Get the free Beneficiary Designation

Get, Create, Make and Sign beneficiary designation

Editing beneficiary designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation

How to fill out beneficiary designation

Who needs beneficiary designation?

Understanding the Beneficiary Designation Form: A How-to Guide

Understanding the beneficiary designation form

A beneficiary designation form is a crucial document that allows an individual to specify who will inherit their assets upon their death. This form plays a vital role in estate planning and helps ensure that your wishes regarding asset distribution are honored. Rather than passing through the probate process, assets listed in a beneficiary designation form can be transferred directly to the designated beneficiaries, simplifying the transfer and potentially saving time and legal expenses.

Designating beneficiaries is critical for several reasons. It not only provides clarity and direction regarding your assets but can also reduce conflicts among heirs. For instance, individuals often use this form for retirement accounts, life insurance policies, and bank accounts to dictate who receives the proceeds directly. Without these designations, your assets may be divided according to state laws, which may not align with your preferences.

Common scenarios that require a beneficiary designation form include the establishment of a new retirement account, purchasing life insurance, or even opening a bank account with the intention of having a payable-on-death (POD) designation. Each of these actions illustrates the importance of being proactive in planning for the future.

Types of beneficiary designation forms

Beneficiary designation forms come in various types, each serving distinct purposes. Understanding the various options available is key to ensuring your wishes are fulfilled in the event of your passing.

