Get the free W-9 Form (rev. March 2024)

Get, Create, Make and Sign w-9 form rev march

Editing w-9 form rev march online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9 form rev march

How to fill out w-9 form rev march

Who needs w-9 form rev march?

Comprehensive Guide to the W-9 Form Rev March Form

Understanding the W-9 form

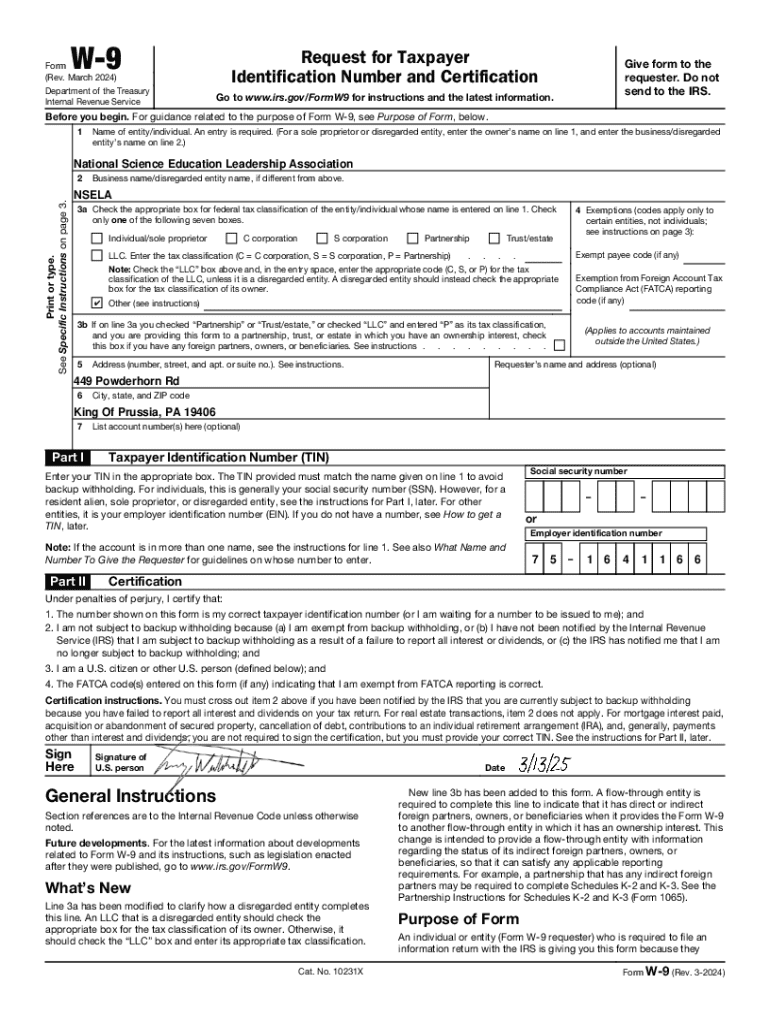

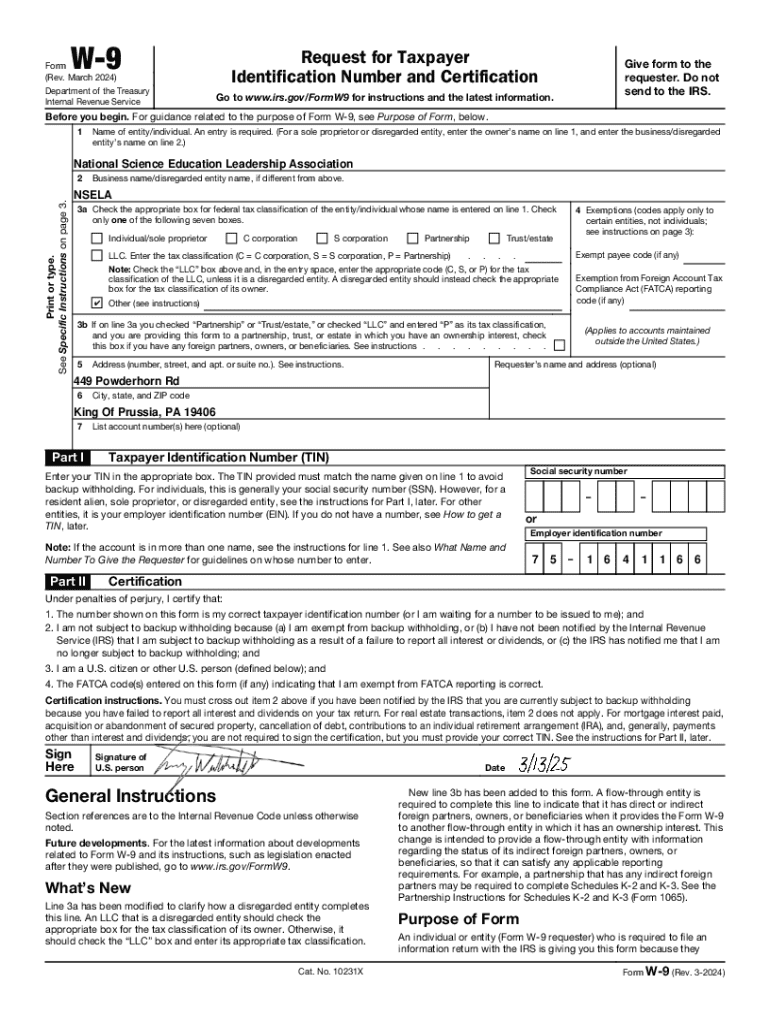

The W-9 Form, officially titled 'Request for Taxpayer Identification Number and Certification,' is an IRS form used by individuals and businesses to provide their Taxpayer Identification Number (TIN) to entities that are required to file information returns with the IRS. These returns might denote reportable payments such as contract work, rent, and certain other income forms, necessitating accurate data to fulfill tax obligations.

Key components of the W-9 form

The W-9 consists of several required fields designed to collect pertinent information about the taxpayer. The most crucial segment is the identification of the TIN or Social Security Number (SSN). Accurate completion of all required fields ensures reduced complications during the tax filing process, fostering compliance with IRS regulations.

Recent changes in the W-9 form (Rev March Form)

The latest iteration of the W-9, known as the Rev March Form, includes several significant changes aimed at simplifying the user experience while ensuring compliance with updated IRS requirements. These revisions may entail clarification of existing fields or adjustments in the instructions to prevent misunderstandings that could arise during completion.

Understanding these modifications is not only crucial for adhering to IRS policies but also aids individuals and businesses in producing accurate information returns, reducing the risk of audits or penalties.

Filling out the W-9 form correctly

Completing the W-9 form accurately is essential to ensure the processing of information returns. Here's a step-by-step guide to assist you in filling out the form.

Common mistakes to avoid when completing the W-9

While filling out the W-9 form, individuals often encounter pitfalls that can lead to complications. Common errors include:

Editing and managing your W-9 form with pdfFiller

pdfFiller provides an interactive platform for editing and managing your W-9 form seamlessly. With tools designed to enhance productivity, users can easily modify the content of their forms.

Interactive tools for form editing

Using pdfFiller, you can upload the W-9 form as a PDF and access powerful tools for editing content. This includes annotating, entering data, and even changing field options, ensuring that your form reflects the most accurate and up-to-date information.

E-signing the W-9 form

Signing documents electronically streamlines the process greatly. pdfFiller allows users to e-sign the W-9 form by clicking on the signature field and following the prompts to create and insert a digital signature.

Saving and sharing your completed form

