Get the free Ira Beneficiary Form

Get, Create, Make and Sign ira beneficiary form

How to edit ira beneficiary form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ira beneficiary form

How to fill out ira beneficiary form

Who needs ira beneficiary form?

A Comprehensive Guide to the IRA Beneficiary Form

Understanding the IRA Beneficiary Form

An IRA Beneficiary Form is a crucial document that designates who will inherit your IRA account in the event of your death. This form plays a vital role in estate planning, ensuring that your retirement assets are distributed according to your wishes and not governed by state laws or probate courts.

The importance of the IRA Beneficiary Form cannot be understated; without it, your retirement account may be subject to complicated legal proceedings that can delay or complicate the distribution of your assets.

Types of beneficiaries

Beneficiaries are typically categorized into two types: primary beneficiaries, who are the first in line to receive the assets, and contingent beneficiaries, who will inherit the account if the primary beneficiaries are unable to do so. Additionally, you can name individual beneficiaries, such as family members or friends, or charitable organizations, further tailoring your estate plan to reflect your intentions.

Why you need an IRA beneficiary form

Designating beneficiaries on your IRA Beneficiary Form ensures that your assets are distributed as you wish, bypassing the often lengthy probate process. It safeguards your intentions against potential disputes and provides your beneficiaries with direct access to the funds, emphasizing the necessity of keeping this form updated.

Key considerations before filling out the IRA beneficiary form

Before completing your IRA Beneficiary Form, it's essential to understand the eligibility requirements for designating beneficiaries. Generally, there are no age restrictions; however, the type of IRA—Traditional, Roth, or SEP—can influence your decisions. Each type has specific rules regarding beneficiary designations that can affect tax implications.

Tax implications for beneficiaries vary based on the type of IRA and the relationship to the account holder. For instance, an inherited Traditional IRA may be subject to income tax upon withdrawal, whereas Roth IRAs might provide tax-free distributions. Additionally, beneficiaries must familiarize themselves with Required Minimum Distributions (RMDs) rules that dictate how much they need to withdraw annually from inherited IRAs.

Moreover, state-specific regulations can affect how beneficiaries are designated and treated upon the account owner's death. Familiarity with these laws can help ensure that your designations comply with local requirements.

How to obtain an IRA beneficiary form

Obtaining an IRA Beneficiary Form is straightforward. Most financial institutions provide downloadable versions of the form directly from their websites. Additionally, platforms like pdfFiller offer customizable, editable templates that can save time and avoid errors during the process.

Whether you choose to download a PDF or use an interactive online platform, make sure the format is compatible with your needs. PDFs offer a standard format, while editable templates allow for easier adjustments.

