Get the free Credit Application

Get, Create, Make and Sign credit application

Editing credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Understanding the Credit Application Form: Your Comprehensive Guide

Understanding the credit application form

A credit application form serves as a crucial document that individuals and businesses must fill out when seeking credit or loans from financial institutions or lenders. This form not only collects vital personal and financial information but also assists lenders in evaluating the applicant's creditworthiness.

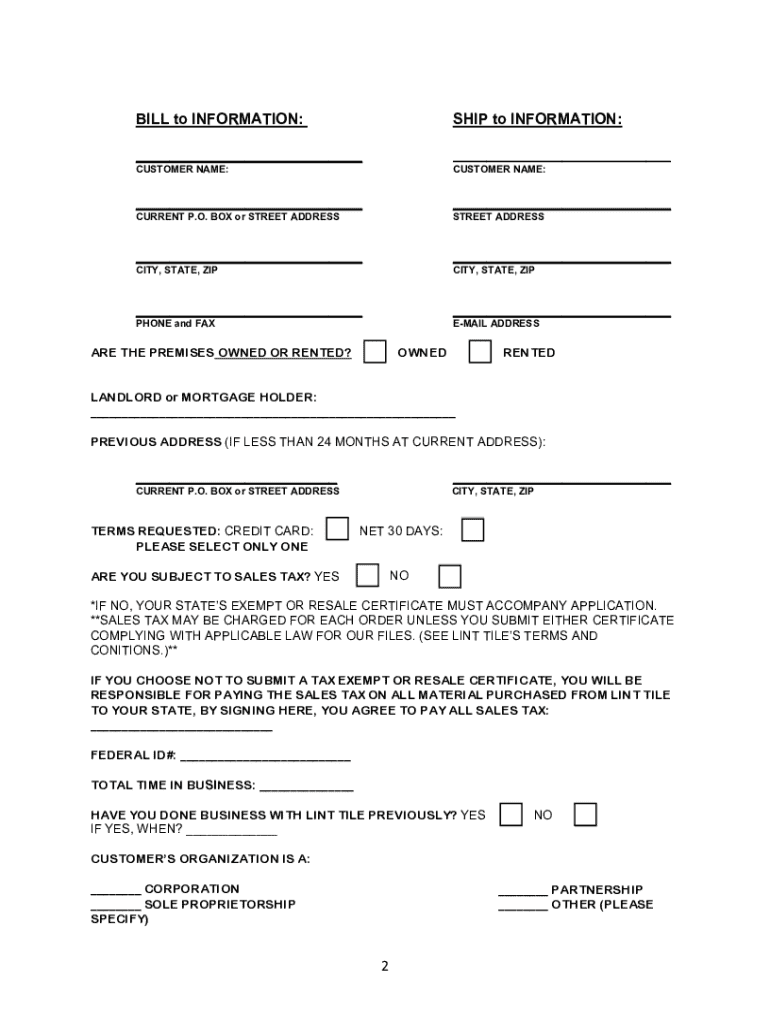

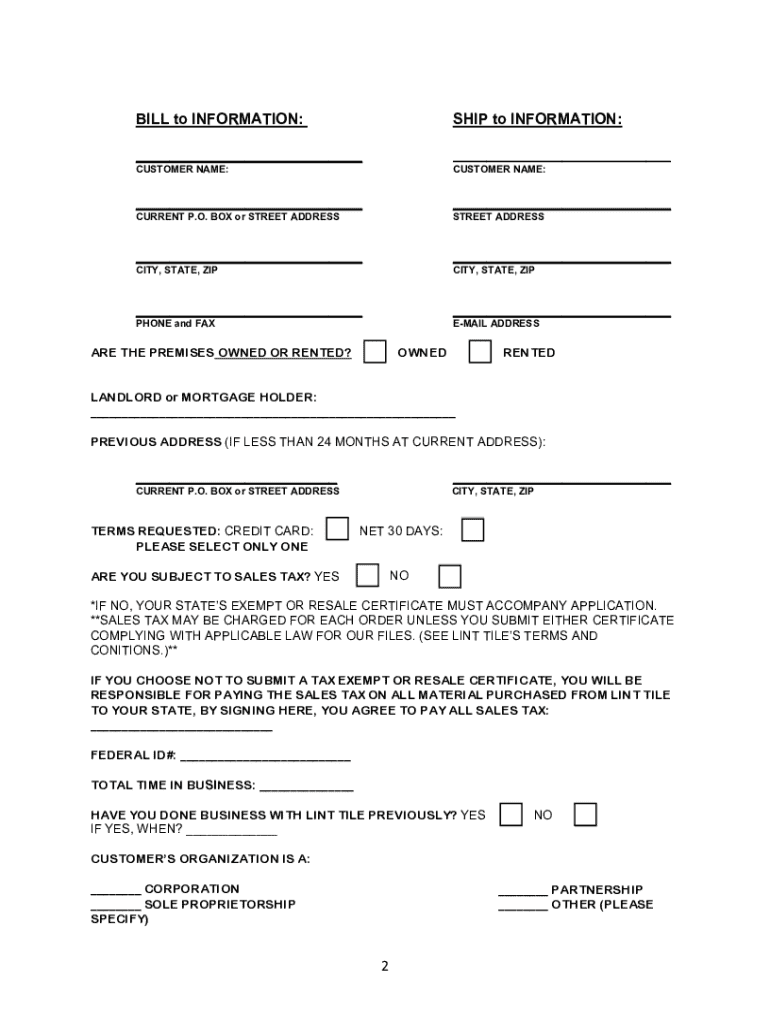

Key components of a credit application form

A robust credit application form typically contains several key sections. The personal information section collects basic details such as name, address, and social security number. The financial history section provides an overview of the applicant's income, expenses, and existing debt, providing lenders insight into their financial health.

