Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding SEC Form 4: A Comprehensive Guide

Understanding SEC Form 4

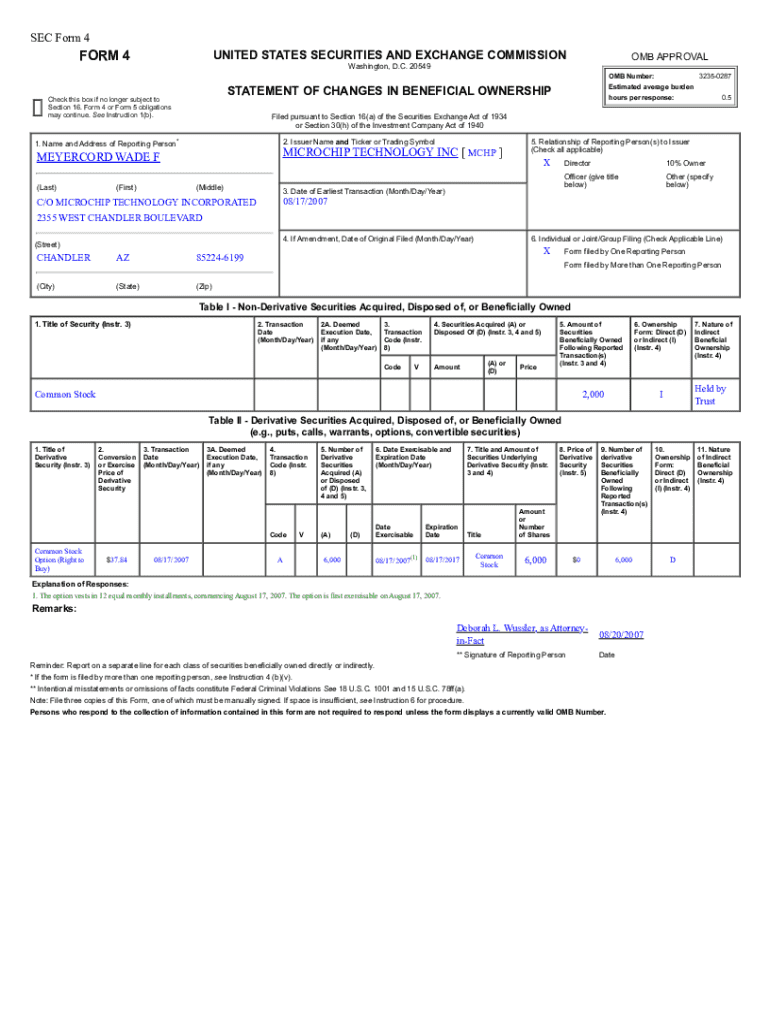

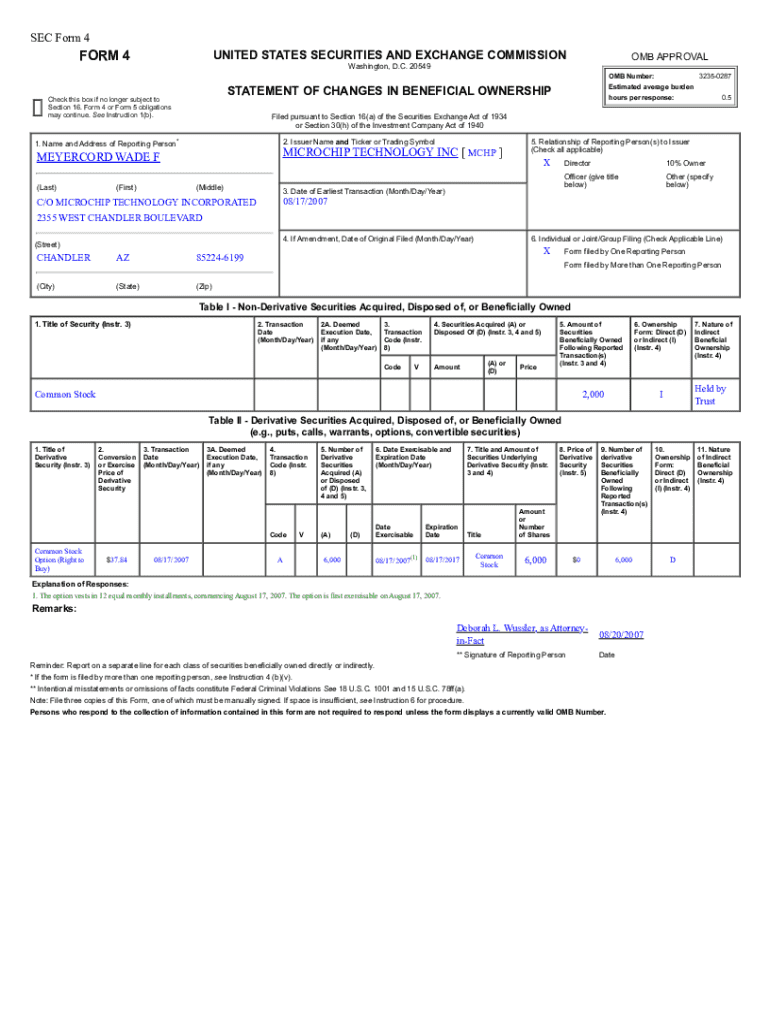

SEC Form 4 is a crucial document that must be filed with the U.S. Securities and Exchange Commission (SEC) to report the purchase or sale of securities by corporate insiders. This form serves as a snapshot of an insider's trading activity, allowing regulators and the public to monitor and assess insider trading practices within publicly traded companies. Its primary aim is to promote transparency and prevent insider trading abuses, thus safeguarding investor interests.

