Get the free Advance Energy Equipment Tax Credit Application

Get, Create, Make and Sign advance energy equipment tax

How to edit advance energy equipment tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out advance energy equipment tax

How to fill out advance energy equipment tax

Who needs advance energy equipment tax?

Advance Energy Equipment Tax Form: Your Comprehensive Guide

Understanding the advance energy equipment tax credit

The advance energy equipment tax credit is designed to incentivize investment in renewable energy technologies. By allowing businesses and individuals to offset the costs associated with purchasing and installing energy-efficient equipment, this tax credit aims to promote sustainability and reduce overall energy consumption. Applicants who qualify can significantly benefit, enabling them to lessen their financial burden while contributing to environmental efforts.

To be eligible for the tax credit, entities must meet specific criteria. This typically includes the type of equipment being claimed, which should align with the guidelines set forth by tax authorities. Typically, this encompasses both personal and business applications, allowing a broad spectrum of individuals and organizations to engage in renewable energy initiatives.

The 48C Program plays a pivotal role in these renewable energy initiatives by offering tax credits to eligible businesses for investments in advanced energy projects. This program not only encourages technological innovation but also aims to position the U.S. as a leader in the global renewable energy sector.

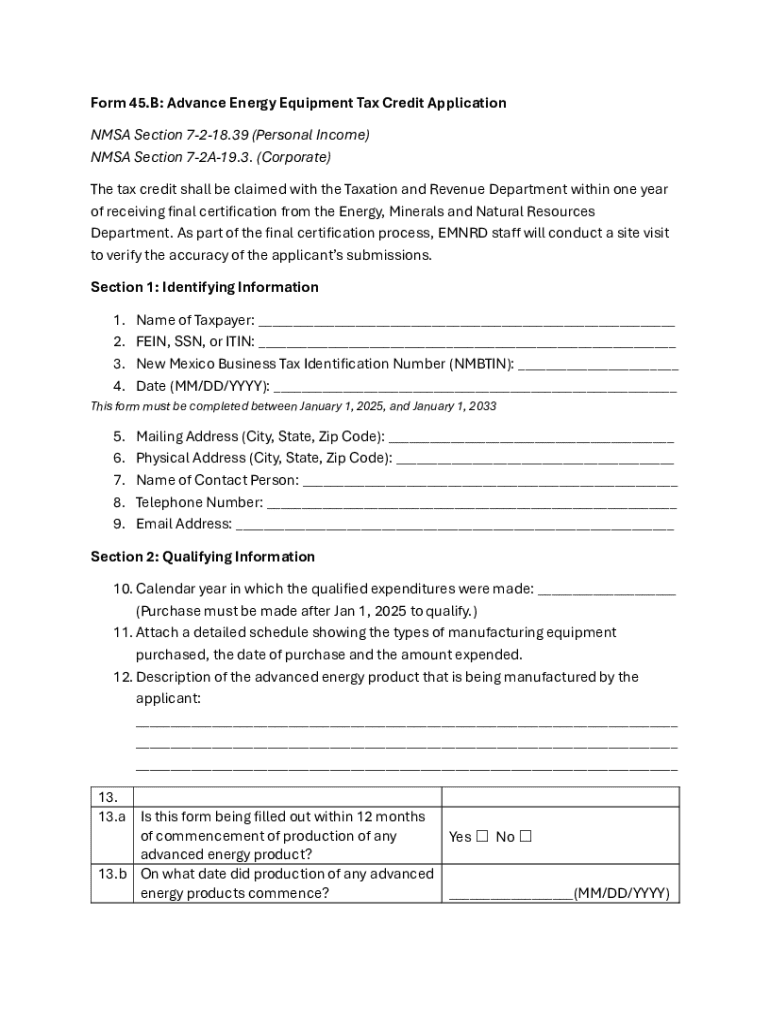

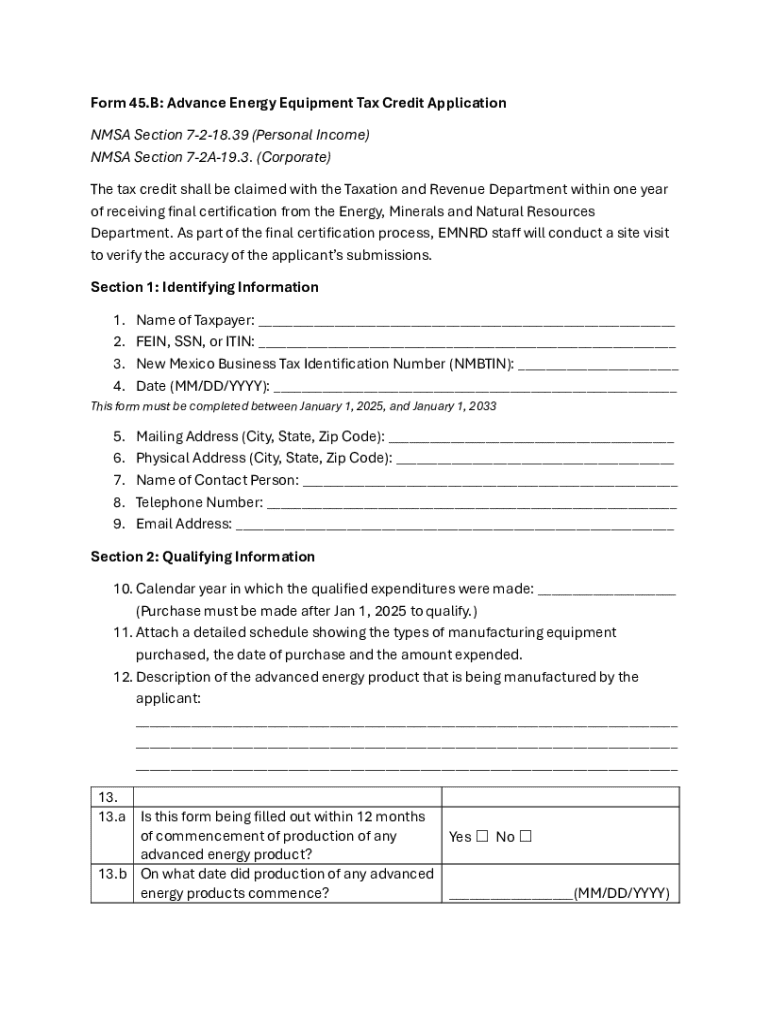

Key components of the advance energy equipment tax form

The advance energy equipment tax form consists of several essential sections that ensure the accurate reporting of eligible expenses. Key components include personal and business identification details, alongside a comprehensive breakdown of eligible equipment and services. Proper documentation is critical for substantiating claims and ensuring compliance with regulatory requirements.

