Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding SEC Form 4: A Comprehensive Guide for Investors and Companies

Understanding SEC Form 4

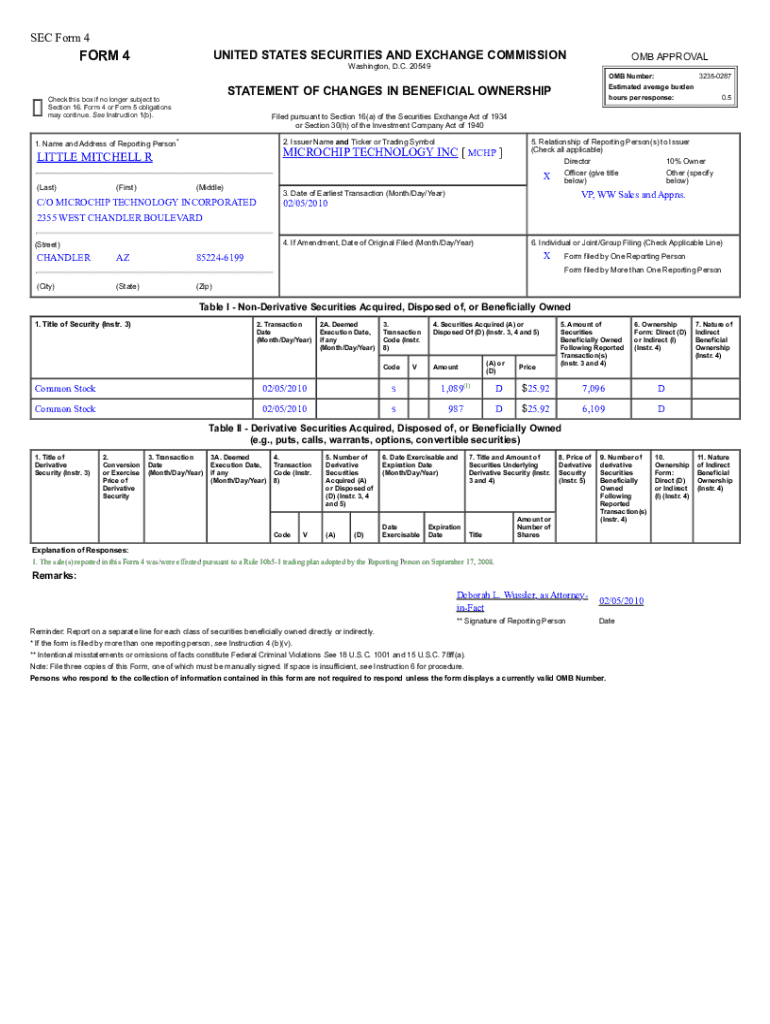

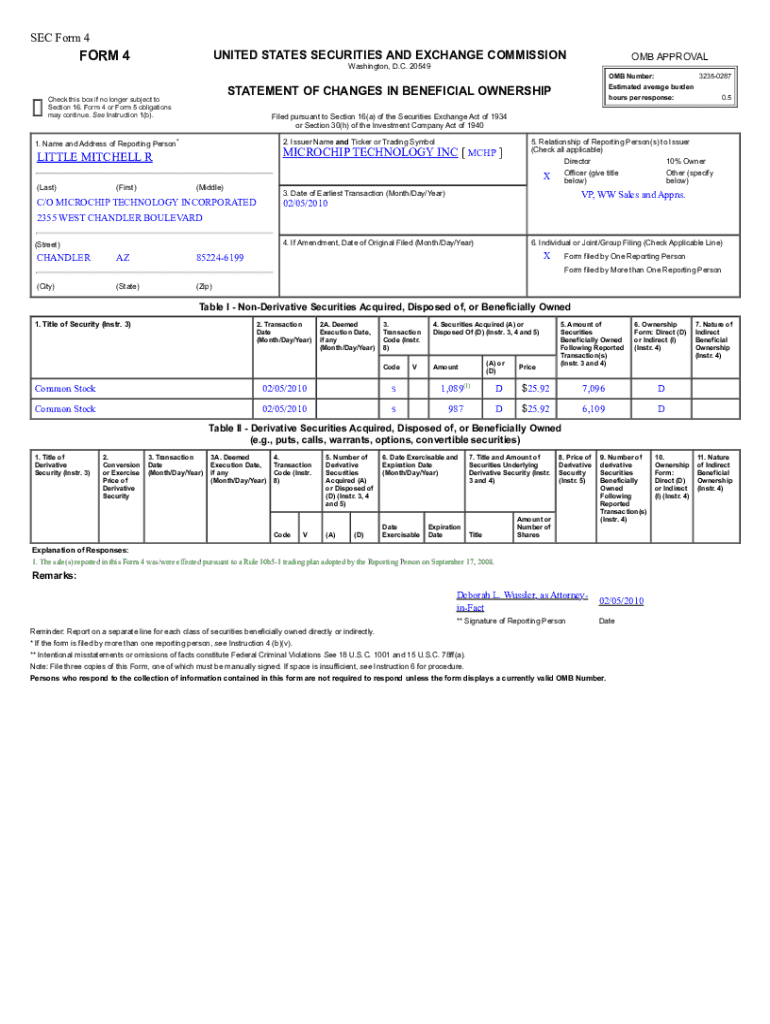

SEC Form 4 is a critical document filed with the Securities and Exchange Commission (SEC) that offers insight into the trading activities of an company's insiders. This form is designed to disclose any changes in the beneficial ownership of securities held by corporate officers, directors, and certain stockholders. The primary purpose of the SEC Form 4 is to maintain transparency within the financial markets and ensure compliance with reporting requirements that help curb insider trading.

Maintaining a transparent market is paramount, and the SEC Form 4 plays an essential role in this regulatory framework. By mandating insider disclosures, the SEC aims to protect investors and enhance accountability among executives regarding their trading decisions.

Why SEC Form 4 matters

SEC Form 4 holds immense significance for investors, primarily acting as a tool for tracking insider trades. Investors often monitor insider trading activities since purchases by executives can serve as a positive signal regarding a company's future prospects, whereas sales may indicate potential red flags. This information can be pivotal for making informed investment decisions and understanding investor sentiment around the stock.

For companies, the implications of SEC Form 4 filings extend beyond mere compliance; they promote transparency and accountability. By publicly disclosing insider trades, companies reduce the chances of fraud and unethical behaviors that could harm an organization’s reputation. This transparency attracts investors, thereby enhancing the company's credibility in the market.

Navigating SEC Form 4

Understanding the structure of SEC Form 4 is crucial for accurate filing and interpretation. The form comprises several key sections that detail essential information regarding insider transactions.

It’s also essential to familiarize yourself with the transaction codes used in the SEC Form 4. Each code corresponds to a specific action, providing clarity and context for the insider's activity. Understanding these codes can enhance your analysis when tracking insider trades and market sentiment.

How to fill out SEC Form 4

Completing SEC Form 4 can seem overwhelming at first, but it becomes straightforward with step-by-step instructions. The following process will guide you through filling out the form accurately.

Editing and managing SEC Form 4

Utilizing tools like pdfFiller can simplify the process of filling out SEC Form 4. It offers features that facilitate easy editing and managing of documents, making compliance a seamless experience.

Collaboration is also enhanced with pdfFiller, allowing individuals and teams to share forms for review, receive real-time edits, and add comments, improving team productivity during the filing process.