Key components of SEC Form 4 include the names of the insiders, the nature of the transaction, the number of shares involved, and the price at which the transaction occurred. The importance of SEC Form 4 in financial transactions cannot be understated, as it creates an essential public record critical for maintaining market integrity. Stakeholders, such as investors and analysts, routinely use this data to make informed decisions.

Who is required to file SEC Form 4?

Individuals mandated to file SEC Form 4 typically include executive officers, directors, and significant shareholders of publicly-traded companies. These individuals are referred to as 'insiders' because they have access to non-public information about the company's operations and financial conditions, which can influence stock prices.

The reporting obligations for company insiders are tightly regulated to ensure that any potential abuses of insider information are minimized. Common types of insiders include the CEO, CFO, other executive team members, and members of the board of directors. Each of these roles carries specific responsibilities and obligations tied to SEC Form 4 reporting.

How to fill out SEC Form 4

Completing SEC Form 4 may seem daunting at first, but a systematic approach can simplify the process. Here’s a step-by-step guide to assist you in filling out the form accurately.

Common mistakes to avoid include forgetting to use the correct transaction codes, failing to file on time, or omitting essential transaction details. Double-checking your form before submission can save you from unnecessary complications.

Detailed breakdown of each section in SEC Form 4

SEC Form 4 is divided into several sections, each designed to collect specific information. A detailed examination of the Personal Information section includes details about the insider such as full name, address, and title within the company, all of which are crucial for accurate identification.

In the Transaction Reporting Details section, you will need to specify the type of transaction (such as open market transactions, acquisition of shares, or exercise of options). Additionally, signatures and dates are required to validate the submission. Footnotes and comments sections allow you to provide supplementary information about complex transactions or any special circumstances surrounding the filing.

How to edit and modify SEC Form 4

Editing SEC Form 4 is more straightforward than it might appear. One effective tool is pdfFiller, which provides an easy interface for making required changes. Start by reviewing your document and identifying sections that need modifications.

Maintaining proper organization and compliance is paramount, especially during busy filing seasons.

eSigning SEC Form 4: Best practices

eSigning SEC Form 4 offers numerous benefits, particularly through tools like pdfFiller, which ensure a quick and legally compliant signing process. To begin, confirm that all required fields in the form are complete before eSigning.

Following these best practices will enhance your efficiency while ensuring that all submissions are done correctly and timely.

Collaborating on SEC Form 4 with teams

Collaboration is essential when completing SEC Form 4, particularly in larger organizations. Using pdfFiller’s collaboration tools allows multiple team members to work on the document simultaneously, facilitating real-time feedback and edits.

Collaboration not only speeds up the filing process but also helps ensure all relevant perspectives are included in the final document.

Managing and storing SEC Form 4 with pdfFiller

Effective document management is crucial for timely submissions of SEC Form 4. pdfFiller offers a range of document management features designed to streamline this process. You can store forms in an organized manner, allowing easy access to previously filed documents.

Taking these steps will help you stay on top of your filing responsibilities and maintain a comprehensive record of all insider transactions.

Interactive tools available on pdfFiller

pdfFiller provides a suite of interactive tools specifically designed for analyzing SEC Form filings. These capabilities can help users identify trends in insider trading and assess the potential market impact of these transactions.

These interactive tools provide invaluable insights, enabling users to make well-informed investment decisions.

Resources for understanding SEC Form 4

For those seeking to deepen their understanding of SEC Form 4, a wealth of resources is available. Educational materials range from guides on filing procedures to interpretations of regulatory requirements. Moreover, various regulatory websites offer additional information that can aid in comprehending the intricacies of SEC filings.

These resources will help you navigate the complexities associated with SEC Form 4, enhancing both your knowledge and compliance capabilities.

FAQs about SEC Form 4

Many individuals have questions regarding the intricacies of SEC Form 4. Common questions often revolve around the filing requirements, including who needs to file, what transactions must be reported, and the penalties for non-compliance.

These FAQs serve as a foundational knowledge base for anyone involved in the preparation and submission of SEC Form 4.

Recent trends in SEC Form 4 filings

Monitoring recent trends in SEC Form 4 filings can yield significant insights into market activities and investor sentiment. Statistical analyses often reveal fluctuations in insider trading activity, allowing analysts to assess how these trends impact stock market movements.

High-profile transactions, particularly by influential corporate insiders, regularly draw attention from both media and investors. Such filings may indicate confidence or concern in a company’s future performance, affecting broader market perceptions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the sec form 4 in Chrome?

How do I fill out sec form 4 using my mobile device?

How do I complete sec form 4 on an iOS device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.