Mandatory documentation includes proofs of purchase and installation—typically receipts from qualified vendors. Additionally, claimants may need to provide project completion certifications to confirm that the installations were fully executed according to specifications.

Step-by-step instructions for completing the form

Before diving into filling out the form, preparation is key. Gather essential information such as your personal details, business tax ID (if applicable), and a comprehensive list of the energy equipment in question. Familiarizing yourself with terminologies related to tax credits and energy efficiencies will also streamline the process and minimize errors.

When you begin filling out each section of the tax form, ensure accuracy—especially in the personal information segment. Mistakes here can delay processing. Then, move on to detailing the equipment by listing each item and connecting each to the proof of purchase documents you've collected. When calculating the tax credit amount, always double-check your math to avoid common calculation pitfalls, which can lead to missed credits.

Filing the advance energy equipment tax form

Once the form is completed, you have several submission methods to choose from. Many applicants opt for online filing, which is available via platforms like pdfFiller. This option offers the convenience of instant submission and tracking. Alternatively, if you prefer traditional methods, you can print the completed form and mail it to the appropriate address; be sure to double-check that you are sending it to the correct location specified by tax authorities.

Keep important deadlines in mind when preparing your submission. Missing these dates could jeopardize your eligibility for the tax credit. Furthermore, tracking your submission status online can provide peace of mind and inform you if any additional information is needed once your form is under review.