Additionally, employment details offer insight into job stability and income reliability, while references and credit references can help lenders verify the applicant's legitimacy and track record.

The importance of credit applications in financial transactions

Credit applications play a pivotal role in risk management for lenders. By analyzing the information provided, lenders can make informed decisions to mitigate financial risks associated with defaults or late payments. This process not only protects their financial interests but also aids in building a culture of responsible lending.

Moreover, these applications enhance customer onboarding by streamlining the process, allowing lenders to quickly gather necessary information. A clear and comprehensive credit application fosters trust and transparency, vital for establishing lasting relationships between lenders and applicants.

Step-by-step guide to completing a credit application form

Before diving into filling out a credit application form, it's crucial to prepare and gather necessary documents. This includes identification documents, proof of income, and any relevant financial information. Prepare all details beforehand to avoid delays during the application process.

When filling out the form, start with personal information, ensuring accuracy to avoid issues later. Common mistakes include submitting without full documentation or omitting critical details, which can lead to delays or rejection. Clarity is key; use straightforward language and provide complete answers.

Best practices for creating a successful credit application form

When designing a credit application form, it's essential to include key elements that enhance user experience. Mandatory questions should be clearly indicated, while optional ones should be thoughtfully placed to avoid overwhelming the applicant. Each section should have clear instructions that guide the applicant on how to complete the form accurately.

Simplicity is paramount in design. A user-friendly layout minimizes frustration and encourages completion. Additionally, digital tools can streamline the process of creating a credit application form, allowing for easier edits and updates. However, staying compliant with legal requirements, like GDPR and creating clear privacy statements, is crucial.

Common challenges in the credit application process

One of the most significant challenges faced during the credit application process is incomplete applications. Missing information can lead to delays or outright denial of applications. To tackle this, lenders should provide checklists to guide applicants in gathering all necessary information.

Delays in processing can arise from placing too much information on the form or a lack of resources for review. Applicants must remain patient while lenders complete their evaluation. If a credit application is denied, it’s vital to understand the reasons behind the rejection. Often, applicants can take specific steps to improve their financial standing for future applications.

Automation and the future of credit application processing

The adoption of automated credit application systems is revolutionizing how these processes are handled. Automation enhances efficiency in processing applications, enabling lenders to review them more quickly than ever. It also reduces human error, ensuring a higher level of accuracy in decision-making.

Implementing automation doesn't need to be daunting. A variety of tools and technologies are available on the market to facilitate seamless integration with existing systems. Companies that have embraced automation in credit processing typically report improved turnaround times and customer satisfaction.

Frequently asked questions (FAQs)

After submitting a credit application, applicants often wonder about the subsequent steps. Usually, the lender will review the application and either approve or decline the request based on the provided information and creditworthiness. Another common query pertains to the expected timeframe for review, which can range from a few hours to several days based on the lender's policies.

Additionally, applicants may wish to know about any red flags that could hinder their application, such as late payments on existing loans or insufficient credit history. Differences exist in the application forms for B2B and B2C contexts, necessitating an understanding of the specific requirements for each. Finally, applicants frequently look for insights into improving their chances of approval by maintaining a good credit score, providing accurate information, and addressing existing debts.

Related tools for managing credit applications

In the realm of credit applications, various tools can significantly facilitate the management process. Document editing and signing solutions enhance the ability to modify forms seamlessly, allowing for quick edits and signatures from anywhere. Collaboration tools for teams can streamline communication, ensuring all parties involved in the application process are on the same page.

Template management also plays a crucial role, allowing businesses to customize application forms according to their needs. Utilizing cloud storage ensures sensitive documents are securely stored while remaining accessible to those who need them, thus enhancing overall efficiency in document management.

Transforming your credit application process with pdfFiller

pdfFiller provides an exceptional platform for managing your credit application process. With features that allow users to edit documents seamlessly, collaborate with teams, and securely eSign documents, pdfFiller empowers organizations to handle credit applications efficiently. Its user-friendly interface makes it easy for anyone to navigate, even those who may not be tech-savvy.

Interactive tools within pdfFiller enhance user experience, guiding applicants through the credit application form in real-time. The platform offers success stories from many users who have streamlined their credit application processes and improved approval rates, showcasing the effective management solutions available through pdfFiller.

Glossary of terms

Understanding the terminology associated with credit applications is vital for navigating the process. Terms such as 'creditworthiness' refer to the evaluation of an applicant's ability to repay debts, while acronyms like B2B (business-to-business) and B2C (business-to-consumer) indicate the nature of the transactions involved.

Familiarity with these terms enhances communication and understanding in financial discussions, allowing applicants and lenders to engage more effectively throughout the application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the credit application in Chrome?

Can I create an electronic signature for signing my credit application in Gmail?

How do I complete credit application on an iOS device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.