Get the free Direct Debit Authorization Form

Get, Create, Make and Sign direct debit authorization form

How to edit direct debit authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct debit authorization form

How to fill out direct debit authorization form

Who needs direct debit authorization form?

Direct Debit Authorization Form: How-to Guide

Understanding direct debit authorization forms

A direct debit authorization form is a crucial document that allows individuals and businesses to authorize regular withdrawals from a bank account. This form acts as a formal agreement between the account holder and the entity receiving the payments, ensuring that funds are transferred automatically at specified intervals without needing repeated manual action.

The primary role of this form in financial transactions is to provide a secure method for routine payments, such as utility bills, subscriptions, and loan repayments. By signing this form, the account holder delegates the authority to withdraw a predetermined amount from their account on specified dates, simplifying their financial management.

Importance of direct debit authorization

The significance of direct debit authorization forms extends beyond mere convenience. For individuals, this method not only enhances cash flow management by ensuring payments are made on time, thereby avoiding late fees, but also provides peace of mind. On the other hand, businesses benefit from predictable cash flow, improving financial forecasting and reliability in receiving payments.

Security considerations must also be at the forefront of using direct debit transactions. Commonly, financial institutions offer protection against unauthorized transactions, contributing to a safer payment environment. Nonetheless, it is imperative for individuals to stay vigilant by regularly monitoring their bank statements and being proactive about revoking authorization if discrepancies arise.

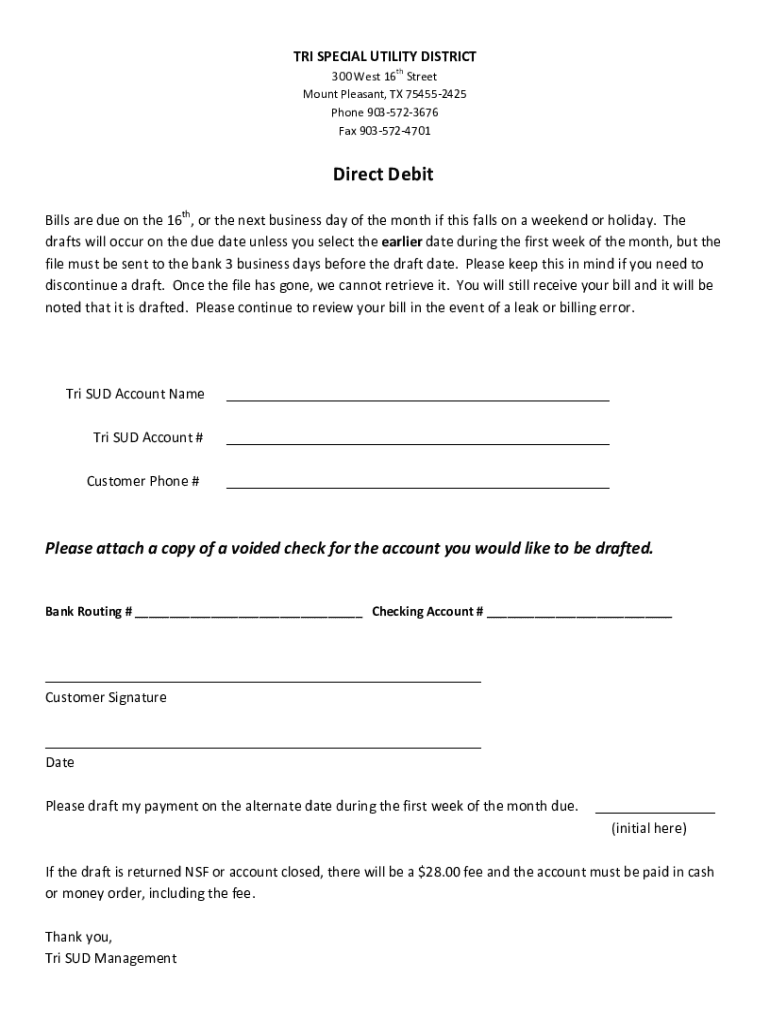

Key components of a direct debit authorization form

To effectively set up a direct debit, it's crucial to understand the essential information required on the authorization form. Key personal identification details, such as the account holder's name, address, and contact information, establish a clear connection between the individual and the bank account. Additionally, the complete bank account information, which includes the account number and sort code, allows for accurate and secure transactions.

Other vital components include the payment amount and frequency, which outline how much will be withdrawn and how often. Some forms may also have space for entering a reference that could help both parties track the transaction.

Additional fields to consider

Beyond the standard requirements, additional fields such as an authorization signature and date are essential for validating consent. Including a clearly defined cancellation policy and terms of service is also highly recommended, as it provides transparency about what actions the account holder can take should they need to stop or amend payments.