Steps to fill out the beneficiary designation form

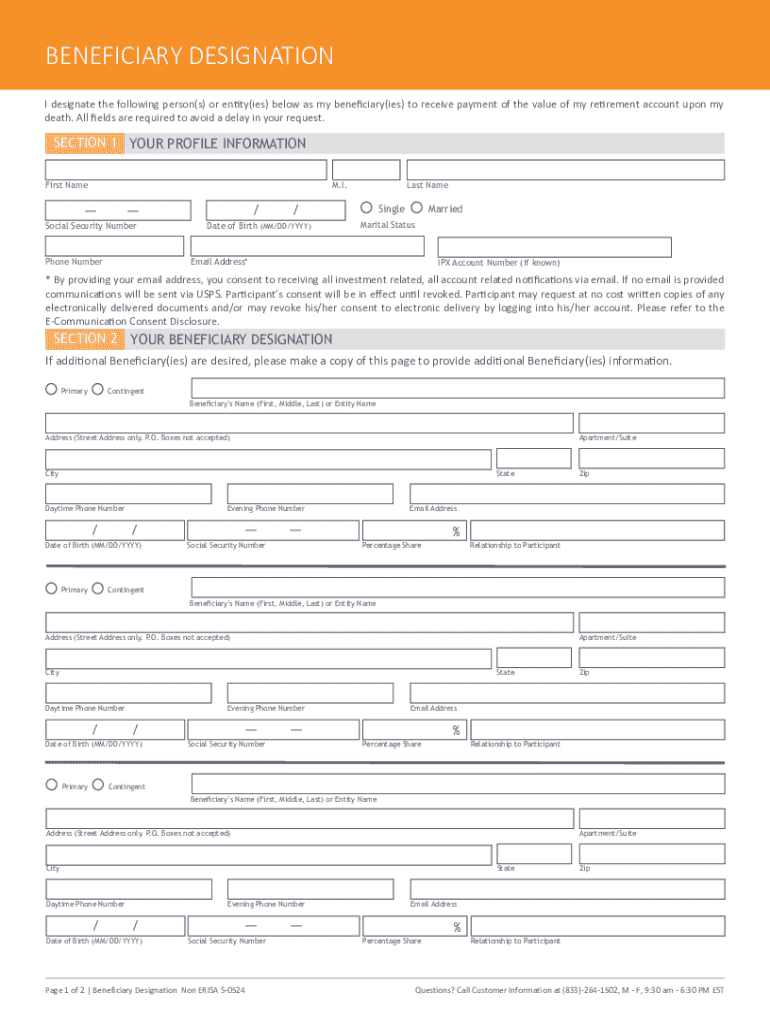

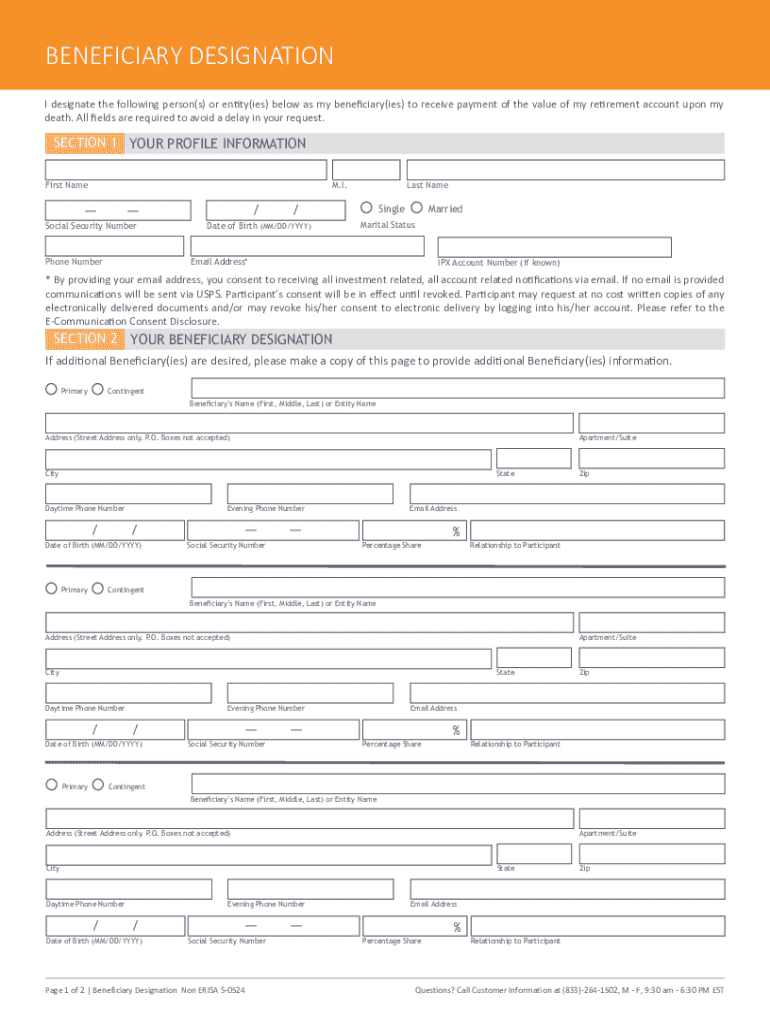

Filling out a beneficiary designation form involves several structured steps to ensure accuracy and compliance with legal standards. Taking the time to fill out the form properly is essential for it to be legally binding.

The first step is to gather necessary information. You’ll need your personal details, including your full name, address, and social security number, along with the required information for each beneficiary, such as their name, relationship to you, and date of birth.

Next, access the beneficiary designation form through your financial institution or insurance company. With pdfFiller, you can quickly download and access the PDF form, clearing the path for seamless editing using powerful tools for clarity and precision.

Once you have the form, complete it step-by-step. Carefully input your information, ensuring that you place it in the correct sections. A common pitfall to avoid is failing to double-check the spelling of beneficiaries' names or ignoring required fields, which can render the form invalid.

After completing the form, review it for accuracy. Utilize pdfFiller’s collaboration tools to share the document for feedback. This ensures that any potential errors are caught before submitting.

Signing and submitting the form

Properly signing and submitting your beneficiary designation form is equally important as completing it accurately. With pdfFiller, signing becomes a breeze, especially with the option for electronic signatures.

If you choose paper submission, ensure that you follow specific mailing instructions provided by your institution. Include any cover letters or additional documents as they may be mandated.

Managing your beneficiary designation form

Once submitted, managing your beneficiary designation form is a crucial step to ensure it reflects your current wishes and circumstances. Changes in your life, such as marriage, divorce, or the birth of a child may necessitate revising your designations.

Keeping your designated beneficiaries informed about their role can also help them understand their responsibilities and expectations, reducing confusion during sensitive times.

Special considerations

It’s essential to be aware of special considerations that may impact your beneficiary designation decisions. For example, tax implications can significantly affect how assets are distributed after death.

Taking proactive steps by discussing your plans with professionals or estate planners can further ensure your assets are managed as per your wishes.

Resources for further assistance

If you find yourself needing assistance with your beneficiary designation form, pdfFiller offers a range of support features tailored for user needs. Their interactive tools allow for streamlined document management, and a responsive customer support team can guide you through the intricacies of the process.

Frequently asked questions (FAQs)

Understanding the nuances surrounding beneficiary designation forms can be daunting. Here are some common inquiries that can provide clarity around the whole process.

By keeping these questions in mind and consulting with professionals when needed, you can navigate the complexities associated with your beneficiary designations with greater confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete beneficiary designation online?

How do I edit beneficiary designation on an Android device?

How do I complete beneficiary designation on an Android device?

What is beneficiary designation?

Who is required to file beneficiary designation?

How to fill out beneficiary designation?

What is the purpose of beneficiary designation?

What information must be reported on beneficiary designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.