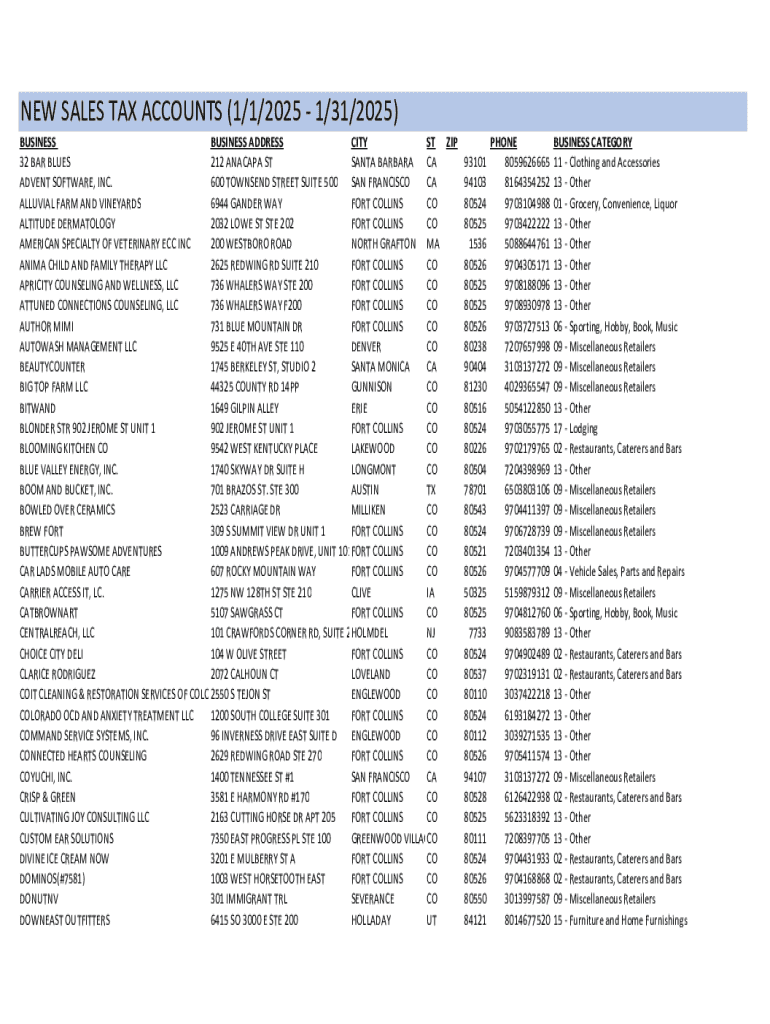

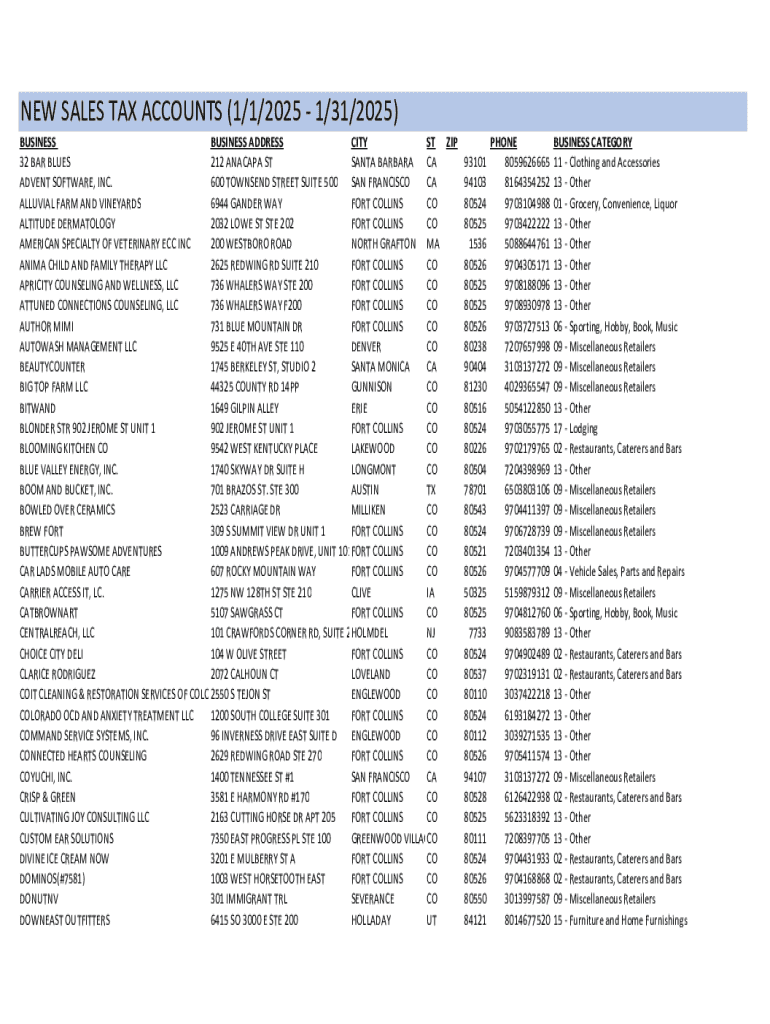

Get the free New Sales Tax Accounts (1/1/2025 - 1/31/2025)

Get, Create, Make and Sign new sales tax accounts

How to edit new sales tax accounts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new sales tax accounts

How to fill out new sales tax accounts

Who needs new sales tax accounts?

