personal records. Maintaining an organized filing system for these forms facilitates easier reference in the event of future audits or questions from tax authorities.

Common scenarios and special considerations

Various scenarios may arise when dealing with the Business Tangible Personal Property Form, especially for businesses operating multiple locations or those seeking exemptions. Knowledge of applicable exemptions can prove beneficial; specific asset types may be exempt from certain taxes, depending on local laws.

Moreover, if your business spans multiple locations, you will need to complete separate forms for each location. Keeping accurate records is essential to avoid misreporting, particularly if your assets fluctuate significantly throughout the year. Addresses or locations must be distinctly tracked to ensure compliance.

Utilizing resources on pdfFiller for better management

pdfFiller not only provides access to the Business Tangible Personal Property Form but also offers a wealth of resources aimed at optimizing business document management. The platform includes tax filing assistance features that ensure you don’t overlook critical dates or requirements.

Integration with other business software further enhances your document management capabilities, undoubtedly contributing to a more streamlined operational workflow. Real user testimonials and case studies exemplifying successful usage pave the way for increased confidence in leveraging these tools effectively.

FAQs on business tangible personal property forms

Frequently asked questions surrounding the Business Tangible Personal Property Form often revolve around definitions and procedures. One common query includes, 'What defines business property?' It generally encompasses any physical asset owned or used by a business that can be viewed, touched, and utilized for business operations.

Another concern may be about appealing a rejected form. It is critical to understand the appeal process and the necessary documentation to provide in such scenarios to facilitate a swift decision from tax authorities.

Stay updated: keeping track of business property tax changes

In a constantly evolving regulatory environment, staying informed about changes in business property tax laws is essential. Failing to keep current could result in unnecessary liabilities or missed opportunities for tax benefits. Regularly checking state and local tax authority updates will ensure that your business remains compliant.

pdfFiller’s platform can facilitate staying current with such changes, providing alerts and updates tailored to your business’s needs, thus allowing for proactive management of your tangible personal property tax obligations.

Interactive features for enhanced experience

To bolster your experience further, pdfFiller provides a variety of interactive tools designed to simplify the form completion process. An interactive calendar that organizes filing dates can keep your business on track, while document preparation checklists guide users through essential steps.

Visual guides and tutorials are also available, delivering an engaging way to learn more about using the platform and completing necessary forms accurately and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute business tangible personal property online?

How do I make edits in business tangible personal property without leaving Chrome?

How do I fill out business tangible personal property on an Android device?

What is business tangible personal property?

Who is required to file business tangible personal property?

How to fill out business tangible personal property?

What is the purpose of business tangible personal property?

What information must be reported on business tangible personal property?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.