Get the free Ira Distribution Request Form

Get, Create, Make and Sign ira distribution request form

Editing ira distribution request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ira distribution request form

How to fill out ira distribution request form

Who needs ira distribution request form?

Navigating the IRA Distribution Request Form: A Comprehensive Guide

Understanding IRA distributions

An Individual Retirement Account (IRA) is a powerful tool designed to help individuals save for retirement. There are primarily two types of IRAs: Traditional and Roth. Traditional IRAs offer tax-deferred growth, meaning you pay taxes on withdrawals, typically during retirement when you may be in a lower tax bracket. Conversely, Roth IRAs allow contributions with after-tax dollars, providing tax-free withdrawals in retirement, as long as specific conditions are met.

You may need to request a distribution for several reasons, including funding retirement expenses, covering unexpected financial burdens, or for strategic tax planning. Understanding the intricacies of your IRA can empower you to make informed withdrawals that align with your financial goals.

The IRA distribution request form: Overview

The IRA Distribution Request Form serves a critical role in the withdrawal process. It simplifies the mechanics of withdrawing funds from your IRA, ensuring compliance with various legal and tax obligations. By using this form, you formalize your request, minimizing errors and misunderstandings—both essential for avoiding costly penalties.

This form is especially pertinent for individual account holders but is also relevant for beneficiaries of deceased account holders, who must navigate a distinct set of rules and guidelines when accessing IRA funds.

Preparing to fill out the form

Before diving into the form, gather all necessary information. This includes your account details—such as your account number and plan number—as well as your personal identification like your Social Security Number (SSN) and current address. Knowing your withdrawal preferences—in terms of both amount and frequency—will streamline the process.

It's crucial to familiarize yourself with various distribution options. You can take a lump-sum distribution, schedule periodic payments, or consider rolling over your funds into another retirement account. Each choice has distinct tax implications and benefits, making careful consideration vital for long-term financial health.