Navigating the New Sales Tax Accounts Form: A Comprehensive Guide

Overview of sales tax accounts

A sales tax account is an essential component for businesses and individuals engaged in selling taxable goods and services. This account essentially allows sellers to collect sales tax from their customers on behalf of the state. Registering for a sales tax account is not just a bureaucratic formality; it ensures compliance with state tax laws, avoids penalties, and fosters trust within the market. The new sales tax accounts form plays a pivotal role in this registration process, offering a streamlined method to establish a sales tax account effectively.

Eligibility requirements for opening a sales tax account

Understanding eligibility is vital when assessing who must register for a sales tax account. Generally, individuals and businesses selling taxable products or services in their state must register. This includes traditional retailers, online sellers, and even service providers. Out-of-state retailers and remote sellers are also required to register if they exceed certain sales thresholds in the state. Notably, there are exceptions; low-volume sellers—those whose annual sales fall below predefined limits—and most non-profits may not need to register.

Information needed to complete the new sales tax accounts form

Compiling the necessary information before filling out the new sales tax accounts form is crucial for an efficient submission process. You'll need personal identification details, including your Social Security number for individuals or a Federal Employer Identification Number (EIN) for businesses. Additionally, business information such as the legal structure, business name, and ownership details must be accurately filled out. To estimate your sales tax liability, you'll also need an approximation of your expected sales over a given period. Supporting documents like a business license or trade registration will also be required to validate your registration.

Steps to fill out the new sales tax accounts form

Filling out the new sales tax accounts form can feel daunting, but with systematic steps, you can manage it smoothly. Begin by gathering all necessary information mentioned previously. Next, access the sales tax form on pdfFiller; the platform simplifies the process of locating and accessing forms. While filling out the form, pay attention to individual sections, including personal information, business information, and financial information. Ensuring accuracy in each section is crucial to avoid delays. Finally, review your entries for correctness before submission to prevent common errors.

How to edit and manage your sales tax form using pdfFiller

Successful completion of your sales tax form is only part of the journey; managing your documents effectively is equally important. With pdfFiller's editing tools, you can easily modify your forms. Each time you save your progress, you can retrieve forms later, ensuring you never lose valuable information. Collaboration features allow team members to review and provide feedback on the document, enhancing the accuracy and thoroughness of the submission.

Filing the new sales tax accounts form

Once your sales tax accounts form is completed and verified, it’s time to file it. The most efficient way to submit your form through pdfFiller is online, ensuring prompt processing and avoiding postal delays. Alternatively, you can download the form, print it out, and mail it if preferred. After submission, always confirm that your application was received to track its status, as many jurisdictions provide online portals for checking the progress of your application.

Common mistakes to avoid when filling out your sales tax form

While filling out the sales tax accounts form, it’s easy to make mistakes that can lead to delays or rejections. Common errors include incorrect identification numbers, mismatched names, or failing to include all required documentation. Ensuring the accuracy of the information is paramount. One effective tip is to double-check every entry against your documentation and have another person review the form for a fresh perspective before submission.

After submitting the new sales tax accounts form

After you've submitted your new sales tax accounts form, you can expect a processing time of varying lengths depending on the jurisdiction. Follow-up notifications may come via email or mail regarding your application status. If there are inquiries or additional information required, quick responses will ensure a smoother approval process. If you need to make amendments after submission, reach out to your local tax authority for guidance on how to correct your application.

Understanding your responsibilities as a sales tax account holder

Once you have your sales tax account, you assume various responsibilities, including regular filing of sales tax returns. It’s crucial to establish a schedule for when returns are due—this can be monthly, quarterly, or annually based on your sales volume. Being aware of the sales tax rates applicable to your products or services is also essential, as tax rates can vary widely. Maintaining precise records of all transactions will help you stay compliant and organized for any audits.

Additional tools and resources on pdfFiller for sales tax management

pdfFiller offers a variety of tools and resources to assist you in managing your sales tax-related documents efficiently. Utilizing available templates simplifies your paperwork. The eSignature functionality also speeds up the signing process, making it easy to manage tax forms electronically. Additionally, pdfFiller’s mobile app enables you to access and manage your sales tax documents on the go, providing a flexible solution for busy professionals.

FAQs about the new sales tax accounts form

It's natural to have questions when navigating the new sales tax accounts form. Common inquiries include eligibility criteria, the necessary documentation for submission, and what to do if there are mistakes after filing. Understanding these aspects can streamline the process. For example, many users often ask about their specific situation regarding whether they qualify as low-volume sellers or how to amend an application—having clear answers can alleviate confusion and promote compliance.

Contact support for additional assistance

If you require further assistance with the new sales tax accounts form, pdfFiller has a dedicated support team. You can reach out via live chat, email, or phone for prompt responses. Engaging with the community forums can also be beneficial, providing users a space to share experiences and insights. Don’t hesitate to seek support; it’s available to ensure your success in handling your sales tax documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit new sales tax accounts from Google Drive?

How can I fill out new sales tax accounts on an iOS device?

Can I edit new sales tax accounts on an Android device?

What is new sales tax accounts?

Who is required to file new sales tax accounts?

How to fill out new sales tax accounts?

What is the purpose of new sales tax accounts?

What information must be reported on new sales tax accounts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.