Post-submission process and certification

After submitting your advance energy equipment tax form, you can typically expect to wait several weeks for processing. During this time, it's essential to maintain meticulous records of documentation related to your submission—this will be critical if your application is selected for an audit. Claimants may also be required to complete a certification process, confirming the accuracy of the details provided on the form and that all equipment meets the necessary standards.

Furthermore, the certification process serves to ensure compliance with ethical and legal guidelines, safeguarding both the applicant and the authority providing the credit. Appropriating these details accurately not only helps in tax claims but fortifies your position if questions arise from tax officials.

Frequently asked questions (FAQs)

Individuals considering the advance energy equipment tax form often have several questions that clarify their eligibility and the nuances of the tax credit. FAQs can address concerns pertaining to the specifics of qualifying equipment, needed documentation, and potential issues that may arise during application processing. Seeking answers to these questions can bolster one's confidence in navigating the tax credit process.

Some common inquiries may include: What types of energy equipment qualify? How do I know if I am eligible? What steps should I take if my application is rejected? Each of these questions represents important considerations that can make or break your claim for tax credits.

Guidance for navigating changes in tax laws

Tax laws can frequently change, especially in the realm of energy credits and renewables. Understanding these shifts is crucial for applicants looking to stay compliant while benefiting from available credits. To navigate changes effectively, it is imperative to utilize multiple resources that provide timely updates and detailed insights into new legislation and adjustments to the tax code.

Websites of tax authorities and reputable financial news outlets often present the latest news, while specialty newsletters may offer focused content on renewable energy tax initiatives. Staying informed empowers applicants to seize new opportunities and adjust strategies accordingly as the landscape evolves.

Interactive tools and resources available on pdfFiller

Utilizing platforms like pdfFiller can vastly simplify the process of filling out the advance energy equipment tax form. With this tool, users can seamlessly edit PDFs, ensuring that the information is accurate and professionally presented. Moreover, pdfFiller's collaborative features allow multiple team members to work on the form concurrently, ensuring that the submission is comprehensive and thoroughly vetted by all stakeholders.

Another key feature offered by pdfFiller is the eSignature capability, enabling cloud-based signing that streamlines submission processes. This means users can complete their forms and officially sign them without needing to be physically present, enhancing convenience and expediting the entire submission.

Case studies and success stories

Learning from others' experiences can provide invaluable insight into successfully navigating the advance energy equipment tax form process. Numerous individuals and companies have leveraged this tax credit to make substantial investments in renewable energy equipment, yielding both environmental benefits and financial savings.

For example, a small business may have documented their equipment purchase meticulously, leading to a significant tax credit that enhanced their bottom line. Analyzing their strategies for compliance and documentation can serve as a roadmap for applicants looking to mirror similar success while ensuring they meet all necessary criteria.

Getting help with your application

Should questions arise during the application process, seeking assistance is a smart move. Platforms such as pdfFiller come equipped with customer support that can guide users through challenges encountered when filling out the advance energy equipment tax form. Additionally, professional tax services can provide further insights and clarity on complex aspects of the tax code.

Engaging with community forums or social media groups focused on tax credits can also yield helpful advice from fellow applicants. Conversations with peers may present unique perspectives and suggestions based on their own experiences.

Stay updated with latest news and developments

Staying abreast of changes in renewable energy tax credits and related legislation can be vital for successful applications. Trends indicate a growing emphasis on sustainability, meaning that tax credits are likely to evolve. Engaging with updated resources, attending webinars, and participating in informational sessions will empower applicants to adapt swiftly.

By being proactive in seeking out new information, you will not only comply with legal frameworks but also maximize the benefits available through the advance energy equipment tax form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my advance energy equipment tax directly from Gmail?

How can I modify advance energy equipment tax without leaving Google Drive?

How can I send advance energy equipment tax for eSignature?

What is advance energy equipment tax?

Who is required to file advance energy equipment tax?

How to fill out advance energy equipment tax?

What is the purpose of advance energy equipment tax?

What information must be reported on advance energy equipment tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.