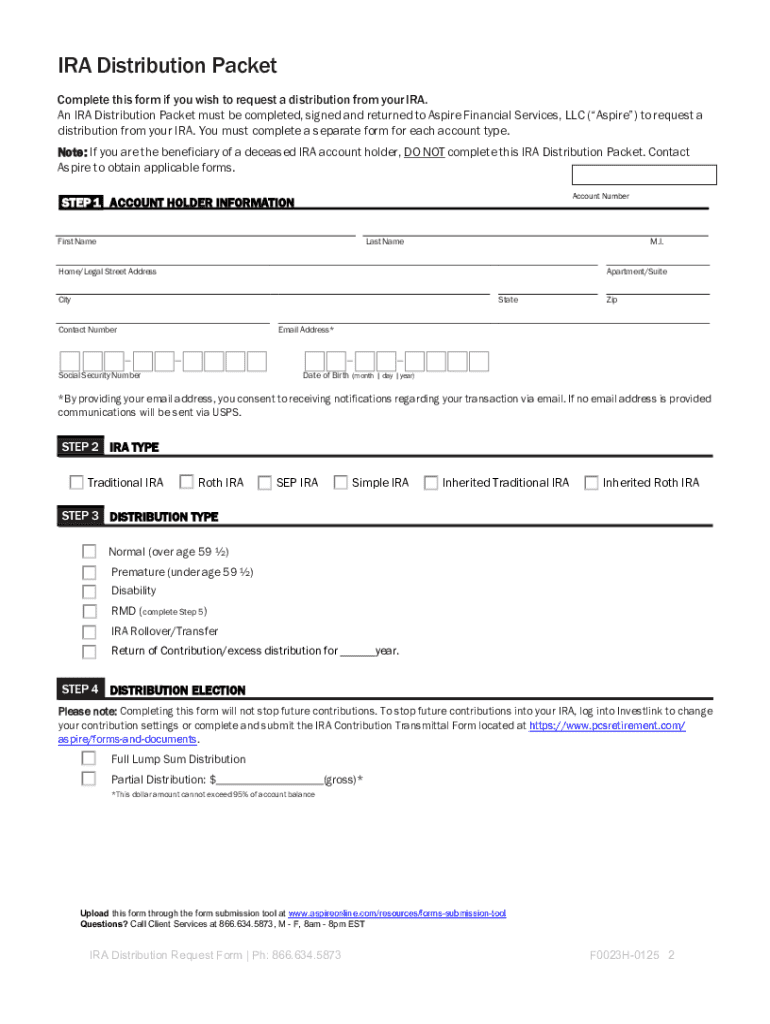

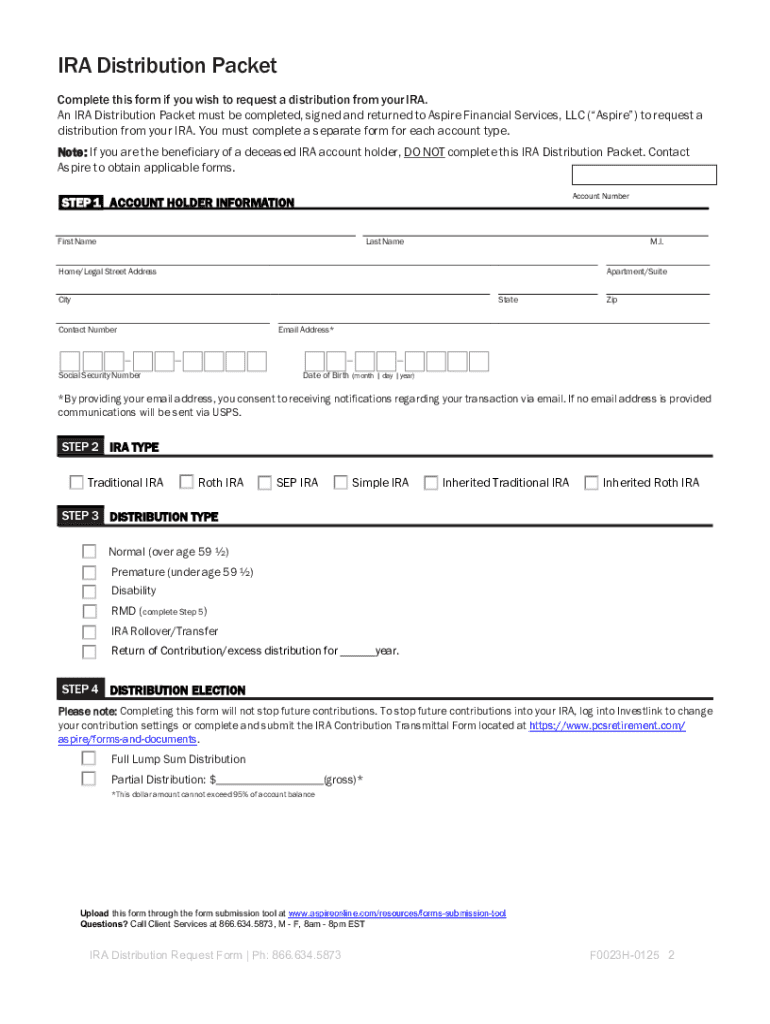

Detailed breakdown of the IRA distribution request form sections

The IRA Distribution Request Form comprises several critical sections that require your attention. In Section 1, provide your personal information—full name, address, and contact details are essential. Additionally, your Social Security Number is crucial for identity verification and tax processing.

Section 2 focuses on account information, where you will specify your account type and provide the necessary account number. Having previous account statements at hand can ease this process.

In Section 3, detail the amount you wish to withdraw and provide specific instructions based on the type of withdrawal you’re opting for. Section 4 addresses tax withholding options; this is where you'll indicate how much tax should be withheld from your distribution, considering both federal and state tax implications.

Finally, Section 5 requires signatures and authorizations. This is crucial for processing your request accurately and swiftly. Some financial institutions may even require a notary or witness for more significant withdrawals.

Step-by-step instructions for filling out the form

Completing the IRA Distribution Request Form requires meticulous attention. Begin with Section 1 by entering your personal information accurately. Common mistakes include misspelling names or misplacing digits in your phone number, so double-check all entries.

For Section 2, ensure your account information matches your bank records to avoid processing delays. When it comes to Section 3, be realistic and specific about the amount you need and understand the implications of a lump-sum versus periodic distributions.

In Section 4 regarding tax withholding, consult with a tax advisor if necessary to make an informed choice about your federal and state tax obligations. Lastly, don’t rush Section 5; your signatures must be clear and complete, as any oversight here could slow down your request.

Submitting the IRA distribution request form

Once the form is filled out, the next step is submission. Depending on your financial institution, you may have several options for submitting the completed form: electronically or through traditional mail. Ensure that you send it to the correct address, as misdirected forms can cause delays.

Processing times can vary. Generally, expect 5 to 10 business days for your request to be processed once received. Understanding the expected timeline can alleviate concerns and help you plan accordingly.

Additional considerations and tips

To track the status of your distribution request, it's important to follow up. Most institutions offer a customer service line or an online portal where you can check the status of pending requests. Being proactive can help ensure any potential issues are addressed swiftly.

Be mindful of potential fees and penalties associated with IRA distributions, particularly for early withdrawals before the age of 59½. While some exceptions apply, such as first-time home purchases or certain medical expenses, understanding these nuances will prevent unexpected charges.

Frequently asked questions (FAQs)

Mistakes on the form can lead to significant delays or misunderstandings, so it’s crucial to handle entries carefully. If a mistake occurs, contact your financial institution immediately to correct it. Some institutions allow a simple re-submission, while others may require a more formal amendment process.

Can changes be made to your distribution request after submission? Yes, but it depends on the policy of your specific financial institution. Most will allow modifications prior to processing but be sure to act quickly.

Lastly, being aware of tax implications is vital. Depending on your withdrawal type and age, distributions may be subject to taxes, and early withdrawals can incur penalties. Consulting with a tax advisor can provide clarity tailored to your situation.

Leveraging PDF solutions for document management

Using pdfFiller can streamline the entire process of completing your IRA Distribution Request Form. With its online form filling and editing capabilities, you can input your data directly into the platform without hassle, ensuring accuracy and clarity.

The eSigning feature is particularly beneficial, allowing you to sign documents digitally, which can expedite submission and processing times. For teams working collaboratively on this form, pdfFiller offers document-sharing options that facilitate informed discussions and swift decisions regarding distributions.

Interactive tools and resources

To make the process even easier, pdfFiller provides direct access to a fillable PDF version of the IRA Distribution Request Form. This interactive form allows you to complete and submit it online, integrating seamlessly into your financial planning workflow.

Additionally, pdfFiller features an interactive FAQ section, offering real-time support for any inquiries you may have while filling out and submitting your form. With resources like these, navigating the complexities of the IRA Distribution Request Form becomes much more manageable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ira distribution request form directly from Gmail?

How can I send ira distribution request form to be eSigned by others?

Can I create an eSignature for the ira distribution request form in Gmail?

What is ira distribution request form?

Who is required to file ira distribution request form?

How to fill out ira distribution request form?

What is the purpose of ira distribution request form?

What information must be reported on ira distribution request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.