Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Your Complete Guide to Credit Application Forms

Understanding the credit application form

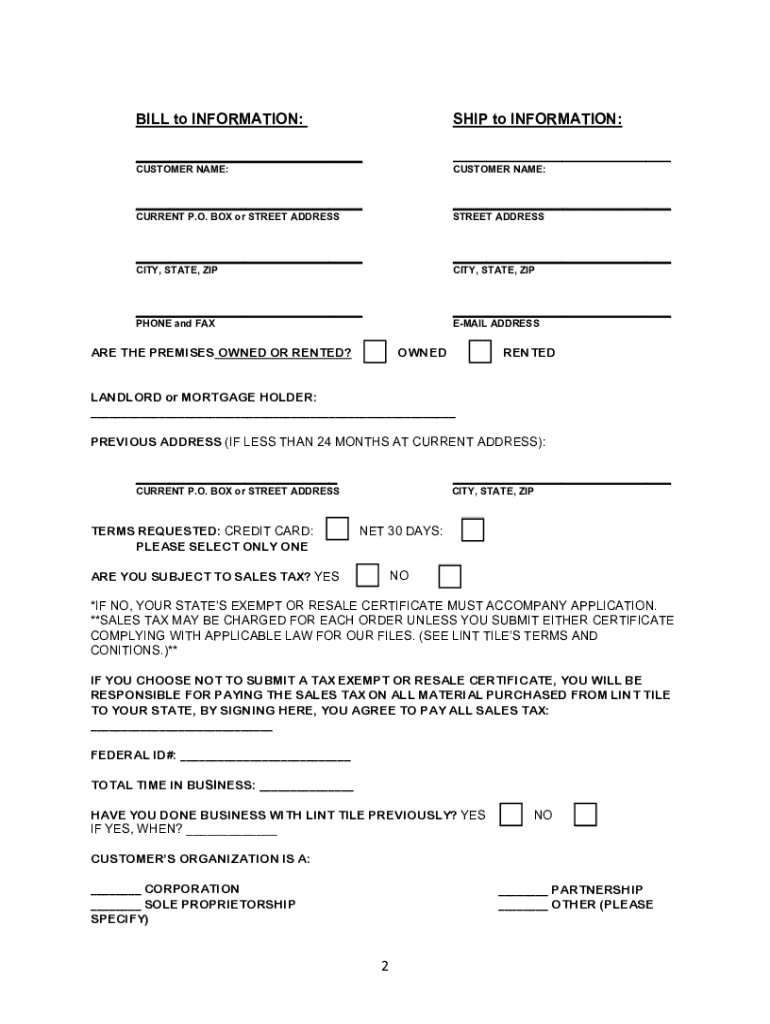

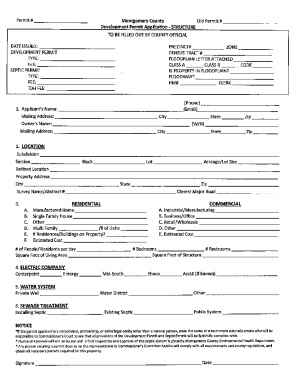

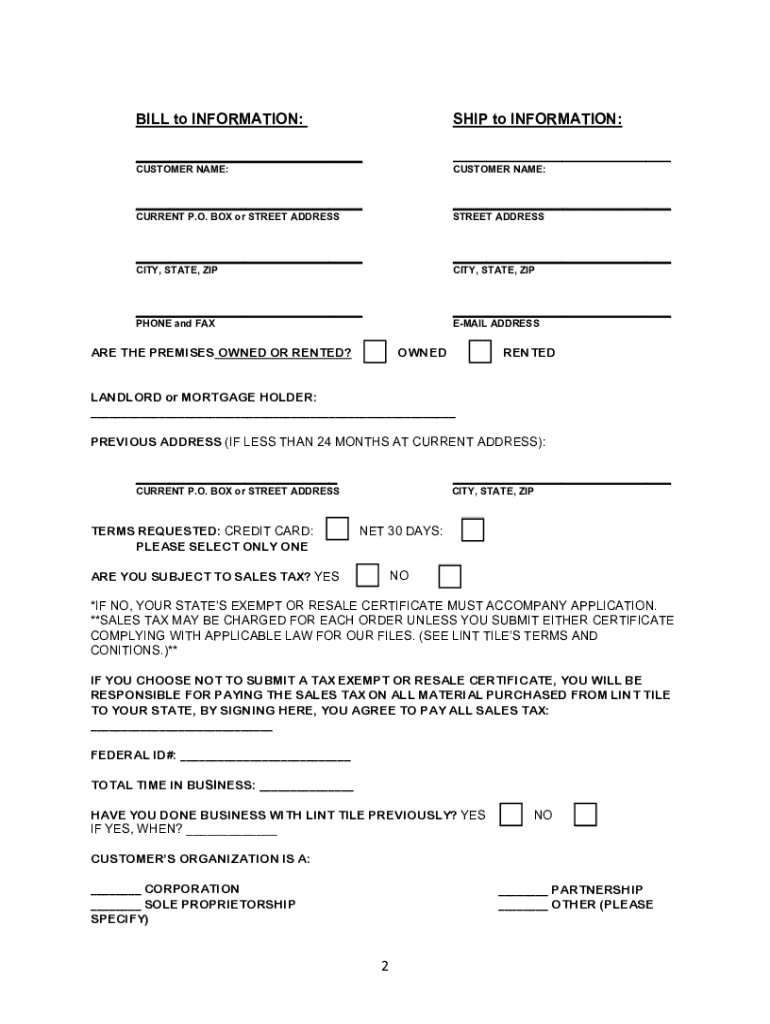

A credit application form is a structured document used by lenders to collect essential information from potential borrowers before granting credit. This form serves as the first step in the credit evaluation process, allowing lenders to assess the creditworthiness of applicants. Credit application forms are vital in financial transactions, as they ensure that the lender has a comprehensive understanding of the borrower's financial behavior and stability.

There are key distinctions between business and personal credit applications. A personal credit application focuses on the individual's financial history, including income and liabilities, while a business credit application dives deeply into the company's background, structure, and financial health. Each type caters to different audiences, making it crucial for applicants to understand which form is appropriate for their borrowing needs.

Key components of a credit application form

To successfully fill out a credit application form, applicants must provide several key components. Here's what typically needs to be included:

How to fill out a credit application form

Filling out a credit application form can seem daunting, but it can be straightforward by following a structured approach. Here is a step-by-step guide to help simplify the process:

Common mistakes to avoid include leaving fields incomplete, misreporting financial data, and failing to disclose essential information. Taking the time to ensure complete and accurate submissions can streamline the approval process and enhance credibility.

Tips for ensuring creditworthiness

Before submitting a credit application form, it's essential to assess your creditworthiness. Here are several tips to help you prepare:

The impact of an effective credit application

An effective credit application form significantly influences the approval process. When completed accurately and thoroughly, it facilitates a smoother path to receiving credit. Lenders appreciate complete applications as they can assess risk more effectively and make informed decisions.

Providing detailed and precise information builds trust with lenders. It demonstrates professionalism and indicates that the applicant is serious about their financial commitments. A comprehensive credit application can speed up approval times and reduce potential follow-up queries.

Digital credit application forms: The pdfFiller advantage

Using digital tools for credit application forms simplifies the entire process. pdfFiller offers numerous advantages, making it a favorable solution for prospective borrowers.

