Get the free Beneficiary Change Form

Get, Create, Make and Sign beneficiary change form

Editing beneficiary change form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary change form

How to fill out beneficiary change form

Who needs beneficiary change form?

Beneficiary Change Form – How-to Guide

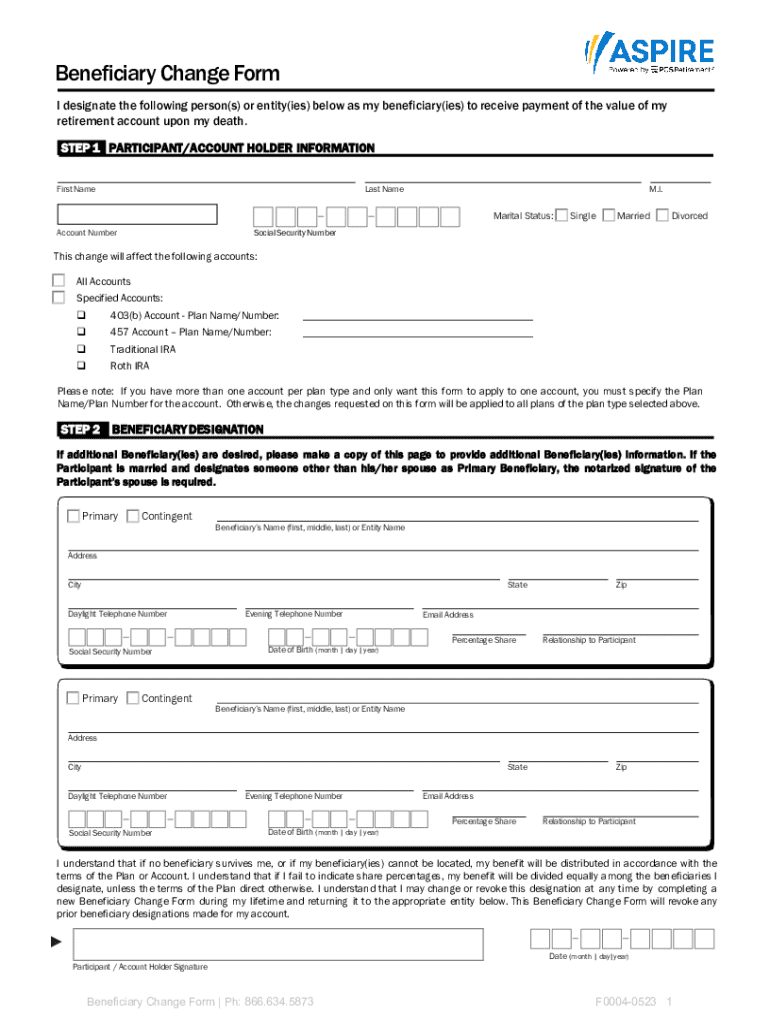

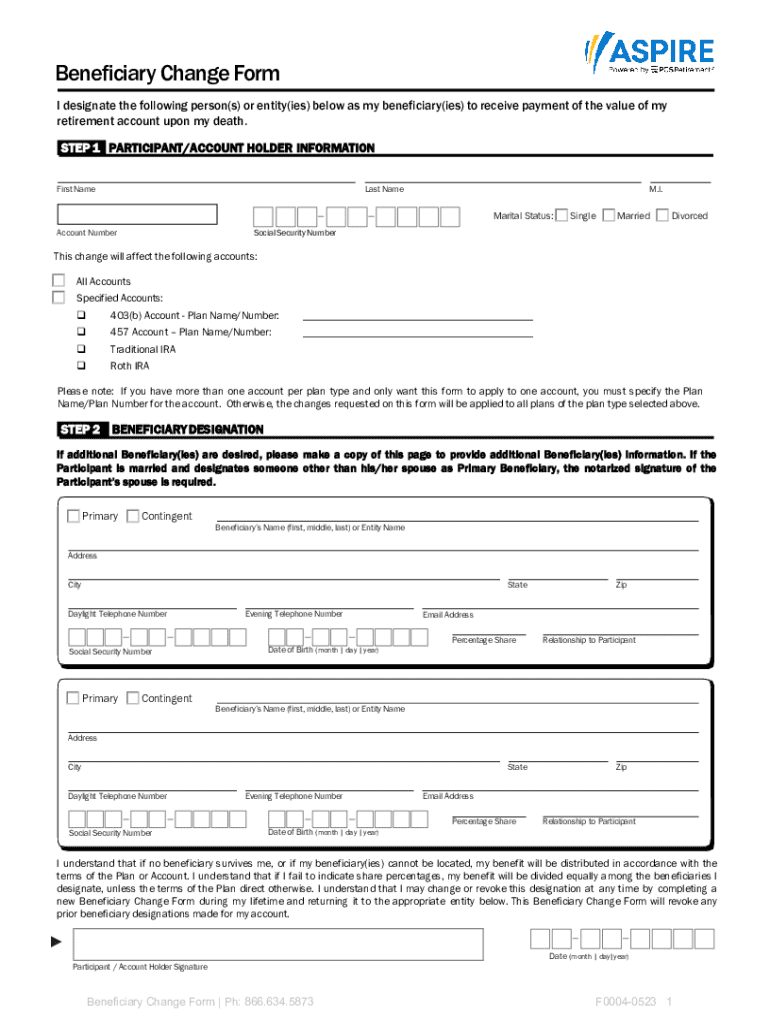

Understanding the beneficiary change form

A beneficiary change form is a legal document used to designate individuals or entities who will receive assets, such as life insurance payouts or retirement fund distributions, upon the policyholder's death. The purpose of this form is to ensure that assets are transferred to the desired parties without the need for probate, enabling quicker and easier access to funds for the beneficiaries. Updating beneficiaries on accounts and policies is vital to reflect changes in personal circumstances and safeguard against unintended distributions.

