Get the free Independent Auditor’s Report and Individual Financial Statements

Get, Create, Make and Sign independent auditors report and

Editing independent auditors report and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out independent auditors report and

How to fill out independent auditors report and

Who needs independent auditors report and?

Independent auditors report and form: A comprehensive guide

Understanding the independent auditor's report

An independent auditor's report serves as an objective assessment of an organization’s financial statements by a qualified professional. This crucial document provides users with assurance regarding the accuracy and fairness of financial reporting, which is vital for stakeholders such as investors, creditors, and regulatory bodies.

The importance of the independent auditor's report cannot be overstated. It reinforces trust in the financial information presented by the organization, which can influence investment decisions and funding opportunities. By offering a third-party perspective, the report enhances the credibility of the financial data.

Independent auditors play a vital role in the financial reporting process. They conduct evaluations to ensure that the financial statements comply with relevant accounting standards, while also assessing risks associated with the entity's operations. Their expertise is essential in identifying discrepancies and ensuring transparency.

Key components of an independent auditor's report

The independent auditor's report is structured around several critical components that served different purposes in financial communication. The first of these is the title, clearly indicating that it is an independent auditor's report. Following this, the auditor's opinion, which summarizes the auditor's findings, is a pivotal part of the document.

The auditor’s opinion can vary: an unqualified opinion indicates that the financial statements present a true and fair view, while a qualified opinion points out issues but does not undermine overall accuracy. In cases where the financial statements do not accurately represent the entity’s financial position, an adverse opinion is provided, and when auditors cannot form an opinion due to insufficient information, it leads to a disclaimer of opinion.

Types of independent auditor’s reports

Independent auditor’s reports come in various forms, each tailored to specific needs. Full financial statement audit reports provide comprehensive evaluations, while review engagement reports offer limited assurance about financial statement accuracy. Compilation engagement reports give an even lighter assurance level, typically suitable for smaller entities.

For nonprofit organizations, specialized reports are often required to comply with different standards, ensuring accountability and proper financial stewardship. Additionally, sector-specific reporting requirements might necessitate unique disclosures, making it essential for auditors to be aware of the specific context in which the organization operates.

The process of conducting an independent audit

Conducting an independent audit involves a systematic process that ensures thoroughness and adherence to standards. This begins with planning the audit, where auditors gather comprehensive information about the entity and its environment. Understanding the risks associated with the organization is crucial for tailoring the audit accordingly.

During the fieldwork phase, auditors perform various tests, including evaluations of internal controls and substantive testing of transactions. Finally, auditors must finalize the audit by evaluating the evidence collected and preparing the auditor's report, which summarizes their findings and offers their opinion based on the financial statements.

Why organizations should consider an independent audit

Organizations, whether small or large, can significantly benefit from undergoing an independent audit. One of the primary advantages is enhanced credibility and trust amongst stakeholders, which can lead to increased investment opportunities and partnerships. Furthermore, audits help identify financial and operational weaknesses, providing valuable insights for improvement.

Compliance is another critical driver for independent audits, especially for organizations subject to regulatory requirements. By ensuring adherence to applicable standards, companies can mitigate risks and avoid potential legal issues. Numerous case studies have shown performance improvements in organizations post-audit, where corrective actions have led to better efficiency and profitability.

Filling out the independent auditor’s report form

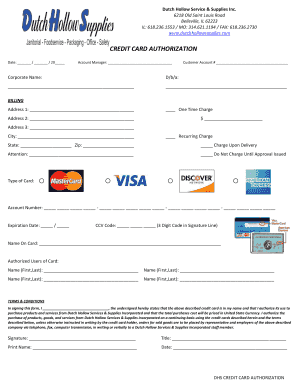

Completing the independent auditor’s report form requires careful attention to detail and a systematic approach. To begin, gather all necessary information, including financial statements, supporting documentation, and prior audit reports. Utilizing templates can help streamline the process, ensuring that all required elements are included impeccably.

In today’s digital world, integrating electronic signature capabilities can expedite the approval process, making it easy for auditors and clients to finalize the report swiftly. However, certain common mistakes should be avoided, like inaccuracies in financial data or overlooking significant disclosures, as these can undermine the report’s effectiveness.

Managing and storing independent auditor reports

Proper management and storage of independent auditor reports are essential for regulatory compliance and organizational transparency. Implementing best practices such as labeling documents appropriately and retaining copies in secure locations is crucial for easy access and compliance with retention policies.

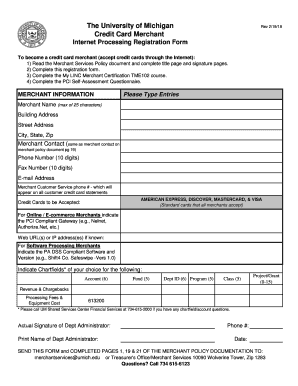

Utilizing cloud-based platforms like pdfFiller for secure storage can increase collaboration between audit teams and stakeholders. By providing a centralized location for document access, pdfFiller enables organizations to manage their reports efficiently, ensuring that vital documents are readily available whenever necessary.

Enhancing the auditor's report with interactive tools

pdfFiller offers an array of features that can enhance the auditor's report significantly. Its tools allow users to edit and customize reports seamlessly, ensuring that they meet specific requirements while maintaining clarity and professionalism. Integrating collaboration functionalities ensures that audit teams can work together effectively, regardless of their physical locations.

Additionally, the eSigning capabilities within pdfFiller streamline the process of report approval. By transforming traditionally tedious tasks into quick digital signatures, auditors can expedite the finalization of reports, allowing organizations to present their financial information to stakeholders with confidence and promptness.

Frequently asked questions (FAQs)

Understanding the ins and outs of independent auditors can often lead to many questions. For example, what qualifications are needed to become an independent auditor? Typically, one must possess relevant certifications, such as CPA (Certified Public Accountant), and have substantial auditing experience. Additionally, how often should organizations have their financials audited? This largely depends on factors such as size, industry, and regulatory requirements, but many businesses choose annual audits.

Another common inquiry is how to select a qualified independent auditor. Organizations should look for auditors with robust qualifications, existing client reviews, and experiences that align with their industry. Lastly, potential clients often wonder about the costs associated with an independent audit, which can vary based on the audit's scope and complexity, making it wise to seek estimates from multiple auditors.

Additional insights on the independent auditor's report

Recent trends in audit reporting indicate a move towards increased transparency and detailed disclosures, reflecting a demand from stakeholders for more comprehensive information. As technology continues to evolve, its impact on auditing practices is substantial, enabling auditors to perform data analytics and better assess risks.

Looking forward, the future of independent audits will likely see further integration of technology, driving efficiencies in both audit processes and reporting. The rise of artificial intelligence and machine learning may enhance accuracy and prediction in audit findings, positioning independent auditors as critical components of organizational governance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my independent auditors report and in Gmail?

How do I fill out independent auditors report and using my mobile device?

Can I edit independent auditors report and on an Android device?

What is independent auditors report?

Who is required to file independent auditors report?

How to fill out independent auditors report?

What is the purpose of independent auditors report?

What information must be reported on independent auditors report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.