For those new to pdfFiller, tutorials guide users through effectively utilizing the platform. Learning how to edit, sign, and send credit applications will enhance user experience and efficiency.

Common challenges in the credit application process

Filling out credit application forms can come with its set of challenges. Many applicants face issues related to manual applications, including risks of errors and unnecessary delays. To mitigate these issues, utilizing a digital platform like pdfFiller can reduce manual errors significantly.

Additionally, dealing with rejections can be daunting. Understanding common reasons for denial—such as poor credit history or insufficient income—can help applicants prepare better for future submissions. If an application is denied, it’s advisable to request feedback, address the identified issues, and consider reapplying after taking the necessary steps to improve financial standing.

Frequently asked questions about credit application forms

A number of questions typically arise in the context of credit application forms. Here are some significant inquiries along with their answers:

Additional considerations

When dealing with credit application forms, it’s important to consider security measures for protecting personal information. Ensure that sensitive data is safeguarded through secure platforms and encrypted channels.

Understanding your rights during the application process is equally critical. Applicants have the right to request clarification on their credit reports and to address potential errors. Once successful, maintaining good credit involves continuous monitoring and responsible borrowing practices.

Related tools and resources available on pdfFiller

pdfFiller provides several valuable resources for those navigating the credit application landscape. Users have access to sample credit application templates that streamline the filling process.

Moreover, financial planning tools assist users in creating budgets and managing expenses, enhancing financial readiness for credit requests. Guides on managing credit risk are also accessible, offering additional guidance in maintaining a healthy credit profile over time.

Navigating the future of credit applications

As digital transformation continues to reshape the credit application process, staying informed about emerging trends becomes essential. Automation and advancements in technology promise to streamline how credit applications are filled out, reviewed, and approved.

Preparedness for changes in regulations or lender requirements is vital for all applicants. By embracing digital platforms like pdfFiller, applicants can ensure they are ready for future shifts, maintaining their ability to secure credit when needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete credit application online?

Can I create an eSignature for the credit application in Gmail?

How do I complete credit application on an iOS device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.