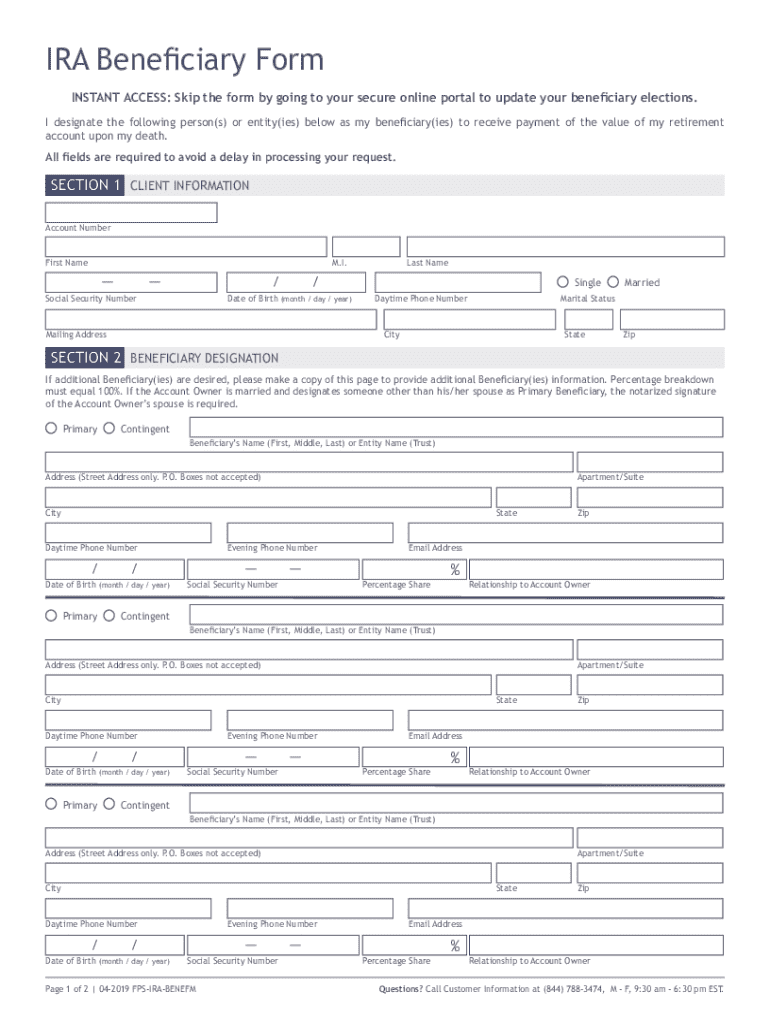

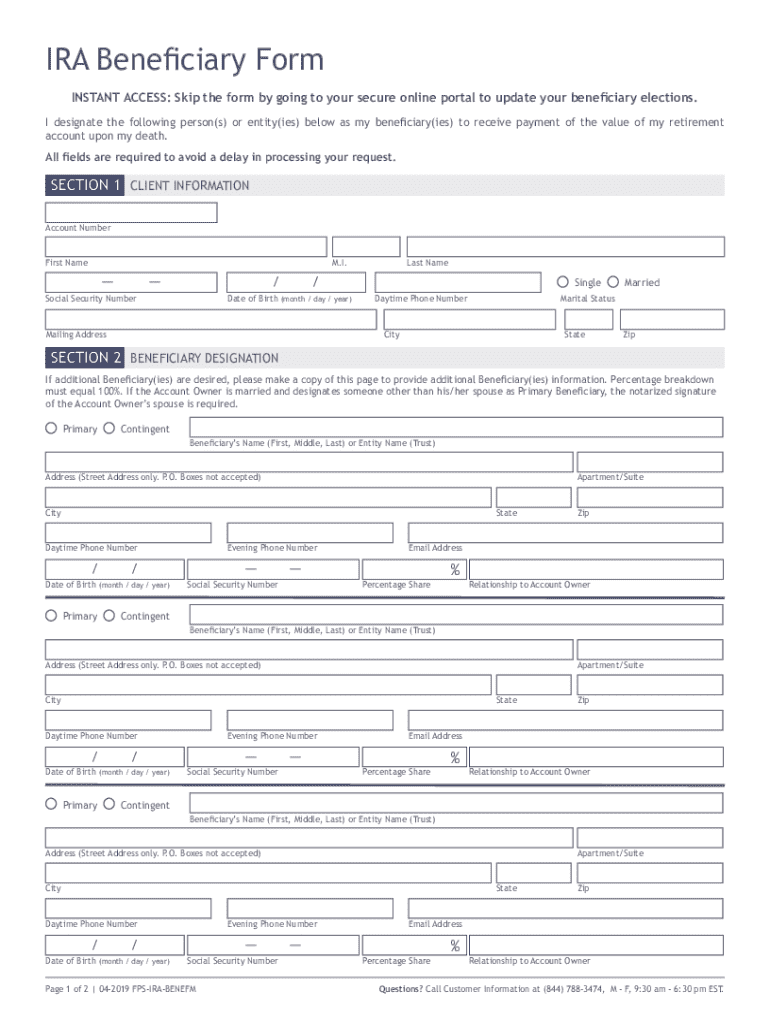

Step-by-step guide to filling out the IRA beneficiary form

Filling out the IRA Beneficiary Form requires careful attention to detail. Start with the personal information section, accurately entering the account owner's details, including full name, address, and contact information. It's beneficial to check for typographical errors at this stage, as these can complicate processing.

