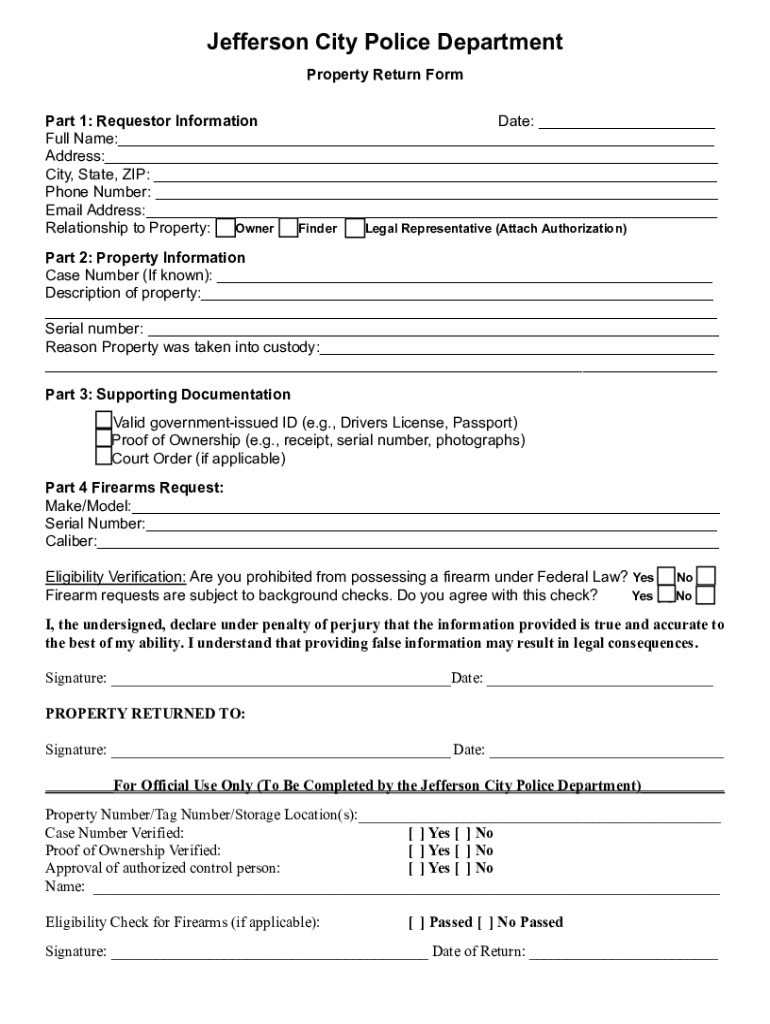

Get the free Property Return Form

Get, Create, Make and Sign property return form

How to edit property return form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property return form

How to fill out property return form

Who needs property return form?

Property Return Form: Your Comprehensive How-to Guide

Overview of the property return form

A property return form is a critical document for property owners and stakeholders that captures information about the property they own, including its value and how it generates income. These forms are essential for tax assessments, ensuring that local and state authorities have the most accurate and up-to-date information to accurately assess property taxes. Proper filing of a property return helps avoid penalties and ensures fairness in the tax process.

When you file a property return, your main objective is to provide transparency about your property’s value and income. This helps local tax authorities in equitable distribution of the tax burden among property owners. Specific requirements may vary depending on your state or local tax authority, which is why understanding the local nuances in filing your form can be pivotal.

Who needs to file a property return form?

Filing a property return form isn’t limited to just homeowners. Various groups are required to submit these forms, each having its unique considerations.

Understanding the components of the property return form

Each property return form includes several key components that must be accurately filled out to ensure compliance and approval. Let’s break down these sections to clarify what is required.

Step-by-step guide to completing the property return form

Completing a property return form can appear daunting, but following a clear, structured process will simplify it significantly. Here’s a step-by-step guide.

Common mistakes and how to avoid them

Filing a property return form is straightforward, but common errors can derail progress and result in penalties. Understanding these pitfalls is essential.

Interactive tools to assist in form completion

Utilizing interactive tools can significantly enhance your efficiency when completing a property return form. Here are some valuable resources.

Future considerations after filing your property return

Once you have filed your property return form, there are several important considerations to keep in mind. Understanding the subsequent steps can help you maintain compliance and prepare for future filings.

Managing your property documents with pdfFiller

pdfFiller offers robust features to help property owners manage their documents efficiently. Utilizing a cloud-based platform can streamline storage and access.

Helpful resources for property owners

Knowledge is power, especially when it comes to property ownership and taxation. Utilize these resources for a better understanding.

Using pdfFiller for a seamless document management experience

Incorporating pdfFiller’s features can revolutionize how you manage property documents. The platform's versatility is tailored for property owners and teams.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find property return form?

How do I complete property return form online?

How do I fill out the property return form form on my smartphone?

What is property return form?

Who is required to file property return form?

How to fill out property return form?

What is the purpose of property return form?

What information must be reported on property return form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.