Once the W-9 form is completed and signed, users can save the document in various formats. pdfFiller streamlines sharing options to send the form to relevant parties via email or by generating a secure link.

Understanding the tax implications of the W-9 form

The circumstances under which a W-9 form is required can significantly influence how it is utilized. Generally, the form is necessary when:

What happens after submitting the W-9?

After submitting the W-9 form, the entity collecting your information uses it to complete various tax forms, such as a 1099 at year-end reporting. This data is crucial for the IRS and ensures that taxpayers are accurately reporting income, which also needs to be reflected on your tax return.

Frequently asked questions about the W-9 form

Understanding who should utilize a W-9 form can simplify tax processes. It primarily targets:

How to revise or update your information on a W-9

Updating information on the W-9 form, such as a name change or change of TIN, requires submitting a new W-9 form that reflects the new details. This ensures all relevant parties have up-to-date information for accurate reporting.

Explore more about tax forms and pdfFiller

In addition to the W-9, numerous other IRS forms may be relevant based on your tax situation. Familiarizing yourself with forms such as the W-2 or 1099 can enhance your understanding of tax obligations.

Leveraging pdfFiller for all document needs

pdfFiller does not only bolster W-9 completion but simplifies the management of various IRS forms and documents, making it a versatile tool for individuals and teams seeking comprehensive document management solutions from anywhere.

The latest updates on IRS regulations

Understanding IRS policies affecting the W-9 form is essential for compliance. Regular updates to these policies may include changes in income thresholds for reporting and the requirements for e-filing.

Importance of regular updates from IRS

Staying informed about the IRS rules and regulations ensures taxpayers avoid penalties and comply with evolving tax obligations. Frequent checks of updates and revisions can help manage your fiscal responsibilities efficiently.

User experiences and feedback on pdfFiller

Users of the W-9 form functionality within pdfFiller have reported enhanced efficiency in filling and managing documents. Many users appreciate the intuitive design and real-time collaboration features.

Success stories in document management using pdfFiller

Several teams have shared success stories about how pdfFiller improved their document workflow. The ability to edit and e-sign documents from a single platform has facilitated quicker turnarounds, allowing companies to focus on their core operations rather than paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the w-9 form rev march in Gmail?

How do I fill out the w-9 form rev march form on my smartphone?

Can I edit w-9 form rev march on an iOS device?

What is w-9 form rev march?

Who is required to file w-9 form rev march?

How to fill out w-9 form rev march?

What is the purpose of w-9 form rev march?

What information must be reported on w-9 form rev march?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.