Next, move to the beneficiary details section. It's crucial to clearly list both primary and contingent beneficiaries, including their names, addresses, dates of birth, and Social Security numbers. Considerations about naming beneficiaries are vital; for instance, naming a trust can provide additional control over how the assets are distributed.

If minor beneficiaries are involved, designate a custodian until they reach the age of maturity. When naming a trust, be specific to avoid ambiguous legal interpretations.

Editing and customizing your IRA beneficiary form

Customizing your IRA Beneficiary Form can be simplified using pdfFiller's editing tools. Users can import their forms and easily edit or fill in the required fields. This accessibility not only streamlines form completion but also reduces the chance of making errors that might arise from handwritten forms.

Additionally, utilizing the eSigning capabilities on pdfFiller can ensure that all signatures are authentic, enhancing the document's validity. Remember, ensuring that all required parties sign off on the form is imperative for it to be processed efficiently.

Reviewing and finalizing your IRA beneficiary form

Once your IRA Beneficiary Form is complete, take the time to double-check for any inaccuracies. Common mistakes to avoid include omitting required information, such as Social Security numbers or dates of birth, or failing to sign where necessary. A thorough checklist can be beneficial at this stage, ensuring that nothing is overlooked before submission.

After finalizing the form, consider the best practices for saving and storing it. Digital storage is increasingly common; however, if you opt for physical storage, consider a safety deposit box or a secure area in your home to minimize the risk of loss.

Submitting your IRA beneficiary form

Submitting your IRA Beneficiary Form to your financial institution can typically be accomplished electronically or by mail. Confirm with your institution about which submission method is preferred or most efficient.

After submission, follow up to ensure that your beneficiary designation has been recorded accurately. Many institutions will provide a confirmation, and it’s advisable to keep records of this confirmation in case any discrepancies arise in the future.

Updating your IRA beneficiary form

Regularly reviewing and updating your IRA Beneficiary Form is essential. Major life changes, such as marriage, divorce, or the birth of children, are key moments that might necessitate an update. Failing to do so may lead to unintended consequences regarding your estate distribution.

When making changes, repeat the process for filling out the form with updated information. Maintain records of these changes and ensure that your financial institution has the most current version of your beneficiary form on file.

Common FAQs about IRA beneficiary forms

Can I name multiple beneficiaries? Yes, you can designate multiple primary beneficiaries and contingent beneficiaries on your IRA Beneficiary Form. It's important to specify what percentage of the assets each will receive.

What happens if I don’t submit a beneficiary form? If no beneficiary form is submitted, your IRA may become part of your estate and will be distributed according to your state's laws, potentially leading to a lengthy probate process.

How does naming a trust as a beneficiary work? When you name a trust as a beneficiary, the trust, as a legal entity, will control the distribution of the IRA assets according to its terms. Ensure that your trust is properly set up to avoid complications in the future.

Troubleshooting common issues with IRA beneficiary forms

Incorrect submissions can often arise, leading to rejection by financial institutions. If your form is rejected, review it to identify potential errors, whether they’re inaccuracies in names, contact information, or missing signatures.

Understanding that processing policies may vary among institutions can be crucial when troubleshooting. Some institutions may require original signatures or specific documentation, so be sure to clarify these aspects during the initial submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ira beneficiary form from Google Drive?

How do I make changes in ira beneficiary form?

How do I make edits in ira beneficiary form without leaving Chrome?

What is ira beneficiary form?

Who is required to file ira beneficiary form?

How to fill out ira beneficiary form?

What is the purpose of ira beneficiary form?

What information must be reported on ira beneficiary form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.