Step-by-step guide to filling out a direct debit authorization form

Filling out a direct debit authorization form can seem daunting, but a step-by-step approach simplifies the process. Begin by gathering all necessary information, including personal identification and bank details. A checklist might include: your full name, address, bank account number, sort code, payment receiver's details, and the specific amount to be withdrawn.

Once you have the required documents, you can start completing the form. Here's how:

After completing the form, reviewing all details is crucial. Double-checking for accuracy can prevent future issues, and commonly overlooked mistakes include incorrect bank information or missing signatures.

Interactive tools for managing your direct debit authorization

Leveraging technology can improve your experience with direct debit authorization forms. One versatile platform for document management is pdfFiller, which offers an array of online tools designed to simplify filling, signing, and managing documents in a cloud-based environment.

Using pdfFiller to fill out direct debit forms not only provides convenience but also enhances accuracy. The software traditionally allows you to upload your document and fill in the necessary fields without any hassle. Here’s a quick tutorial on using pdfFiller for direct debit forms:

Additionally, when considering electronic signature options, it’s essential to note that valid digital signatures hold the same weight as traditional handwritten ones in most jurisdictions. Understanding the legal considerations surrounding electronic signing will ensure compliance and security.

Submitting your direct debit authorization form

Once your direct debit authorization form is properly completed and signed, the next step is to submit it to the receiving party. Various submission methods are available: you could choose to send it via email, post, or directly through an online portal if the organization has set one up. Each method has its pros and cons, thus weighing them according to your urgency and convenience is essential.

In terms of online submissions, many organizations have embraced eForms, allowing instantaneous processing. If you choose postal submission, always ensure to send it via a tracked mailing service to confirm delivery. After submission, follow-up actions are equally important, such as:

Troubleshooting common issues

Even after completing the necessary steps, issues may arise. One common problem is submitting a direct debit authorization form with expired or incorrect information. If discrepancies are noticed, promptly address them by contacting your bank or the authorized party to resolve it, adjusting any erroneous information as necessary.

Another situation to consider involves changes to payment details, such as bank account changes. Individuals should familiarize themselves with the proper process for updating their direct debit authorization. This typically involves completing a new authorization form with the latest information and notifying the organization of the changes.

Lastly, understanding the process for cancellations and disputes related to direct debits is vital. Should you need to revoke your authorization, typically, notifying the payment recipient in writing is necessary, following any specific cancellation procedures they have in place.

Frequently asked questions (FAQs)

Several concerns often arise regarding direct debit authorizations. One common question is, 'What happens if I change my bank account?' The essential action is to immediately update your direct debit with the new bank details to avoid potential payment failures. Another prevalent query is about protection against unauthorized claims; rest assured, most banks provide robust protection policies to address such situations.

Another consideration is whether you can set up multiple direct debits from the same account. Yes, you can set up as many direct debits as necessary; however, it’s crucial to manage them wisely to prevent overdrafts or unintended consequences.

Real-life scenarios and case studies

Gaining practical insights into direct debit authorizations can be beneficial. For instance, consider a case study of an individual setting up direct debit for utility payments. This individual initiates a direct debit to ensure their utility bills are paid on time, enhancing budgeting ease. By authorizing a fixed amount monthly, they avoid the hassle of manual payments while ensuring their service remains uninterrupted.

In another scenario, a family subscribes to a streaming service that offers discounts on direct debit payments. By utilizing a direct debit authorization form, they simplify their monthly budgeting and benefit from lower rates. This further illustrates how efficiently managing direct debits can lead to savings and greater financial control.

Valuable resources for further assistance

To enhance your understanding and management of direct debit authorizations, refer to various regulatory bodies' websites, which provide helpful guidelines and support. Numerous articles and guides on financial management are also available online, offering insights into best practices fordirect debit transactions.

If you require immediate support, platforms like pdfFiller offer excellent customer service options to address any questions regarding document management, ensuring you are never left in the dark about your direct debit arrangements.

Engaging with the community

For ongoing support and the latest trends concerning direct debit authorizations, individuals can engage with the community through various social media platforms. Many forums and networks allow users to share experiences, tips, and best practices, helping foster a sense of community and support.

By contributing to these discussions, not only can individuals find immediate answers to their inquiries, but they can also share insights that benefit others navigating the complexities of financial transactions like direct debit authorizations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my direct debit authorization form in Gmail?

Can I create an electronic signature for the direct debit authorization form in Chrome?

How do I fill out the direct debit authorization form form on my smartphone?

What is direct debit authorization form?

Who is required to file direct debit authorization form?

How to fill out direct debit authorization form?

What is the purpose of direct debit authorization form?

What information must be reported on direct debit authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.