Common mistakes to avoid

While filing SEC Form 4, certain common mistakes can occur that may lead to compliance issues. Being aware of these potential pitfalls can help enhance the accuracy of your filings.

To maintain accuracy, consider the following tips: Always double-check filing dates and confirm shareholder ownership changes before submitting the form. Taking these precautions can significantly mitigate the risk of errors.

Interpreting SEC Form 4 filings

Reading SEC Form 4 is crucial for investors wanting to analyze insider activities correctly. Understanding how to interpret the information helps in identifying trends or patterns in trading behavior among executives.

Investors can make informed decisions by analyzing insider activity such as frequency, volume, and timing of trades. Consistent buying by executives may suggest positive company sentiment, while selling could hint at underlying issues.

Legal and regulatory considerations

Filing SEC Form 4 is governed by a comprehensive framework of SEC regulations. These regulations outline the legal obligations for insiders concerning reporting trades and maintaining compliance to prevent insider trading.

Non-compliance can carry severe penalties ranging from fines to criminal charges, making it essential for corporate executives to remain informed about their reporting obligations. Building a robust compliance protocol not only safeguards executive integrity but also upholds the company’s ethical standards.

Conclusion: Maximizing insights from SEC Form 4

Understanding and utilizing SEC Form 4 can significantly enhance your investment strategy. By analyzing insider trading data, investors can make data-driven decisions that align with market sentiment. Considering the activities of company insiders provides an additional layer of insight when formulating financial strategies.

Incorporating this analytical perspective helps investors navigate market fluctuations and enhances their ability to respond to changes proactively.

Key resources and next steps

For individuals or teams looking to streamline the process of filing SEC Form 4, utilizing tools like pdfFiller can be a game-changer. With a focus on enhancing document management, pdfFiller can assist users in navigating the complexities of form submissions efficiently.

Accessing additional document templates and engaging with financial analysts for professional insights can further enhance the usability of SEC Form 4 data. Embracing these resources will empower you to effectively track insider trades and enrich your investment strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in sec form 4 without leaving Chrome?

Can I sign the sec form 4 electronically in Chrome?

How do I fill out sec form 4 using my mobile device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.