Who needs a beneficiary change form?

Several groups may find themselves needing a beneficiary change form, particularly those who have undergone significant life changes. For instance, individuals who have recently married or divorced often need to reevaluate their beneficiary selections to align them with their current personal relationships. Moreover, the birth of a child may prompt parents to add a new beneficiary to their life insurance or retirement accounts. Additionally, teams and organizations, like employee benefits coordinators, who manage collective benefits on behalf of others, are also responsible for updating beneficiary information as staff members' life events change.

When to use a beneficiary change form

There are specific life events that typically necessitate the completion of a beneficiary change form. One such event is a change in marital status, which might include marriage or divorce. Similarly, the addition of a new dependent or the loss of a dependent signifies a crucial moment to assess and alter beneficiaries. Financial responsibilities or asset changes, such as selling or acquiring significant property, also warrant a review of designated beneficiaries.

It is recommended to review beneficiary designations annually and update them periodically, especially after significant life changes. Staying proactive ensures that your wishes are accurately reflected and made known to the relevant parties.

Step-by-step guide to completing the beneficiary change form

Completing a beneficiary change form requires careful attention to detail. Here’s a step-by-step guide to ensure you fill it out correctly.

Common mistakes to avoid

When filling out the beneficiary change form, several common mistakes can jeopardize the accuracy of your designations. One of the most frequent errors is entering incorrect personal information—double-check all entries to avoid delays. Failing to specify beneficiary percentages is another critical oversight; without clear allocation, disputes may arise among beneficiaries. Additionally, neglecting the review for completeness can lead to complications later on.

Editing and updating your beneficiary change form

After submitting your beneficiary change form, you may need to make modifications. Contact the issuing company or financial institution to inquire about their procedure for requesting updates or revisions. Keeping the form current is crucial, as failing to do so may result in unintended beneficiaries receiving your assets.

For those who prefer digital management, pdfFiller offers an excellent platform for seamless changes. Its user-friendly interface allows individuals to edit and update forms easily. Whether you need to revise a name or adjust percentages, pdfFiller’s tools streamline the process without the hassle of physical paperwork.

Submission process for the beneficiary change form

Submitting your completed beneficiary change form is the next critical step in the process. Many companies offer multiple submission methods, including digital submissions through online portals or forms. Ensure that you follow the specific guidelines outlined by your provider to ensure a smooth process.

If mailing the form, include all necessary documentation and double-check the address for accuracy. After submission, it’s wise to follow up with a phone call or email to confirm receipt and processing of your changes. This will help put your mind at ease, knowing that your beneficiary designations are now up to date.

Interactive tools and resources available on pdfFiller

pdfFiller offers a range of interactive tools that make the process of managing your beneficiary change form more efficient. Users can access a variety of document templates specifically designed for beneficiary changes, significantly reducing the time spent on creating forms from scratch.

Additionally, collaboration features allow teams to work together, ensuring all stakeholders have input where necessary. The eSigning capabilities provided by pdfFiller facilitate quicker processing, allowing for immediate completion of the submission process, which can save valuable time and reduce the hassle of traditional paperwork.

Frequently asked questions (FAQs)

Addressing common concerns about the beneficiary change form can help clarify the process for users. One common query is how long it takes for changes to take effect; typically, it can take anywhere from a few days to a few weeks, depending on the institution's processing times. It's crucial to inquire about the expected timeline when submitting your form.

Another frequently asked question pertains to naming a minor as a beneficiary. While it is legally permissible, it introduces complexities regarding guardianship and how funds will be managed until the child reaches adulthood. It is often advisable to consult with a financial advisor to mitigate any risks involved.

Additional considerations for beneficiary changes

When making beneficiary changes, it's important to consider not only the immediate implications but also the long-term legal and tax ramifications. Different states may have varying laws regarding beneficiary designations, so you should be aware of local regulations. This could influence how your estate is taxed or how assets are distributed in case of disputes.

Furthermore, reviewing your choices with a knowledgeable financial advisor or estate planner can be beneficial. They can help navigate the nuances and highlight potential pitfalls or advantages that may arise as your circumstances and regulations change. Ensuring your beneficiary choices align with your overall financial strategy is vital for securing your legacy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find beneficiary change form?

How do I complete beneficiary change form on an iOS device?

Can I edit beneficiary change form on an Android device?

What is beneficiary change form?

Who is required to file beneficiary change form?

How to fill out beneficiary change form?

What is the purpose of beneficiary change form?

What information must be reported on beneficiary change form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.